|

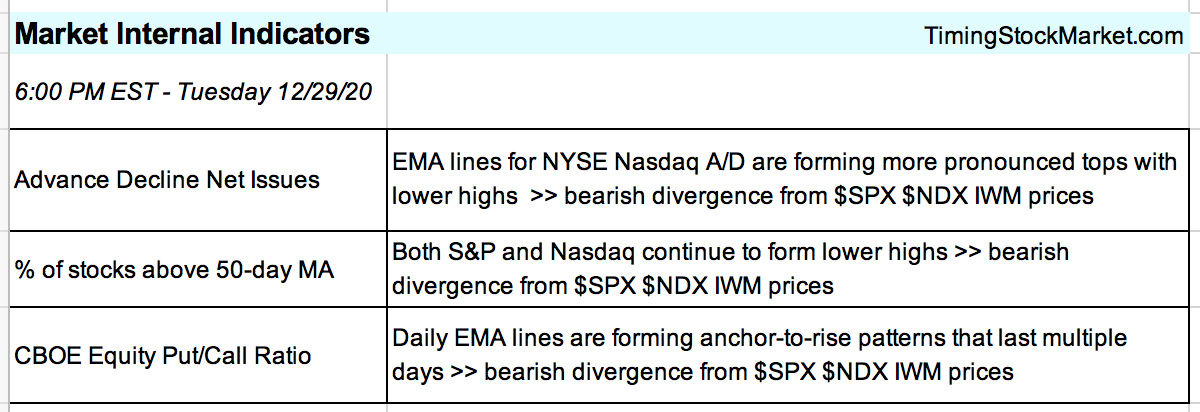

Entry/exit signals for SPY QQQ TQQQ IWM SPX NDX based on VIX. Click here for our Signal Trades. Updates 1:48 AM EST - Wednesday 12/30/20 Summary The dip for $SPX $NDX IWM came on Tuesday, just as we projected on Monday night. $VIX $VXN charts show that this is likely a shallow dip for $SPX $NDX, and the Santa Claus rally is likely to resume. Market Internals Having said that, we want to emphasize that market internals still continue to diverge bearishly from $SPX $NDX IWM prices. These dark clouds on the horizon will turn into a nasty storm at some point in the near future. Just not this week. $VXN $VIX UVXY $VIX $VXN charts warned on Monday that they were going to rise. And just like clockwork, $VIX $VXN rose on Tuesday. So far the volatility rise is minor, and the resulting dips in $NDX $SPX are shallow. The exception is IWM which has a bigger dip. Here are the same charts that we shared yesterday, with Tuesday data added. For now $VXN $VIX UVXY have formed short-term tops and are likely to drop early Wednesday. However, $VXN $VIX UVXY may still rise further as we explained yesterday. Therefore, we have outlined bullish and bearish scenarios to monitor for. There is no guarantee which one will show up, but you will know how to interpret them as $VXN $VIX UVXY patterns unfold on Wednesday. ... Read the rest of this analysis, and get the latest entry/exit signals for SPY QQQ TQQQ IWM SPX NDX based on VIX here.

0 Comments

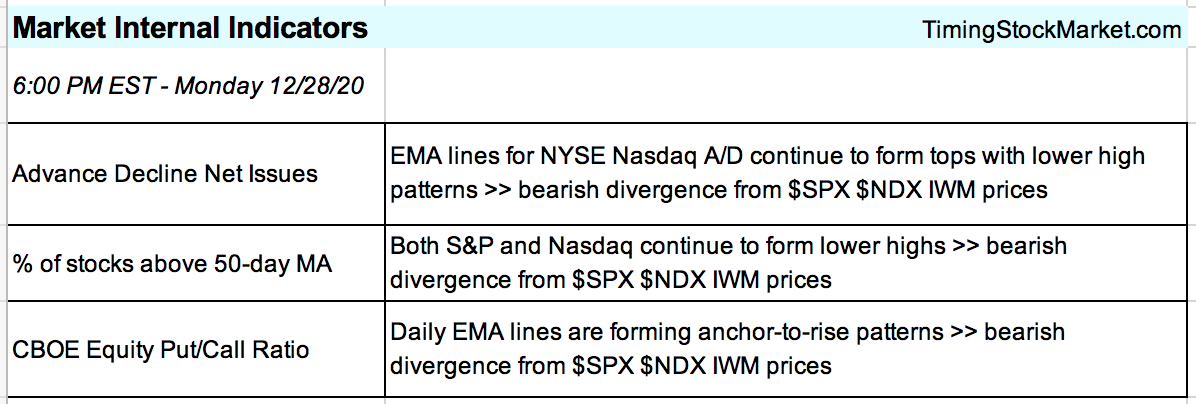

Entry/exit signals for SPY QQQ TQQQ IWM SPX NDX based on VIX. Click here for our Signal Trades. Updates 9:04 AM EST - Tuesday 12/29/20 Shallow dip Pre-market $VIX UVXY and general price actions indicate this will most likely be a shallow dip. We've exited QuickBull TNA for now because it's acting the most bearish of all the indices right now. There will opportunity to re-enter IWM TNA at a lower price. Updates 1:39 AM EST - Tuesday 12/29/20 Summary $VIX $VXN are not showing any crash signals. But they are showing that a dip for $SPX $NDX IWM is likely for Tuesday or Wednesday. Market Internals Market internals continue to diverge bearishly from $SPX $NDX IWM prices. These are the equivalents of dark clouds gathering on the horizon. At some point they can turn into a nasty storm, but right now they are just dark clouds. Table of Support & Resistance Zones IWM and TNA S/R levels have been updated in the table below. Everything else remains the same for $SPX SPY $NDX QQQ TQQQ. ... Read the rest of this analysis, and get the latest entry/exit signals for SPY QQQ TQQQ IWM SPX NDX based on VIX here. Entry/exit signals for SPY QQQ TQQQ IWM SPX NDX based on VIX. Click here for our Signal Trades. Updates 7:45 PM EST - Sunday (for Monday 12/21/20) Summary $SPX $NDX IWM are likely to keep marching upward to higher highs by end of year. Market Schedule This Week This will be a short week due to Christmas. Stock market will close early by 1 PM EST on Thursday 12/24, and closed on Friday 12/25. Here are the important reports for this week. Tue:

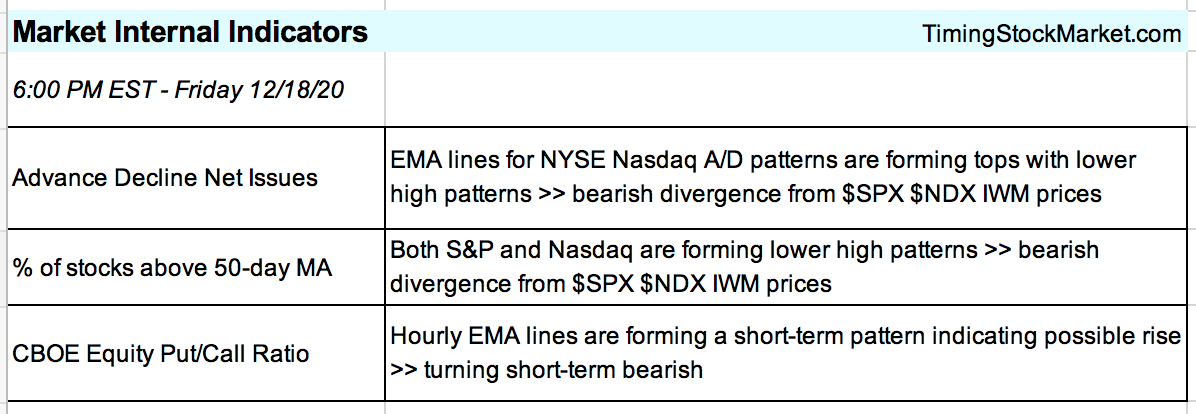

Market Internals The current bullishness in stocks is starting to verge on irrational exuberance. But as the famous economist John Maynard Keynes said, “markets can remain irrational longer than you can remain solvent.” It is going to be disconcerting to continue looking at the bearish divergence between market internals and stock price actions. These are the kinds of signals that can fool eager early bears. In our experience, bearish divergence can go on for quite a while. At some point, the bearish messages will have a big bearish impact. But not right now. We have to trade what's in front of us, while keeping in mind that the good times will not last forever. $VIX $VXN While market internals are showing the start of bearish divergence, $VIX $VXN are showing the continuation of more bullishness. ... Read the rest of this analysis, and get the latest entry/exit signals for SPY QQQ TQQQ IWM SPX NDX based on VIX here. Click here for our Signal Trades. Below is a time-delayed excerpt from our live updates for members. Updates 11:10 AM EST - Friday 12/18/20 $SPX $VIX TSLA At 12:55 AM, we posted the full analysis explaining that $VIX may rise today based on the signal from $VVIX. Indeed $VIX rose a bit, and $SPX dropped correspondingly this morning. This is not surprising. We alerted you earlier this week that today will be one of the biggest trading days in history. In addition to quadruple witching, TSLA is being added to $SPX at the close. Indexers tied to $SPX will need to buy $80B worth of TSLA, which means issuers will have to sell $80B of the remaining stocks in $SPX. Tesla will likely be roughly 1% of the S&P 500′s market capitalization after its inclusion. So the question is is this just a dip or the start of a much bigger sell-off? Read the rest of this analysis and get our highly accurate VIX-based trading signals for SPY QQQ TQQQ TNA here. Click here for our Signal Trades. Below is a time-delayed excerpt from our live updates for members. Updates 12:33 PM EST - Friday 12/11/20 How deep is the dip? As we posted at 2:22 AM, there is not enough fear and panic for the current spike in volatility to qualify as a VMajor signal. A VMajor signal is what we saw between 8/26 and 9/4, and between 10/23 and 10/30. But there is definitely fretting and worrying and hand wringing and profit taking. So there is enough to cause a pullback in price. The key question now is "how deep is the dip?" The green support zones from the S/R table (posted at 2:22 AM) are key support levels. $SPX $NDX IWM are very likely to find enough buyers to resume the rise from their green support zones. But $SPX $NDX IWM may not dip that low. Don't forget that FOMC meeting starts on Tuesday next week. And market typically does not have a huge sell-off prior to FOMC meeting. Maybe after, but not before. Still this kind of sell-off can cause discomfort for the bulls. This is why we urged you to think about position management on Monday. If you book partial profit, you will have the fortitude to hold through a draw down. In a strong up trend like what we are in right now, it's very difficult to precisely time the dips. Lots of bears get burned by that. But the dips can cause enough discomfort to make the bulls get out too early. So position management is the key, and position management is a highly individual thing as it depends on how you trade. We've been sharing with you our position management strategy in Signal Trades. We hope that has been helpful. Get our highly accurate VIX-based trading signals for SPY QQQ TQQQ TNA here. Click here for our Signal Trades. Below is a time-delayed excerpt from our live updates for members. Updates 10:55 PM EST - Wednesday (for Thursday 12/10/20) Summary Short-term: There is a high probability that $VIX $VXN are launching a major spike in volatility (VMajor). As a result, $SPX $NDX IWM are likely to drop a good amount down to their new green support zones. Big Picture: This sell-off will relieve some selling pressure, bring in new buyers to propel $SPX $NDX IWM to their new orange resistance zones by end of year. Access full analysis and our highly accurate VIX-based trading signals for SPY QQQ TQQQ TNA here. Click here for our Signal Trades. Below is a time-delayed excerpt from our live updates for members. Updates 1:56 AM EST - Wednesday 12/9/20 Today’s rise in $VIX is not a surprise. On Monday we shared this $VIX chart with our members to explain that $VIX may be rising soon. Last night and earlier today, we discussed how to determine if the current $VIX rise will become a major spike or a head fake. Access full analysis and our trading strategies for SPY QQQ TQQQ TNA here. Click here for our Signal Trades. Below is a time-delayed excerpt from our live updates for members. Updates 1:09 AM EST - Tuesday 12/8/20 Summary Big Picture: $NDX $SPX IWM are all likely going to rise to the top of their orange resistance zones, or even surpass these zones, all by the end of the year. Short Term: In the short term however, $NDX $SPX IWM may experience a moderate sell-off first as a result of a VMajor signal from $VIX $VXN. ... Click here for our Signal Trades. Access full analysis and our trading strategies for SPY QQQ TQQQ TNA here. Click here for our Signal Trades. Below is a time-delayed excerpt from our live updates for members. Updates 12:24 AM EST - Monday 12/7/20 Summary Short Term: $NDX $SPX IWM are all likely to continue rising this week as conditions are very bullish right now. Big Picture: $VIX $VXN are providing bullish tailwinds for stocks. But they may get a substantial spike in volatility (VMajor signal) later next week. ... SUBSCRIBE now to read the rest of this post, including current analysis and projections for $SPX $NDX IWM. Get complete access to our intraday live Signal Trades. Take advantage of our introductory low rate of just $39/month. You can cancel anytime. Click here for our Signal Trades. Click here for our Signal Trades. Below is a time-delayed excerpt from our live updates for members. Updates 1:05 AM EST - Friday 12/4/20 Summary Big Picture: The message from $VIX $VXN is bullish right now. No crash signal (VCrash) or major spike in fear (VMajor). Not yet. Short Term: $NDX $SPX are likely to continue rising more. IWM may even join in the fun too. ... SUBSCRIBE now to read the rest of this post, including current analysis and projections for $SPX $NDX IWM. Get complete access to our intraday live Signal Trades. Take advantage of our introductory low rate of just $39/month. You can cancel anytime. Click here for our Signal Trades. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed