|

Click here for our Signal Trades. Below is a time-delayed excerpt from our live updates for members. Updates 12:30 AM EST - Tuesday 12/1/20 Summary Big Picture: No VCrash signal on the horizon from $VIX $VXN. And while a major spike in fear (VMajor) may come soon, it is not here yet. Short Term: $NDX $SPX are likely to continue rising a bit more. IWM is now starting to head down short term. ... SUBSCRIBE now to read the rest of this post, including current analysis and projections for $SPX $NDX IWM. Get complete access to our intraday live Signal Trades. Take advantage of our introductory low rate of just $39/month. You can cancel anytime. Click here for our Signal Trades.

0 Comments

Click here for our recent Signal Trades. Below is a time-delayed excerpt from our live updates for members. Updates 12:54 AM EST - Monday 11/30/20 Current rise in $VIX $VXN is a VMinor signal $VIX $VXN rose this morning as we anticipated. However, they only formed a VMinor signal. They have already topped out after a brief spike. $VXN daily chart currently shows a small spike forming. This is considered a VMinor signal. $VIX $VXN VMajor signal would be a much bigger spike, one that pushes them at least to their 200-day EMA level. Subscribe to get full access to $VIX $VXN charts. In order for $VXN to form a VMajor signal that accompanies a big sell-off in stocks, $VIX and $VXN first must form a much more definitive V or W bottom on their intraday charts. They have not formed that yet. What $VIX $VXN did this morning was a quick pop and drop. In fact, the bulls should root for $VIX $VXN to do another quick pop and drop tomorrow, one that is high enough to anchor $VIX $VXN at their 20-day EMA blue lines. This would be an "anchor to drop" pattern, which would bring back a lot more bullish tailwinds for stocks. In Signal Trades, we booked some profit earlier by exiting our Quick Swing TQQQ position. If $VIX $VXN form another "anchor to drop" pattern tomorrow, we will re-enter TQQQ Quick Swing. Updates 9:55 AM EST - Monday 11/30/20 Minor rise in volatility $VIX $VXN are not showing the formation of a VMajor signal yet, but they are rising somewhat. We consider this a VMinor signal. As a result, there's some amount of profit-taking selling in $NDX $SPX IWM. In Signal Trades, we exited QuickSwing TQQQ, but are holding onto the Big Swing TQQQ and FNGU. The current rise in $VIX $VXN is likely to be brief as most VMinor signals are. So it's not a good idea to try to trade UVXY right now. Updates 11:35 PM EST - Sunday (for Monday 11/30/20) Summary Big Picture: Conditions are highly bullish for stocks as $VIX $VXN continue to drop. There are no signs of a potential crash, and while a major spike in fear may come soon, it is not here yet. Short Term: $NDX $SPX are likely to continue rising a bit more. IWM is now in overbought territory. The Week Ahead Tuesday: Powell speaks starting at 10 AM EST Friday: Job report 8:30 AM EST Next week is FOMC meeting December 15-16. Market Internals Subscribe to get full access to table of market internal data. Table of Support & Resistance Zones Subscribe to get full access to table. Terminology We have come up with some labels for different types of $VIX $VXN signals. We plan to use these labels going forward so you will get a better idea of what we are referring to. There are 3 types of rise in volatility.

