|

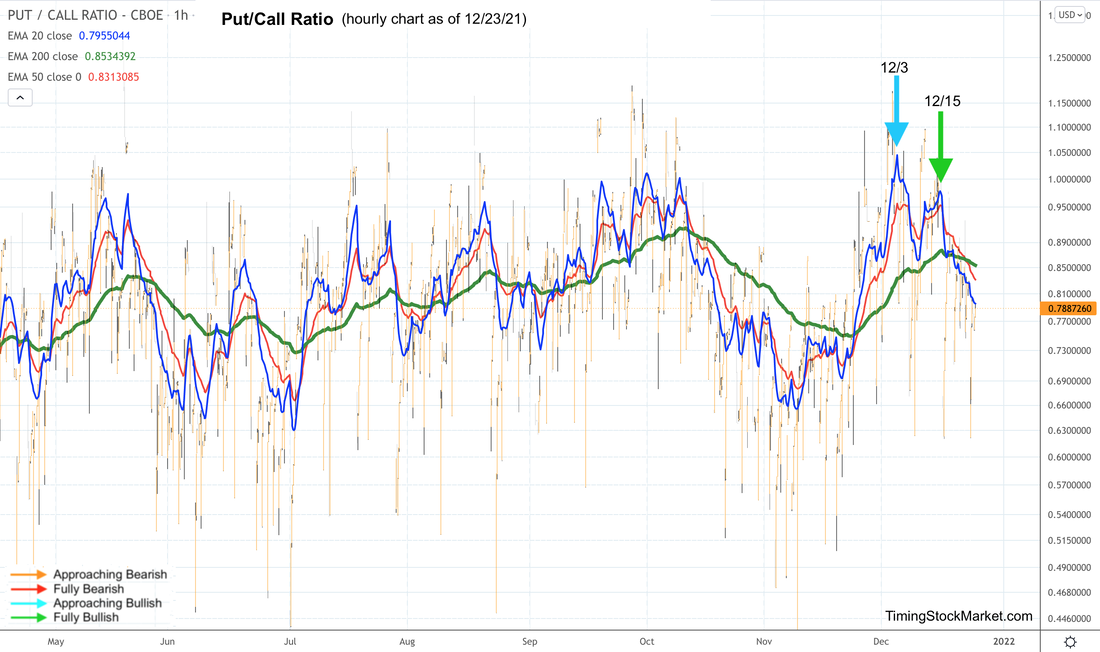

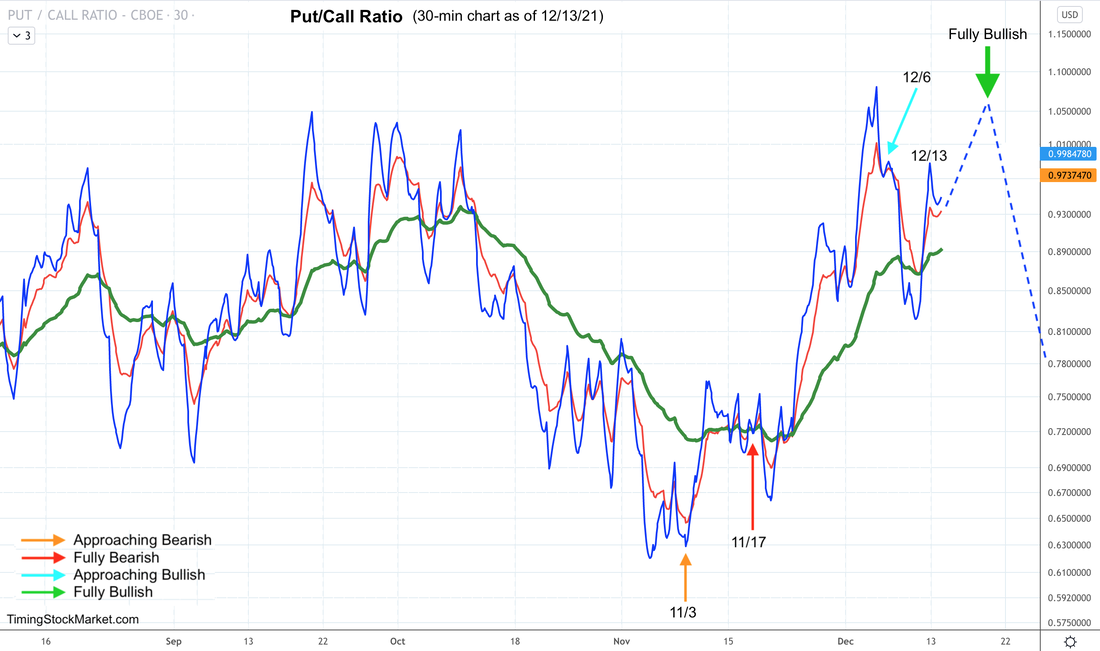

We trade 3x ETFs such as TQQQ TNA SOXL LABU UVXY using proprietary analysis of volatility. Subscribe to get our latest analysis, trade plans and live intraday trades. Current trade record here. Updates 1:30 PM EST - Sunday Key Dates The stock market will be open this entire week, including Friday 12/31, the last trading day of the year. The economic reports are few this week. Looking ahead into January, here are some key dates that will definitely move the market. As you can see the latter part of January may get turbulent. January 21: OPEX January 26: FOMC announcement Hedging by Traders: Put/Call Ratio Notice how the 20-hour EMA blue line is still dropping steadily below the 200-hour EMA green line in the P/C ratio chart below. The demand for puts is still declining. This leads to lower volatility, which leads to lesser demand for puts. Conditions remain "Fully Bullish" for now. Hedging by Dealers Here are the updated key price levels below which dealer hedging swings from "dampening volatility" to "fueling volatility". Currently $SPX $NDX IWM are all above their key levels. Therefore, we should continue to see the "dampening volatility" effect of dealer hedging.

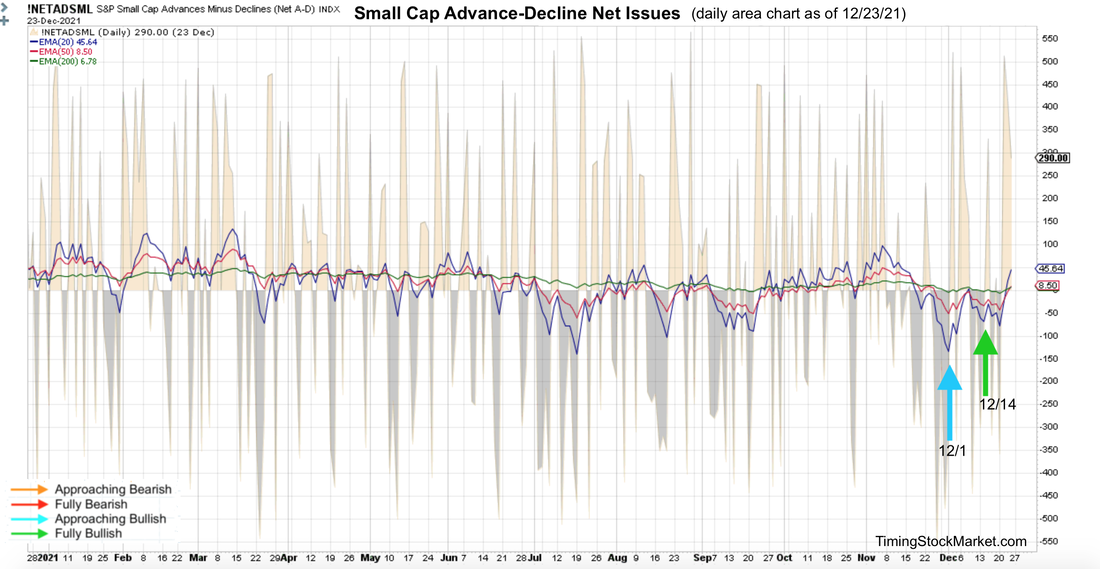

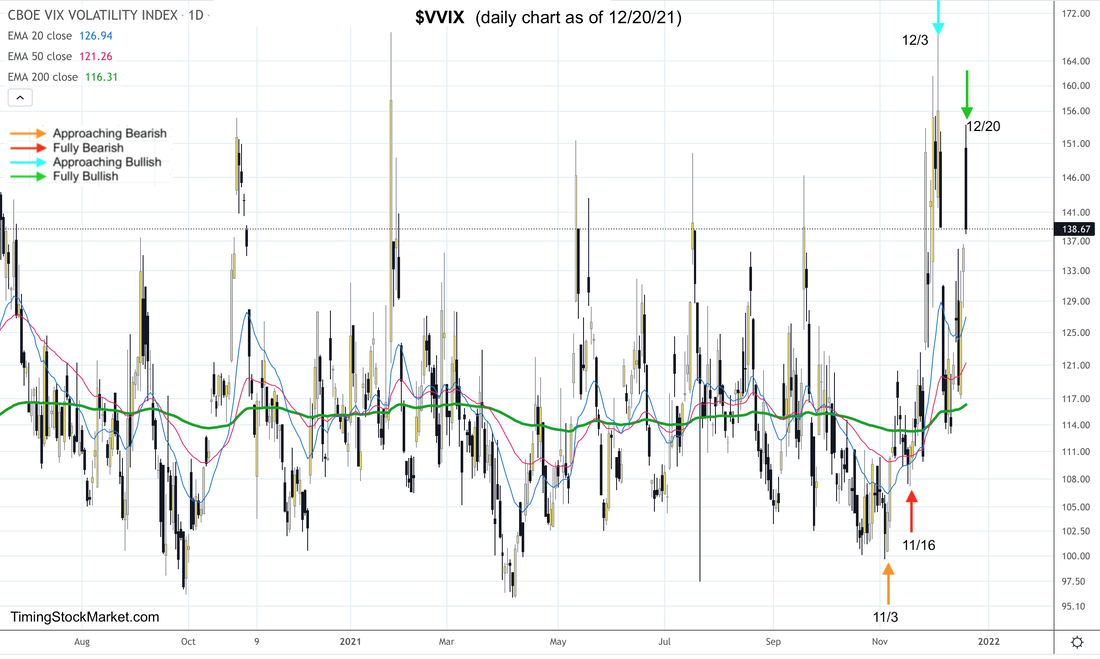

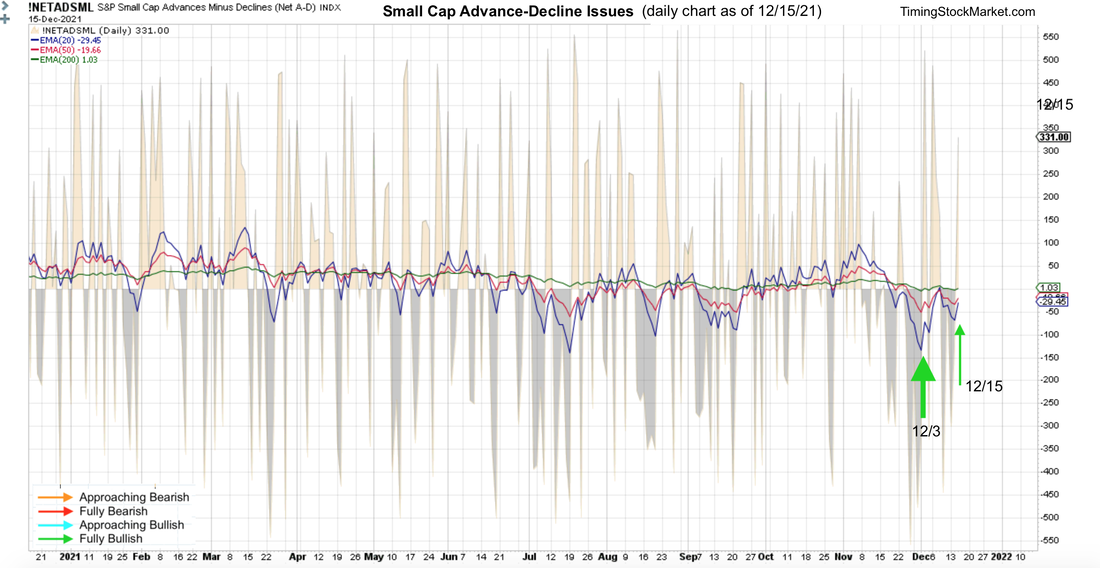

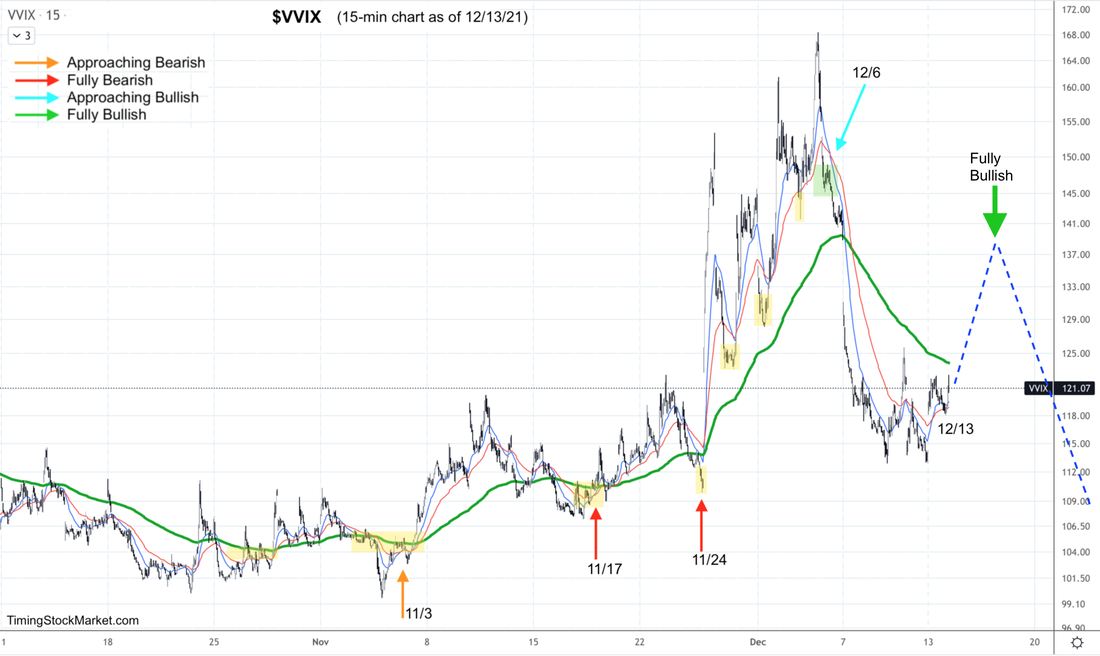

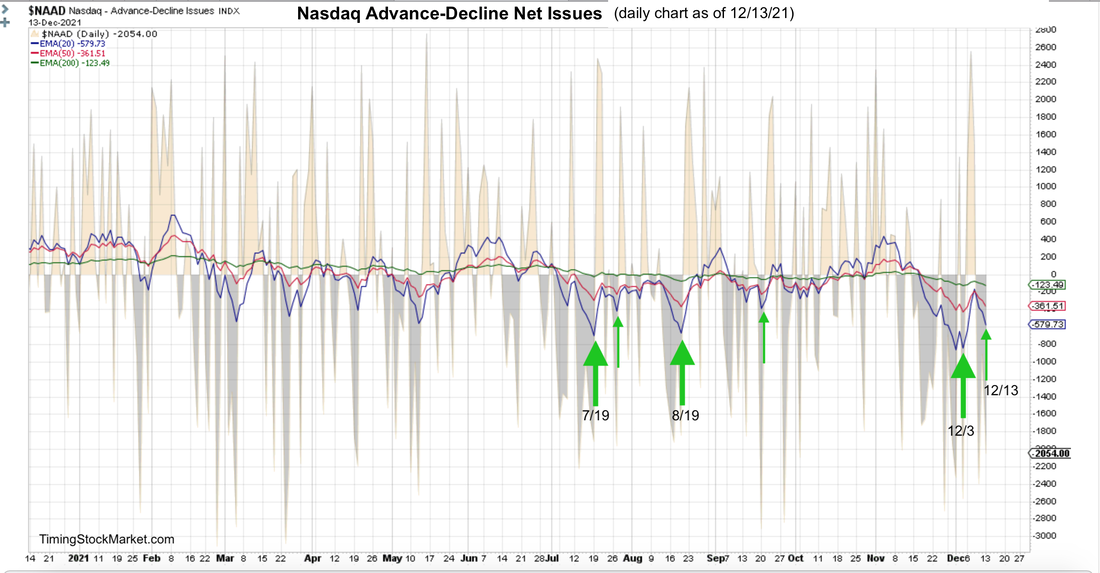

Volatility: $VVIX $VIX $VXN $RVX Read more about $VIX $VXN $RVX $VVIX and the effects of options and hedging on the market here. As the demand for puts drop, volatility drops. This is most evident in $VIX 30-minute chart below. Observe how the 200 EMA green line has formed a top since 12/3, and has been declining nicely. $VVIX $VXN $RVX charts are all showing similar lower high patterns, confirming their "Full Bullish" signals as well. It would actually be even more bullish if $VIX spikes up early in the week to the zone of 22-23 one more time. That would result in another lower high spike, with the accompanying dips in $SPX $NDX IWM, and the arrival of more buy-the-dip buyers. Market Breadth: Advance-Decline Net Issues NYSE, Nasdaq and S&P small caps have been forming big W bottoms (via their 20-day EMA blue lines) since 12/1. This bullish pattern is still intact for all three charts. Here it is shown for small caps. Other Signals

The Dark Pool Index shows that silent money has been buying $SPX since 11/18. However, the buying appears to be ebbing last week, so we'll have to keep an eye on this. Bond volatility (MOVE index) formed another lower high on its chart relative to the level from late November. We consider this bullish for stocks. Junk bonds (JNK HYG) had a very bullish week last week. This indicates a risk-on mood, and bodes well for the stock market. Short-term Key Levels and Trade Plan Subscribe to get our latest analysis, trade plans and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our suggestions.

0 Comments

We trade 3x ETFs such as TQQQ TNA SOXL LABU UVXY using proprietary analysis of volatility.

Subscribe to get our latest analysis, trade plan and live intraday trades. Current trade record here. We trade 3x ETFs such as TQQQ TNA SOXL LABU UVXY using proprietary analysis of volatility.

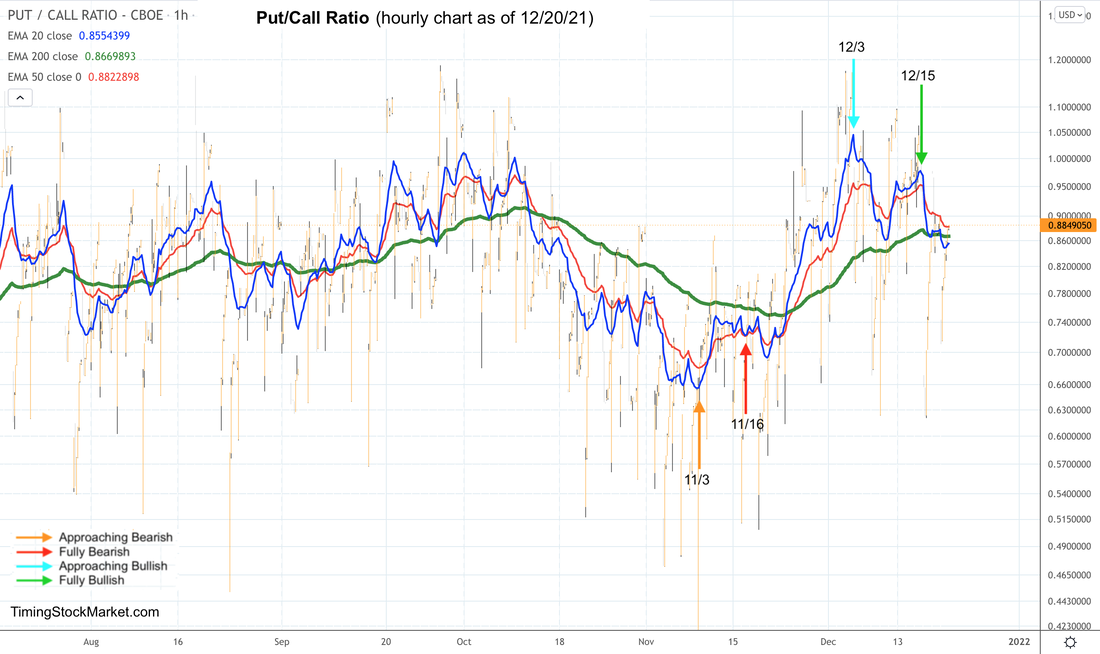

Subscribe to get our latest analysis, trade plan and live intraday trades. Current trade record here. We trade 3x ETFs such as TQQQ TNA SOXL LABU UVXY using proprietary analysis of volatility. Updates 1:30 AM EST - Tuesday 12/21/21 Volatility: $VVIX $VIX $VXN $RVX Read more about $VIX $VXN $RVX $VVIX and the effects of options and hedging on the market here. Recall our system's basic rule: same/lower high spike for all volatility charts simultaneously constitute a "Fully Bullish" signal. And that is what we still got as a pattern for $VVIX $VIX $VXN $RVX charts. Despite the fact that Monday's high is higher than the two previous days, it is technically lower than the key spike on 12/3. Hedging by Traders: Put/Call Ratio The P/C ratio 20-hour EMA has dropped below its 200-hour EMA level, reflecting short-term drop in the demands for puts by traders and fund managers. Again, the P/C ratio pattern signals "Fully Bullish" for now. Hedging by Dealers Here are the updated key price levels below which dealer hedging swings from "dampening volatility" to "fueling volatility". Currently $SPX $NDX are below the key levels, and IWM is just barely above it. So buckle up for some more big price swings, up and down.

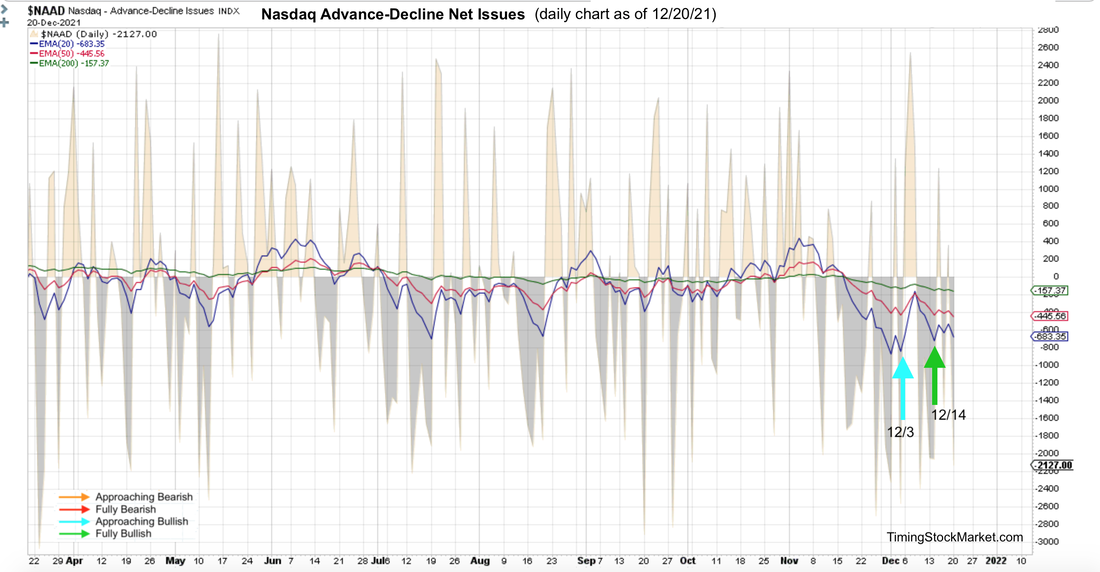

Market Breadth: Advance-Decline Net Issues NYSE, Nasdaq and S&P small caps had been forming big W bottoms since 12/1. The bullish pattern is still intact, though barely. Other Signals The Dark Pool Index shows that silent money has been buying $SPX since 11/18. But it dropped as of 12/20. This has been a long run, so let's see how this may affect the regular market. Short-term Key Levels and Trade Plan Subscribe to get our latest analysis, trade plan and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our suggestions. We trade 3x ETFs such as TQQQ TNA SOXL LABU UVXY using proprietary analysis of volatility.

Subscribe to get our latest analysis, trade plan and live intraday trades. Current trade record here. We trade 3x ETFs such as TQQQ TNA SOXL LABU UVXY using proprietary analysis of volatility.

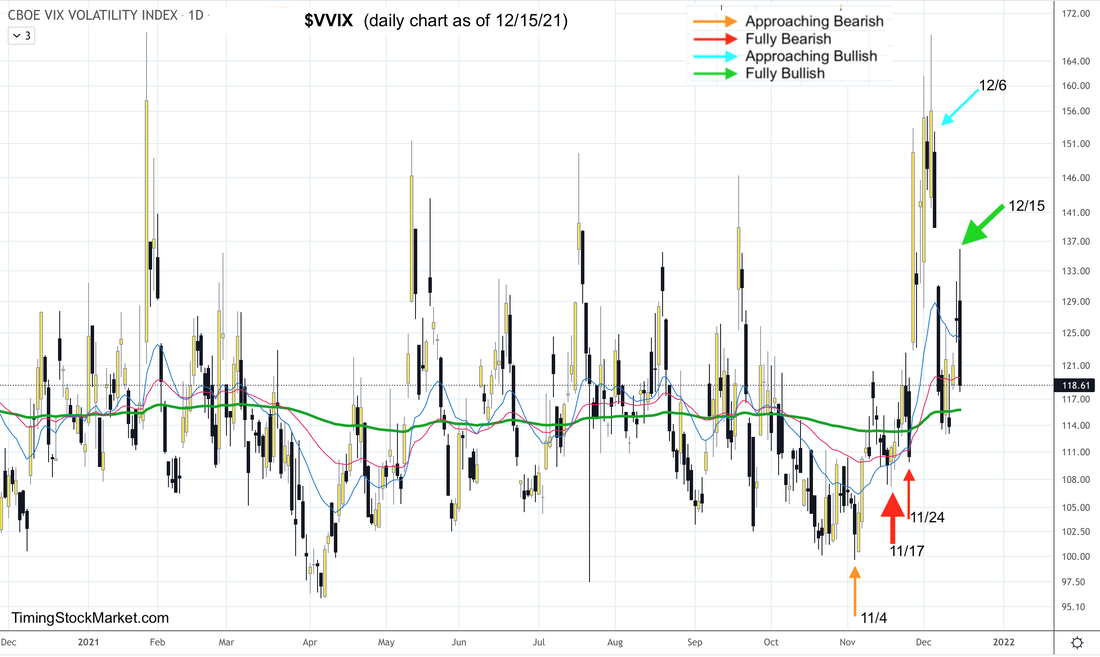

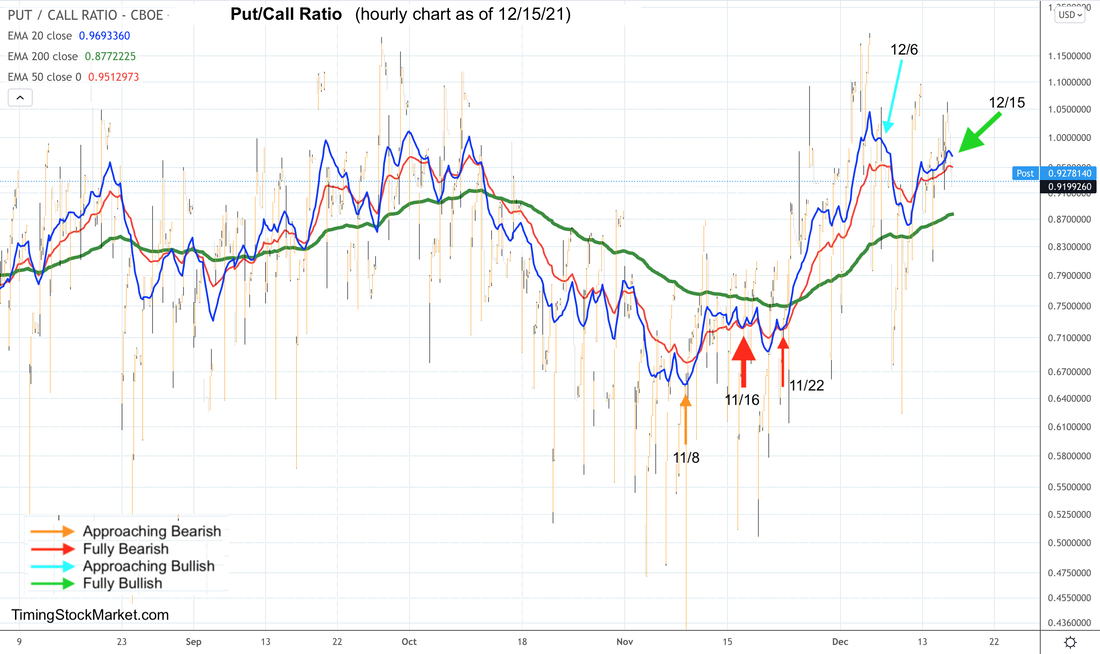

Subscribe to get our latest analysis, trade plan and live intraday trades. Current trade record here. We trade 3x ETFs such as TQQQ TNA SOXL LABU UVXY using proprietary analysis of volatility. Subscribe to get our latest analysis, trade plan and live intraday trades. Current trade record here. Updates 12:30 AM EST - Thursday 12/16/21 Volatility: $VVIX $VIX $VXN $RVX Read more about $VIX $VXN $RVX $VVIX and the effects of options and hedging on the market here. We've been describing that we want to see all volatility charts form lower highs. That's a ”Fully Bullish” signal. And that's what we got post FOMC Wednesday. Hedging by Traders: Put/Call Ratio We also wanted to see similar pattern on the Put/Call ratio chart. Such pattern is a ”Fully Bullish” signal. And that's what we got post FOMC Wednesday. Hedging by Dealers Note that the P/C ratio 20-hour EMA blue line is still above the 200-hour EMA green line. This is bullish. It means there are still puts held by traders. This put inventory is going to expire this OPEX Friday. The subsequent covering of stock and futures hedges by dealers will continue to provide fuel for the Santa Claus rally. Key price levels to keep an eye on. Below these levels, dealer hedging can cause violent price swings. IWM is still in this category.

Market Breadth: Advance-Decline Net Issues NYSE, Nasdaq and S&P small caps had been forming big W bottoms since 12/1. The bullish pattern is still intact. Of all the indices, small caps breadth is actually the strongest in its pattern as shown below. Other Signals

The Dark Pool Index shows that silent money has been buying $SPX since 11/18, and is still buying as of Wednesday 12/15. In addition, they are buying notable amount of QQQ and TNA. Junk bonds (JNK HYG), which tend to behave like $SPX, have been rallying since 12/2. The rally stalled for a bit last week, but has resumed post FOMC. This is bullish for $SPX. Short-term Key Levels and Trade Plan Subscribe to get our latest analysis, trade plan and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our suggestions. We trade 3x ETFs such as TQQQ TNA SOXL LABU UVXY using proprietary analysis of volatility.

Subscribe to get our latest analysis, trade plan and live intraday trades. Current trade record here. We trade 3x ETFs such as TQQQ TNA SOXL LABU UVXY using proprietary analysis of volatility. Updates 8:00 PM EST - Monday Volatility: $VVIX $VIX $VXN $RVX Read more about $VIX $VXN $RVX $VVIX and the effects of options and hedging on the market here. We are still looking for the same key patterns discussed yesterday. Here's what to look for on $VVIX chart.

$VVIX is actually the chart that shows the clearest warning pattern as of Monday. It's a W pattern below the 200 EMA green line. That is usually a warning that volatility overall is likely to rise some amount. To be clear, we are not talking about a massive volatility spike that accompanies a market crash. We are just saying there's likely one more volatility spike for $VVIX $VIX $VXN $RVX, and one more dip of some sort for $SPX $NDX IWM some time post FOMC. Hedging by Traders: P/C Ratio Even though implied volatility has been dropping, the demand for puts from traders and fund managers are still high, above the 200 EMA green line in the P/C ratio chart below. This is understandable as they want to be hedged ahead of FOMC on Wednesday. Key patterns to look for in the intraday charts of P/C ratio:

Hedging by Dealers Keep an eye on the following key gamma levels. If prices drop below them, gamma turns negative. This means dealer will hedge by selling into weakness and buying into strength. This action will fuel volatility and causes big price swings.

IWM is actually below the key gamma level. This means that gamma for small-caps index is still negative. In other words, big price swings are still likely for IWM. Market Breadth: Advance-Decline Net Issues NYSE, Nasdaq and S&P small caps had been forming big W bottoms since 12/1. The pattern is stalling a bit, but is still intact. Of all the indices, Nasdaq breadth is still the weakest. Below is its daily area chart.

Other Signals

Short-term Key Levels and Trade Plan Subscribe to get our latest analysis, trade plan and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our suggestions. We trade 3x ETFs such as TQQQ TNA SOXL LABU UVXY using proprietary analysis of volatility.

Subscribe to get our latest analysis, trade plan and live intraday trades. Current trade record here. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed