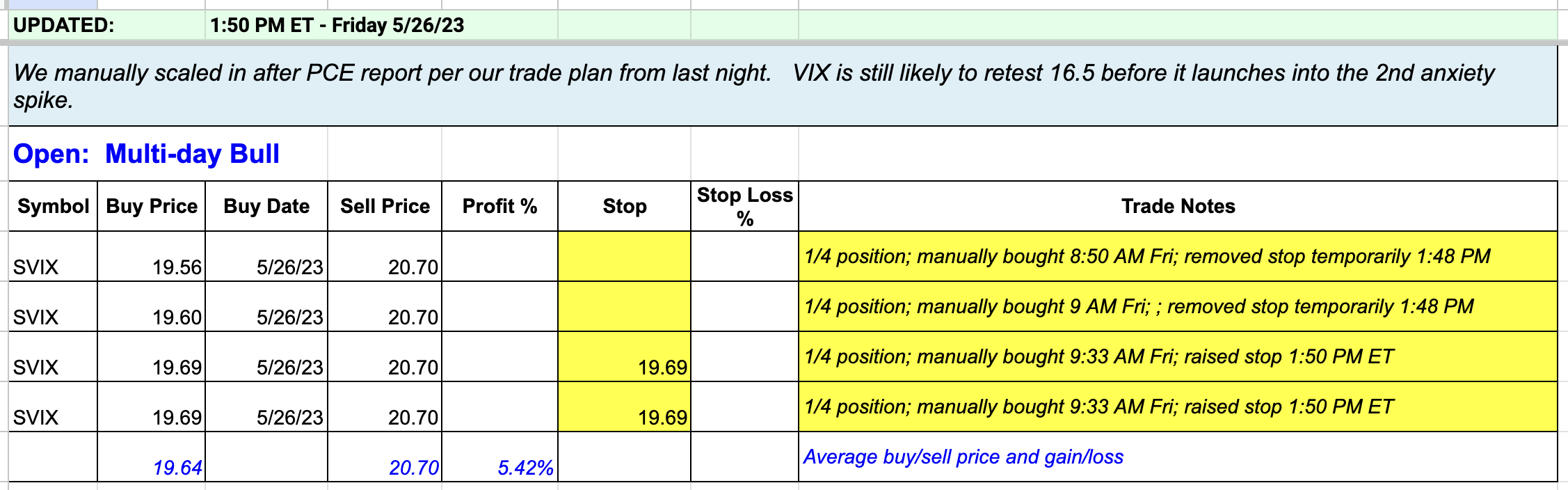

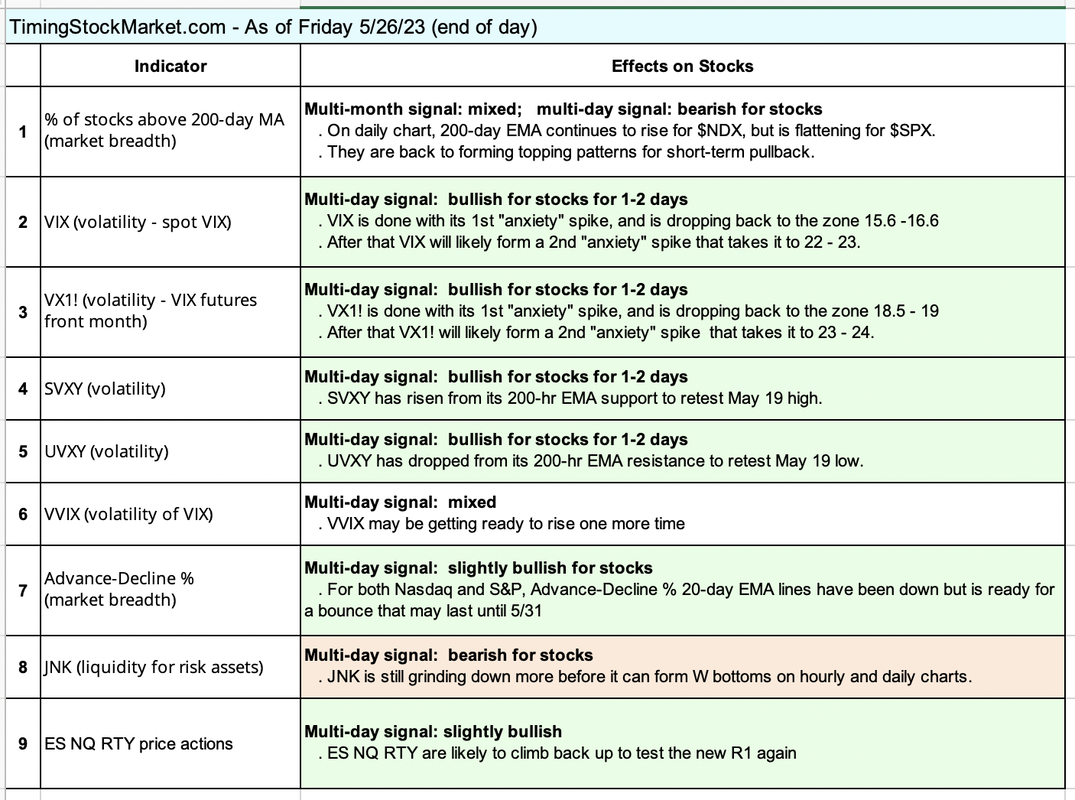

Updates 2:21 PM ET - Friday 5/26/23 Our SVIX trades so far We manually scaled into SVIX after PCE report per our trade plan from last night. Based on VIX patterns, VIX is still likely to retest 15.6 - 16.6 before launching into its 2nd "anxiety" spike. This means that SVIX is likely to retest near its May 19 high. We've tightened stop on 1/2 of our position to get out at breakeven, but removed stop on the other half to cope with big swings if they come. We intend to hold onto at least 1/2 position over the weekend. Updates 1:30 AM ET - Friday 5/26/23 Explanation of Indicators Background info on $VIX, $VVIX, ES, NQ RTY Key S/R levels RTY support levels have been updated. All other levels remain the same. Projections Here are our updated projections.

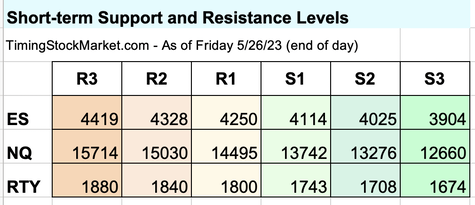

An "anxiety" spike typically results in a moderate drop for ES NQ RTY. Right now, we don't see any VIX setup for a "real fear" spike, and certainly not a "panic" spike. Not yet anyway. However, after VIX reaches back into the support zone 15.6 - 16.4, it may form a 2nd "anxiety" spike. This 2nd spike may happen during the week of 6/12 with CPI, FOMC and June OpEx. This spike may take VIX up to 22 - 23 before it drops back down again. We don't have enough data at this point to project what will happen after the 2nd "anxiety" spike. But both bulls and bears should keep in mind that these "anxiety" spikes are short-lived and typically result in choppy price actions for ES NQ RTY. Our Personal Trade Plan

Click here for Signal Trades spreadsheet. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades.

0 Comments

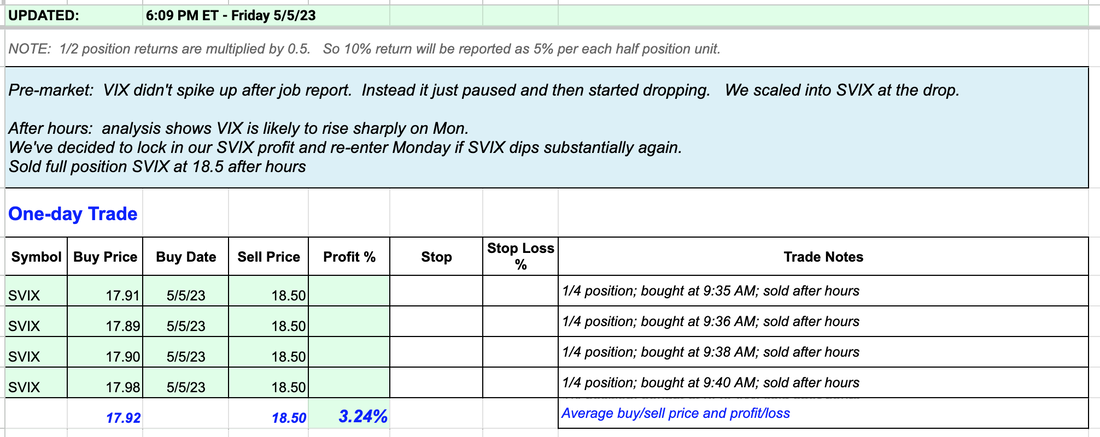

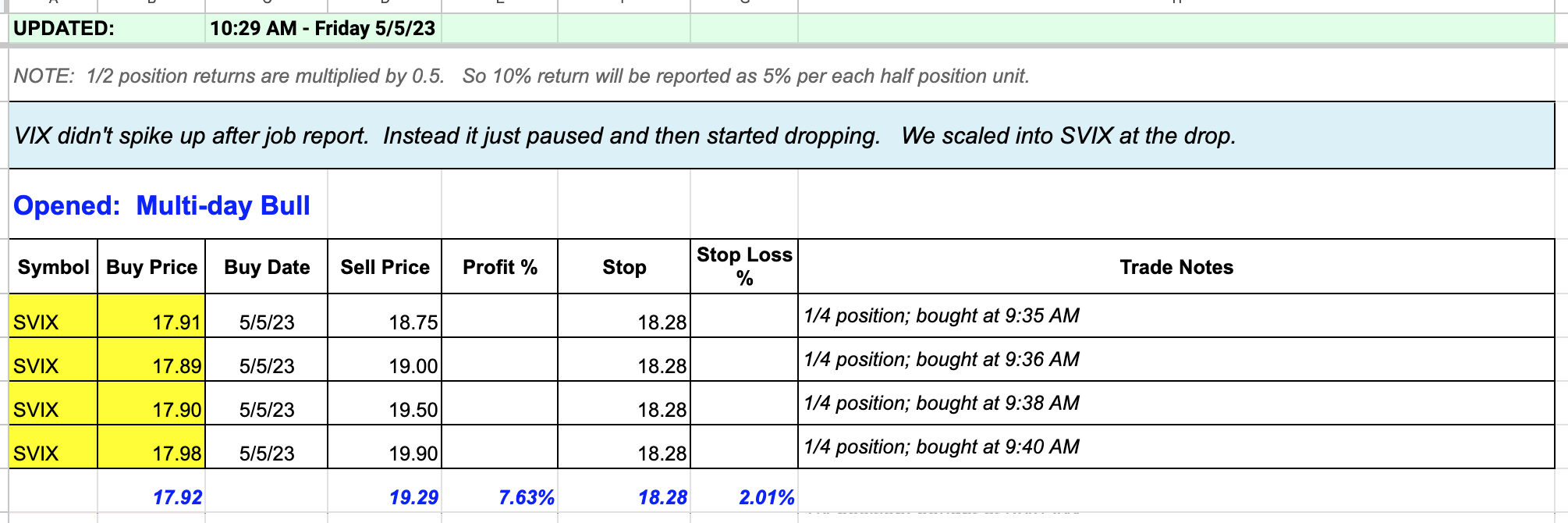

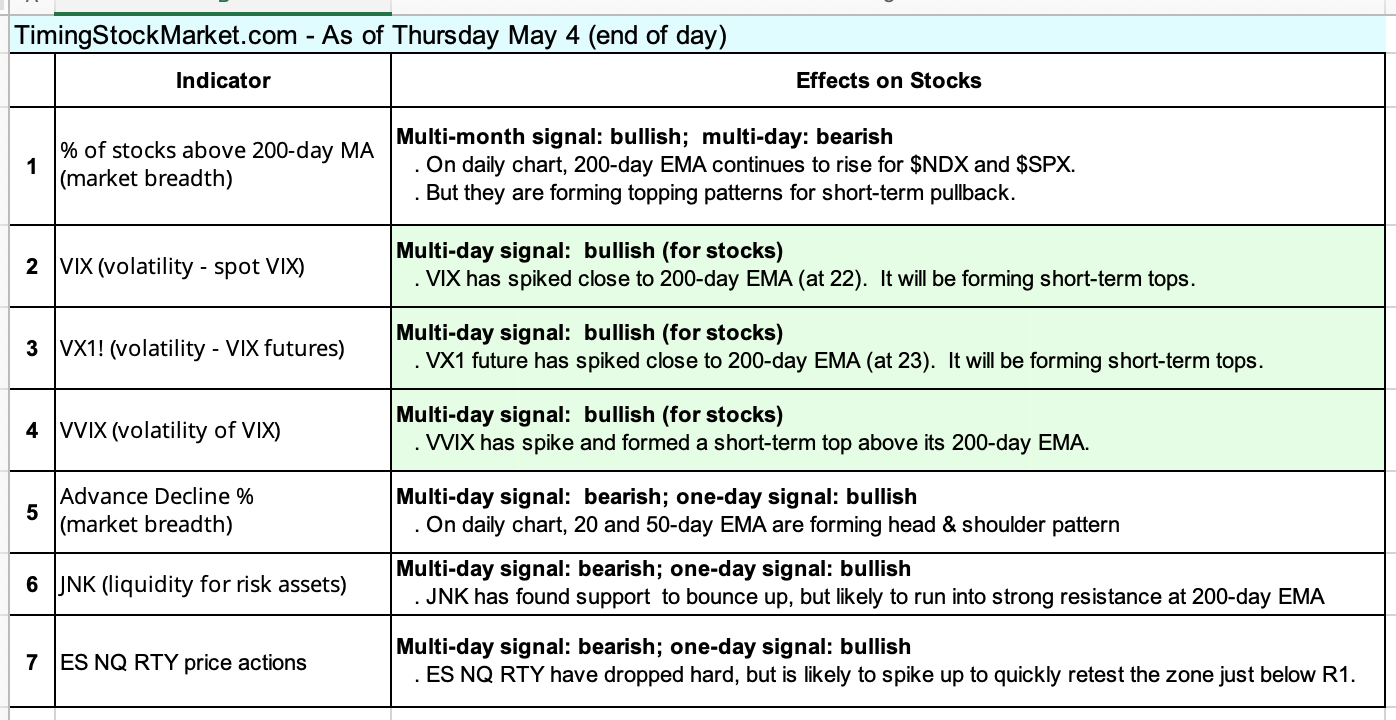

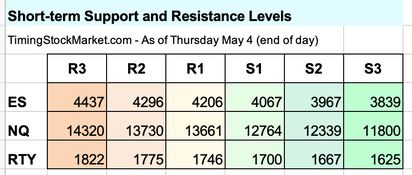

Updates 6:10 PM ET - Friday 5/5/23 Sold SVIX because... After hours analysis shows VIX is likely to rise sharply on Mon. We've decided to lock in our SVIX profit and re-enter Monday if SVIX dips substantially again. Sold full position SVIX at 18.5 after hours. (This alert was shared live on Twitter DM.) Updates 12:21 PM ET - Friday 5/5/23 Watch out for VIX bouncing VIX dropped right after the job report. VIX is now below all the EMA lines. It may start to bounce after such a sharp drop. This is why we raised SVIX stop. Entered SVIX per trading plan VIX didn't spike up after the job report. Instead it just paused and then started dropping. We scaled into SVIX at the drop. (This alert was shared live on Twitter DM.) Updates 1:30 AM ET - Friday 5/5/23 Explanation of Indicators Background info on $VIX, $VVIX, ES, NQ RTY Key S/R levels The table below has been fully updated. VIX rose higher on Thursday on fear of more regional banks collapsing. VIX got close to its 200-day EMA which is currently at 22. Our indicators are still leaning mildly bullish. So we are projecting that VIX will spike up to test 22 after the job report. Then VIX will likely begin its multi-day descend. VIX may drop as low as 16.6 before it builds a W bottom to surge up again. What will ES NQ RTY do while VIX drops? They are likely to rise up to retest R1. NQ may find enough bullish momentum to pierce R1, but ES and RTY are likely to run into major resistance at R1. We may see VIX drop steadily towards 16.6 while ES NQ RTY go sideway around R1 levels. Our Personal Trade Plan We want to capture VIX potential drop from 22 down to 16.6 zone. Click here for our buy orders. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed