Updates 2:11 PM ET - Monday 10/31/22 Summary

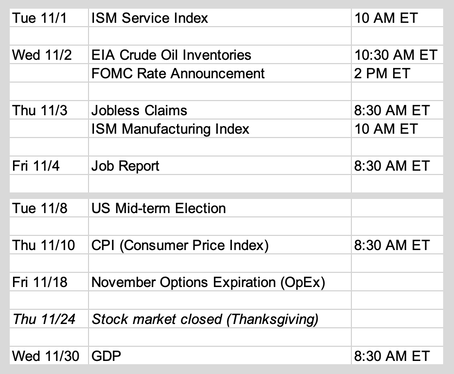

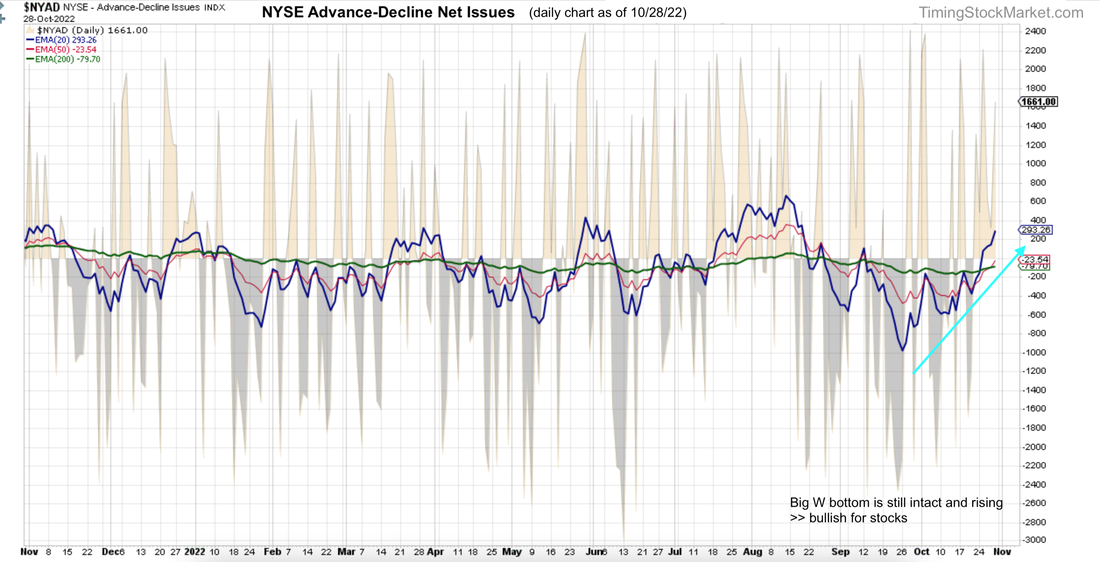

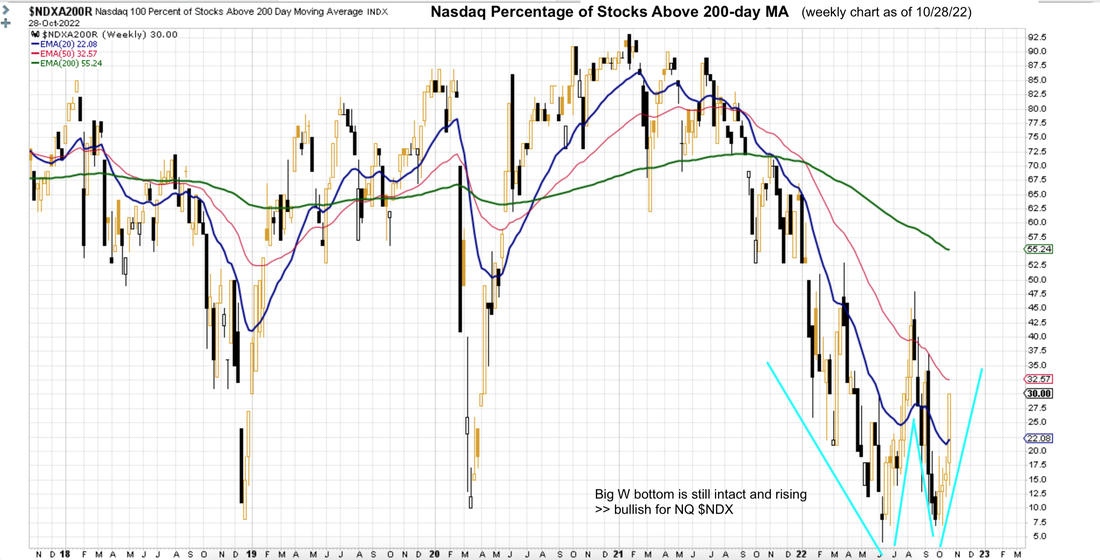

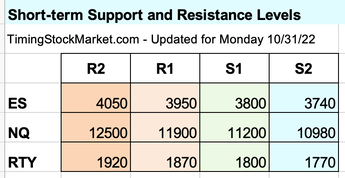

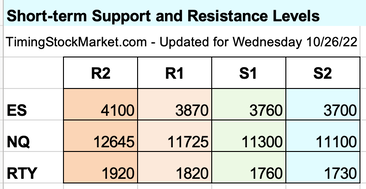

Market breadth is still positive, but NYSE Nasdaq A/D lines are forming short-term tops on their hourly charts. $VIX gapped up and rose to 27 in the early morning hours today. It has since dropped but we expect to see $VIX stays above 25.7, and starts rising back up again towards 28-29. Conditions are consistent with a setup for a retracement before ES NQ RTY can resume their rally as we explained last night. There is a high probability that ES NQ RTY will retest S1. Updates 12:30 AM ET - Monday 10/31/22 Upcoming key events The biggest event this week is FOMC rate announcement on Wednesday. Job report on Friday will also be very exciting. Read here for more information on economic news this coming week. Earnings releases this week Chart courtesy of Earnings Whispers. What to expect from FOMC this week The Fed is likely to raise its benchmark rate by another 0.75% as it attempts to cool the economy and bring down high inflation. The Fed's job is extra complicated due to rising wage and cash-rich consumers. Read more here. Market breadth is still supportive of stocks The bear market rally that started on Oct 13 has been going strong. There have been lots of explanations offered for this rally. We don't really know for sure all the reasons behind the rally. But we have confidence that since our system was able to identify the seed of the rally on Oct 3, it can identify the end of the rally. For now, market breadth is still very supportive of stocks as shown in the charts below. $VIX is dropping and has room to drop more $VIX 20 EMA blue line in its 2-hour chart below has been dropping straight down since Oct 13. This has been very bullish for ES NQ RTY. We did mention on Friday that $VIX is at its pivot zone which is 25-26, right at its 200-day EMA line. There is a high probability that $VIX will rise a bit from here to tag its 200 EMA green line, which is around 28 - 29. Then it is likely to drop down from there, possibly to 20 eventually. Key S/R levels With $VIX having a lot of room to drop, ES NQ RTY can potentially rise up to R2 or higher before this rally ends. However, while $VIX spikes up to 28-29, we may see ES NQ RTY retest support at S1. Trade Plan Last week, we locked in 20% profit with TNA runner, and 6% profit with TNA swing. Both positions did what they were supposed to do. Now we are aiming to scale back into TNA runner and swing during the pullback. We don't know if the pullback will happen before or after FOMC, but we'll be monitoring for the target entry level. Subscribe to get our latest analysis, daily trade plans and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades.

0 Comments

Updates 3:20 PM ET - Wednesday 10/26/22 Bear market rally is still intact

Price actions this morning set up a bull trap, and we are likely to see sharp selling. We are still projecting ES NQ RTY to drop and tag S1 as $VIX rises and tags 30. This type of swing is to be expected in this market. But again, volatility and breadth support the bear market rally continuing. We continue to hold TNA runner position as is, and wait for RTY to retest S1 to scale back into TNA swing position. Updates 11:40 PM ET - Tuesday Summary

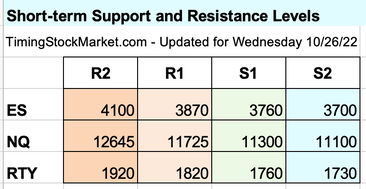

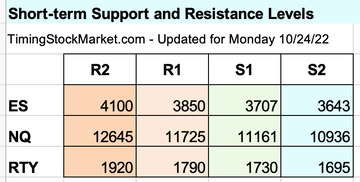

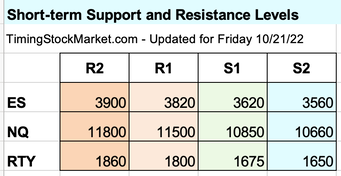

Against this bullish backdrop, Microsoft and Alphabet earnings resulted in sharp drops after hours. S/R levels So expect some pullback on Wednesday, or at least choppy market conditions. Below are updated S/R levels. We may see ES NQ RTY1 tag S1 before resuming the bullish rise. Is the rally over? Not according to volatility and market breadth.

Trade plan The TNA runner position is still intact and we will continue to leave the stops at breakeven for now. We will be monitoring for pullback overnight and at open to re-enter TNA swing position. Subscribe to get our latest analysis, daily trade plans and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades

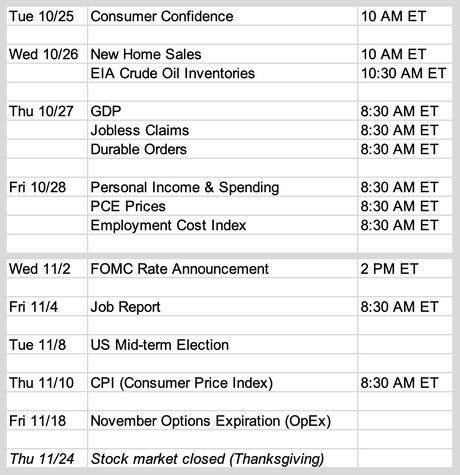

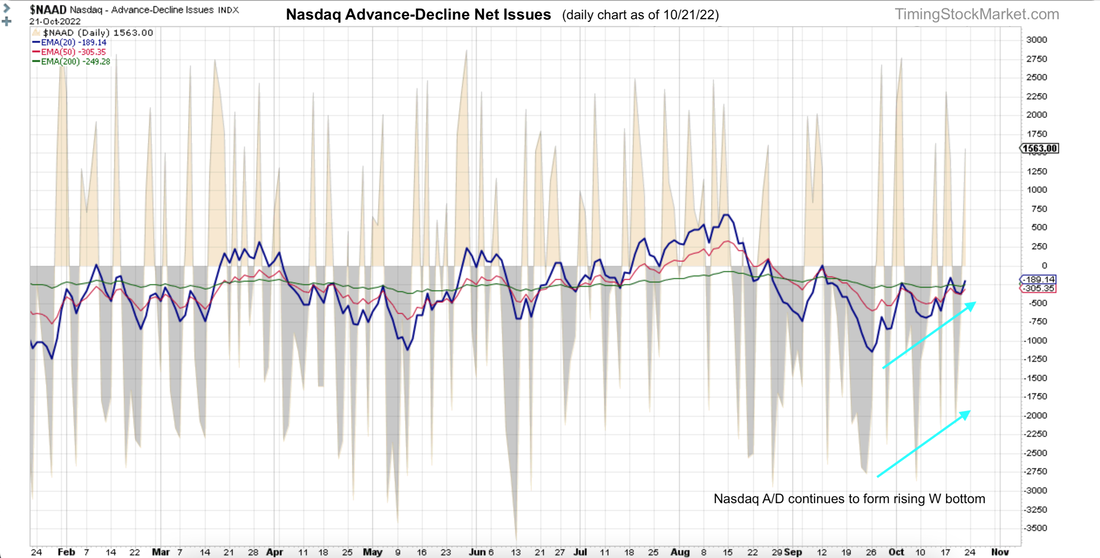

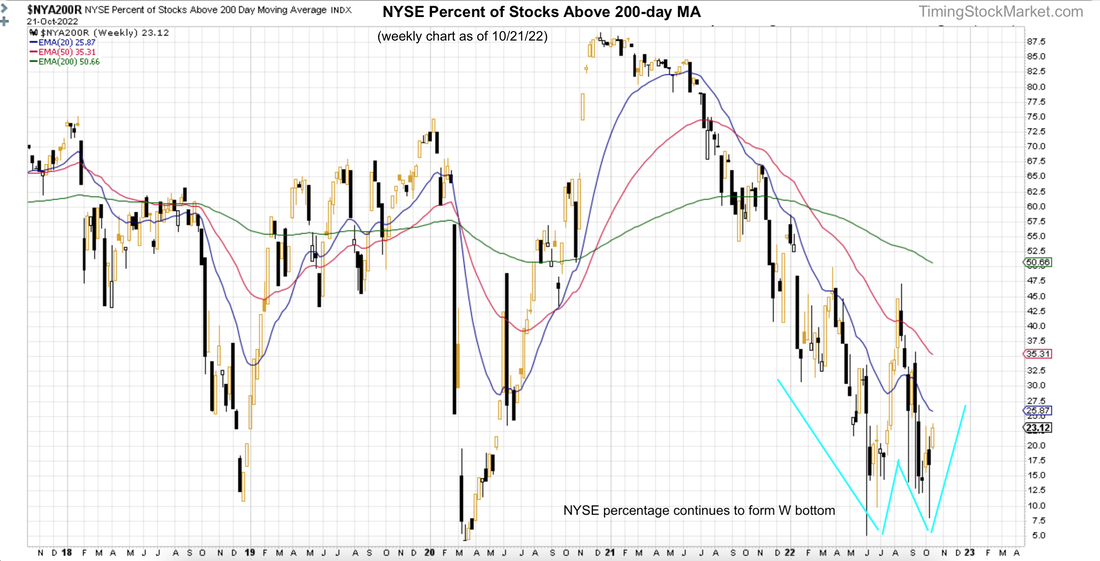

Updates 2:12 PM ET - Monday 10/24/22 Bullish but $VIX needs to stay below 31 Conditions are still bullish in the short term, but $VIX needs to stay below 31 an start to head down below 29 soon. If $VIX starts to base between 29 and 30 and inches up from there, then it may make a serious attempt to climb up to 33 - 34. This climb would trigger bigger drops in ES NQ RTY, where we may see ES tests 3600 again. In that bearish scenario, TNA would drop back down to 28 or lower. Therefore, we will aggressively tighten stop on our TNA runner position if $VIX starts to base in the 29 - 30 zone. There is no low-risk bullish setup right now to re-enter TNA swing position, so we're holding that capital in cash for now. Updates 12:30 AM ET - Monday 10/24/22 Upcoming key events Thursday GDP and Friday PCE reports will add fresh data to the state of inflation and economic growth, ahead of FOMC rate announcement next Wednesday 11/2. Earnings releases this week Chart courtesy of Earnings Whispers. This is a big week for tech earnings: Microsoft and Alphabet on Tuesday, Meta on Wednesday, Amazon and Intel on Thursday. Why did stocks rise on Friday? Global macro economic conditions are still very bleak, yet ES NQ RTY sharply rose last week. Why? One theory says the bullish rise was due to dovish comments by a couple Fed officials, and a WSJ article that many traders are guessing to be trial balloon by the Fed: One possible solution would be for Fed officials to approve a half-point increase in December, while using their new economic projections to show they might lift rates somewhat higher in 2023 than they projected last month. Another theory is that it's just the result of large number of puts expiring on OpEx Friday. As the previously sold puts expire, dealers who hedged these sold puts by shorting stock futures had to cover their shorts as price started to rise. All of this happened at a very large scale, and resulted in a massive short squeeze. We suspect that both of these events functioned as catalysts. They were the match that lit the pile of dried wood on Friday. But this bullish pile of dried wood has been building for some time if you recall. The evidence has been showing up in the rising market breadth (since 9/30) and declining volatility (since 10/12). So by tracking breadth and volatility in addition to price actions, we were able to anticipate the growing bullish setup that took off on Friday. And now we need to examine them again. Market breadth is still very supportive of stocks

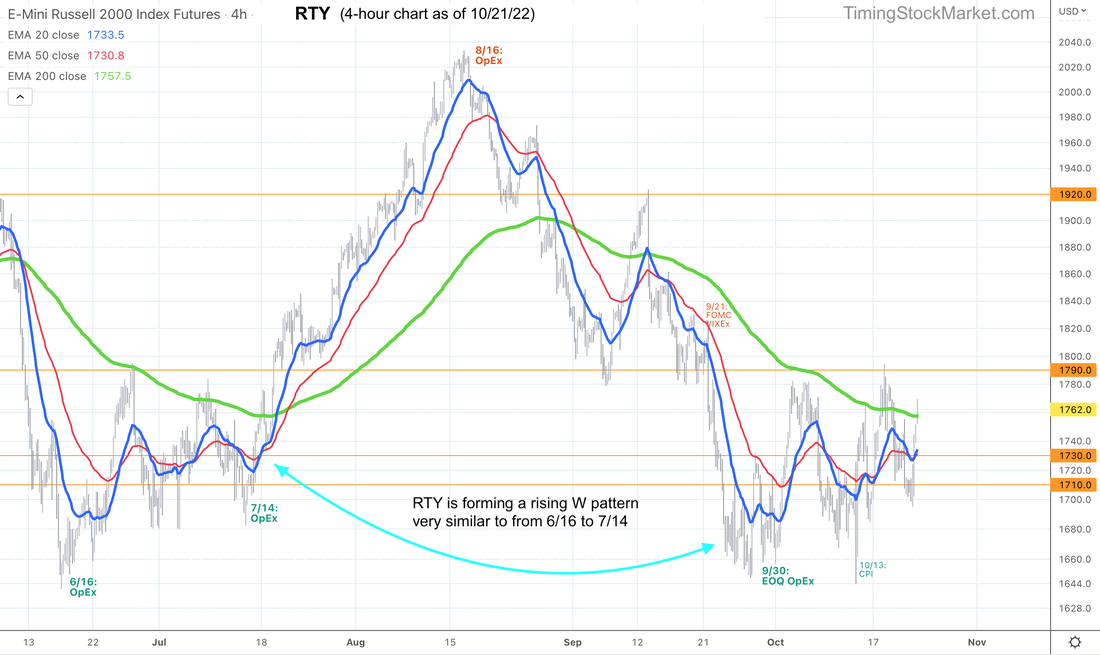

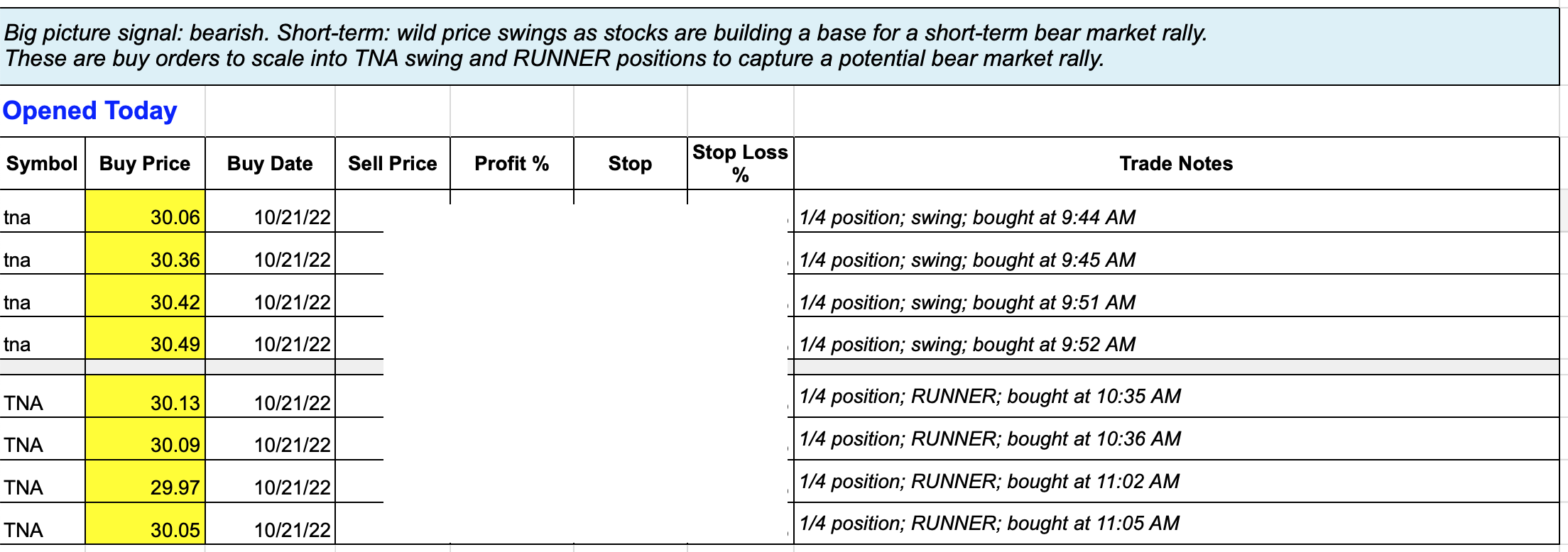

Volatility is still declining $VIX 200-hour EMA green line in the hourly chart below has been going sideway all of last week. Meanwhile, $VIX 20-hour blue line and 50-hour red line have been steadily marching down. They are now both below the green line. As long as this condition remains true, $VIX is very supportive of stocks. Keep in mind though that $VIX may pop back up quickly to retest the zone 31- 32 one more time before it continues the march downward. $VIX may get down to 25 before this rally is over. RTY has formed W bottom similar to mid June Key S/R levels On Monday, we may see ES NQ RTY dip back into the zone between S1 and S2 while $VIX pops up possibly to retest 31-32. Trade plan Right after open on Friday, we sent out a series of alert as soon as we noticed that $VIX was continuing to drop and ES NQ RTY were turning bullish at opening. We manually scaled into TNA runner and swing positions. When ES NQ RTY opened on Sunday (6 PM ET), they all rose straight up. ES tagged 3813 before dropping rather sharply. We suspect that ES NQ RTY are going to tag these price levels again near open on Monday (9:30 AM ET).

Then we may see an intraday pullback before the climb resumes. We plan to tighten the stop on TNA swing position to lock in some partial profit. But we'll leave the stop at breakeven for TNA runner and give that position a chance to grow. Note that we plan to re-enter TNA swing position during the pullback. Buy orders for this will be posted as we get more data. Subscribe to get our latest analysis, daily trade plans and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades

Updates 12:47 PM ET - Friday 10/21/22 Volatility and Breadth are supportive of stocks

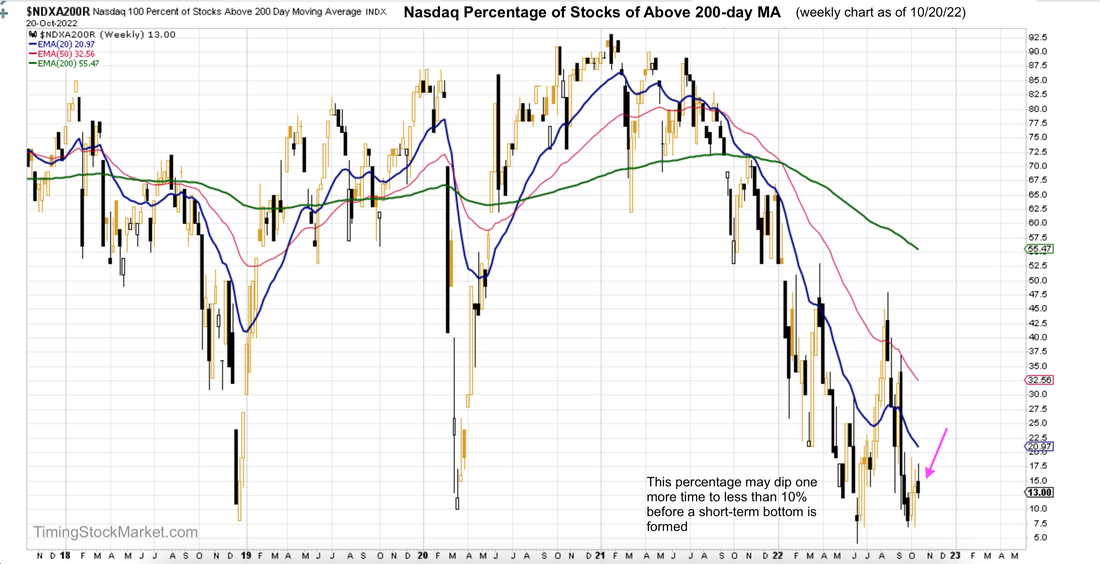

RTY has formed W bottom ES NQ RTY all rose this morning from the opening lows. RTY hourly chart continues to show a complex rising W bottom similar to the one formed between May and June. We sent out a series of alert as soon as we noticed that $VIX was continuing to drop and ES NQ RTY were turning bullish at opening. They didn't dip into the support zones that we cited last night. That is the nature of trading. It's very difficult to predict the pivot points. But we have been prepping you to visualize a bullish W bottom being formed. We showed you what to look for with $VIX and market breadth to confirm the thesis. And we said OpEx Friday is likely to be the major pivot day. So it should come as no surprise that ES NQ RTY headed up today. Here are the entries that we scaled into. Keep in mind that there will be wild intraday swings as $VIX is still yearning to rise up and tag 30 one more time. Also as long as ES is still below 3800, the way market makers have to hedge their books result in wild price swings as they need to sell into weakness and buy into strength. Once ES rises above 3800 (R1), price should calm down and start to grind up more steadily. Updates 12:15 AM ET - Friday 10/21/22 Summary Big picture signal is bearish based on macro conditions. But short-term signal is still bullish. ES NQ RTY are building W bottom to rise post OpEx. Market breadth continues to improve, but... The daily charts of NYSE and Nasdaq A/D net issues are still forming rising bottoms. However, the weekly charts of NYSE and Nasdaq percentage of stocks above 200-day MA suggest they are capable of dipping a bit more before rising more substantially. Nasdaq weekly chart below shows a topping pattern so far for this week, while the percentage hovers at 13%. It could dip back to below 10% before rising again. Volatility of $VIX shows a quick rise in volatility likely $VVIX formed a hammer on its daily chart below on Thursday. It is the type of pattern typically seen before $VVIX rises a bit, possibly back up to 95 before dropping again. $VIX may not retest that high Despite these cautions, we don't think will rise back up to 34 at this point. On $VIX 30-minute chart below all of its EMA lines have been trending down. $VIX is likely to tag 32 again before dropping more substantially. Key S/R levels

Trade plan Our buy orders placed yesterday are still the same. Subscribe to get our latest analysis, daily trade plans and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades

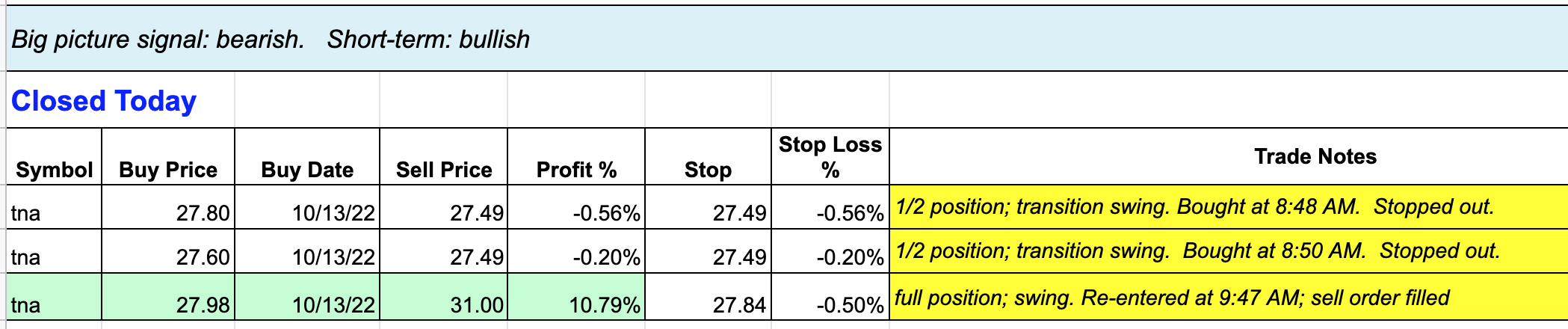

Updates 4 PM ET - Thursday 10/13/22 Trade results Updates 9:46 AM ET - Thursday 10/13/22 Re-entered TNA We have re-entered TNA. (Sorry but Stocktwits messaging is not working right now). Updates 8:53 AM ET - Thursday 10/13/22 $VIX is struggling $VIX is struggling to rise above 33.5. This is NOT supportive of a massive market crash. Updates 8:46 AM ET - Thursday 10/13/22 CPI hot From CNBC: "Consumer price index rose 0.4% in September, above the 0.3% expected by economists according to Dow Jones. Core CPI, which strips out food and energy, was up 0.6% month over month, also higher than expected." ES NQ RTY dropped sharply with ES getting close to 3500. However, UVXY is not rising above October 11 high just yet. We're monitoring for now, but if UVXY forms a top above its 200 EMA (5-min chart), we may scale into TNA. Remaining flexible because market is very news driven right now. Updates 8:15 AM ET - Thursday 10/13/22 Squeeze alert CNBC headlines said futures are jumping because of the British pound. ES NQ RTY as well as SVXY have spiked up. We may have a setup for a squeeze. So we're looking at either SQQQ or TNA depending on the post CPI reaction. Don't feel compelled to jump in immediately. Updates 12:15 AM ET - Thursday 10/13/22 Market breadth is supportive

$VIX is stalling or transitioning $VIX hourly chart below shows that it has been stuck in the 33-34 range for multiple days. After a hot PPI report that exceeded projection, $VIX barely moved. So we have to ask ourselves if the market is about to undergo a short squeeze. That is certainly possible given the large amount of puts purchased for CPI hedging. They function as potential fuel for short squeeze. But the truth is no one really knows. So rather than speculating, we are going to focus on two patterns that have been reliable, and they both share one common characteristic. Bullish: If $VIX forms a true 2nd top (relative to 9/30), then conditions are supportive of a rally. But to do so $VIX 20-hr EMA blue line has to weave around its 50-day EMA red line for a few days before dropping. This means $VIX has to have a sharp dip to start, perhaps down to 31-32 (see pink arrows below). From this sharp dip, $VIX then can rise up to test 34 again before forming a top. Bearish: In order for $VIX current trend to resume with vigor and longevity, $VIX also needs to dip a bit. Again, we want to see $VIX dips to 31-21 zone to gain fuel for the next surge up. Trade plan So we want to catch $VIX dip as described above, whether it's a setup for a $VIX top, or a setup for $VIX trend resumption. We plan to do so by looking for comparable dip in SQQQ. By the way, small caps RTY IWM TNA look promising in terms of a possible W bottom. But we need SVXY to confirm first, and SVXY is quite lethargic right now. So we will continue to monitor SVXY RTY, but not jump in just yet. Incidentally, if $VIX does form the complex top, SVXY will form a W bottom and that will be a very bullish setup for RTY. Subscribe to get our latest analysis, daily trade plans and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed