Updates 2:11 PM ET - Monday 10/31/22 Summary

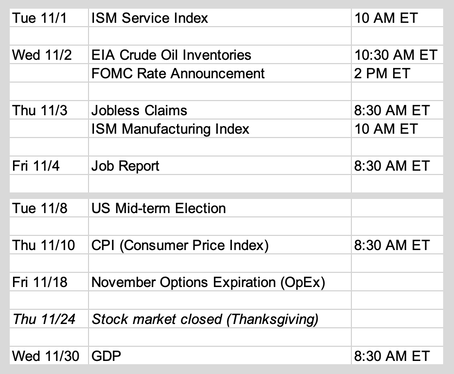

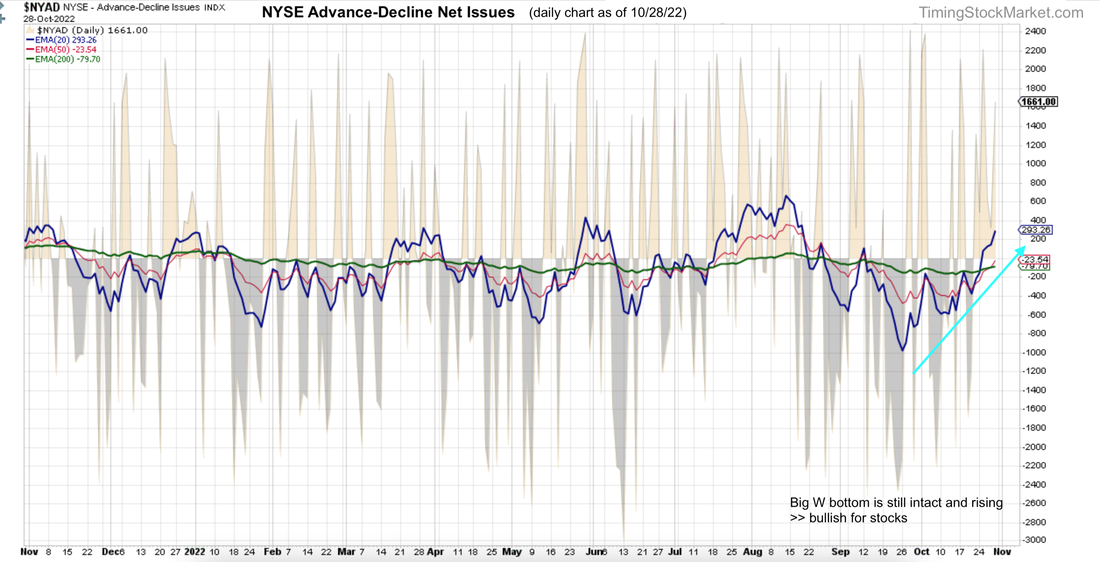

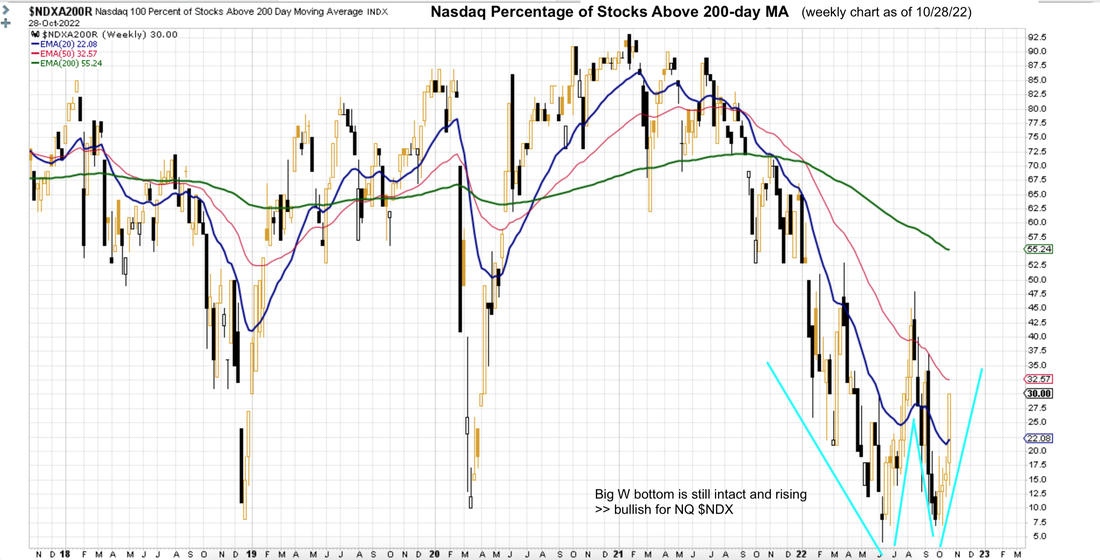

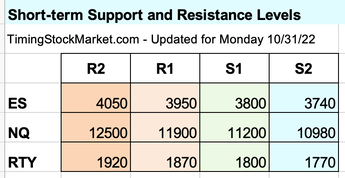

Market breadth is still positive, but NYSE Nasdaq A/D lines are forming short-term tops on their hourly charts. $VIX gapped up and rose to 27 in the early morning hours today. It has since dropped but we expect to see $VIX stays above 25.7, and starts rising back up again towards 28-29. Conditions are consistent with a setup for a retracement before ES NQ RTY can resume their rally as we explained last night. There is a high probability that ES NQ RTY will retest S1. Updates 12:30 AM ET - Monday 10/31/22 Upcoming key events The biggest event this week is FOMC rate announcement on Wednesday. Job report on Friday will also be very exciting. Read here for more information on economic news this coming week. Earnings releases this week Chart courtesy of Earnings Whispers. What to expect from FOMC this week The Fed is likely to raise its benchmark rate by another 0.75% as it attempts to cool the economy and bring down high inflation. The Fed's job is extra complicated due to rising wage and cash-rich consumers. Read more here. Market breadth is still supportive of stocks The bear market rally that started on Oct 13 has been going strong. There have been lots of explanations offered for this rally. We don't really know for sure all the reasons behind the rally. But we have confidence that since our system was able to identify the seed of the rally on Oct 3, it can identify the end of the rally. For now, market breadth is still very supportive of stocks as shown in the charts below. $VIX is dropping and has room to drop more $VIX 20 EMA blue line in its 2-hour chart below has been dropping straight down since Oct 13. This has been very bullish for ES NQ RTY. We did mention on Friday that $VIX is at its pivot zone which is 25-26, right at its 200-day EMA line. There is a high probability that $VIX will rise a bit from here to tag its 200 EMA green line, which is around 28 - 29. Then it is likely to drop down from there, possibly to 20 eventually. Key S/R levels With $VIX having a lot of room to drop, ES NQ RTY can potentially rise up to R2 or higher before this rally ends. However, while $VIX spikes up to 28-29, we may see ES NQ RTY retest support at S1. Trade Plan Last week, we locked in 20% profit with TNA runner, and 6% profit with TNA swing. Both positions did what they were supposed to do. Now we are aiming to scale back into TNA runner and swing during the pullback. We don't know if the pullback will happen before or after FOMC, but we'll be monitoring for the target entry level. Subscribe to get our latest analysis, daily trade plans and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades.

0 Comments

Leave a Reply. |

Archives

April 2024

Categories |

RSS Feed

RSS Feed