$VXN So are there any signs of VCrash right now? NO. $VXN weekly chart is a reliable source for VCrash signal. $VXN weekly chart below shows some yellow highlights. Those are the VCrash signals since 2016. We don't have any such VCrash signal right now. See the chart annotations below for why $VXN is showing more bullishness. Subscribe to get full access to $VXN chart. $VIX $VIX futures contango is at 9:33% right now. This is a high number, which implies that there are a lot of tailwinds for $SPX $NDX IWM to rise higher. Still are there any signs of a VMajor signal at least? Not yet. A VMajor signal will probably come soon, but it is not here yet. So what should we look for that would warn us of a VMajor rise? See the explanations on $VIX 2-hour chart below. Subscribe to get full access to $VIX chart. $NDX $SPX $NDX $SPX charts in different time frames below show how $NDX and $SPX are both in rising channels. If they follow the boundaries and directions of their channels, $NDX and $SPX can go quite far by end of the year as shown below. Subscribe to get full access to $NDX $SPX charts. IWM IWM is in a rising channel too, but it is too steep in the short term. It is misleading to use this slope for IWM rising channel. It is more prudent to let IWM drop down a bit, at least to its green support zone, before buying IWM. Subscribe to get full access to IWM chart. Signal Trades The way to approach trading the current market is to continue riding the bullish momentum, but don't assume that it will last forever. $SPX $NDX IWM are vulnerable to a quick but major rise in fear (VMajor) soon. The trick is to stay patient, keep monitoring, and make a plan for your bullish positions for when VMajor shows up. Our strategy for VMajor signal is to take partial profit by exiting our Quick Swing position at that time. We will also tighten stops on Big Swing positions. We may also enter a small Quick Swing UVXY to capture the VMajor rise itself. Please check Signal Trades for updated stops and sell targets. Keep in mind that the sell targets are simply projections for now. We will exit per our strategy above, and the exact exits will depend on when VMajor shows up. Subscribe to get full access to live Signal Trades. Disclaimer The information presented here is our own personal opinion. It is intended to supplement your own research and trading systems. Consider it as food for thought. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. While we offer scenarios for you to consider in your trade planning, know that you are proceeding at your own risk if you follow our suggestions. Why 3x ETFs like TQQQ lose money over the long term The risks of investing in inverse ETFs Simple explanations of contango and backwardation Click here for our Signal Trades. Below is a time-delayed excerpt from our live updates for members. Updates 1:48 AM EST - Wednesday 11/25/20 Summary Big Picture: Conditions are highly bullish for stocks as $VIX $VXN continue to drop. There are no signs of a potential major spike in fear right now. Short Term: $NDX $SPX are breaking out from their consolidation patterns. $NDX in particular has some catching up to do so it may rise quite a bit. Meanwhile IWM is now in overbought territory. ... SUBSCRIBE now to read the rest of this post, including current analysis and projections for $SPX $NDX IWM. Get complete access to our intraday live Signal Trades. Take advantage of our introductory low rate of just $39/month. You can cancel anytime. Click here for our Signal Trades. Click here for our recent Signal Trades. Below is a time-delayed excerpt from our live updates for members. Updates 1:36 AM EST - Tuesday 11/24/20 Summary Big Picture: $NDX $SPX IWM are still in an up trend from a big picture perspective. $VIX $VXN are back to sending out bullish messages as they resume their downward drop. Short Term: IWM has been shooting up like a rocket, but $SPX and especially $NDX may not be done consolidating yet. Market Internals Market internals are back to sending out all bullish messages. Table of Support & Resistance Zones Subscribe to get full access to table. $VIX $VXN The overall message from $VIX $VXN is quite bullish. No crash. No major fear spike in the short term. On Monday, $VIX $VXN rose up a small amount early, but that quickly fizzled out. And now their charts are sending out the bullish message again. Subscribe to get full access to $VIX $VXN charts. $NDX Monitor the pennant pattern that $NDX has been forming. This is another way to look at the boundary of the 3-peak consolidation pattern we've discussed before. $NDX daily chart below shows some key signals to look for to confirm the potential bullish breakout. Subscribe to get full access to $NDX chart. $SPX Overall, $SPX pattern is quite bullish. Subscribe to get full access to $SPX chart. IWM While we entered into a TNA position in Signal Trades, we have some doubts about IWM TNA ability to continue rising so sharply in the short term. So we recommend tight stops to protect your IWM TNA profit. Also take a look at the low-risk bullish setups that IWM typically forms after it has pulled back from a fresh high. It may be a much better low-risk high-reward setup to wait for the next "pinching" of the 20 and 50-day. Subscribe to get full access to IWM chart. Signal Trades With the renewed bullish messages from $VIX $VXN and market internals, there is no need to hedge our long positions right now. We have updated the exit targets such that some positions will be Quick Swings and others will be Big Swings. Please check Signal Trades for our current positions. Note the Watch List also. Click here for our Signal Trades.

Below is a time-delayed excerpt from our live updates for members. Updates 11:37 PM - Sunday (for Monday 11/23/20) Summary Big Picture: $NDX $SPX IWM are still in an up trend from a big picture perspective. $VIX $VXN are not flashing any crash signal right now. Short Term: However, $VIX $VXN $NDX $SPX IWM are all at a potentially important pivot point in the short term. See analysis below. ... SUBSCRIBE now to read the rest of this post, including current analysis and projections for $SPX $NDX IWM. Get complete access to our intraday live Signal Trades. Take advantage of our introductory low rate of just $39/month. You can cancel anytime. Click here for our Signal Trades. Click here for our recent Signal Trades.

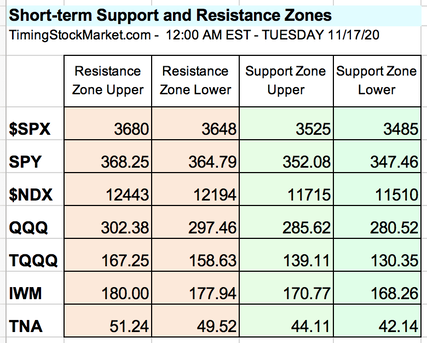

Below is a time-delayed excerpt from our live updates for members. Updates 1:57 AM EST - Friday 11/20/20 Summary Big Picture: $VIX $VXN are still in a downward march. They have not yet formed a pattern indicating that they are ready to rise. Their message is still bullish. Short Term: $NDX $SPX IWM are still in an up swing technically. ... SUBSCRIBE now to read the rest of this post, including current analysis and projections for $SPX $NDX IWM. Get complete access to our intraday live Signal Trades. Take advantage of our introductory low rate of just $39/month. You can cancel anytime. Click here for our Signal Trades. Click here for our recent Signal Trades. Below is a time-delayed excerpt from our live updates for members. Updates 11:45 AM EST - Tuesday 11/17/20 Summary After a quick rise this morning, $VIX $VXN are continuing to form their "anchor to drop" patterns on charts in different time frames. This indicates that there are a lot of bullish tailwinds for stocks right now. We wrote at 2:15 AM "However, we may see some profit taking on Tuesday." This did turn out to be true early morning for $NDX $SPX IWM. And it was great because it relieved some of the selling pressure. Furthermore, the pullback provided opportunities to enter at a lower price. In fact, in Signal Trades our TNA buy limit order was filled and reversed upward quickly. We also decided to add SPXL to the Signal Trades portfolio. Again, SPXL target entry price from yesterday was met. At this point $NDX $SPX IWM are all in up swings based on the direction of their 200 EMA (5-minute charts). Any price pullback to anchor at the 200 EMA line is low-risk setup to enter or add to your long positions. We will be updating stops shortly in Signal Trades. Updates 2:15 AM EST - Tuesday 11/17/20 Summary Big Picture: $VIX $VXN have been dropping and are getting ready to drop even more. Conditions are highly bullish for $SPX $NDX IWM. Short Term: $NDX $SPX IWM are in up swings again. However, we may see some profit taking on Tuesday. Market Internals Market internals are sending out very bullish messages right now. Table of Support & Resistance Zones The S/R table has been updated. $VIX $VXN ... SUBSCRIBE now to read the rest of this post, including current analysis and projections for $SPX $NDX IWM. Get complete access to our intraday live Signal Trades. Take advantage of our introductory low rate of just $39/month. You can cancel anytime. Click here for our Signal Trades. Click here for our recent Signal Trades. Below is a time-delayed excerpt from our live updates for members. Updates 9:13 AM EST - Thursday 11/12/20 Pre-market Based on overnight actions, $VIX is likely to rise back up to about 29 or 30 before it can drop again. This will happen today or tomorrow. We may trade a quick swing UVXY to capture this move. While $VIX rises, $SPX IWM will drop. Again, they need to anchor in their green support zones to find enough buyers to launch into the next up swing. $VXN will most likely rise along with $VIX, back up to 33.5 or 34 . We expect $NDX to drop down and anchor in its green support zone as well. We will be monitoring for TQQQ W bottom in this zone to add one more TQQQ position. Updates 1:33 AM EST - Thursday 11/12/20 Summary Big Picture: bullish unless $VIX $VXN rise up from their consolidation zones. Short Term: $NDX $SPX IWM are all in up channels, but in order to launch the next up swing, they all need to anchor in their green support zones to bring in more buyers. Market Internals Market internals are easing up on their bullish messages. We may see market breadth going net negative on Thursday and Friday. Table of Support & Resistance Zones ... SUBSCRIBE now to read the rest of this post, including current analysis and projections for $SPX $NDX IWM. Get complete access to our intraday live Signal Trades. Take advantage of our introductory low rate of just $39/month. You can cancel anytime. Click here for our Signal Trades. Click here for our Signal Trades. Below is a time-delayed excerpt from our live updates for members. Updates 12:23 PM EST - Friday 11/6/20 The last couple thrusts may be big We wrote last night and pre-market this morning that the current up swing is approaching the end. However, instead of petering out at Thrust4 and starting the drop on the early side, $SPX $NDX IWM are likely to have a couple more big thrusts to propel them up quite a bit higher. $SPX $NDX IWM, as well as SPY QQQ TQQQ TNA, are likely to reach the top of their orange resistance zones early next week. In fact, this morning sharp drop at open relieved some of the profit-taking selling pressure, thereby creating an intermediate level of support to propel $SPX $NDX IWM higher. The most reassuring proof is $VIX and $VXN looking poised to drop out of their consolidation zone, as shown below. That would be bullish tailwinds for $SPX $NDX IWM to rise even more. For these reasons, we are holding our TQQQ positions in Signal Trades over the weekend. Updates 9:18 AM EST - Friday 11/6/20 Short term up swing approaching the end As we mentioned in earlier writing today, the current up swing is approaching the end. We recommend taking partial profits.

$SPX $NDX are unlikely to rise above their 10/12 high by the end of the current short-term up swing. We expect bigger pullbacks before a new up swing starts. $VIX is bouncing inside its consolidation zone. This should provide a period of calm to support the last thrust of the current up swing. Updates 12:45 AM EST - Friday 11/6/20 Summary Short Term: Current bullish up swing that started on 11/2 may be done Friday or Monday. Minor selling will most likely follow, but nothing that's highly bearish. Big Picture: Bullish at least until after $VIX $VXN finish consolidating. ... SUBSCRIBE now to read the rest of this post, including current analysis and projections for $SPX $NDX IWM. Get complete access to our intraday live Signal Trades. Take advantage of our introductory low rate of just $39/month. You can cancel anytime. Click here for our Signal Trades. Click here for our Signal Trades. Below is a time-delayed excerpt from our live updates for members. Updates 1:03 PM EST - Thursday 11/5/20 FOMC FOMC announcement is at 2 PM EST today. Though we don't expect any major announcement from the Fed, we should allow for profit taking activity immediately after the announcement. $SPX $NDX IWM surged up this morning to form today's thrusts (see below). Now $SPX $NDX are in the process of snapping back to support at their 50 EMA lines (5-minute chart). Expect FOMC announcement to make them to drop towards their 200 EMA lines (5-minute chart). That would be a low-risk setup to add to your long positions based on $SPX $NDX. Additionally, $SPX $NDX IWM are expected to form the last thrust of the current up swing by tomorrow Friday. So the end target is likely to be the highs of 10/12, not 9/2. After that we may see a short-term down swing before the next up swing. Updates 9:12 AM EST - Thursday 11/5/20 Summary Short Term: Bullish for $SPX $NDX IWM. They should reach 9/2 high later next week. Pre-market $SPX $NDX IWM are gapping up big again. For today, the indices are forming these thrust counts.

Pre-market price actions currently tell us that $SPX $NDX IWM may tag yesterday's closing price before rising to form today's thrust. Earlier we had entered TQQQ Position2 in Signal Trades pre-market. We may add a TQQQ Position3 when price pulls back to tag yesterday's closing price. Updates 2:14 AM EST - Thursday 11/5/20 Summary Short Term: Bullish for $SPX $NDX IWM. They should reach 9/2 high later next week. Big Picture: Bullish at least until after $VIX $VXN finish consolidating. ... SUBSCRIBE now to read the rest of this post, including current analysis and projections for $SPX $NDX IWM. Get complete access to our intraday live Signal Trades. Take advantage of our introductory low rate of just $39/month. You can cancel anytime. Click here for our Signal Trades. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed