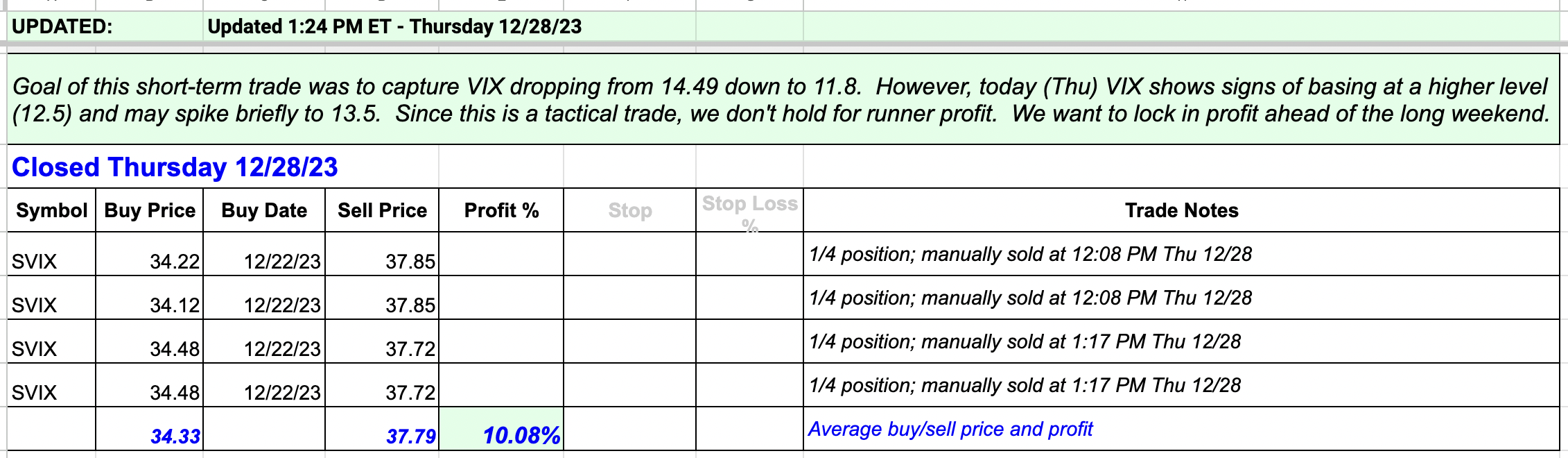

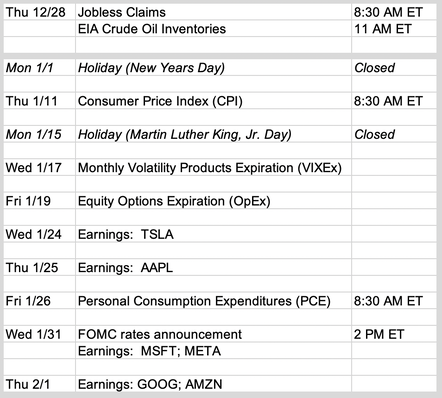

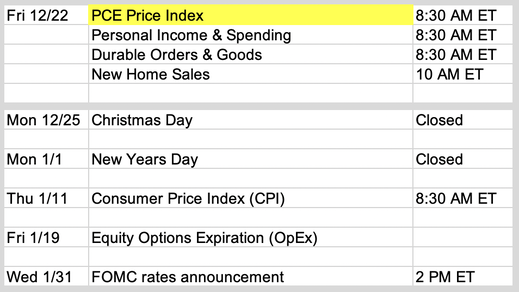

Updates 4:00 PM ET - Thursday Exited SVIX We wanted to capture VIX dropping from 14.49 down to 11.8. So we entered SVIX on Friday Dec 22. This is a quick bull trade and with UVXY rising ahead of the holiday, we decided to lock in our profit. Updates 1:00 PM ET - Thursday Upcoming key events 2023 is coming to an end. It's time to focus on January. Note that we've added the earnings dates of the Magnificent 7 stocks to the calendar below. The second half of January will have a lot of fireworks. Read more economic analysis here. Key S/R levels All levels are still the same. All indicators still support the bulls

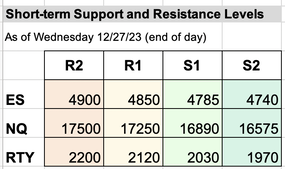

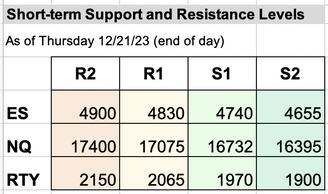

We expect the current bullishness to last into the early part of next week, which is the start of January. Expect VIX swings in January Keep an eye on VIX as it is the leading indicator. We expect to see VIX drops to 11.8, then bases at this level for multiple days during the first week of January. ES NQ RTY are likely to rise and may reach resistance at R1 while VIX does this. Once we enter the second half of January, we are likely to see VIX rise again, and it may rise as high as 15.5 in this second attempt. Once VIX starts to rise again, ES NQ RTY will likely retest support at S1. If VIX manages to rise up to 15.5, then ES NQ RTY will likely retest support at S2. Our personal trade plan As we wrote on Fri Dec 22, we entered SVIX Fri morning to capture VIX dropping from 14.49 down to 11.8. If VIX anchors at 11.8 and then starts to rise, we'll aim to capture the rise in VIX from 11.8 to 15.5 with UVXY. Click here for Signal Trades spreadsheet. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades.

0 Comments

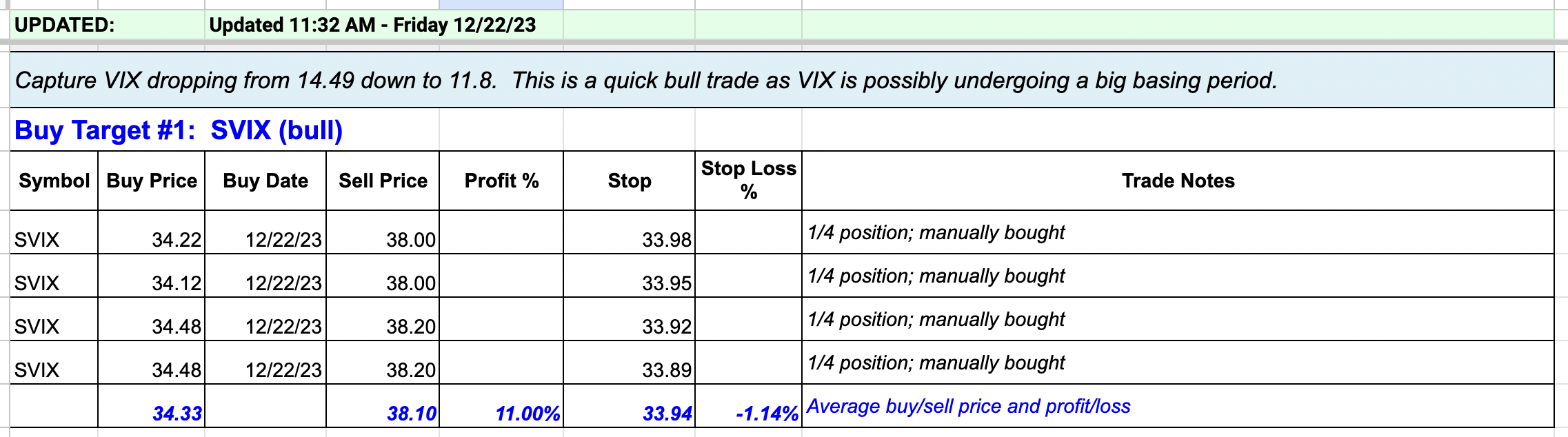

Updates 11:40 AM ET - Friday Entered into SVIX As we wrote earlier today, we want to capture VIX dropping from 14.49 down to 11.8. So we entered SVIX earlier this morning. This is a quick bull trade as VIX is possibly undergoing a big basing period. Updates 12:45 AM ET - Friday Upcoming key events According to WSJ, inflation is closing in on the Fed’s target. Read more about what to expect for Friday's PCE report here. Key S/R levels All levels are still the same. VIX woke up and is now the leading indicator Before Wed Dec 20, we shared charts which showed warnings of an upcoming dip for ES NQ RTY. These are the warnings that came true on Wednesday.

VIX has woken up at last. We now can use it as the leading indicator to guide us for the next few weeks. We have been writing about VIX spiking up to 14.3 for the short term. It rose to 14.49 on Thu Dec 21. We think that is VIX top for now until early Jan. We expect VIX to drop on from 14.49 high to retest 11.8 again between now and the first week of Jan. While VIX drops, McClellan Oscillator (Stockcharts.com $NYMO) is likely to grind downward but still stay positive. With this confirmation, ES NQ RTY should recover and likely to surpass resistance at R1 as part of the Santa Claus rally. This could start as early as Fri Dec 21 and may last into the first week of Jan. Once VIX drops down to 11.8, if it anchors at this level and starts to rise, VIX can reach as high as 15.5. If McClellan Oscillator swings negative also, then ES NQ RTY will drop and may retest support at S2. However, if VIX continues to drop below 11.8, then ES NQ RTY will spike up to resistance at R2. Our personal trade plan We now want to capture VIX dropping from 14.49 down to 11.8 via SVIX. Then if VIX anchors at 11.8 and then starts to rise, we'll aim to capture the rise in VIX from 11.8 to 15.5 with UVXY. Click here for Signal Trades spreadsheet. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed