|

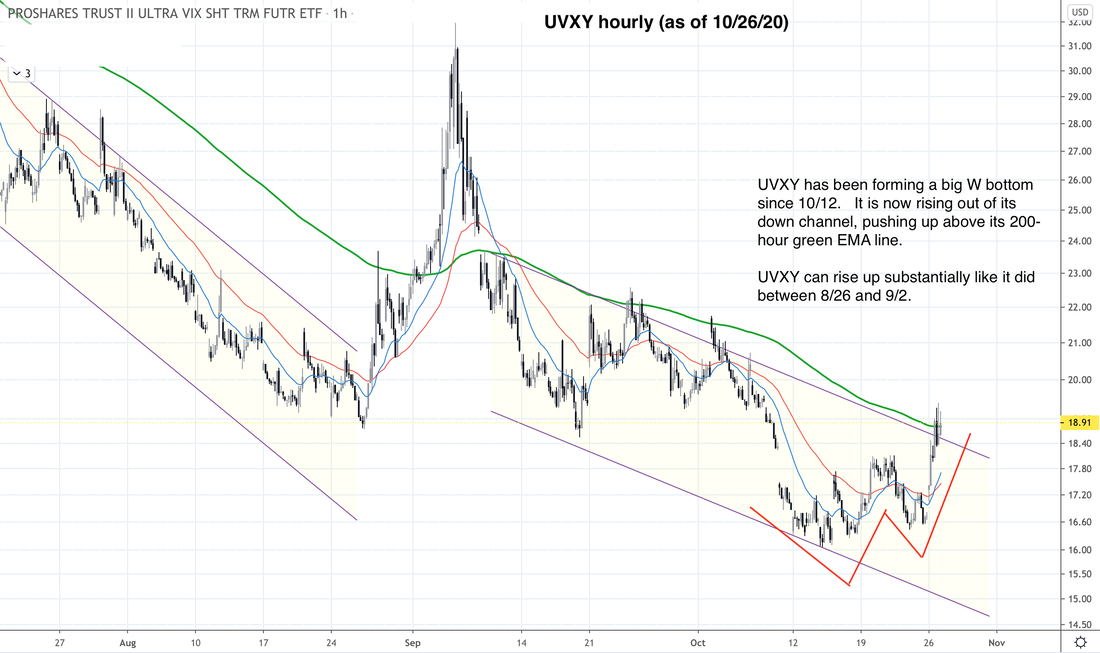

Click here for our Signal Trades. Below is a time-delayed excerpt from our live updates for members. Updates 5:32 PM EST - Tuesday 10/27/20 After hour entries The bearish signals we discussed just before closing turned really bearish after hours. Futures are dropping sharply, $VIX swung up sharply at end of day, and $VXN anchored at support by closing. UVXY and TZA have gapped up, and SQQQ is ready to climb more. These signals indicate that market participants are growing more nervous as the election approaches. While there most likely won't be a full-blown crash as in February, we may see more selling that will take $SPX $NDX IWM to the bottom of their green support zones, or 9/24 lows. We have decided to enter one UVXY full position (Big Swing) in Signal Trades, and have placed an updated buy order to add more UVXY on minor pullbacks. We will post new Quick Swing positions pre-market. Updates 3:43 PM EST - Tuesday 10/27/20 End of day Bearish: $SPX $NDX IWM are not finding enough buyers to lift them up higher. Any attempt to seriously rise are met with selling. IWM looks vulnerable to a drop lower than 10/26 low. In our Signal Trades, we got stopped out of the Quick Swing TNA trade. Our UVXY Big Swing buy order is still intact. Updates 2:54 AM EST - Tuesday 10/27/20 Summary Bearish: $SPX $NDX IWM may continue dropping more, as $VIX $VXN continue to rise. UVXY Many traders on Stocktwits were surprised at the persistent selling in stocks today. But you had plenty of warnings. Last Thursday (2:14 AM post), we alerted you that things were turning bearish for $SPX $NDX IWM. This was based primarily on the bearish patterns of UVXY. With today's upward surge, UVXY has finished forming a big W bottom on its hourly chart. This pattern is frequently seen before UVXY rises up substantially. $VIX We've been writing that $VIX tight range is something to be concerned about. $VIX usually contracts tightly before it surges. Today's $VIX gapped up above its 200-day EMA green line. This suggests that the contraction is now turning into a potential multi-day surge. $VXN Similar to $VIX, $VXN is forming the kind of pattern that typically precedes a bigger rise. Table of Support & Resistance Zones The S/R table has been updated to reflect the downward pressure on $SPX $NDX IWM. ... SUBSCRIBE now to read the rest of this post, including current analysis and projections for $SPX $NDX IWM. Get complete access to our intraday live Signal Trades. Take advantage of our introductory low rate of just $39/month. You can cancel anytime. Click here for our Signal Trades.

0 Comments

Click here for our Signal Trades. Below is a time-delayed excerpt from our live updates for members. Updates 11:27 AM EST - Monday 10/26/20 Nervousness growing into more selling We are not sure if we can label it "real fear" yet, but the nervousness we talked about pre-market has morphed into some substantial selling in $SPX $NDX IWM. We do expect intraday bullish reversals for $SPX $NDX IWM. We also expect more coiling and grinding as prices go down some more. This kind of price actions can be great for day traders interested in scalping. For us, we prefer to stick with the more predictable $VIX $VXN UVXY signals. What $VIX $VXN UVXY are telling us right now is that big money is feeling quite nervous and will be hedging actively. $VIX $VXN UVXY are not at "real fear" stage yet, and certainly not "exploding panic". But the profit taking and hedging will likely continue this week. Price actions are unfolding according to the plan we outlined pre-market. In our Signal Trades:

Updates 9:12 AM EST - Monday 10/26/20 Pre-market The nervousness in the market has been detected by UVXY, TZA, and the CBOE equity put/call ratio since late last week. Now it is growing more apparent based on overnight future actions, and pre-market drops.

We have repositioned ourselves in the Signal Trades:

Updates 8:55 PM EST - Sunday (for Monday 10/26/20) ... SUBSCRIBE now to read the rest of this post, including current analysis and projections for $SPX $NDX IWM. Get complete access to our intraday live Signal Trades. Take advantage of our introductory low rate of just $39/month. You can cancel anytime. Click here for our Signal Trades. Click here for our Signal Trades. Below is a time-delayed excerpt from our live updates for members. Updates 12:41 PM EST - Friday 10/23/20 More volatility ahead and watch that IWM Pretty much everything we wrote pre-market today unfolded according to projections. Both $VIX and $VXN have been coiling to rise up steadily. They are likely to retest their 10/19 highs. Therefore, we are leaving our UVXY positions in place with breakeven stops to accommodate this coiling process. We project to reach our UVXY target of 18 either today or Monday. We have been tempted to enter TQQQ several times this morning because it appears to have formed bottom. However, the following clues stopped us:

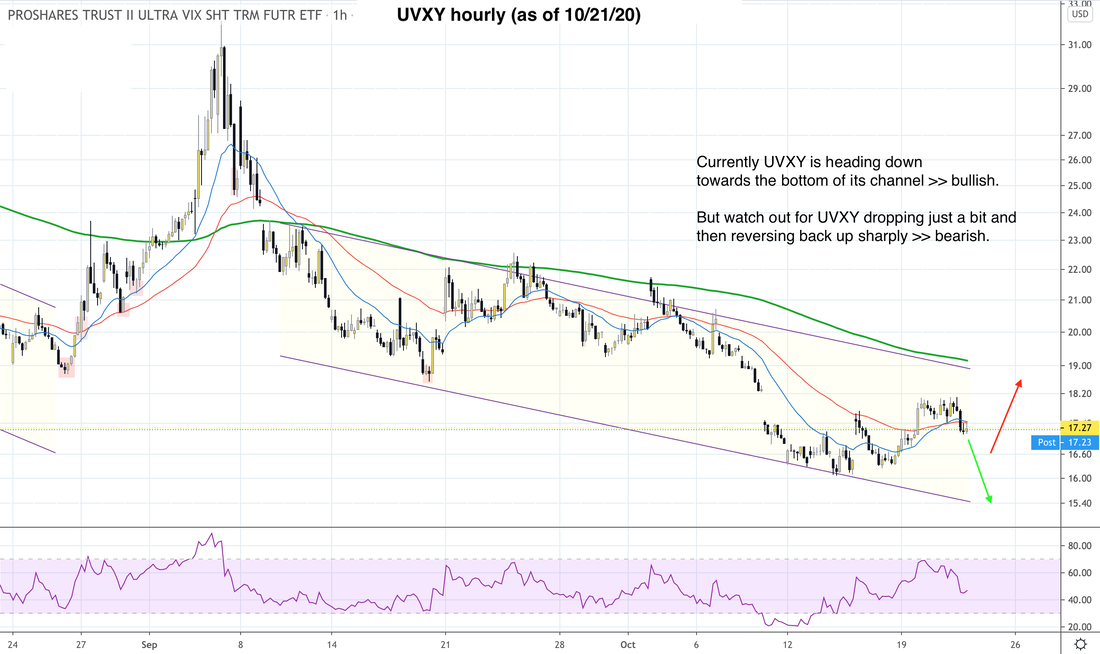

$NDX QQQ TQQQ are all likely to test the bottoms of their green support zones before they can find enough buyers to rise. Similarly $SPX SPY are likely to test the tops of their green support zones. Most interesting is the wild and crazy IWM. This index has been acting as a leading indicator for us. This morning pre-market everyone was cheering the surge in small caps. But we thought it looked like IWM was about to form a 3rd short-term top. So we quietly bought TZA pre-market at 12.95. Sold it prematurely at 13.14. Wished we had kept it. Wished we had told you about it. We wrote last night that we are likely to see $SPX $NDX IWM form same high or lower high tops before the election. If IWM is truly the canary in the coal mine, it is showing us that this is very likely to happen, as IWM is in the process of forming a lower-high top. We are likely to see $SPX $NDX find short-term support next week, rise up, but run into resistance at or below the highs of 10/12. $SPX $NDX will then form lower-high tops. Meanwhile $VIX $VXN will continue to anchor and coil quietly before they break out. We are monitoring a potentially big W bottom with UVXY. For that reason, we are holding UVXY over the weekend. Updates 9:22 AM EST - Friday 10/23/20 Pre-market Quiet this morning in terms of news. $SPX IWM are set to gap up, but pre-market price actions tell us to look for profit taking with $SPX IWM when market opens. For this reason, we are not jumping into buy TQQQ just yet. We have placed buy order to enter TQQQ when it swings low again. $VIX dropped last night, but looks ready to reverse this morning. Half of our UVXY position got filled. We will see how $VIX $VXN unfolds before entering the remaining if any. Updates 2:27 AM EST - Friday 10/23/20 From now to the election The truth is no one knows what will happen on 11/3 election date. The prudent thing to do is not to build up big position ahead of this game changing date. However, between now and then, here are the scenarios we most likely will see. ... SUBSCRIBE now to read the rest of this post, including current analysis and projections for $SPX $NDX IWM. Get complete access to our intraday live Signal Trades. Take advantage of our introductory low rate of just $39/month. You can cancel anytime. Click here for our Signal Trades. Click here for our Signal Trades. Below is a time-delayed excerpt from our live updates for members. Updates 2:14 AM EST - Thursday 10/22/20 Summary Bearish: $SPX $NDX IWM may be heading towards a substantial drop. UVXY $VIX $VXN The charts of $VIX $VXN continue to show sideway contracted patterns. So we have to rely on UVXY again to clarify the volatility situation. Currently UVXY is heading down towards the bottom of its channel. This is short-term bullish for $SPX $NDX IWM. But watch out for the scenario where UVXY drops just a bit, and then reverses back up sharply. That would form an upward coiling pattern, and would be a highly bearish setup against $SPX $NDX IWM. ... SUBSCRIBE now to read the rest of this post, including current analysis and projections for $SPX $NDX IWM. Get complete access to our intraday live Signal Trades. Take advantage of our introductory low rate of just $39/month. You can cancel anytime. Click here for our Signal Trades. Click here for our Signal Trades. Below is a time-delayed excerpt from our live updates for members. Updates 2:48 PM EST - Tuesday 10/20/20

$VIX $VXN $VIX $VXN may retest the highs of today, but they are not about to break out. This is actually a bullish setup for $SPX $NDX. $SPX $NDX $SPX $NDX up channels are intact, although $SPX $NDX may retest the lows of today. These are strong support levels. So $SPX $NDX should find enough buyers here to resume the rise up in their up channels. IWM Short-term direction is unresolved, but IWM up channel is still intact. We are staying away from IWM TNA for now, but not testing with TZA either. In the Signal Trades, we are continuing to hold TQQQ with b/e stops for the different entries. If we get stopped out, we will look to re-enter at lower price. We are holding all TQQQ overnight. Updates 9:18 AM EST - Tuesday 10/20/20 Pre-market Futures have stabilized around the lows of Monday 10/19. $SPX $NDX IWM will most likely retest these lows before rising. However, we need to allow for the fact that they may still dip a little further in their green support zones before rising. Pre-market $VIX and UVXY are forming short-term tops, supporting the rise in $SPX $NDX IWM. In the Signal Trades, we plan to scale in a bit more TQQQ when $NDX retests its Monday low. However, we don't want to build up a large position just yet. Let's see how the morning unfolds. Updates 1:43 AM EST - Tuesday 10/20/20 Summary $SPX $NDX IWM up channels are still intact (bullish). However, $SPX $NDX IWM are in a down swing within the up channels. $SPX $NDX IWM may still need to drop a bit further in their green support zones before starting an up swing within the up channels. ... Click here for our Signal Trades. Below is a time-delayed excerpt from our live updates for members Updates 9:13 AM EST - Tuesday 10/13/20 Pre-market

This is the profit taking process that we discussed at 2:25 AM today. It is likely to start now for $NDX $SPX IWM, rather than surging into the orange zones first. Keep in mind that $NDX $SPX IWM up channels are still intact. But prices are likely to swing down towards the lower edge of their channels, before they swing back to the upper edge of the channels again. Per our plan posted at 2:25 AM:

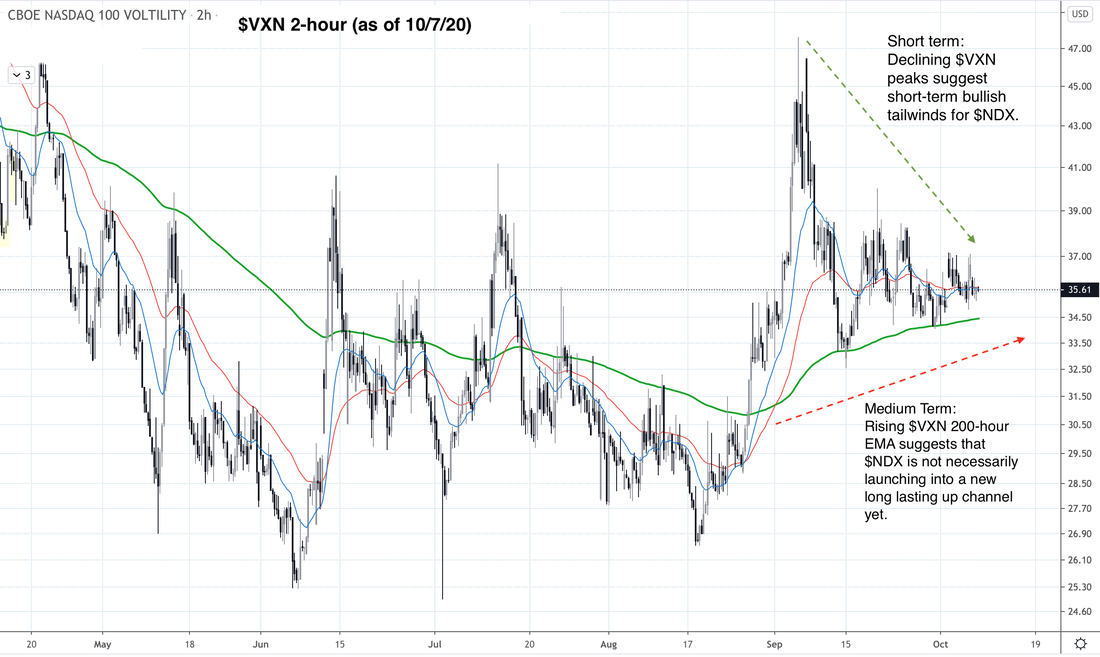

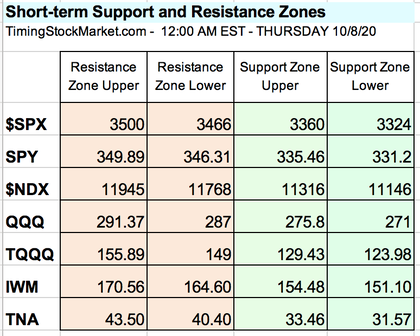

Click here for our Signal Trades. SUBSCRIBE now to read the rest of this post, including current analysis and projections for $SPX $NDX IWM. Get complete access to our intraday live Signal Trades. Take advantage of our introductory low rate of just $39/month. You can cancel anytime. Click here for our Signal Trades. Updates 3:11 PM EST - Thursday 10/8/20 $VIX $VXN Conditions are bullish in the short term for $SPX $NDX IWM. $VIX $VXN are steadily dropping lower. UVXY dropped sharply today. $VIX $VXN 200-hour EMA green lines are starting to flatten. They may descend in the next few days. This potentially sets up $SPX $NDX IWM for new bullish up channels. We will explore this possibility in the full analysis tonight. Updates 9:15 AM EST - Thursday 10/8/20 Pre-market Conditions are bullish in the short term for $SPX $NDX IWM. Futures rose overnight, and pre-market prices are up. We have started to scale into our Big Swing positions and have posted updates in Signal Trades. We expect $SPX $NDX IWM to reach the top of their orange resistance zones in the next couple trading days. Updates 2:09 AM EST - Thursday 10/8/20 $VIX $VXN Both $VIX $VXN 2-hour charts below show the same two themes. Short term: Declining $VIX $VXN peaks suggest short-term bullish tailwinds for $SPX $NDX IWM. Medium Term: As long as $VIX $VXN 200-hour EMA green lines continue to rise up, it means that conditions are still not yet conducive for a medium-term bullish trend to be launched. A bullish trend will show up as an up channel. And medium term here means multiple months. This actually makes sense. There are potentially enough buy-the-dip buyers out there to lift $SPX $NDX up toward their 9/2 highs. But market participants, especially big money, are nervous about 11/3 election. There is a good chance that chaos and violence and lack of clear leadership may ensue. That kind of unstable and uncertain situation is what Wall Street dreads. Table of Support & Resistance Zones The S/R table has been updated to reflect the potentials for $SPX $NDX IWM to rise short term. $SPX $NDX Conditions are bullish in the short term for both $SPX and $NDX. On Thursday, they may tag their 200-hour EMA green lines one more time to anchor and bring in more buyers. This will enable them to rise higher, possibly to the top of their orange resistance zones by Friday. IWM Conditions are also bullish in the short term for IWM. It may retest the high of January by the end of this week. Signal Trades We are going to scale into multiple positions to capture the bullish up swings for $NDX IWM. We'll do this via TQQQ and TNA. We will post updated buy limit orders pre-market. Click here for current Signal Trades. Disclaimer The information presented here is our own personal opinion. It is intended to supplement your own research and trading systems. Consider it as food for thought. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. While we offer scenarios for you to consider in your trade planning, know that you are proceeding at your own risk if you follow our suggestions. Note that we trade highly risky 3x leveraged ETFs. You may end up losing a lot of money with them. They suit our portfolio, but they may not be appropriate for you. Please read more about them before trading them. Proshares UltraPro and UltraPro Short ETFs Direxion Leveraged and Inverse ETFs Why 3x ETFs like TQQQ lose money over the long term The risks of investing in inverse ETFs Simple explanations of contango and backwardation |

Archives

July 2024

Categories |

RSS Feed

RSS Feed