|

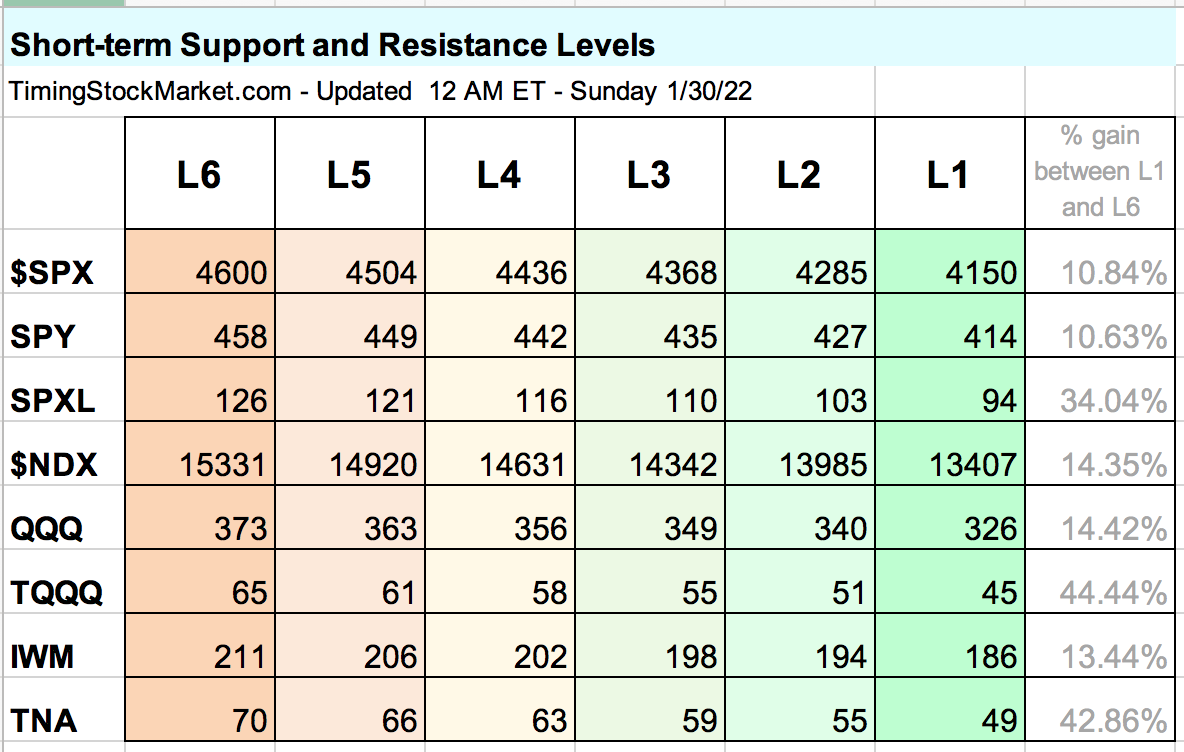

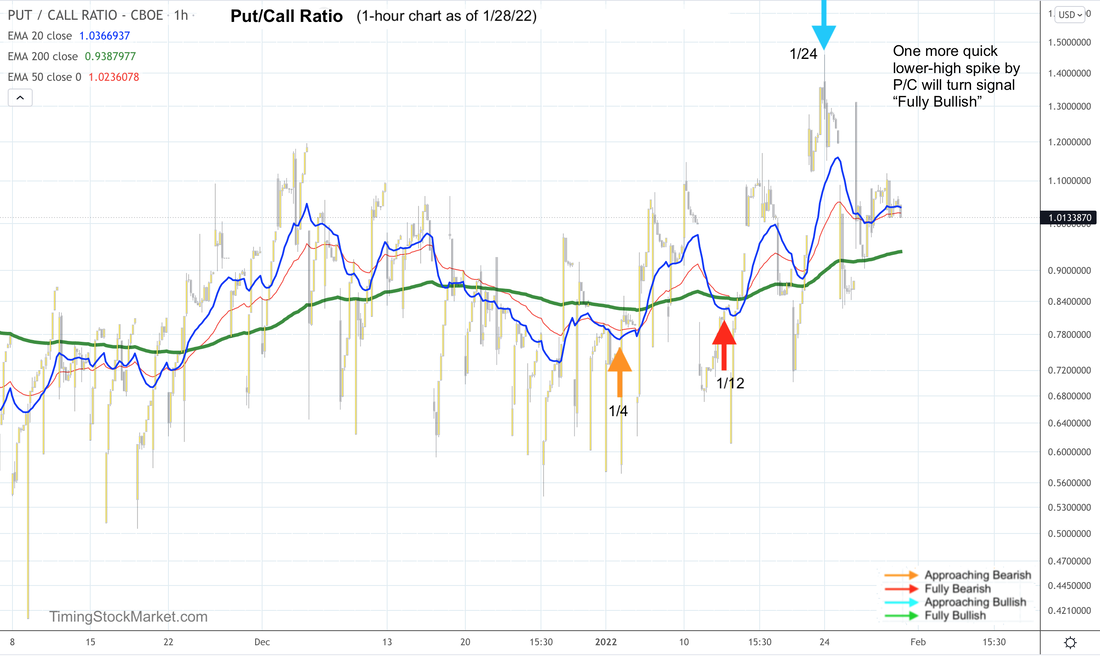

We trade 3x ETFs such as TQQQ TNA SOXL LABU UVXY using proprietary analysis of volatility. Subscribe to get our latest analysis, trade plans and live intraday trades. Current trade record here. Updates 7:15 PM ET - Sunday Key dates this week Tuesday is the start of Lunar New Year, which means there may be a lot less participation from Asian markets. This may have notable impact on futures trading. The next monthly option expiration (OPEX) date is 2/18. Expectations for next couple weeks Our system composite signal technically turned "Approaching Bullish" by end of day on 1/24. This signal still intact, and is getting more ripe. In other words, we are getting very close to "Fully Bullish". Friday's price actions ended with a big bullish move in the last 30-minutes of the trading day. This further confirms this. Our system signal is sensitive and accurate in gauging true market sentiments. It tells us that the odds are high that $SPX $NDX IWM will continue to rise for the next 1-2 weeks. Keep in mind though that the signal cannot tell us for sure the magnitude of the move (how high), or the smoothness of the move (choppy vs. steady). Expectations for next couple months So the short-term picture is improving for the stock market. However, looking out over the next couple months, there's a strong possibility that $SPX $NDX IWM may see lower lows (relative to 1/24). This is because on the weekly charts, $VIX $VXN $RVX are forming the kind of pattern that makes it possible for them to really surge. This is further confirmed by VIX futures chart. VIX futures are in backwardation, which means that traders are really worried about the market right now, as opposed to later this year. In fact, VIX futures show that they are quite worried about February and March in particular. So with OPEX coming up on 2/18, we may see our system signal turns "Fully Bullish", but does not last very long before becoming bearish again. Key price levels The key price levels are actually still the same for the indices. However, we've added SPXL to the table as we plan to trade this 3x ETF going forward. Trade Plan Click here for Signal Trades spreadsheet. Since the composite signal is a very ripe "Approaching Bullish", we will look to scale into SPXL and TQQQ on Monday. Volatility: $VVIX $VIX $VXN $RVX Read more about $VIX $VXN $RVX $VVIX here. All volatility charts have turned "Approaching Bullish" by end of 1/24. This signal is still intact. We are now looking for $VVIX chart pattern to anchor at or below its 200-hour EMA green line. Then bulls should hope that $VVIX forms a quick lower-high spike (relative to 1/24). This will shake out the weak hands and turn the signal "Fully Bullish". Hedging by Traders: Put/Call Ratio The signal from P/C ratio chart has turned "Approaching Bullish" by end of 1/24. This signal is still intact. Bulls should hope that P/C ratio chart forms a quick lower-high spike (relative to 1/24). This will turn the signal "Fully Bullish". Hedging by Dealers Read more about how options are impacting the market and the effects of dealer hedging here. Below are the updated volatility trigger levels.

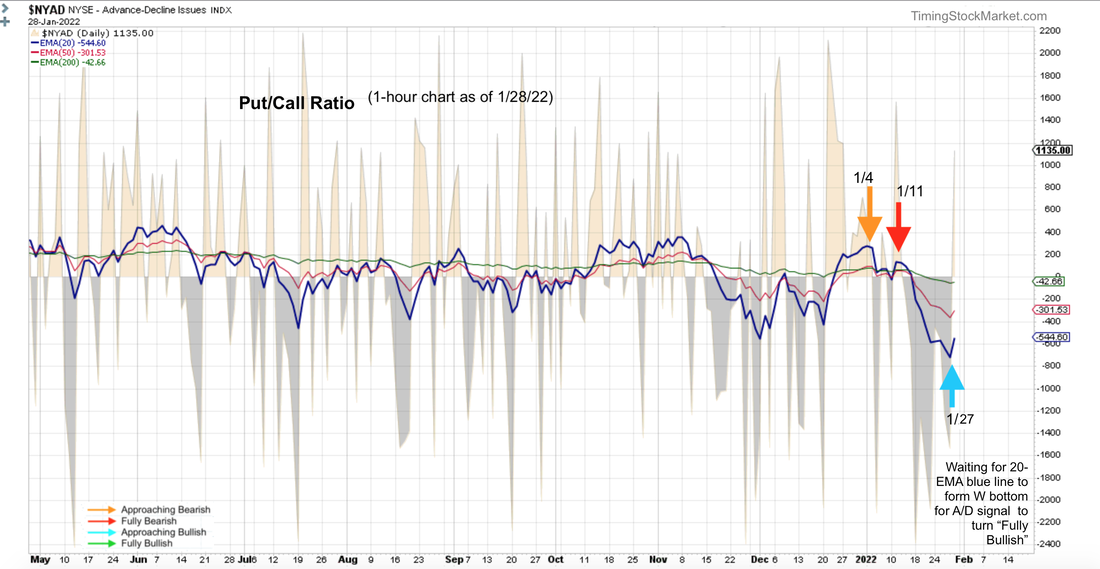

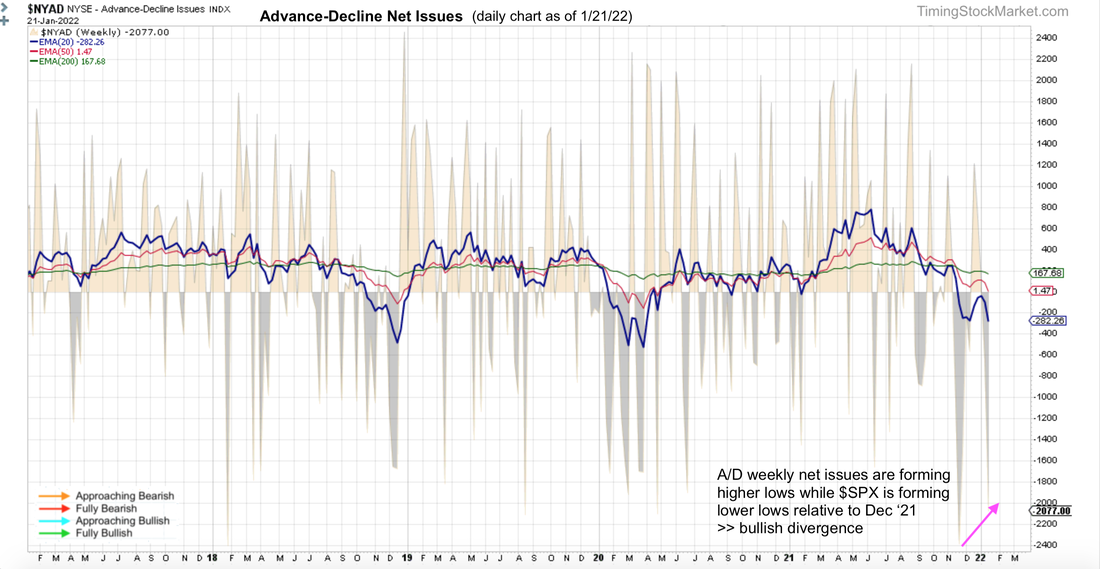

As of this writing, all indices are still below their trigger levels. This means dealer hedging will fuel volatility rather than dampen it. So expect big price swings to continue both up and down. Market Breadth: Advance-Decline Net Issues The signal for all A/D charts have changed to "Approaching Bullish" by end of 1/27. Other Signals for Big Picture Consideration The Dark Pool Index (DIX) shows silent money had a huge bullish reversal early last week. The buying has eased up somewhat. This is still an important bullish divergence. Like stock indices, most bond ETF charts (TLT IEF LQD JNK) showed bullish end of day pattern on Friday. And bond volatility (MOVE index) has formed another lower high relative to 11/26/21. This supports the short-term bullish move for stocks. Click here for Signal Trades spreadsheet. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our suggestions.

0 Comments

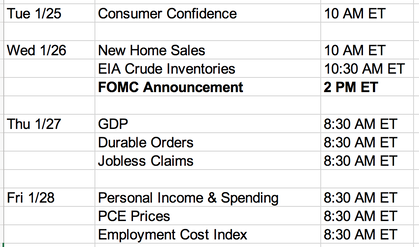

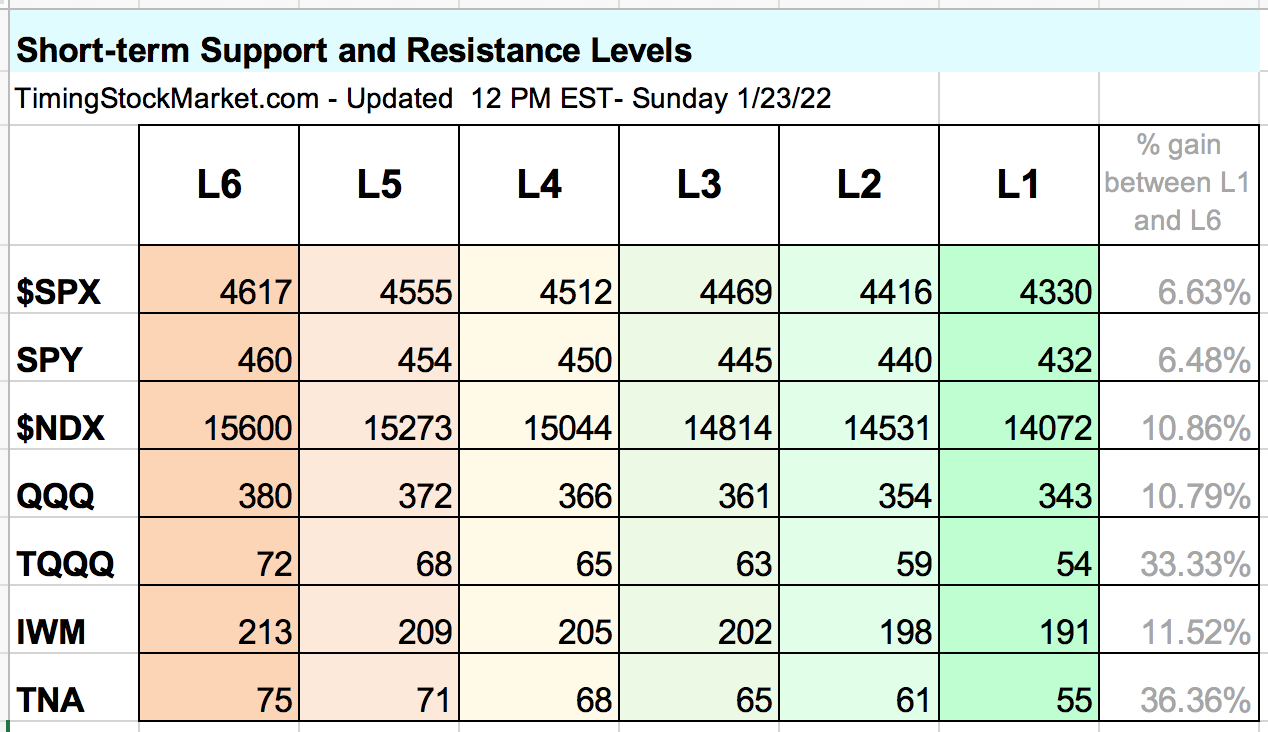

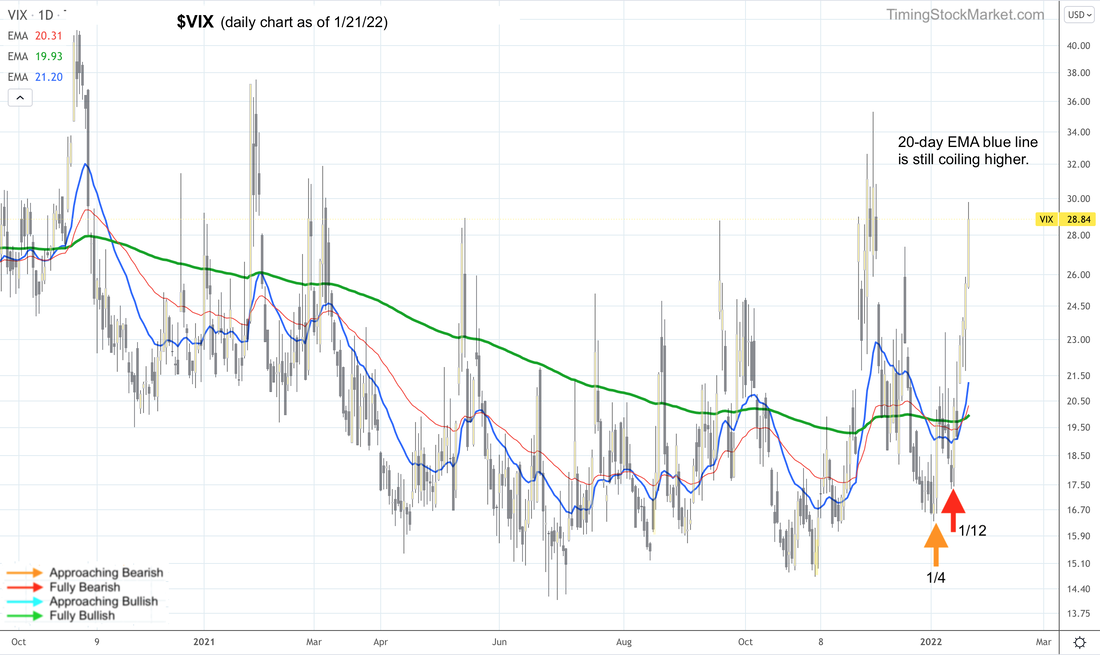

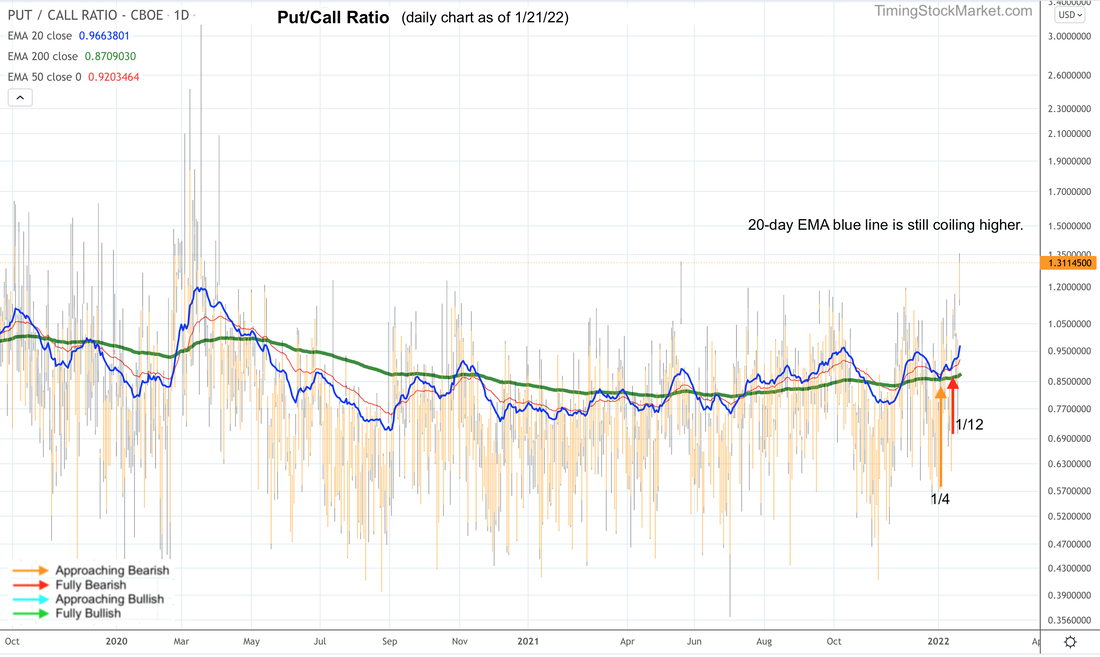

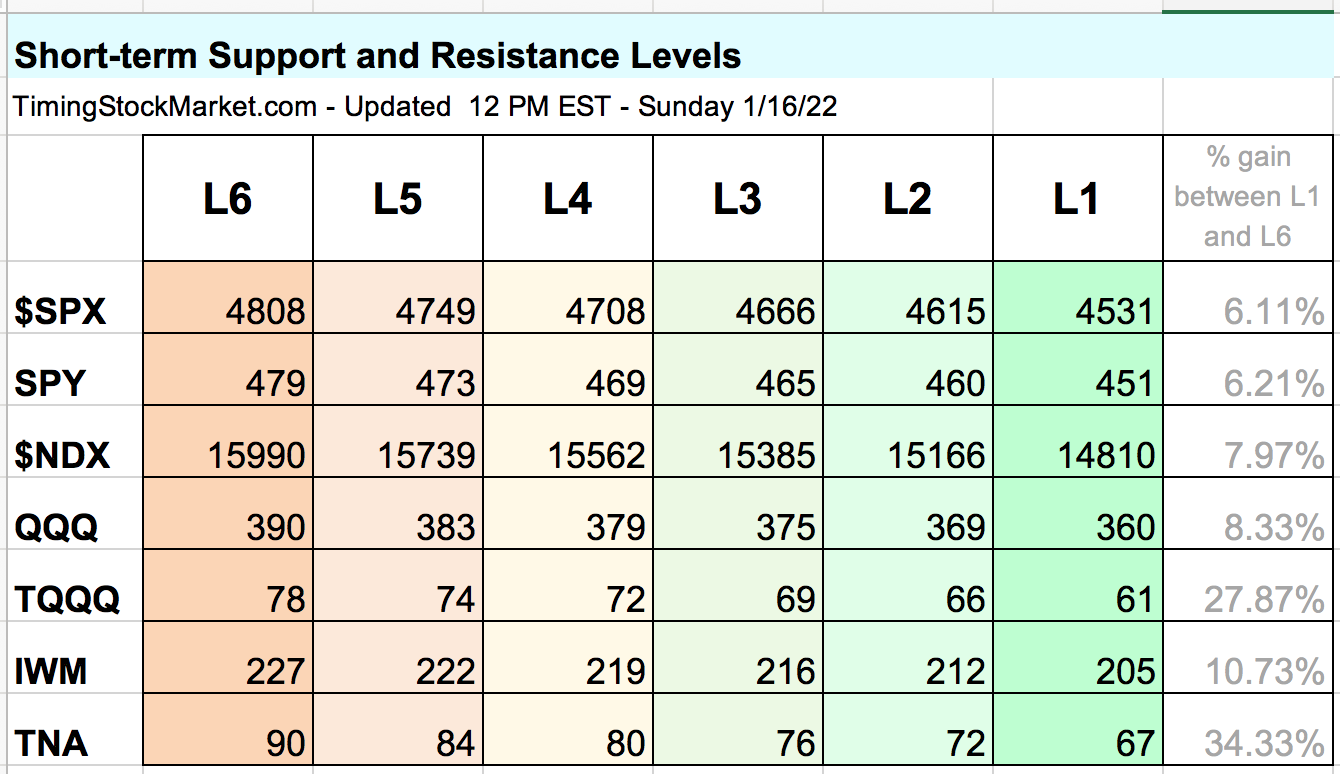

We trade 3x ETFs such as TQQQ TNA SOXL LABU UVXY using proprietary analysis of volatility. Subscribe to get our latest analysis, trade plans and live intraday trades. Current trade record here. Updates 5:45 PM ET - Sunday Key dates this week The big event this week is of course FOMC announcement on Wednesday. In addition, these gorillas are reporting earnings this week: MSFT, TSLA, AAPL. Their earnings will either be the catalysts to end the sell-off, or fuel to continue the meltdown. Expectations for this week Our system composite signal technically turned "Fully Bearish" on 1/11. And stocks have been selling off hard since then. We must confess that we underestimated the magnitude of this sell-off. At this point, the signal is still "Fully Bearish", which means more selling ahead, until the signal changes to "Approaching Bullish". However, market conditions have reached extreme oversold. So we are likely to see a bit of stabilizing and possibly a relief rally early in the week, ahead of FOMC. Depending on what the Fed says on Wednesday, there's a chance the relief rally can turn into a real rally. But the Fed may fumble it, and trigger a meltdown in the market. This is what happened back in December 2018. So stay nimble. Key price levels The table below is fully updated. Trade Plan We are planning on two different trades for this week. On Monday, we will monitor for the setup for a bounce in TQQQ. This will be a single quick trade, possibly from L1 to L3. Regardless of how high TQQQ can rise, we will exit this trade ahead of FOMC. Note that if the signal remains "Fully Bearish" while UVXY SQQQ TZA pull back (due to $SPX $NDX IWM bounce), it's a setup for re-entering UVXY SQQQ TZA. But we won't enter this bearish setup, or anything, ahead of FOMC. Simply too risky. Instead we will be monitoring for post-FOMC market reactions, and the setup of the next trade based on that. Click here for Signal Trades spreadsheet. Volatility: $VVIX $VIX $VXN $RVX Read more about $VIX $VXN $RVX $VVIX and the effects of options and hedging on the market here. All volatility charts show "Fully Bearish" signal right now. The 20-day EMA blue line is still coiling higher, confirming the bearishness. However, a big spike formed last week. So volatility may be getting close to starting the topping process. Hedging by Traders: Put/Call Ratio The signal from P/C ratio chart is still "Fully Bearish". We need to see at least a "same-high" or "lower-high" pattern from P/C ratio chart for this signal to edge towards "Approaching Bullish". Unfortunately, the 20-day EMA blue line is still coiling higher. So nothing has changed yet. Hedging by Dealers Stock market has been in a vicious cycle since the sell-off started. Steady selling triggered margin calls and panic in traders. So they sell calls and buy puts. Dealers have to take the other side of those trades, and they have to hedge their books to stay neutral. Dealer hedging in this case results in them selling into weakness and buying into strength. This causes volatility to rise. Rising volatility makes traders panic even more. So they sell more calls and buy more puts. And on it goes. Below are the updated volatility trigger levels.

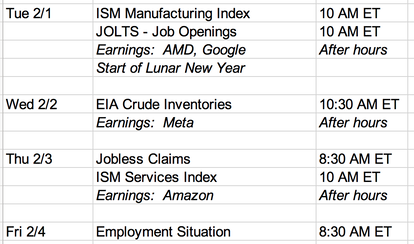

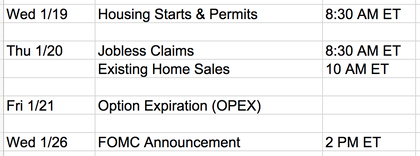

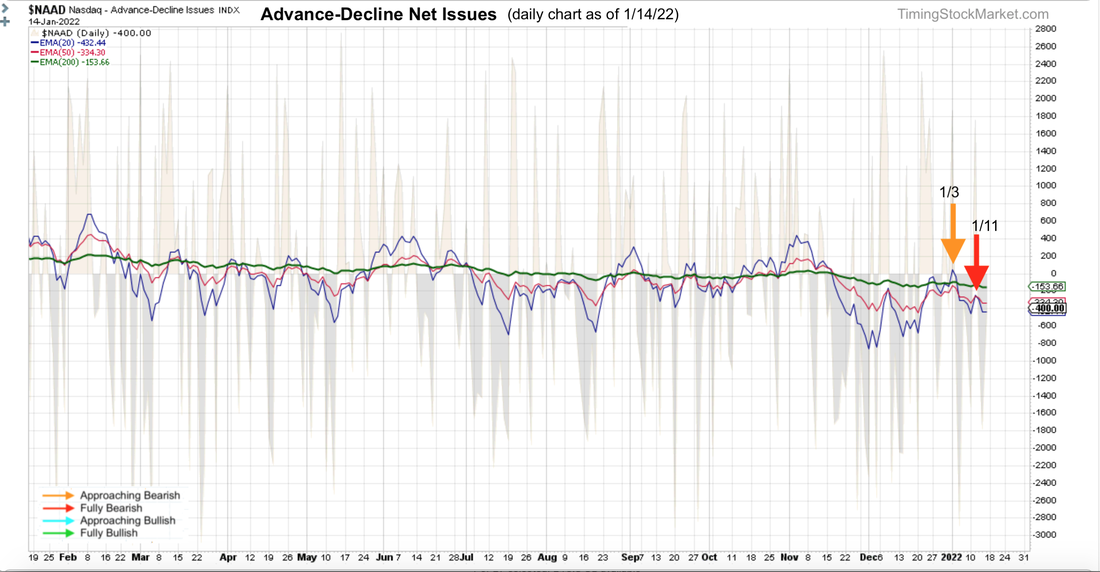

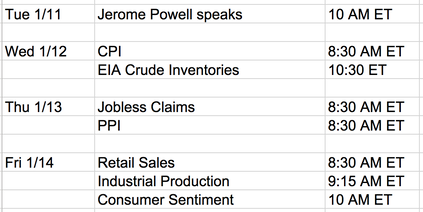

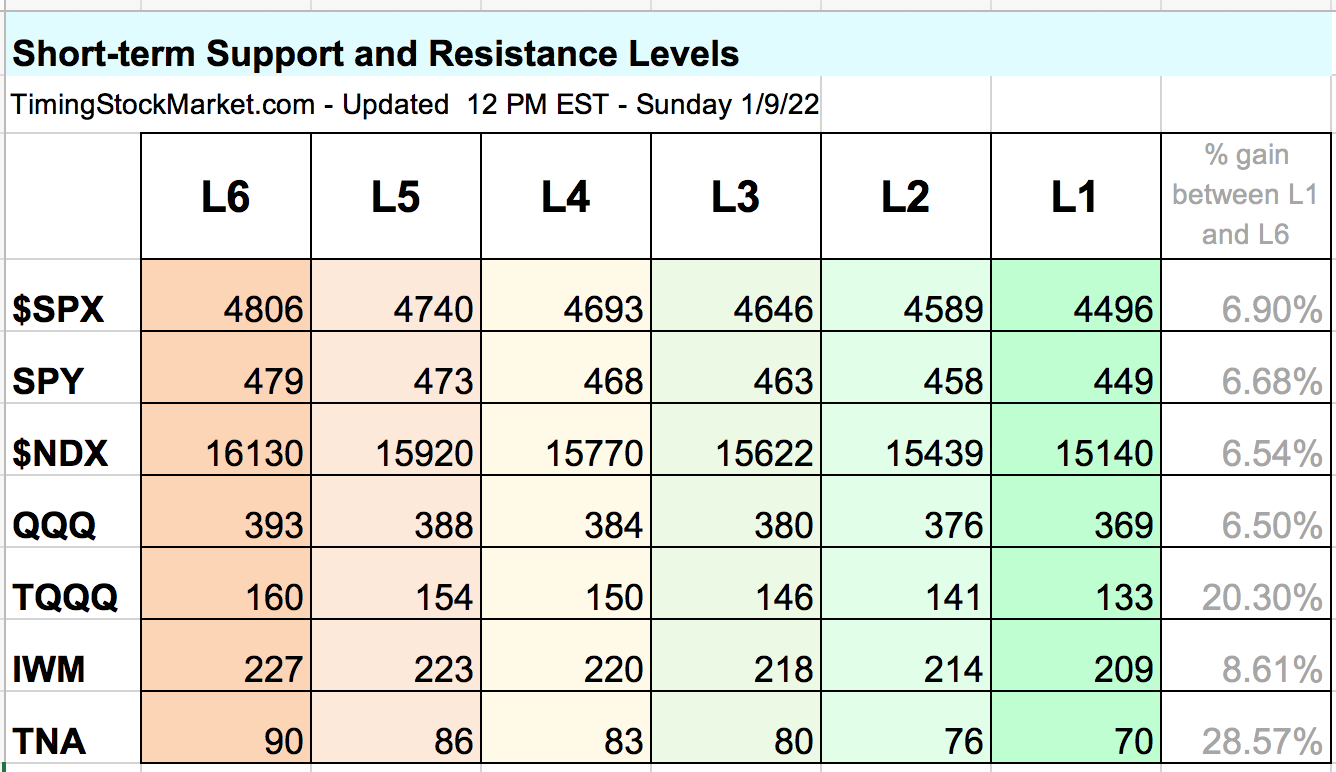

Market Breadth: Advance-Decline Net Issues The signal for all A/D charts based on their EMA lines are all "Fully Bearish" right now. But we have been noticing this pattern. NYSE A/D weekly net issues are forming higher lows while $SPX is forming lower lows relative to Dec ‘21. This is possibly a very early bullish divergence. Keep an eye on this, but don't hold your breath. Other Signals for Big Picture Consideration The Dark Pool Index shows silent money has not been actively buying $SPX. Bond volatility (MOVE index) is ended last week with a clear lower high pattern, relative to its November peak. This may be short-term topping process for bond volatility, and if true, it is an early bullish divergence for stocks from bond messages. In fact, bond ETF (TLT IEF LQD) weekly charts show that they have formed bullish candles at key support levels last week. One could argue that money is rotating into bonds for safety. But the fact that big money is buying bonds at all in the face of sharply rising rates and inflation is a good thing for the financial system overall. Click here for Signal Trades spreadsheet. To Read We urge you to read this article about risk management and position sizing. 1% Risk Rule If you are new to trading 3x leveraged ETFs like TQQQ TNA SOXL FNGU, read: Why 3x ETFs like TQQQ lose money over the long term If you are new to trading inverse ETFs like SQQQ TZA SOXS FNGD, read: The risks of investing in inverse ETFs Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our suggestions. We trade 3x ETFs such as TQQQ TNA SOXL LABU UVXY using proprietary analysis of volatility. Subscribe to get our latest analysis, trade plans and live intraday trades. Current trade record here. Updates 3 PM ET - Monday 1/17/22 Key Dates Here is the economic calendar for this week. The most important date is OPEX this Friday. Price Projections The table of key price levels has been fully updated. Earnings season has started last week. There is hope for a market boost. But based on our analysis of P/C ratio, volatility and market breadth (see discussions further below), we think the boost may be short-lived. Volatility is very likely to continue rising higher as we approach OPEX this Friday. There is a high probability that we will see price movements as follows this week:

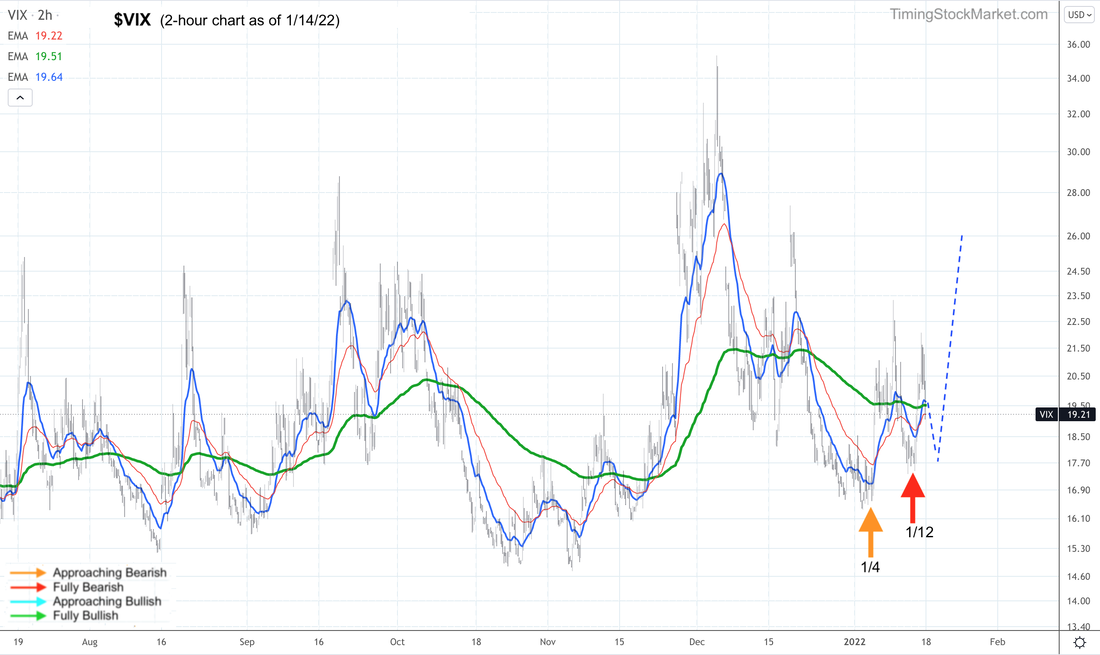

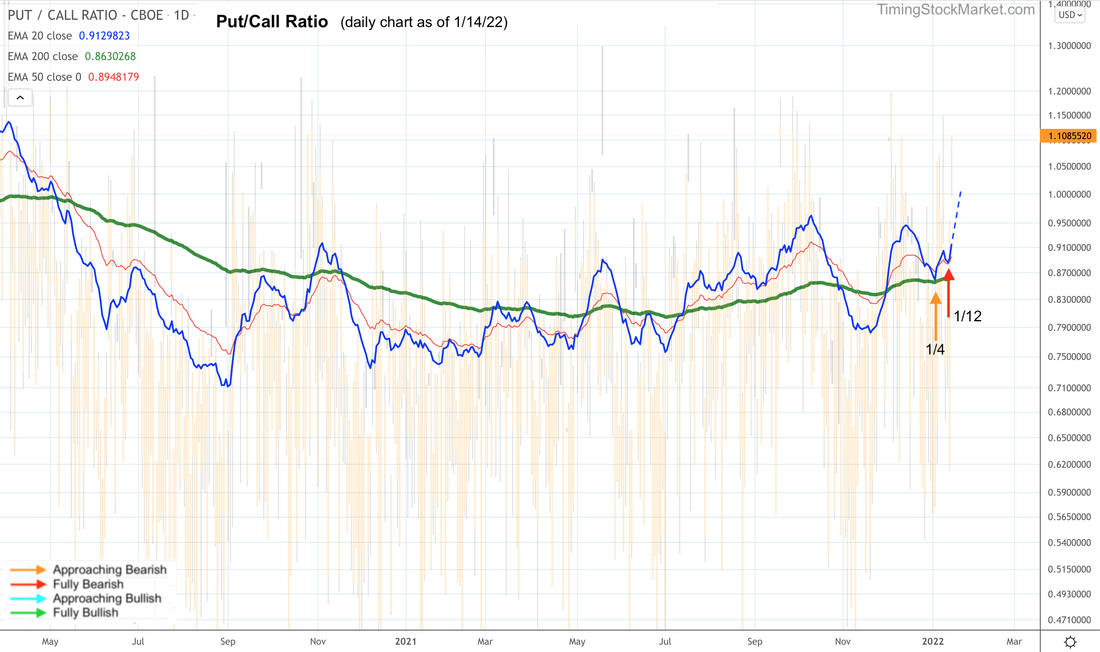

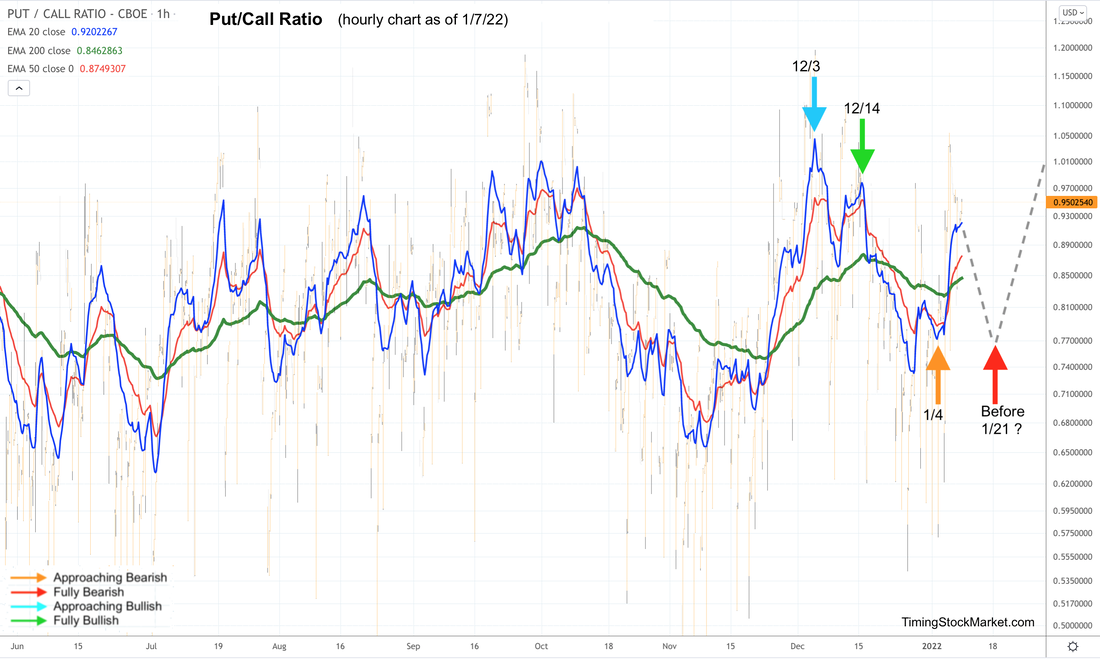

After 1/21, volatility is likely to drop while stock indices start to rise again. But be careful here as there is a rising possibility of a real big volatility spike in the first half of 2022. We will report more on that as the data unfolds. Trade Plan In this environment, we prefer to trade quick positions, and/or intraday positions, until after OPEX. Our plan is a quick trade to capture the bounce, then a bigger quick trade to capture the drop. See updated plan in spreadsheet. Volatility: $VVIX $VIX $VXN $RVX Read more about $VIX $VXN $RVX $VVIX and the effects of options and hedging on the market here. All volatility charts are showing "Fully Bearish" signal. Hedging by Traders: Put/Call Ratio The signal from P/C ratio chart is now "Fully Bearish". Hedging by Dealers Below are the updated volatility trigger levels. If price is above the trigger level, dealer hedging will change from "fueling volatility" (big price swings) to "dampening volatility" (calm price movements).

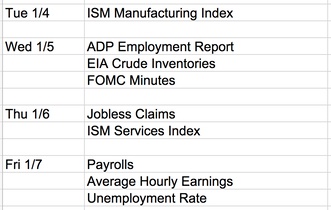

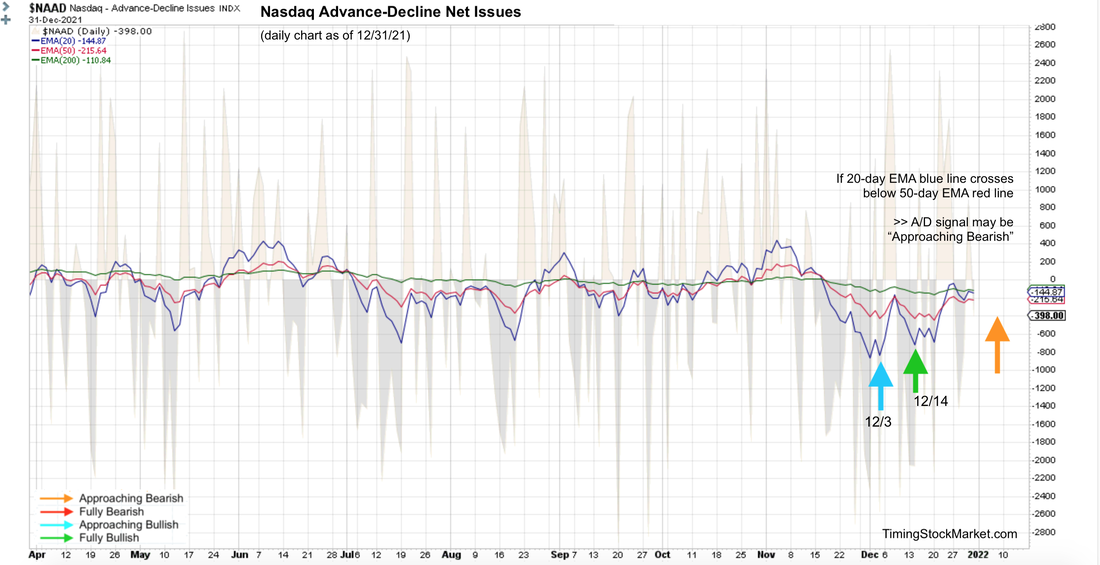

The Deep January Options Expiration On OPEX Friday 1/21, there are deep in the money calls worth over $125 billions set to expire. The magnitude of this expiration is likely a catalyst for volatility. Even if you don't trade options, this big wave is going to rock your boat. So we recommend that you read the full explanation of this important expiration here. Market Breadth: Advance-Decline Net Issues The 20-day EMA lines on A/D charts for NYSE, Nasdaq and small caps are heading down. The message here is "Fully Bearish". Other Signals for Big Picture Consideration The Dark Pool Index shows silent money has eased up on buying $SPX. We are keeping this in mind, but not assigning a lot of weight to it yet. Bond volatility (MOVE index) continues to form lower high relative to late November. We interpret this to mean that the bond market is not in turbulent mode for now, and consider it a bullish divergence from bond prices. A calm bond market is necessary for a calm stock market to follow. Junk bonds (JNK HYG) is dropping to retest its 1/10 low. On the weekly chart, JNK HYG EMA lines are converging, setting up a vulnerable pattern for junk bonds. This is a bearish warning for stocks. Click here for Signal Trades spreadsheet. To Read We urge you to read this article about risk management and position sizing. 1% Risk Rule If you are new to trading 3x leveraged ETFs like TQQQ TNA SOXL FNGU, read: Why 3x ETFs like TQQQ lose money over the long term If you are new to trading inverse ETFs like SQQQ TZA SOXS FNGD, read: The risks of investing in inverse ETFs Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our suggestions. We trade 3x ETFs such as TQQQ TNA SOXL LABU UVXY using proprietary analysis of volatility. Subscribe to get our latest analysis, trade plans and live intraday trades. Current trade record here. Updates 12:45 AM ET - Monday 1/10/22 Key Dates Here is the economic calendar for this week. Jerome Powell's speech will undoubtedly be monitored closely for level of hawkishness. And the inflation data (CPI and PPI) can potentially move the market a lot too. Looking further into January, we have two key dates. Fri 1/21: OPEX Wed 1/26: FOMC announcement Finally, all markets will be closed on Monday 1/17 for Martin Luther King holiday. Market Breadth: Advance-Decline Net Issues We start today with the indicator that has the clearest pattern. The signal from A/D line "Approaching Bearish". This is true for NYSE, Nasdaq and small cap charts. Hedging by Traders: Put/Call Ratio The current signal from P/C ratio chart is "Approaching Bearish". From here, there are two possible scenarios for P/C ratio.

Hedging by Dealers Below are volatility trigger levels. If price is above the trigger level, dealer hedging will change from "fueling volatility" (big price swings) to "dampening volatility" (calm price movements).

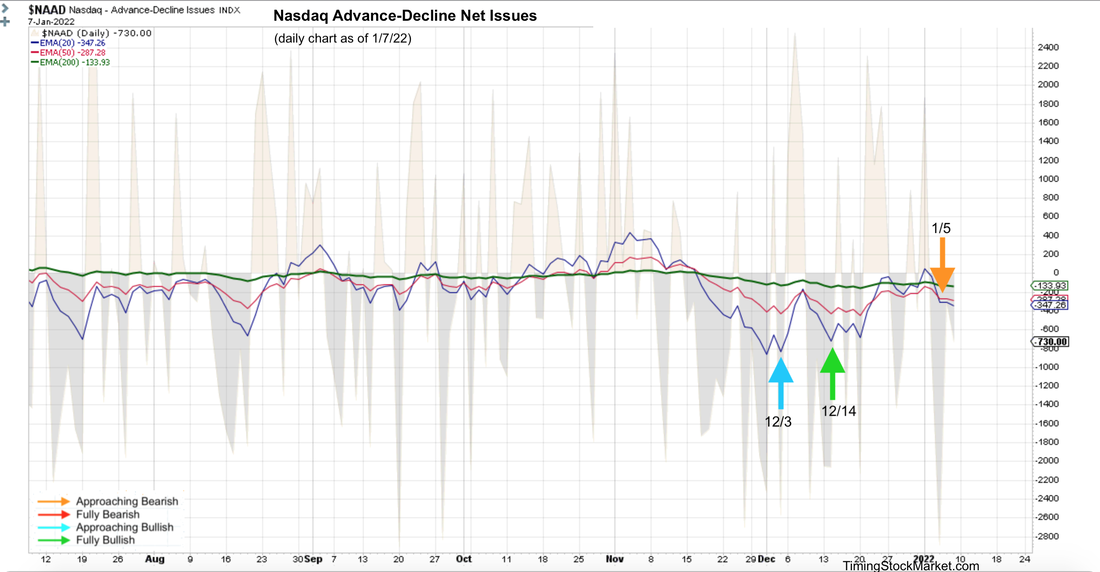

As of this writing, $SPX $NDX IWM are all below their trigger levels. Expect big price swings to continue. Volatility: $VVIX $VIX $VXN $RVX Read more about $VIX $VXN $RVX $VVIX and the effects of options and hedging on the market here. By the end of last week, $VIX $VXN $RVX daily charts all show the possibility of a lower high topping formation. If this pattern persists, it certainly is a bullish divergence and eventually becomes bullish tailwind for $SPX $NDX IWM. However, when it comes to volatility, we can't ignore the monthly option expiration (OPEX) cycle. As January progresses, the chart that is the most reliable keeper of this cycle is $VVIX (volatility of $VIX). $VVIX 2-hour chart below shows that it may have formed the "Approaching Bearish" signal on 1/5. Assuming that this is true, we are now looking for a same-low or higher-low pattern to form which would make the signal "Fully Bearish". Then we would expect to see $VVIX rises above its 200 EMA green line, and keeps rising until it forms its monthly spike around OPEX. Of course, none of this is guaranteed. But there is a high probability that some pattern comparable to this will unfold. Other Signals The Dark Pool Index brings some good news for the bulls. It is showing a moderate upturn in $SPX buying. There are a few possible implications:

Bond volatility (MOVE index) eased up again on Friday. Zooming out on this chart, we observe that over the next few weeks, bond volatility is likely to drop some amount. But over the next few months, there is a strong possibility that bond volatility will really spike up big. If this happens, it will have a big impact on the stock market. Junk bonds (JNK HYG) dropped steeply last week, and may be approaching a short-term bottom. Junk bonds tend to behave more like $SPX, so this may be welcoming for $SPX bulls. But in the big picture context, junk bonds chart continues to look vulnerable. Short-term Key Levels This table is all updated except for $SPX SPY. Trade Plan At this point, the combined signal is "Approaching Bearish". So here is our personal short-term strategy for trading. We plan to wait for this signal to turn into "Fully Bearish", then:

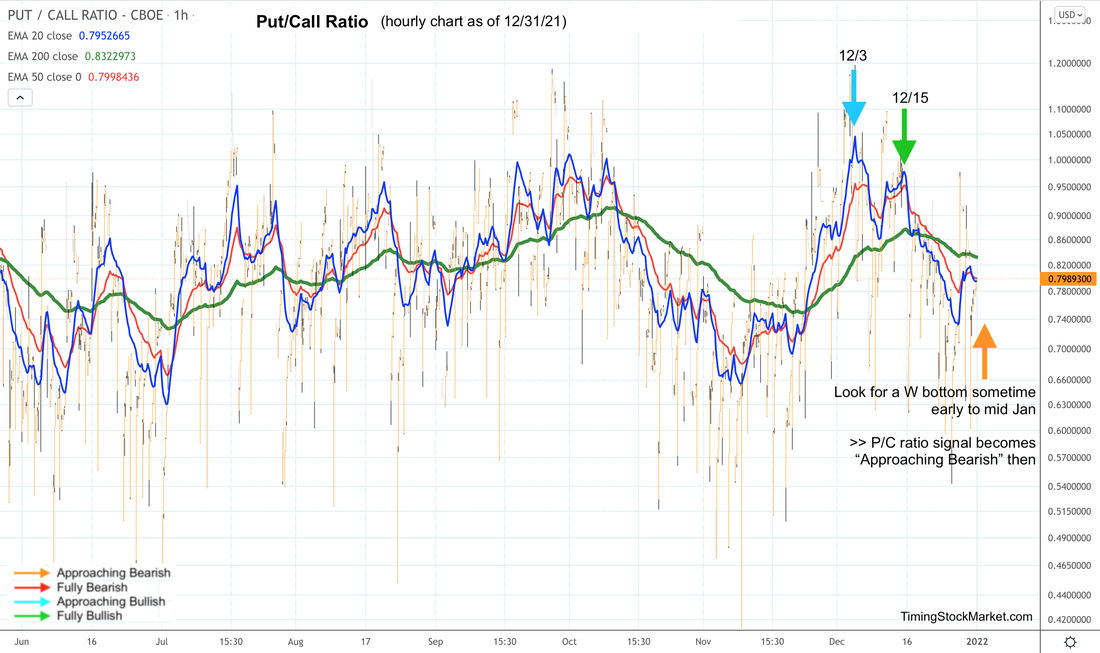

See updated plan in spreadsheet. To Read We urge you to read this article about risk management and position sizing. 1% Risk Rule If you are new to trading 3x leveraged ETFs like TQQQ TNA SOXL FNGU, read: Why 3x ETFs like TQQQ lose money over the long term If you are new to trading inverse ETFs like SQQQ TZA SOXS FNGD, read: The risks of investing in inverse ETFs Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our suggestions. We trade 3x ETFs such as TQQQ TNA SOXL LABU UVXY using proprietary analysis of volatility. Subscribe to get our latest analysis, trade plans and live intraday trades. Current trade record here. Updates 8:00 PM EST - Sunday Key Dates Here is the economic calendar for this week. Friday's job report will no doubt have a lot of impact on the market. But the big ones will be these two key dates. Fri 1/21: OPEX Wed 1/26: FOMC announcement Volatility: $VVIX $VIX $VXN $RVX Read more about $VIX $VXN $RVX $VVIX and the effects of options and hedging on the market here. Currently the signals from all volatility charts are still "Fully Bullish". There are three possible scenarios that may show up early this week. And each scenario has a different implication. We'll be monitoring for them closely.

Hedging by Traders: Put/Call Ratio Currently the signal from P/C charts is still "Fully Bullish". What the P/C ratio is showing is that traders and fund managers are not loading up on puts to hedge their long portfolios. Not yet. Using the P/C ratio chart to visually guide us, we still need to wait for at least one W bottom to form (20-hour EMA blue line). This may happen some time early to mid January. When this pattern shows up, then the P/C ratio signal becomes “Approaching Bearish”. Hedging by Dealers Dealer hedging right now has a "dampening volatility" effect on the market. This is bullish for stocks. Here are the updated key price levels. If $SPX $NDX IWM drop below these key levels, dealer hedging will swing from "dampening volatility" to "fueling volatility".

Market Breadth: Advance-Decline Net Issues Currently the signal from A/D line is still "Fully Bullish". NYSE, Nasdaq and S&P small caps have been forming big W bottoms (via their 20-day EMA blue lines) since 12/1. This bullish pattern is still technically intact for all three charts. Factoring in the possible upcoming changes in volatility and P/C ratio, we would say that if the 20-day EMA blue line turns down and crosses below the 50-day EMA red line, the signal from A/D line may become "Approaching Bearish". Other Signals The Dark Pool Index shows that silent money has eased up on their buying of $SPX during the entire last week of 2021. This may be an early warning of bearish time to come, but we have to take this information with a grain of salt as it does not track as closely as the other indicators above. Bond volatility (MOVE index) continues to form another lower high on its chart relative to the level from late November. We consider this bullish for stocks. Junk bonds (JNK HYG) is forming a short-term top. Junk bonds tend to behave more like $SPX, so this is not bullish news for $SPX. This is some thing to continue monitoring. Short-term Key Levels and Trade Plan Subscribe to get our latest analysis, trade plans and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our suggestions. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed