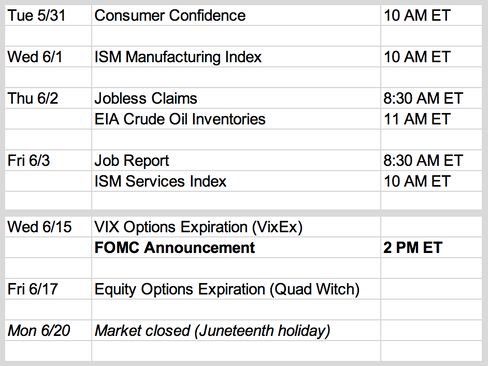

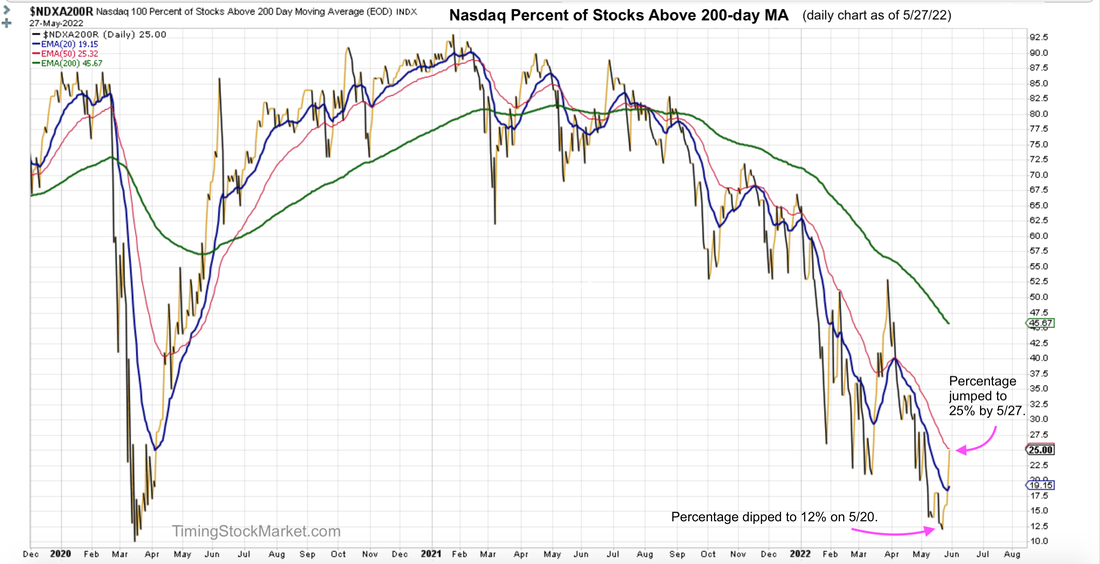

Updates 11 AM ET - Monday Upcoming key events The key events coming up are actually mid-June, on 6/15 and 6/17. That will be a fairly explosive week, followed by a 3-day weekend. So mark your calendar not to go on vacation during that week. Is this the bottom of the bear market? No one really has the answer for that, but there are some interesting projections by various analysts. The latest projection from Bank of America calls for S&P at 3000 by October, which is a depressingly low number. Below is the daily chart of Nasdaq percentage of stocks above their 200-day MA. This is what we call the percentage of "happy stocks". On 5/20, it got a low as 12%. Historically, when the percentage of "happy stocks" drops below 10%, it is a reliable indication that the bear market has reached capitulation level. 12% is not as clear of an indication. Meanwhile NYSE only got as low as 22%, and small caps got to 17% as the latest low. So we can't say that the bear market has reached capitulation level. This is not good big picture news for the bulls. Improving breadth supports bear market rally However, in the short term, bulls should rejoice. The sharp jump in the percentage of "happy stocks" indicates improving breadth.

This is confirmed by the sharply rising Advance/Decline lines for all stock indices as well. Short-term volatility signal: "Fully Bullish" Our volatility signal turned "Fully Bullish" by end of 5/20. That was after a very sharp drop where the S&P dipped into "bear market territory" officially. But volatility charts ($VIX $VXN $RVX $VVIX) all showed that volatility was steadily declining. That was why the volatility signal turned "Fully Bullish". What this demonstrated was the accuracy of our volatility signal. We must confess that even we sometimes have a hard time fully believing it. The bearish sentiments were so strong during the week of 5/16. It can make you doubt your own system. But there is no doubt now that the volatility signal has been right all along. And as of this Friday, it is sending out a bullish message, showing that volatility is not ready to rise yet. Key support and resistance levels The battle ground for this week will be between these key levels:

(Support is the low of 5/27. Resistance is the high of 5/4.) The bulls have the advantage for now. As long as ES NQ RTY stay above their support levels, they will try to clim up towards resistance. To track their upward progress, use their 15-minute charts to monitor the 200 EMA green line. For example, ES 15-minute chart below, as long as ES 200 EMA green line is still rising, its bullish momentum is still intact. Once this green line starts to go sideway, pay close attention to the message by $VIX and $VVIX. If one of them turns bearish, the volatility signal will become "Transition" at that point. Do note that the resistance levels listed above are very strong. They are where the bulls got trapped post FOMC on 5/4. So a lot of sellers are likely to step in at this level. Trade plan Click here for live trades. Subscribe to get our latest analysis, daily trade plans and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades.

0 Comments

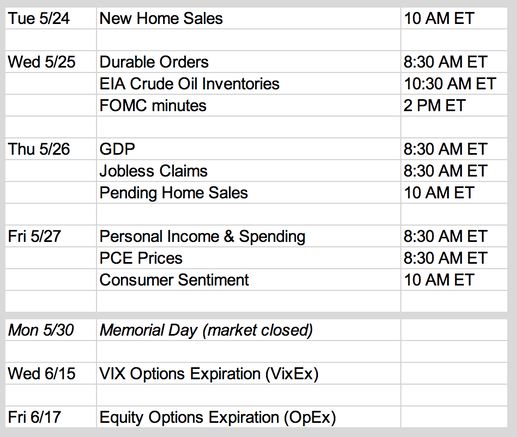

Updates 12 AM ET - Monday 5/23/22 Upcoming key events FOMC minutes on Wednesday and GDP report on Thursday will no doubt move the market in some ways. But given the disastrous earning reports of Walmart and Target last week, Friday's reports are going to be monitored closely to gauge whether or not consumers will continue to support this economy. And speaking of earnings, the following earning reports will also be closely monitored on Thursday after hours: COST (Costco), NVDA (Nvidia). Bear market is not done In the big picture context, the bear market is not done yet. The horrible combination of super hot inflation, supply chain disruption, unending pandemic, China shutdown, Ukraine war is not improving. Not anytime soon. A recent WSJ article discussed how this could be the lost decade for stocks. We are inclined to agree. But a bear market rally is imminent Having said all that, we will now say that a bear market rally is imminent. It is likely to start as early as Monday based on volatility signal (see more on that further below.) Besides volatility signal, there are other important signs of market stabilizing for the short term.

Short-term volatility signal: "Fully Bullish" $VIX: "Fully Bullish"

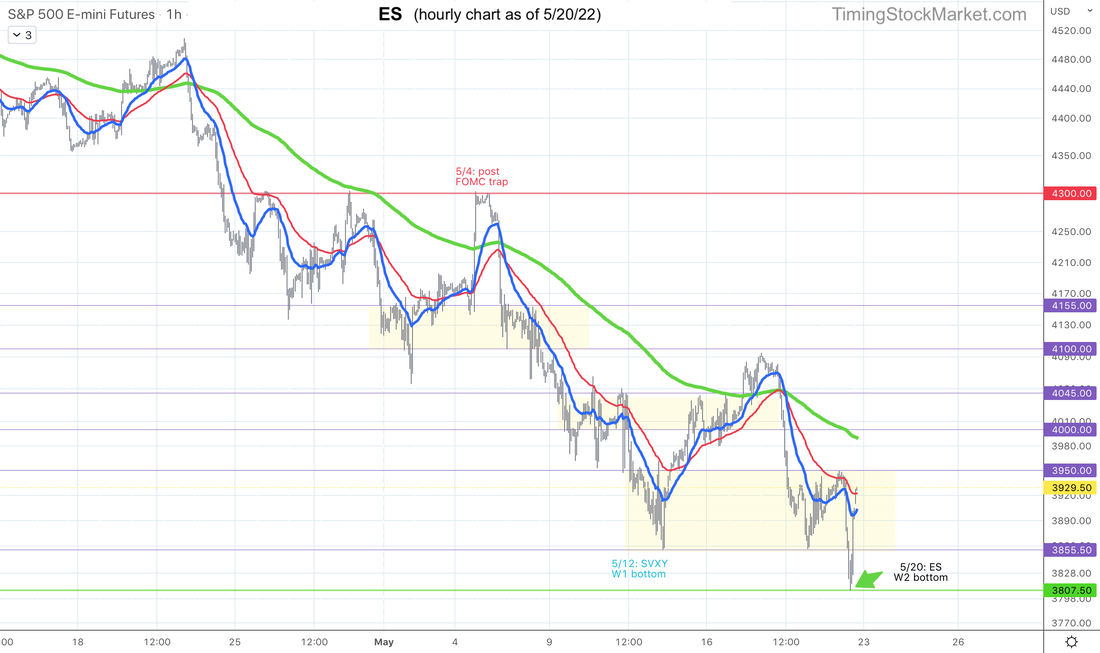

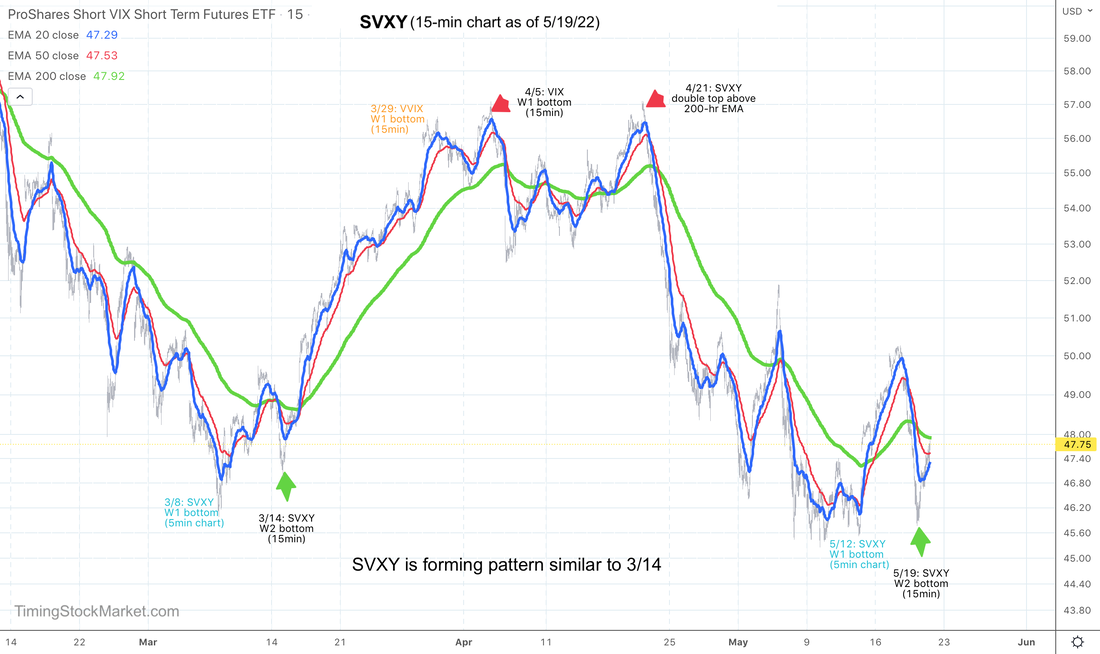

SVXY: "Fully Bullish" SVXY 15-minute chart below shows 2 sets of W bottoms formed since 5/2. ES: "Fully Bullish" Don't let ES $SPX dip towards 3800 on Friday fool you. That was a bear trap. Price dropped just enough towards this key level to trigger the criteria for the algos to go short. Then price reversed hard. And reversed across the board for S&P, Nasdaq and small caps. All this happened in on a Friday afternoon. That's a bullish turnaround. However, we don't think ES, along with all the other indices, will just take off right away on Monday. Below is ES hourly chart with key consolidation zones highlighted in yellow. While we don't think ES will retest 3800 again this week, we think bulls and bears are going to fight it out in ES support zone between 3855 and 3950 for a bit. If ES can get down close to 3855 one more time and find enough buyers there to help it reverse sharply upward, then the bargain hunters are likely to step in to help with momentum. Once ES reverses upward, it can rise up to the top of the next consolidation zone at 4045. Ultimately, ES may rise back up to 4300 before signal turns "Fully Bearish" again. Trade plan Click here for live trades. Subscribe to get our latest analysis, daily trade plans and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades.

Updates 3:14 PM ET - Friday 5/20/22 Volatility signal failure >> "Fully Bearish", but... We wrote at 9:20 this morning that key charts are showing for setups for retest of lows. We've been saying that a successful retest means volatility signal will turn "Fully Bullish". All the indices came very close to forming the pattern we've been hoping for. But the pattern failed. $SPX $NDX IWM all dropped below support from 5/17. That failure turns the signal back to "Fully Bearish". However, our SQQQ position got stopped out (at breakeven) after a strong directional move. All indices reversed sharply upward. At this point, there is a lot of conflicting data that requires further analysis. How the market closes today will offer a lot of clues. One important clue we've been tracking is that while $VIX rose up, it has not risen above the high of 5/12 yet. And $VVIX 200-hour EMA is still trending down. But we do not feel comfortable recommending either bullish or bearish entry at this point. We'll be providing a full analysis this weekend, and hopefully the end-of-day and end-of-week charts and data will reveal where market is really heading next. Updates 9:20 AM ET - Friday 5/20/22 Retest of lows likely This morning the key charts are showing setups for a retest of lows.

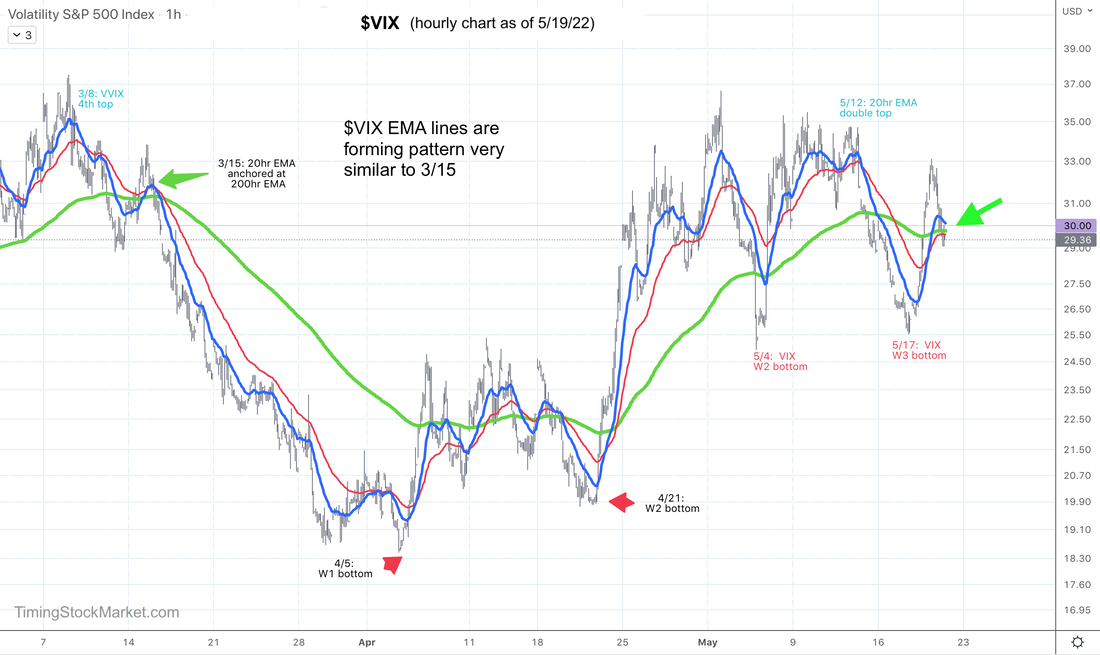

A successful retest of these zones may be our entry points to go long. We don't plan any Quick Bear trade here. We are getting ready for the Multi-day Bull positions only. Updates 1:30 AM ET - Friday 5/20/22 Bear market is still here, but getting close to short-term "Fully Bullish" To be clear, this bear market is still raging. But in the short term, our volatility signal may be turning "Fully Bullish" by tomorrow. What's the catalyst for stock indices to turn bullish? OpEx. Today is May options expiration for equity. This market is heavily hedged with puts. As these puts expire, dealers will buy to cover their shorts put in place previously to hedge their own books. All these short covering actions will provide fuel for a bear market rally. However, there may not be as much fuel this time as there was back in March. This is because traders are not as heavily hedged with puts. And some of these puts have already been unwound by Wednesday VixEx. So the remaining fuel for a red hot rally is low. Nevertheless, the key charts are showing very high possibility of signal turning "Fully Bullish", setting the stage for a bounce. We may only have enough fuel for this bounce to rise up to the high of 5/17. But we expect it to be a multi-day bounce. Let's take a look at the key charts containing our signals. $VIX: very close to "Fully Bullish" All of $VIX EMA lines along with $VIX itself are forming a pattern very similar to 3/15.

We expect $VIX to drop from here, at least back to 5/17 low. If it can drop lower than that, then this rally has longer to run. SVXY: "Fully Bullish" but... Zooming in on SVXY 15-minute chart below, we see that:

This pattern technically "Fully Bullish", but we really would like to see SVXY dipped towards 46 one more time. ES: very close to "Fully Bullish" ES 15-minute chart below shows it is likely to be forming a W bottom with its 20 EMA blue line. We would like to see ES consolidate a bit more below the 200 EMA green line, giving this line time to go sideway, setting the stage for a big rally. Having said this, if ES retests 3856 successfully today, we will consider it "Fully Bullish". Note also that in ES chart below, we've marked the likely resistance zones as ES climbs upward. These resistance zones apply to $SPX as well. $SPX is likely to lead the indices up, so keep an eye on these zones. Trade plan Click here for live trades. Subscribe to get our latest analysis, daily trade plans and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades.

Updates 11:09 AM ET - Wednesday 5/18/22 New bets on fear As May VIX options expire this morning (VixEx), it appears that there is renewed fear on the part of traders. They are buying VIX calls, placing fresh bets on rising volatility. These bets may override the bullish effect of expiring equity options (Friday OpEx). We think the odds are high here that $VIX will retest at least 30, possibly rising as high as 35 if the fears persist. This means that $SPX $NDX IWM will most likely be testing the low price zones formed between 5/12-5/13. For today, we are sticking with a Quick Bear trade via UVXY to capture this rise in $VIX. Keep in mind that this is a tough environment to trade in because VixEx and OpEx are producing opposite effects. Updates 1:45 AM ET - Wednesday 5/18/22 Short-covering rally is likely to continue...but weak The current rally is happening because of VixEx and OpEx. $VIX options are expiring today, while equity options are expiring this Friday. Equity options are mostly puts purchased for hedging. As these puts are unwound, dealers buy to cover their own shorts which were set up originally to protect their books. All this short-covering activity reduces volatility and boosts equity prices. Going into this week, we were hoping for $VIX to retest at least 30 or higher before dropping down again towards 20. This would mean a retest of the lows for $SPX $NDX IWM. If successful, it would set the stage for a sustained rally all the way up to $SPX at 4300 or higher. However, we haven't gotten this retest yet. And at this point, as we approach Friday, there's no reason for volatility to rise. Not while these bearish bets are getting unwound. So we have to assume that the current short-covering rally will continue up, at least until Friday. However, unlike March OpEx where there was a huge volume of puts, this put volume this time is not as high. So there may not be as much fuel to help push the rally past Friday. And there are very few calls, and not a whole lot of demands for equity from non-options buyers. So we have our doubts about the longevity of this rally. Finally, NQ $NDX are not rallying as strongly as ES $SPX are. We want to see the weakest sector have a super rally as proof of strong short covering activities. Key levels for $SPX ES Still, even if this rally isn't going to last that long, it is likely to last until Friday, or into early next week even. Regardless of what you trade, keep an eye on ES and $SPX levels. For Wednesday, ES $SPX are likely to be traverse between 4040 and 4110. In order for this rally to continue, ES $SPX need to stay above 4040. If that support level is maintained, the short-covering activities can push ES $SPX all the way to 4110, and then 4155. Trade plan

Click here for live trades. Subscribe to get our latest analysis, trade plans and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed