|

The full article covers:

Market Internal Indicators Support & Resistance Levels Market Projections Planning Your Trades To read the full article, register your email here. You will get immediate full access to all our nightly analysis and trading plans. No credit card necessary. Trial membership is FREE for one month. Here are testimonials from our readers.

0 Comments

Since 12/16, we’ve been describing how $VIX $VXN have been forming an “anchored-to-rise” pattern. And on 12/23, we wrote: “$VIX $VXN patterns right now suggest that a shallow dip is coming. It most likely will appear right after Christmas.”

Meanwhile $SPX $NDX $RUT ignored the message from $VIX $VXN, marching gleefully up along with volatility since 12/16. But on Friday 12/27, $VIX $VXN finally got some attention as $SPX $NDX $RUT dropped sharply at the start of the day. That, we believe, is the shallow dip mentioned above. So is it done? The full article covers: Market Internal Indicators Support & Resistance Levels Market Projections Planning Your Trades To read the full article, register your email here. You will get immediate full access to all our nightly analysis and trading plans. No credit card necessary. Trial membership is FREE for one month. Here are testimonials from our readers. In this analysis, we discussed how to trade between now and early January 2020.

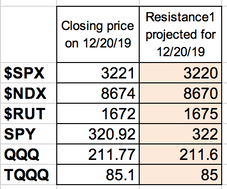

There are definitely opportunities to make money in the long direction, but knowing how to time it, and where to place entry/exit orders can really enhance your profits. Our trading plan is based on proprietary analysis of market internals, in context of price actions. We cover $SPX $NDX $RUT SPY QQQ TQQQ TNA $VIX $VXN. The full article covers: Market Internal Indicators Support & Resistance Levels Market Projections Planning Your Trades To read the full article, register your email here. You will get immediate full access to all our nightly analysis and trading plans. No credit card necessary. Trial membership is FREE for one month. Here are testimonials from our readers. Market Context We projected on the evening of Thursday 12/19 that $SPX $NDX $RUT would break out on Friday, and indeed they all did that. They gapped up and spent most of Friday at our projected Resistance1 level, as shown in the comparison below. We don’t usually achieve this level of accuracy across all indices, so we thought we might show off here a bit :-) Market Internal Indicators Market breadth is still strong, indicating that Surge10 still has momentum behind it. However, the percentage of bullish stocks are approaching top levels. 83% of Nasdaq stocks are above their 200-day EMA. That’s very bullish, but it also means that prices are approaching a short-term top soon. 90% is typically where the percentage starts to drop again. This potential short-term top is confirmed by volatility $VIX $VXN. So exactly how soon will this short-term top appear? And what is the potential size of the pullback? The full article covers: Market Internal Indicators Support & Resistance Levels Market Projections Planning Your Trades To read the full article, register your email here. You will get immediate full access to all our nightly analysis and trading plans. No credit card necessary. Trial membership is FREE for one month. Here are testimonials from our readers. $SPX $NDX broke out to a new high today, while $RUT steadily marched upward. The bullish strength is very high.

What’s making this bull charge along? The Fed and their “non-QE” liquidity injection, at a time when the economy is still strong and job growth is still robust. Will we pay a price in the future? Most definitely, but not right now. So even though our gut is telling us that this bull market can’t be real, we have to trade what’s in front of us. And what’s in front of us right now is a bull charging along at top speed. The full article covers: Market Internal Indicators Support & Resistance Levels Market Projections Planning Your Trades To read the full article, register your email here. You will get immediate full access to all our nightly analysis and trading plans. No credit card necessary. Trial membership is FREE for one month. Here are testimonials from our readers. We now have a situation where volatility looks ready to rise some amount, but against this potential bearishness, we have the start of a breakout in $RUT IWM TNA.

Tomorrow Thursday, we have the following market moving reports: jobless claims, Philadelphia Fed business outlook survey, existing homes sales. Friday 12/20 is quadruple witching day, and the GDP report. All of these reports have the potential to create sharp price movements. Our projection is this... The full article covers: Market Internal Indicators Support & Resistance Levels Market Projections Planning Your Trades To read the full article, register your email here. You will get immediate full access to all our nightly analysis and trading plans. No credit card necessary. Trial membership is FREE for one month. Here are testimonials from our readers. Surge10 has been surging up with very strong bullish momentum since 12/3/19. And it still has plenty of room to go up.

In fact, based on market internal indicators, we project that there's a 10% profit trade that you can make with TQQQ very soon if you can jump on this bullish bandwagon at the right time and the right price. Read the rest of this article for a concise trading plan on how to plan and execute this trade. The full article covers: Market Internal Indicators Support & Resistance Levels Market Projections Planning Your Trades To read the full article, register your email here. You will get immediate full access to all our nightly analysis and trading plans. No credit card necessary. Trial membership is FREE for one month. Here are testimonials from our readers. Melt Up

We’ve been writing for several months now that The Up Trend that started on 12/26/18 is still intact. It would appear that BOA lead analyst is now in agreement with us :-) According to Bloomberg: Financial markets are set for a “risk asset melt-up” in the first quarter of the new decade, according to Bank of America Corp. As Brexit and trade war risks recede, and with the Federal Reserve and European Central Bank still adding liquidity, the outlook for the beginning of 2020 is bullish, strategists including Michael Hartnett wrote in a Dec. 12 note to clients. The strategists expect the S&P 500 to reach 3,333 by March 3 -- a rise of 5.2% from Friday’s close -- and see the 10-year Treasury yield hitting 2.2% by Feb. 2, an increase of 36 basis points. We fully agree that the underlying mood for the market is very bullish, and Surge10 has quite a way to go. The most important strategy now is to find a reasonable place to jump on this bullish train and ride Surge10 for as long as possible. The second most important strategy is that we should not bet against this market, no matter how irrational it might appear to be. Day trading a small short position is fine when prices appear to reach a short-term top. But as we all learned, holding a short position overnight in this market can result in a lot of pain. The full article covers: Market Internal Indicators Support & Resistance Levels Market Projections Planning Your Trades To read the full article, register your email here. You will get immediate full access to all our nightly analysis and trading plans. No credit card necessary. Trial membership is FREE for one month. Here are testimonials from our readers. Trader’s Education

Many of our readers have asked for books and resources that you can use to further your own trader education. Here are 2 great online resources that are free and are very useful for learning or reviewing popular chart patterns: Investopedia: Introduction to Technical Analysis Price Patterns Stockcharts.com Common Chart Patterns Additionally, we highly recommend the following classic trading psychology book to learn about mastering your own emotions and to become a more disciplined trader. Trading In The Zone by Mark Douglas Market Internal Indicators Surge10 technically started on 12/10, and took off in a big way on 12/12. A number of factors helped it along: a dovish Fed, solid job report, some wage growth without immediate inflation threat, and phase 1 of the trade deal. However, market internals have backed off a bit from being super bullish. Now things are more or less neutral. Additionally... The full article covers: Market Internal Indicators (more) Support & Resistance Levels Market Projections Planning Your Trades To read the full article, register your email here. You will get immediate full access to all our nightly analysis and trading plans. No credit card necessary. Trial membership is FREE for one month. Here are testimonials from our readers. Market Context

Yesterday we wrote: Yes, Surge10 is starting. But Resistance1 looms immediately and it’s pretty strong. $SPX $NDX $RUT will have to prove that they have the bullish strength to rise above it. This morning $SPX $NDX $RUT proved that they had plenty of bullish strength to surpass the previous Resistance1 by a large amount. Of course it does not hurt that stocks were helped along by a certain tweet designed to spike the market and deflect the glare of impeachment. Whether or not we can believe that “it’s a real deal” is besides the point. Algos trading on headlines eat up stuff like this. And you knew since yesterday that under the hood, market was turning bullish. $VIX $VXN were forming a top, indicating that Surge10 is starting. So we had all the elements in place for a very bullish morning. Tonight, after hours futures gapped up at open and stayed up. So the odds are high that we will see a gap up at open tomorrow Friday morning. The questions now are: (1) are we setting up for a dip in Surge10? (2) If so, how big? We will explain the answers to these questions below. The full article covers: Support & Resistance Levels Market Internal Indicators Market Projections Planning Your Trades To read the full article, register your email here. You will get immediate full access to all our nightly analysis and trading plans. No credit card necessary. Trial membership is FREE for one month. Here are testimonials from our readers. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed