|

Click here for our Signal Trades. See FAQ for more explanations on terms, labels and abbreviations that we use. Below is a time-delayed excerpt from our live updates for members. Updates 11:23 AM EST - Friday 7/31/20 Short Term $VIX is likely to be done rising for today. However, it is unlikely to drop below 23.5. $VIX came close, reaching 23.6 pre-market. But like magic, $VIX immediately rose up from there. $VXN (Nasdaq volatility) gapped down big at open and immediately reversed upward. That's a highly bearish signal for $NDX. IWM dropped down hard this morning, indicating growing weakness in small caps. $VIX is likely to continue grinding towards the tip of its pennant. And $VIX is also likely to continue testing its support zone from 23.5 to 25. And as we've been saying, as long as $VIX stays above 23.5, it is building up its bearish headwinds for stocks. So when $VIX reaches the tip of its pennant next week, there is a good chance that it may break out from there. Next week is the start of August. August is the worst month for the S&P 500 since 1987, according to the Stock Trader’s Almanac. Keep all this in mind, but we do not recommend holding UVXY right now. This is due to contango. Contango is running close to 10% right now, so UVXY will drop in value each day you hold it. The current condition is not conducive for holding long or short. Market is undergoing some changes under the hood. Best strategy right now is TMAR (Take Money And Run). Take whatever the market gives you and be happy walking away with it. Updates 9:42 AM EST - Friday 7/31/20 Short Term

However, $VIX is unlikely to break out from its pennant pattern just yet. It may only reach up into the zone between 27 and 28 today. Updates 9:17 AM EST - Friday 7/31/20 Short Term $VIX signal is unclear right now. It is forming the kind of pattern that precedes an upward reversal. But it is not done forming this pattern yet. So we have to allow for it to fully form. $SPX $NDX appear to be stuck at the highs form after hours on Thursday. During the night, ES and NQ hardly moved after the post-earnings pop. This indicates a lack of buyers as well as sellers. IWM has gapped down, so we should pay close attention to TZA. Updates 1:55 AM EST - Friday 7/31/20 Breakout? Maybe not AMZN and AAPL earnings announcements after hours resulted in a big surge for $NDX $SPX. $NDX reached to the top of the previous orange zone. However there wasn't follow-through buying in futures Thursday night. Additionally, UVXY dropped down sharply after hours but anchored in an important support zone. Between 7/21 and 7/30, UVXY has anchored 5 times in this support zone. This is happening despite UVXY high contango value, and the sharp surge in $NDX $SPX. So there is a good chance that $VIX will not drop below 23.5 on Friday. $VIX 2-hour chart below shows $VIX is getting to the end of a pennant pattern. It shows that $VIX has formed 4 anchors at this point in $VIX support zone between 23.5 and 24.8. This kind of “anchor to rise” $VIX pattern tends to precede a breakout from the pennant. So we should keep this possibility in mind. The breakout in $VIX isn't a guarantee, but is a high probability. .... SUBSCRIBE now to read the rest of this post and gain full access to all our analysis and signals. Take advantage of our introductory low rate of just $39/month.

0 Comments

Click here for our Signal Trades. See FAQ for more explanations on terms, labels and abbreviations that we use. Below is a time-delayed excerpt from our live updates for members. Updates 1:24 PM EST - Wednesday 7/29/20 Short term There is a high probability that $SPX $NDX IWM will attempt to rise into the lower part of their orange resistance zones after FOMC today. And $VIX $VXN may do a sharp drop before they anchor themselves again. $VIX may drop below 23.5. So monitor for this bullish opportunity to exit long $SPX $NDX IWM. Do not enter short yet. We need $VIX $VXN to demonstrate they are ready to rise first. Updates 9:16 AM EST - Wednesday 7/29/20 Short term We have mixed signals right now. $VIX dropped into key zone between 23.5 and 24.5 and promptly started rising. It formed yet another "anchor to rise". This means bearish headwinds are building up for $SPX $NDX IWM. $SPX $NDX IWM are all forming bullish patterns pre-market, indicating they too are ready to rise, most likely at least to the highs of Monday 7/27. So it appears that $SPX $NDX IWM are ready to rise despite the bearish headwinds building up. Do not initiate new positions. Our Signal Trade is targeting to exit long in the orange resistance zone. No low-risk high-reward setup to enter short yet. Updates 1:30 AM EST - Wednesday 7/29/20 Subscribe for full analysis SUBSCRIBE now for full access to all our analysis and signals.

Take advantage of our introductory low rate of just $39/month. Click here for our Signal Trades. See FAQ for more explanations on terms, labels and abbreviations that we use. Below is a time-delayed excerpt from our live updates for members. Updates 9:45 AM EST - Monday 7/27/20 Short Term $VIX is not testing its Friday high. It is dropping. This means we can start long entries based on $SPX $NDX IWM. Updates 9:12 AM EST - Monday 7/27/20 Short Term

But don't jump in to long positions just yet. Here is the bullish setup we are looking for.

This is a low-risk setup to test long entries. The goal is to capture the ride up into $SPX $NDX IWM orange resistance zones. SUBSCRIBE now for full access to all our analysis and signals. Take advantage of our introductory low rate of just $39/month. Click here for our recent trade record. See FAQ for more explanations on terms, labels and abbreviations that we use. Below is a time-delayed excerpt from our live updates for members. Updates 3:33 PM EST - Friday 7/24/20 Short-term $SPX $NDX IWM demonstrated that they have found support from today's drop, but they haven't found enough buyers to propel prices upward rapidly. In other words, not enough buyers are willing to risk it before the weekend. This is consistent with the growing nervousness / fear / bearishness, reflected in $VIX patterns since 7/21. We will be monitoring prior to open on Monday for the following bullish setup to enter long $SPX $NDX IWM:

SUBSCRIBE now for full access to all our analysis and signals.

Take advantage of our introductory low rate of just $39/month. Click here for our recent trade record. See FAQ for more explanations on terms, labels and abbreviations that we use. Below is a time-delayed excerpt from our live updates for members. Updates 11:58 AM EST - Wednesday 7/15/20 Short-term Trades The long TQQQ position got stopped out per our 10:10 AM post. The short position TZA got triggered per 11:20 AM post. Market continues to send out bearish short-term signals.

Updates 11:20 AM EST - Wednesday 7/15/20 Short-term Trades We now have more data. $VIX is forming a coiling pattern on its 5-minute chart. It is coiling upward. This is bearish. $SPX looks most vulnerable. It may retest the morning high, but most likely won't surpass it. $NDX is not finding the usual buy-the-dip buyers to raise price up quickly. It is struggling and is likely to continue dropping down. $RUT IWM small caps were surprisingly the most bullish. But it looks like TZA is ready to rise now. TZA may still retest 18.7 but it most likely won't drop below that. We will update our current Signal Trade very shortly. Updates 10:10 AM EST - Wednesday 7/15/20 Short-term Trades We are seeing the following combination:

The data is somewhat conflicting. We recommend continuing to tighten stop on long positions. If $SPX IWM continue to run into sellers at the top of their orange resistance zones, then manually exit long. At the same time, you can enter into a small bearish bet to start against IWM (via TZA for example). Updates 9:18 AM EST - Wednesday 7/15/20 Short-term Trades We are seeing the following combination that we discussed at 1:15 AM.

We recommend tightening stops on your long positions. Do not enter short yet. Updates 1:15 AM EST - Wednesday 7/15/20 <Subscribe for full access to all the analysis.> SUBSCRIBE now for full access to all our analysis and signals.

Take advantage of our introductory low rate of just $39/month. See FAQ for more explanations on terms, labels and abbreviations that we use. Below is a time-delayed excerpt from our live updates for members. Updates 10:25 AM EST - Tuesday 7/14/20 Short Term Trades What a morning! We have enough data points now to draw the following conclusion.

Time to exit short and start testing long positions. Click here for current Signal Trade. Updates 9:47 AM EST - Tuesday 7/14/20 Short Term Trades $VIX shows that it's time to exit short-term bearish positions against $NDX $SPX IWM. $VIX as well as $SPX $NDX IWM are still not showing a low-risk high-reward (LRHR) setup to enter short-term bullish positions yet. Updates 9:10 AM EST - Tuesday 7/14/20 Short Term Trades Pre-market data shows we are not going to get the exact bullish combination of signals that we wrote about at 1:26 AM EST. Not yet. So it is best to wait for the following bullish combination to show up.

This combination will be a short-term bullish signal for entering positions based on $NDX $SPX IWM, and exit short-term bearish positions against $NDX $SPX IWM. Updates 1:26 AM EST - Tuesday 7/14/20 <Subscribe for full access to all the analysis.> SUBSCRIBE now for full access to all our analysis and signals. Take advantage of our introductory low rate of just $39/month. See FAQ for more explanations on terms, labels and abbreviations that we use. Below is a time-delayed excerpt from our live updates for member Updates 1:53 PM EST - Monday 7/13/20 Short Term We had a buy order for TZA at 20. TZA has dropped down low enough for our buy order, so we manually entered TZA since $VIX is steadily rising. See current Signal Trade here. Updates 1:29 PM EST - Monday 7/13/20 Short Term $VIX has been rising steadily since open. $VIX is now over 28.5. We recommend tightening stops on your long positions. $NDX $SPX IWM are ripe for a reversal downward. SUBSCRIBE now for complete access to all our analysis and signals. Take advantage of our introductory low rate of just $39/month. See FAQ for more explanations on terms, labels and abbreviations that we use. Below is a time-delayed excerpt from our live updates for members Updates 3:10 PM EST - Friday 7/10/20 Short Term Trades Our nightly analysis and pre-market data confirmation have yielded some very accurate projections for the trading day. A quick review shows that all the projections we shared pre-market today (at 9:15 AM) have unfolded as anticipated

We hope that these projections were helpful for your trading today. Full analysis coming this Sunday. Updates 9:15 AM EST - Friday 7/10/20 Short Term Trades Pre-market data suggests that $VIX is likely to drop to the bottom of its channel, retesting the zone between 27 and 28. This means that at the start of today, there is a high probability that prices will head in these directions.

It's important to monitor what will happen at that point. There is a high probability that sellers will come out once these levels are tested. Updates 1:35 AM EST - Friday 7/10/20 <Subscribe for access to the complete analysis with tables and charts.> SUBSCRIBE now and take advantage of our introductory low rate of just $39/month. See FAQ for more explanations on terms, labels and abbreviations that we use. Below is a time-delayed excerpt from our live updates for members. Updates 11:28 AM EST - Thursday 7/9/20 $VIX is intent on rising up further. It turned out that $VIX wild gyration pre-market was a warning that $VIX was about to surge.

We closed out our TZA trade at 22.5 which was obviously too early. It was still a profitable 11% trade. Updates 9:44 AM EST - Thursday 7/9/20 The selling is happening as we projected. So we are using this opportunity to exit TZA. Updates 9:21 AM EST - Thursday 7/9/20 $VIX gyrated wildly early this morning, making it hard to predict the next move. For now, $VIX appears to be ready to rise at open, possibly to reach 29.3. But it is likely to drop down from there. This means that after some possible selling at open, we may see $SPX $NDX IWM rising up for a good part of the day. We don't have high confidence in these projections because $VIX is not giving us a clear message right now. Updates 12:01 AM EST - Thursday 7/9/20 <Subscribe for access to the complete analysis with tables and charts.> SUBSCRIBE now and take advantage of our introductory low rate of just $39/month. You get full analysis and signals in advance of your trading day. You also get live intraday signal updates. And you can cancel at any time. See FAQ for more explanations on terms, labels and abbreviations that we use. Below is a time-delayed excerpt from our live updates for members. Updates 10:57 AM EST - Tuesday 7/7/20 Short Term

Updates 10:42 AM EST - Tuesday 7/7/20 Short Term $VIX is rising back up.

Updates 10:32 AM EST - Tuesday 7/7/20 Short Term While $VIX is dropping some amount, $VXN (Nasdaq volatility index) is steadily rising. This is an important bearish divergence from $NDX rising, indicating that traders are nervous. Additionally, market breadth shows a moderate net declining day for both NYSE and Nasdaq stocks. Again this is a bearish divergence, as more stocks are being sold then bought. We consider $NDX $SPX rise into the orange resistance zone as Thrust5 formation (of Bounce8). We discussed this in our post at 12:45 AM today. Keep in mind that Thrust5 is really stretching it, so take advantage of it to book your profit. Updates 9:55 AM EST - Tuesday 7/7/20 Market price actions are unfolding pretty much as we projected in our 12:45 AM updates. Short Term: $VIX

Short Term: $NDX $SPX

Short Term: IWM TZA Yesterday we posted a few entry zones for TZA throughout the day. At 9:41AM we wrote:

At 12:45 PM we wrote:

Some members day traded TZA, but some used these entry points to build up the position. Congratulations! If you are building TZA position today, look for.

Updates 9:13 AM EST - Tuesday 7/7/20 Short Term Trades The indices are gapping down this morning pre-market, and $VIX is climbing up. We are not going to get the signal combination we were looking for as the ideal setup to enter short against $RUT IWM. Here are updated signals to look for.

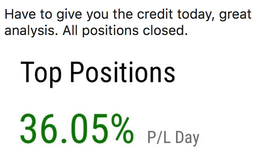

Updates 12:45 AM EST - Tuesday 7/7/20 <Subscribe for full nightly analysis.> Here's a comment from one of our members who successful day traded using our signal at on Tuesday 7/7/20. SUBSCRIBE now and take advantage of our introductory low rate of just $39/month. You get full analysis and signals in advance of your trading day. You also get live intraday signal updates. And you can cancel at any time. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed