|

Entry/exit signals for SPY QQQ TQQQ IWM SPX NDX based on VIX. Click here for our Signal Trades. Updates 7:45 PM EST - Sunday (for Monday 12/21/20) Summary $SPX $NDX IWM are likely to keep marching upward to higher highs by end of year. Market Schedule This Week This will be a short week due to Christmas. Stock market will close early by 1 PM EST on Thursday 12/24, and closed on Friday 12/25. Here are the important reports for this week. Tue:

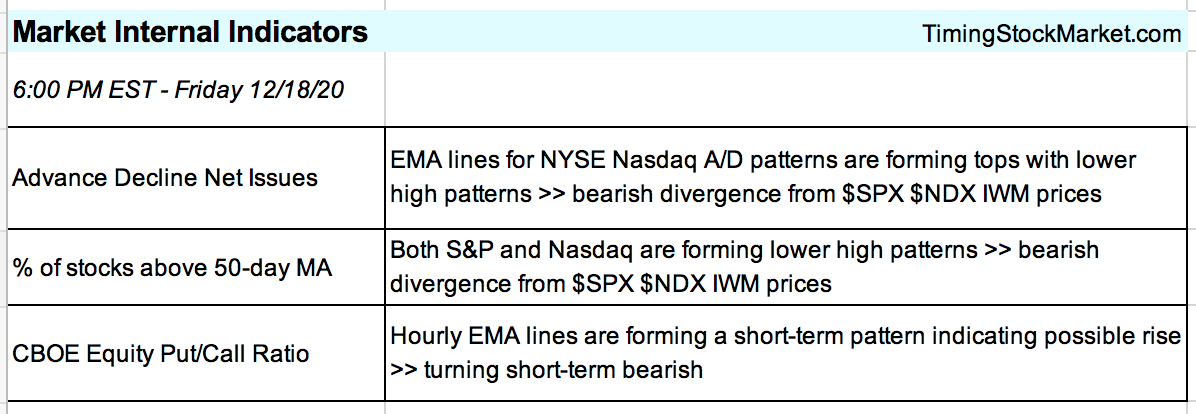

Market Internals The current bullishness in stocks is starting to verge on irrational exuberance. But as the famous economist John Maynard Keynes said, “markets can remain irrational longer than you can remain solvent.” It is going to be disconcerting to continue looking at the bearish divergence between market internals and stock price actions. These are the kinds of signals that can fool eager early bears. In our experience, bearish divergence can go on for quite a while. At some point, the bearish messages will have a big bearish impact. But not right now. We have to trade what's in front of us, while keeping in mind that the good times will not last forever. $VIX $VXN While market internals are showing the start of bearish divergence, $VIX $VXN are showing the continuation of more bullishness. ... Read the rest of this analysis, and get the latest entry/exit signals for SPY QQQ TQQQ IWM SPX NDX based on VIX here.

0 Comments

Leave a Reply. |

Archives

April 2024

Categories |

RSS Feed

RSS Feed