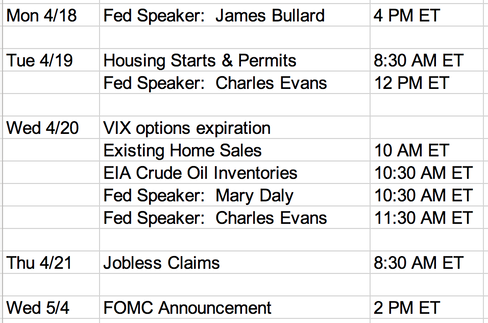

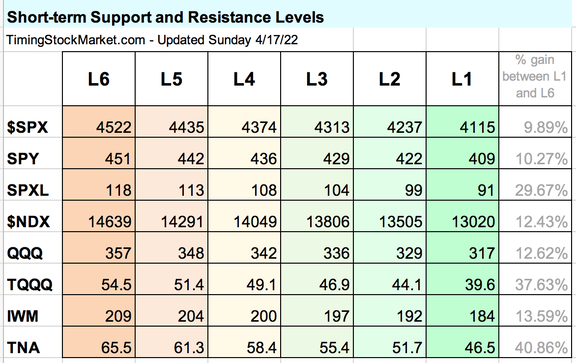

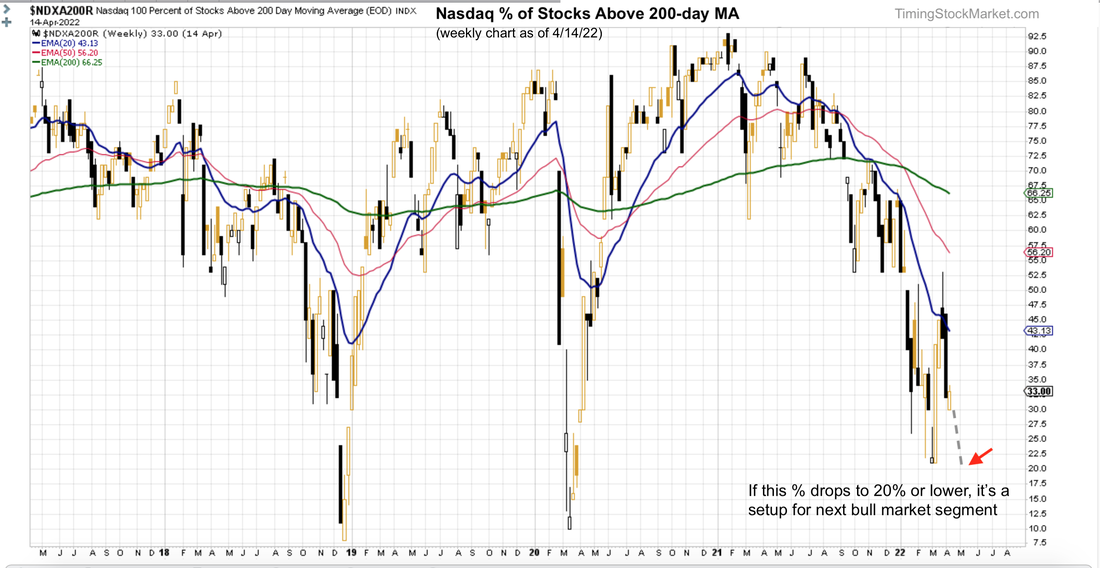

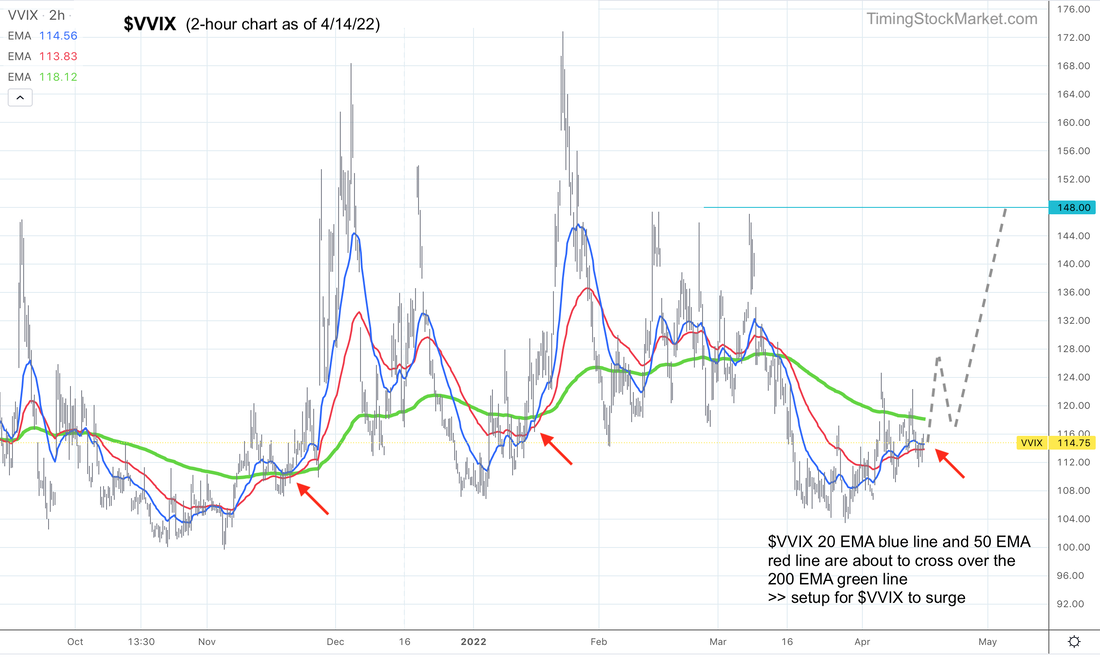

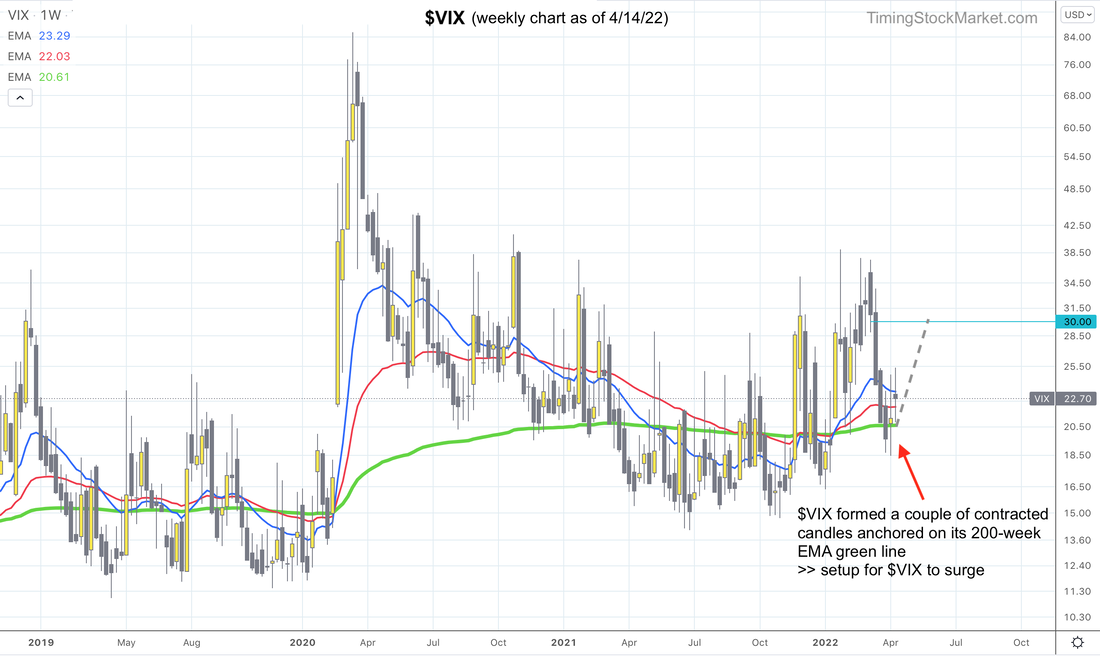

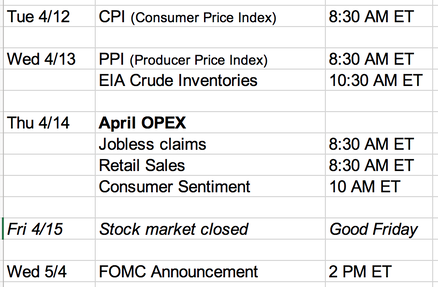

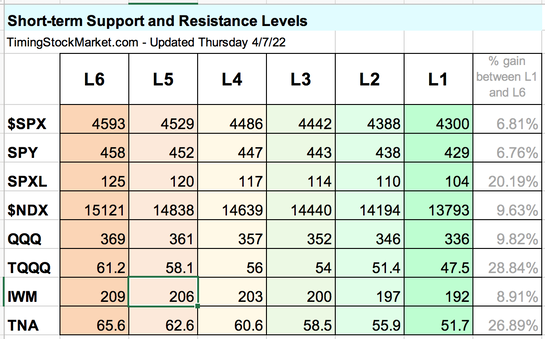

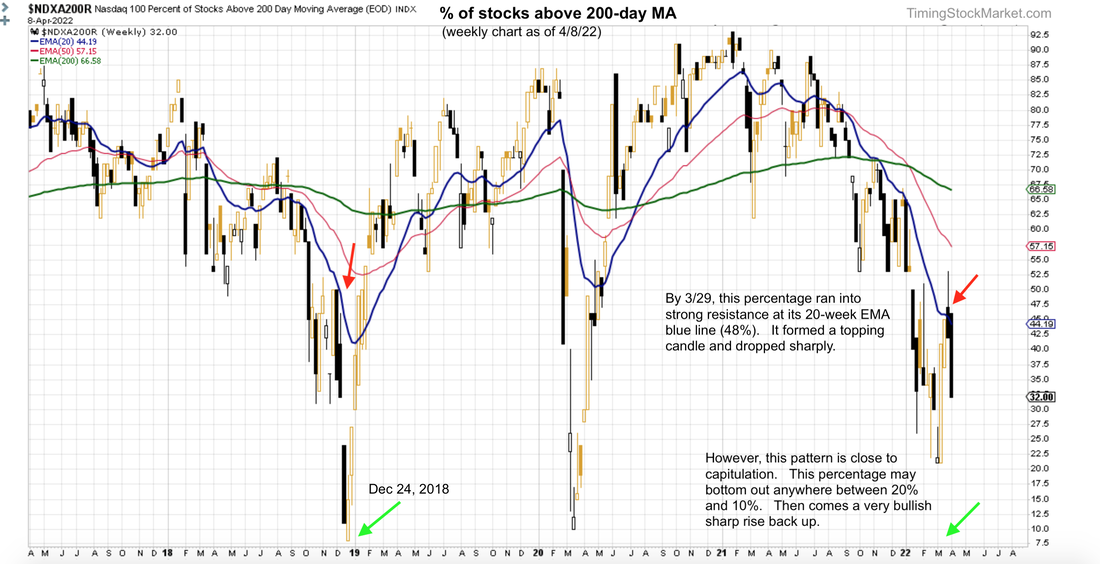

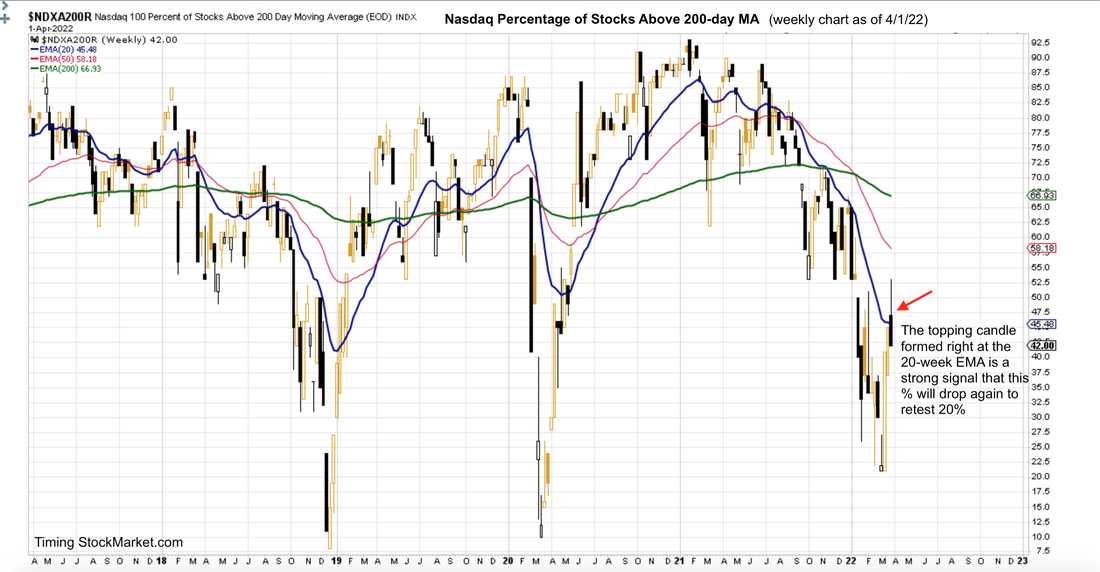

Updates 10:30 PM ET - Sunday Upcoming key events There are 2 key dates that may see a rise in $VIX. First is April VIX options expiration this Wednesday. Once these options expire, we may see a fresh rise in demand for new $VIX calls (long volatility) and equity puts (short stocks). This demand may increase substantially as traders feel the need to hedge ahead of FOMC announcement on May 4. Key Price Levels The table below has been updated for all but IWM TNA. L1 is a strong support level, and this is where we expect the current sell-off to end. The Big Picture: bad news and good news We've been relying on the Percentage of Happy Stocks chart to show us a pretty accurate snapshot of big picture market moods. ("Happy Stocks" are stocks that are above their 200-day MA). Below is the Nasdaq Happy Stocks chart. There are two important messages on this chart. Bad news: Last week we wrote this about the percentage of Nasdaq Happy Stocks: It is on its way to retest 20% zone. This path seems to be happening for not only $NDX, but also $SPX and IWM as well. This signal is currently "Fully Bearish". We're unlikely to see real recovery before Nasdaq tests 20%. Good news: This is a chart pattern that we typically see at the end of a bear market, not at the beginning. This pattern is close to capitulation. The percentage may bottom out anywhere between 20% and 10%. After that we typically see a very bullish sharp rise back up as a new bull market starts. Volatility confirms "Fully Bearish" Read more about $VIX $VXN $RVX $VVIX and the effects of options and hedging on the market here. On 3/29, volatility of volatility ($VVIX) gave us the initial warning that market conditions were "Approaching Bearish" as a new volatility cycle was starting back up. Since then, $VVIX has been coiling upward. $VVIX 20 EMA blue line and 50 EMA red line are about to cross over the 200 EMA green line. As you can see from previous patterns, this is typically a setup for $VVIX to surge. We may see $VVIX revisits the high of March 8. Meanwhile $VIX weekly chart showed that it has formed a couple of contracted weekly candle, anchored on its 200-week EMA green line. This is typically a setup for $VIX to surge. Supplemental Indicators: confirm "Fully Bearish" (mostly)

Dealer hedging: $SPX $NDX IWM are currently below the key levels where dealer hedging turns to "fueling volatility". This means that dealers are now buying strength and selling weakness, potentially creating big swings in price. This is typical of "Fully Bearish" conditions. Nasdaq is the leader on the way down Keep an eye on $NDX. It has a good chance of finding bottoms at February 24 low. When $NDX finds strong support, $SPX and IWM will also. Trade plan While the signal is "Fully Bearish", we will focus on trading SQQQ and UVXY. We won't attempt any counter-signal trades because our record for those trades have not been as successful.

Subscribe to get our latest analysis, trade plans and live intraday trade adjustments. Current trade record: 340% since July 2020 Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades.

0 Comments

We trade 3x ETFs such as TQQQ TNA SOXL LABU UVXY using proprietary analysis of volatility. Current trade record here. Click here for live trades. Updates 3:00 PM ET - Sunday Upcoming key events This is a short week as the stock market is closed on Friday for Easter weekend. The CPI report on Tuesday is expected to be hot, but by now everyone knows and expects this number to be high. So there may be no negative surprise here. But April options expiration (OPEX) is earlier than usual, and $VIX monthly expiration follows on 4/20 rather than precedes OPEX. Given the 3-day holiday weekend, sandwiched between the two expiration dates, there may be some unusual swings. Key Price Levels The table below is the same as Thursday.

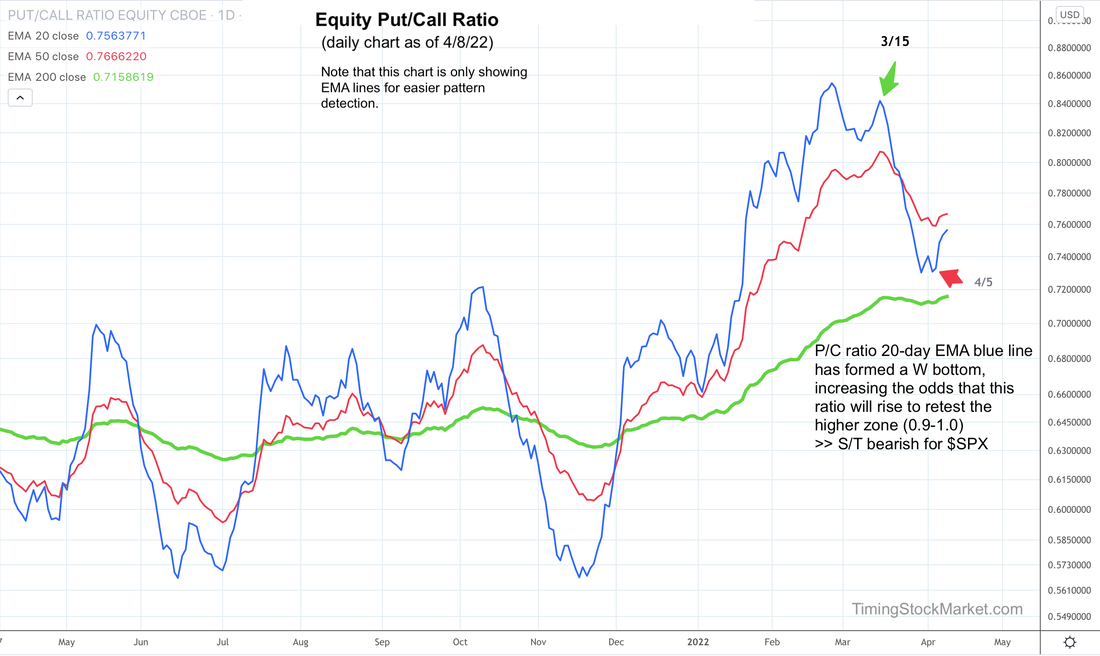

The Big Picture: bad news and good news We've been relying on the Percentage of Happy Stocks chart to show us a pretty accurate snapshot of big picture market moods. ("Happy Stocks" are stocks that are above their 200-day MA). Below is the Nasdaq Happy Stocks chart. There are two important messages on this chart. Bad news: By 3/29, Nasdaq percentage of Happy Stocks ran into strong resistance at its 20-week EMA blue line (48%). It formed a topping candle and dropped sharply. It is on its way to retest 20% zone. This means we are likely to see selling this week for tech stocks. NYSE and small cap charts are showing similar patterns. This means selling for the S&P and small caps as well. Good news: This is a chart pattern that we typically see at the end of a bear market, not at the beginning. This pattern is close to capitulation. The percentage may bottom out anywhere between 20% and 10%. After that we typically see a very bullish sharp rise back up as a new bull market starts. Volatility confirms "Fully Bearish" Read more about $VIX $VXN $RVX $VVIX and the effects of options and hedging on the market here. On 3/29, volatility of volatility ($VVIX) gave us the initial warning that market conditions were "Approaching Bearish" as a new volatility cycle was starting back up. Since then, $VVIX has formed a W bottom and its 200-EMA green line is coiling upward (see 15-minute chart below). $VIX itself also formed a W bottom and its 200 EMA green line is coiling upward as well. We may see $VIX tags 20 quickly on Monday. After that it is likely to climb up, possibly reaching 29 before this volatility cycle ends. Supplemental Indicators: confirm "Fully Bearish" Equity Put/Call ratio: The P/C ratio daily chart below shows only EMA lines to make it easier to discern its pattern. Observe how the 20-day EMA blue line is forming a W bottom, ready to rise back up to form possibly a lower high top. This confirms the "Fully Bearish" mood happening right now. What the P/C ratio pattern is telling us is that traders have been buying more puts, and are likely to keep up the demands for hedging puts as market sells off. This creates a vicious cycle with dealer hedging, becoming a technical force that can drive price down short term. Dealer hedging: Given the current dealer hedging of their books, if $SPX drops below 4475 and QQQ below 357, sharp price swings will kick in. This is because as price drop below these levels, dealers will need to buy into strength and sell into weakness to stay delta neutral. This means they will be fueling volatility, creating a vicious cycle. Bonds: Bond volatility (MOVE) has been rising sharply again. All bonds are selling off, and Treasury yields are rising sharply. We may see capitulation in the bond market in a couple weeks, but until then traders will be selling bonds, and selling equities as well. Dark Pool Index: This index has been forming a topping pattern, confirming the "Fully Bearish" conditions for now. Trade Plan We think there's a strong possibility that $SPX will drop down to retest 4300.

In the spreadsheet, we show our plan to continue scaling into SQQQ and UVXY and where we plan to take profits. Looking further down the road, once conditions become "Approaching Bullish", we will start scaling into:

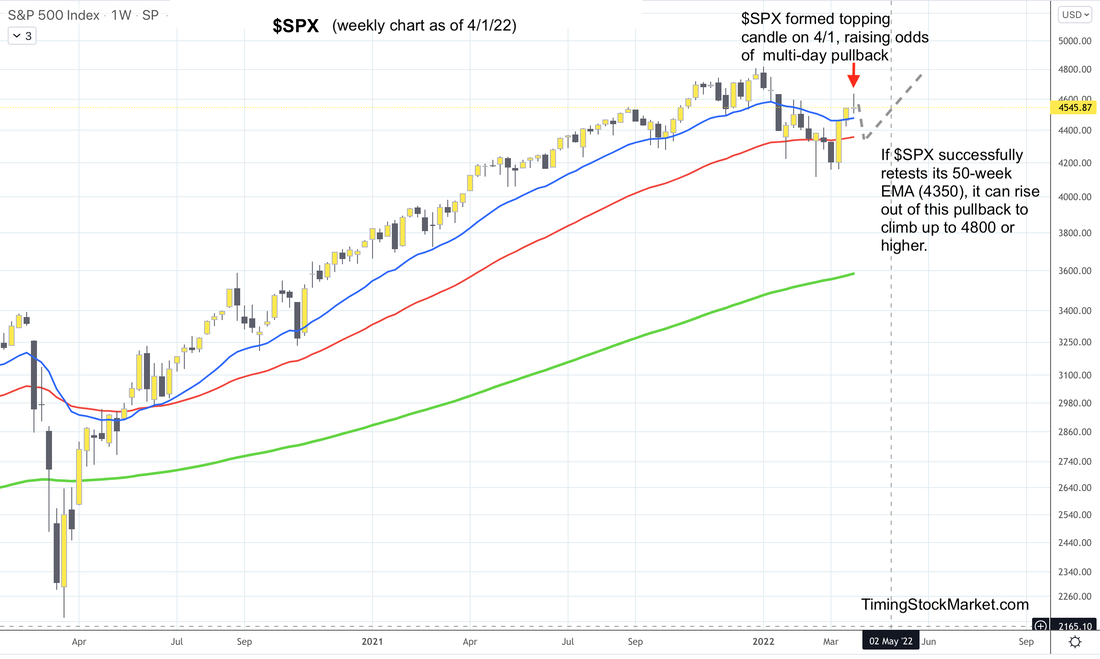

Click here for live trades. Subscribe to get our latest analysis, trade plans and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades. We trade 3x ETFs such as TQQQ TNA SOXL LABU UVXY using proprietary analysis of volatility. Current trade record here. Updates 6:30 PM ET - Sunday 4/3/22 Upcoming key events This week is light in economic reports, but there are few Fed speakers as well as the release of FOMC minutes to stir things up a bit. Key Price Levels The table below has been fully updated. These new price levels will be in focus this week. Table is available in members section. Weekly index charts confirm "Approaching Bearish" $VVIX has been warning us that volatility is about to rise some amount. This means stock indices are about to pull back a certain amount. Stock conditions have changed to "Approaching Bearish". This is confirmed by the topping candles formed on $SPX $NDX IWM charts. How much of a drop can we expect and how long? We don't think stock indices are starting a lower-low leg in a bear market. Rather, they are building the 2nd leg of a really big W from which they can propel themselves higher, getting out of the bear market for real. This potential path is shown on $SPX weekly chart below. Here are our projections:

"Happy stocks" charts confirm "Approaching Bearish" The weekly chart of Nasdaq percentage of stocks above 200-day MA shows a big topping candle formed right at the 20-week EMA blue line. The odds are high that this percentage will drop, possibly to retest 20% again. This confirms the "Approaching Bearish" condition for $NDX. NYSE and small cap charts are showing similar patterns as well. Volatility confirms "Approaching Bearish" Read more about $VIX $VXN $RVX $VVIX and the effects of options and hedging on the market here. Volatility of volatility ($VVIX) formed a complete W bottom by 4/1, setting the stage for a possible multi-day climb back up. $VIX $VXN $RVX all confirm the "Approaching Bearish" conditions. Supplemental Indicators Equity Put/Call ratio: This ratio has stopped dropping and started rising steadily since 3/25. This means traders are starting to buy more puts for hedging and shorting purpose. This confirms the "Approaching Bearish" conditions. Dealer hedging: If $SPX $NDX IWM drop and stay below Friday's lows, current state of dealer hedging will fuel volatility. This is because dealers will be selling into weakness and buying into strength, thereby creating sharp price swings. Bonds: Bond volatility (MOVE) has been rising sharply for the last several weeks. Junk bonds (JNK HYG) weekly charts show topping patterns. Junk bonds tend to behave like equities. This confirms the "Approaching Bearish" conditions. Dark Pool Index: This index is starting to show a topping pattern, confirming the "Approaching Bearish" conditions. Trade Plan After $VIX $VVIX form a W bottom, they will be ready to rise for multiple days. We plan to capture this rise volatility and drop in price via UVXY and SQQQ. The charts below show the possible price paths for UVXY and SQQQ. Note that we plan to scale into both positions at the lows of last week, and take partial profits along the way. Click here for UVXY SQQQ charts and current buy/sell orders. Subscribe to get our latest analysis, trade plans and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed