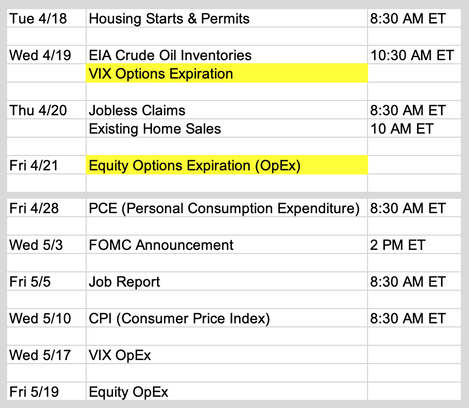

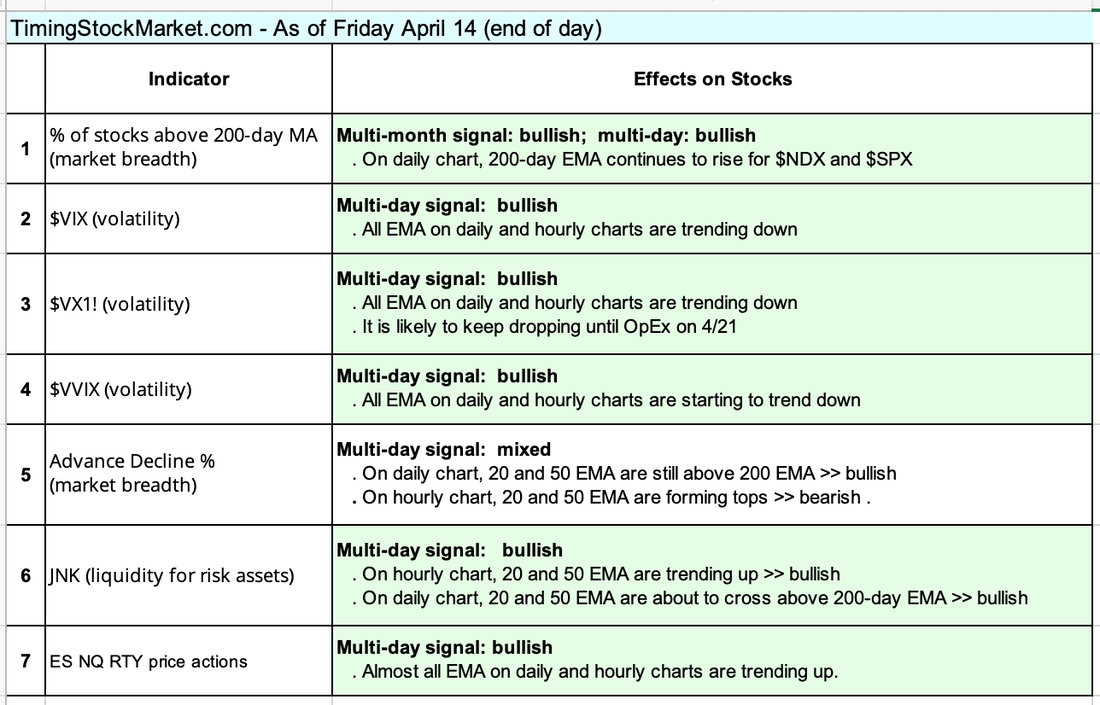

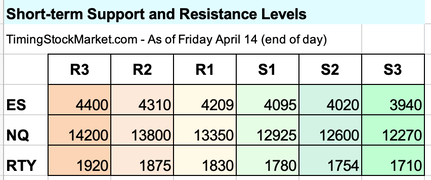

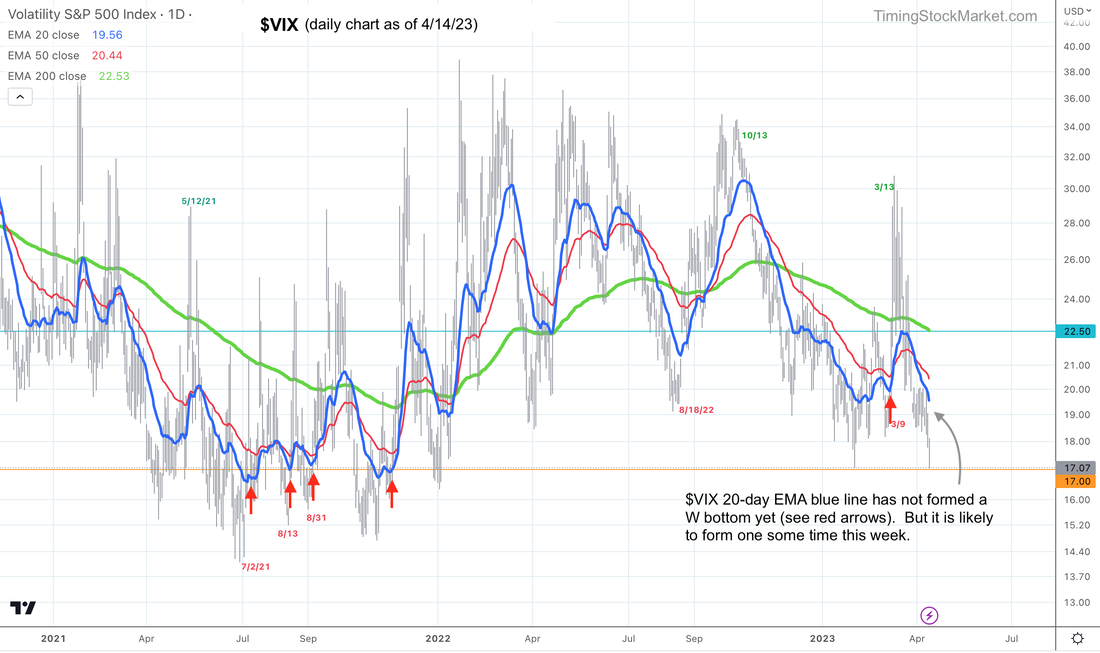

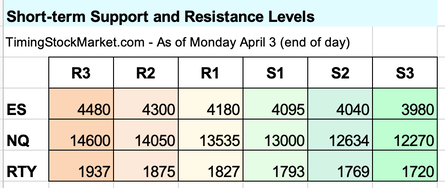

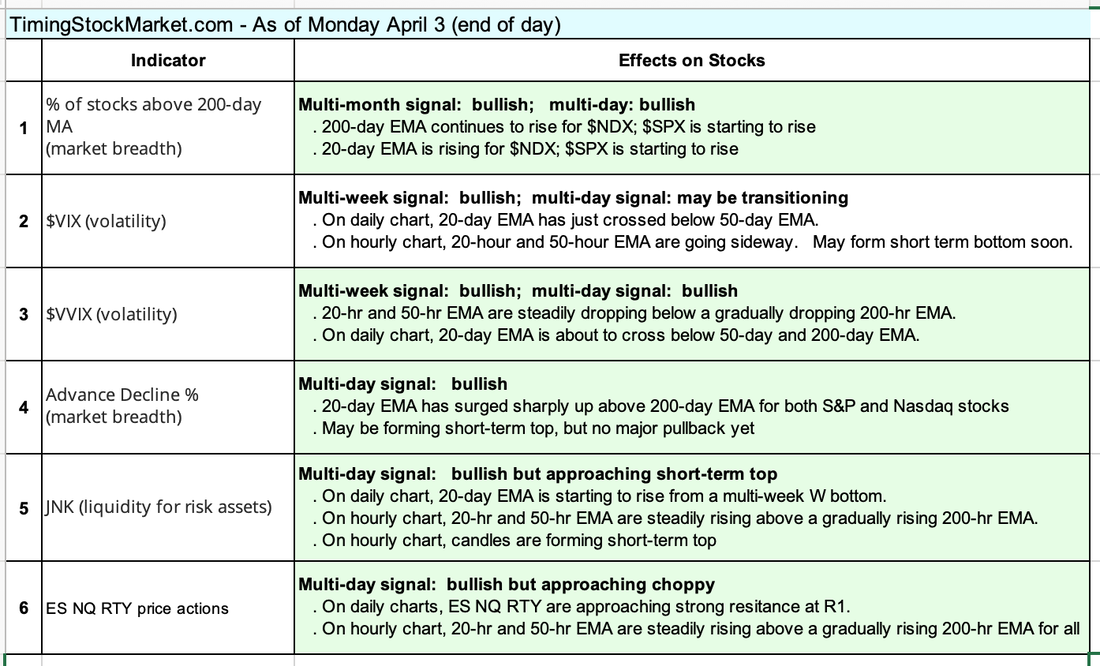

Updates 7:15 PM ET - Sunday Upcoming key events The key event this week is VIX OpEx on Wednesday and OpEx on Friday. We will discuss more about this further below. Earnings this week Chart courtesy of Earnings Whispers. Earnings season gets going in earnest this week with important reports from Tesla, Schwab, Bank of America, Netflix, Johnson & Johnson and Goldman Sachs. Traders will also be closely monitoring smaller regional banks for the viability of their earnings. (Read more on macro conditions here.) Key S/R levels The table has not changed. Our indicators are still mostly bullish (green). However, much of this has to do with $VIX dropping as VIX OpEx approaches (Wednesday 4/19). By Thursday, we may see VIX futures start to rise, and spot VIX ($VIX) may rise at the same time. However $VIX may not seriously rise until Monday April 24, after equity OpEx. What this means is that bulls should consider taking profits or tightening stops by Wednesday - Thursday this week. After that bulls and bears should both be patient because the period between VIX OpEx and equity OpEx can be unpredictable. Wait until VIX, market breadth and ES NQ RTY price patterns convey the same message (bullish vs. bearish) before scaling into the next multi-day position. Updated NQ projection:

ES and RTY are likely to follow the same path as NQ. Is volatility going to erupt next week? No. Even though $VIX is likely to rise after April 19, it is unlikely to exceed the zone 22-23. $VIX 20-day EMA blue line has not formed another W bottom yet (see red arrows). These W bottoms have to form repeatedly in the same zone for $VIX to take off. Our Personal Trade Plan On Friday, $VIX continues to drop as expected, but ES NQ RTY were not tracking $VIX moves as closely. Instead they dipped more than expected in the morning. This happens sometimes. The market acts more bearish than as reflected by $VIX. Our attempts to scale into bull position TNA resulted in a minor loss. But we re-entered one more time with a half-size TNA position to hold over the weekend. We plan to add the remaining half on Monday, and hold until Wednesday. See our buy orders in spreadsheet. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades.

0 Comments

Updates 11:59 AM ET - Tuesday 4/4/23 Quick $VIX spike coming $VIX has formed an intraday W bottom, as shown on its 30-minute chart below. $VIX is likely to spike from here to the zone 21 - 21.5 before resuming the down trend. It may not spike until tomorrow. As $VIX spikes up, ES NQ RTY are likely to retest S1. But they are unlikely to drop lower. The bullish momentum is still strong. This is just a short term dip. Therefore, this is not a low-risk setup for bears to enter multi-day bear positions. Rather it's a signal for bulls to lock in short term profit, and re-enter at the next dip when ES NQ RTY retest S1. This should coincide with our TQQQ entry as shown in spreadsheet. Updates 1:40 AM ET - Tuesday 4/4/23 Key S/R levels The table below has been partially updated. Our indicators are still mostly bullish (green), but there are hints of a short term top forming for ES NQ RTY. We may see $VIX forms a quick spike to retest the zone 21 - 21.5. As $VIX spikes up, ES NQ RTY are likely to retest S1. But they are unlikely to drop lower. The bullish momentum is still strong. This is just a short term dip. Our Personal Trade Plan Our plan is to buy the dip. See updated trade setups and buy orders in spreadsheet. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed