|

Members click here for full article.

(It is currently free to join our membership.) Here is an excerpt from our trading plan. Stocks are primed for selling rather than buying Yesterday Monday we explained that $VIX $VXN were likely to rise up in the short term, which supports the theory that Dip6 is likely to arrive after FOMC announcement tomorrow Wednesday. Indeed, today $VIX gapped up and rose to a high of 14.18, and $VXN gapped up and rose to a high of 17.69 today. This happened a bit sooner than we anticipated though. And now the rest of market internal indicators are putting out an increasingly louder and more bearish message. We all really should pay more attention to this. Dip6 has been overdue for over a week now. And under the hood, market internals are saying that stocks are more primed for selling than buying. All that’s needed it a negative catalyst. This catalyst is likely to be FOMC announcement tomorrow. The Fed is expected to cut rate by ¼ point tomorrow, which they most likely will do. But the Fed is unlikely to commit to cutting rates aggressively for the rest of 2019, into 2020. This is what the market really wants, and it is likely to be disappointed and upset about this. So the probability of Dip6 arriving after FOMC is higher now. ... The rest of this article covers: Updates from market internals Support and resistance zones for $SPX $NDX $RUT How to approach your trades Register here to read the rest of the article. All free.

0 Comments

Members click here for full article.

(It is currently free to join our membership.) Here is an excerpt from our trading plan. Yesterday Sunday we wrote: “Based on the message from market internals, the odds are high that tomorrow Monday, we will see test of Support1 before $SPX $NDX $RUT can march back up. The odds are also high that $SPX $NDX $RUT will pass this test at Support1 tomorrow Monday. If that happens $SPX $NDX $RUT will rise up quickly to Resistance1.” This is pretty much what happened today Monday. $SPX $NDX $RUT passed the test at Support1 which is essentially just a shallow dip. And they all rose up. And based on futures actions tonight, at least $SPX $NDX will rise up to Resistance1 tomorrow Tuesday. So price actions are looking bullish on the charts, but under the surface market internals are sending out more short-term bearish signals. ... The rest of this article covers: Updates from market internals Support and resistance levels for $SPX $NDX $RUT How to approach your trades Register here to read the rest of the article. All free. Members click here for full article.

(It is currently free to join our membership.) Here is an excerpt from our trading plan. What constitutes Dip6? Stock market price levels rise and fall as a result of the moment by moment battle between buyers and sellers. Us human traders need to slap a label on the up and down movements just so we can keep track of things mentally. For us, we’ve been using the label Dip6 to track a possible good size dip that is somewhat overdue at this point, at least for $SPX and $NDX. After successfully testing Support1 last Thursday 7/25, which essentially was a shallow dip, market participants decided that it was a good enough support level to buy into. And so $SPX $NDX $RUT all rose enthusiastically on Friday, helped along by GOOGL strong earnings report. Many traders are wondering at this point whether Dip6 will ever come. It would be helpful to define what Dip6 looks like. In our definition, if tomorrow Monday, $SPX $NDX $RUT drop down from the current level to the following support levels, then that would be Dip6. $SPX: 2938 $NDX: 7700 $RUT: 1540 However, given the current enthusiasm for buying, the chance of that drop happening Monday is low. So Dip6 per this definition will most likely not happen tomorrow. Can a comparable drop that would constitute Dip6 happen later this week though? Very possibly. Most likely after FOMC announcement this Wednesday 7/31. ... The rest of this article covers: Updates from market internals Support and resistance zones for $SPX $NDX $RUT How to approach your trades Register here to read the rest of the article. All free. Members click here for full article.

(It is currently free to join our membership.) Here is an excerpt from our trading plan. Surge6 is likely to transition into Dip6 Yesterday we wrote: “For tracking purpose, we’ll continue to refer to this as the resumption of Surge6, and the dip from 7/15 to 7/19 was a minor dip. ...The reason is because we are tracking the definition of Dips by the impact $VIX $VXN have on prices. In this minor dip, $VIX $VXN have not made enough of a panic impact on prices yet. Therefore, the real Dip6 is still lurking.” Today’s price actions and rise in volatility confirm that Dip6 is still lurking. While $SPX $NDX $RUT may have resumed Surge6 yesterday, the possibility is high that Surge6 is transitioning into Dip6, and that Dip6 can be a good-size dip. And Dip6 is likely to arrive after FOMC announcement next Wednesday 7/31. Updates from market internals Volatility: Yesterday we wrote: “almost every time $VIX has a sharp drop into the low zones, it ends up rising up sharply very soon afterwards. The same is true with $VXN.” We saw this behavior repeating itself again today. $VIX $VXN dropped down sharply yesterday, and they both gapped up at open today. This is an important message to note. $VIX $VXN are saying that... The rest of this article covers: Updates from market internals (more) Support and resistance zones for $SPX $NDX $RUT How to approach your trades Register here to read the rest of the article. All free. Members click here for full article.

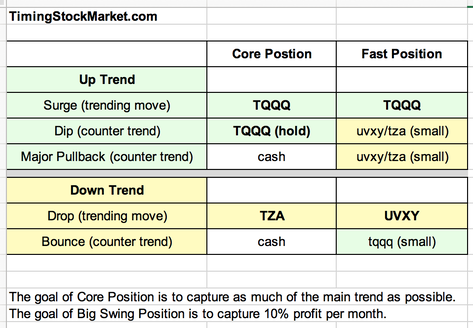

(It is currently free to join our membership.) Here is an excerpt from our trading plan. We would like to welcome new subscribers. If you have not had a chance to read our weekend analysis, please read it before reading this post for clearer understanding. Dip6 is launched We have a bearish divergence right now where $SPX $NDX are acting as though they may recover from being down since 7/15. However, under the hood, market internals are collectively shouting “Dip6 is happening!” Here are some specifics. $VIX $VXN are forming a pattern indicating they will surge. $VIX can surge up into the zone of 17 to 17.5. $VXN can surge into the zone of 21 to 21.5. When $VIX $VXN sharply surge, $SPX $NDX $RUT will sharply drop further. Market breadth are no longer confirming the bullish scenario. Both NYSE and Nasdaq A/D lines have been steadily marching down since 7/15. The percentage of bullish Nasdaq stocks has been dropping steadily since 7/3, NYSE since 7/15. CBOE Put/Call ratio has been forming a pattern indicating it is ready to rise into selling territory. And it is nowhere near oversold yet. Finally, $RUT has gone ahead with its steady march downward today. $RUT is the canary in the coal mine. It adds further confirmation that Dip6 is happening. The rest of this article covers: Support zones for $SPX $NDX $RUT at the end of Dip6 What to expect after Dip6 Our trading plan Register here to read the rest of the article. All free. Members click here for full article. (It is currently free to join our membership.) Here is an excerpt from our trading plan. Our trading strategy This past week was a big one for us. Our membership jumped by 20%. We would like to welcome all our new subscribers who came on board recently. We would also like to share with you a snapshot of our trading strategy. We hope this helps to put in perspective the way we frame up our market analysis. Our trading system is based primarily on analysis of $SPX $NDX $RUT price actions, with heavy reliance on market internals for context and confirmations. When we say market internals, we mean specifically:

Many of our readers have remarked that our trading system is amazingly accurate. (Thank you!) As you may have noticed, we don’t rely on popular technical indicators. That is because they are overused, and because they are derivatives of price actions. Prices can be easily distorted in the short-term. Instead, we have found over the years that market internals, when analyzed properly and viewed collectively, can deliver a much more reliable message consistently. Up Trend is still intact Before we plunge into the discussion of Dip6, we should explain that the current Up Trend that started on 12/26/18 is still intact. And it may last into early October, though that is merely an early projection at this point. Dip6 is launched During most of last week, we relied on market internals to guide us through the transition from Surge6 into Dip6. It was a very useful guide as market internal messages were spot on. And now market internals are collectively shouting "Dip6 is happening for real". During Dip6, we should expect to see $SPX $NDX $RUT drop substantially more. $VIX $VXN will surge a good amount. However, at the start of tomorrow Monday ... The rest of this article covers: Dip6 is launched (more) Dip6 may morph into Major Pullback2 Support zones for $SPX $NDX $RUT at the end of Dip6 Our trading plan Register here to read the rest of the article. All free. Members click here for full article.

(It is currently free to join our membership.) Here is an excerpt from our trading plan. We’d like to welcome a number of new members who just signed up today on board. Please make sure you read yesterday's post before proceeding with this post, as there's a lot of explanations that we won't be repeating. The transition into Dip6 is happening Yesterday Wednesday we wrote: “On Thursday or Friday, the bouncing that we mention will likely start... There’s a high probability that $VIX $VXN will surge at the start of tomorrow Thursday where $VIX can reach into the zone between 14.6 and 15. $VXN may reach up to 18.5...Then $VIX $VXN are likely going to drop as $SPX $NDX $RUT rise back up to test the highs of Monday 7/15... If you have already entered UVXY TVIX SQQQ TZA, you may think the market has started Surge7 and is moving against you. This isn’t the case. This is just a test. And this test is crucial for $VIX $VXN to really rise up, and for $SPX $NDX $RUT to have a meaningful drop that constitutes Dip6.” It is pretty amazing that $VIX $VXN $SPX $NDX $RUT pretty much followed this script during the day today Thursday. (Sorry we have to crow about it for a bit here :-) You do understand this greatly increases the pressure for us to come up with another precise script tomorrow. Well, for that we offer you this $SPX hourly chart. The rest of this article covers: Chart explanation What to expect for Friday: bull trap Trading Plan Register here to read the rest of the article. All free. Members click here for full article.

(It is currently free to join our membership.) Here is an excerpt from our trading plan. If you are a new reader who just joined, please read the weekend analysis for more background information before reading this post. This is the start of Dip6 but... Yesterday Tuesday we wrote: “We are likely to see $SPX $NDX $RUT bounce around in the price zones below while $VIX $VXN continue to climb up. Keep in mind though that the climbing will not be a straight line. And the price bouncing around will be just that - bouncing around.” So first off, $VIX $VXN definitely did climb up today, especially at the end of the day. $SPX $NDX $RUT did not do intraday bouncing. They all dropped toward the bottom of the zones we discussed, basically forming a minor dip. Tomorrow or Friday, the bouncing that we mention will likely start. ... The rest of this article covers: This is the start of Dip6 but... (more) Support zones for $SPX $NDX $RUT at the end of Dip6 Warning: Dip6 may morph into Major Pullback2 Trading Plan Register here to read the rest of the article. All free. Members click here for full article.

(It is currently free to join our membership.) Here is an excerpt from our trading plan. If you are a new reader who just joined, please read the weekend analysis for more background information before reading this post. Surge6 is winding down and Dip6 is coming soon Yesterday Monday we wrote: “$VIX $VXN are starting a pattern that indicates the beginning of a small rise coming up.” And that is what $VIX $VXN started doing today. When it comes to market internals, $VIX $VXN are the most sensitive and the most reliable indicators. So it’s important to pay attention to their messages. And the message right now is that Surge6 is winding down and Dip6 is coming soon. We are likely to see $SPX $NDX $RUT bounce around in the price zones below while $VIX $VXN continue to climb up. Keep in mind though that the climbing will not be a straight line. And the price bouncing around will be just that - bouncing around. ... The rest of this article covers: Surge6 is winding down and Dip6 is coming soon (more) Dip6 possible Monday 7/22 Trading Plan Register here to read the rest of the article. All free. Members click here for full article.

(It is currently free to join our membership.) Here is an excerpt from our trading plan. If you haven’t had a chance to read Sunday evening trading plan post, please read it before proceeding with this post. It contains a lot of background explanation. Surge6: Minor dip likely Thursday $SPX $NDX spent the day creeping upward, while $RUT continues its sideway pattern. Not even a minor dip occured! However, $VIX $VXN are starting a pattern that indicates the beginning of a small rise coming up. We may see $VIX rise up to 14, and $VXN up to 18 by Thursday. Keep in mind though, with contango running at almost 19%, the most effect that this will have is a minor dip where $SPX $NDX $RUT will test these support levels below. ... The rest of this article covers: Surge6: Minor dip likely Thursday Dip6 possible Monday 7/22 Support & resistance levels Trading Plan Register here to read the rest of the article. All free. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed