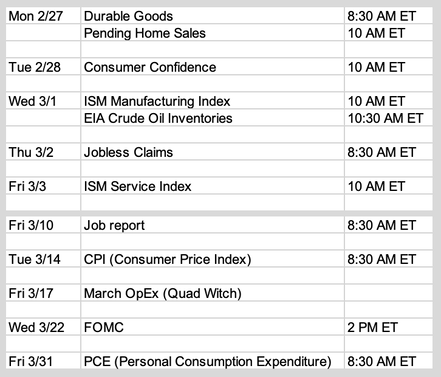

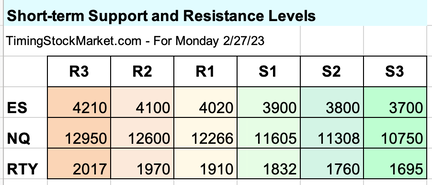

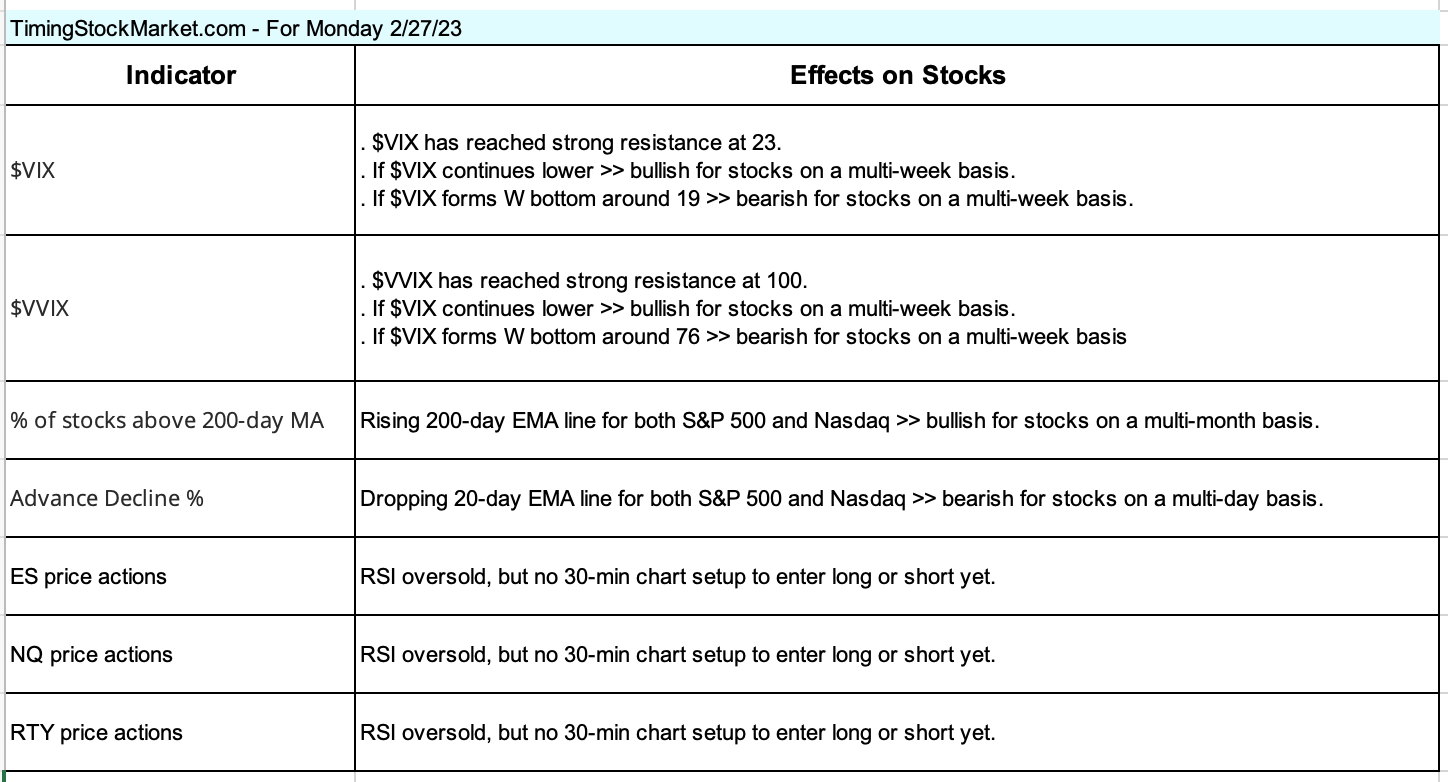

Updates 8:30 PM ET- Sunday Upcoming key events Though this week has a number of economic reports, the true market moving event will be the job report next Fri Mar 10. Earnings this week Chart courtesy of Earnings Whispers. What, me worry? Bears should take note of the muted reactions to negative economic news lately. Feb 14 CPI was higher than expected, as was Feb 24 PCE. FOMC minutes on Feb 22 were highly hawkish. However, none of these events caused a major sell-off or a nosedive to the bottom. One could argue that the price actions of ES, NQ, and RTY since Feb 2 have been a way for the market to process the overly enthusiastic buying since the start of the year. As we wrote on Friday, traders don't appear to be panicking. There is no rush to buy puts, no panic selling, and no priming for Black Monday. It seems that high inflation and high interest rates for longer periods of time are becoming the norm for the market. This combination is getting baked into price actions, and it will likely take much more dramatic events to cause panic in the market. Key S/R levels All support levels have been updated to reflect the current sell-off. Projections

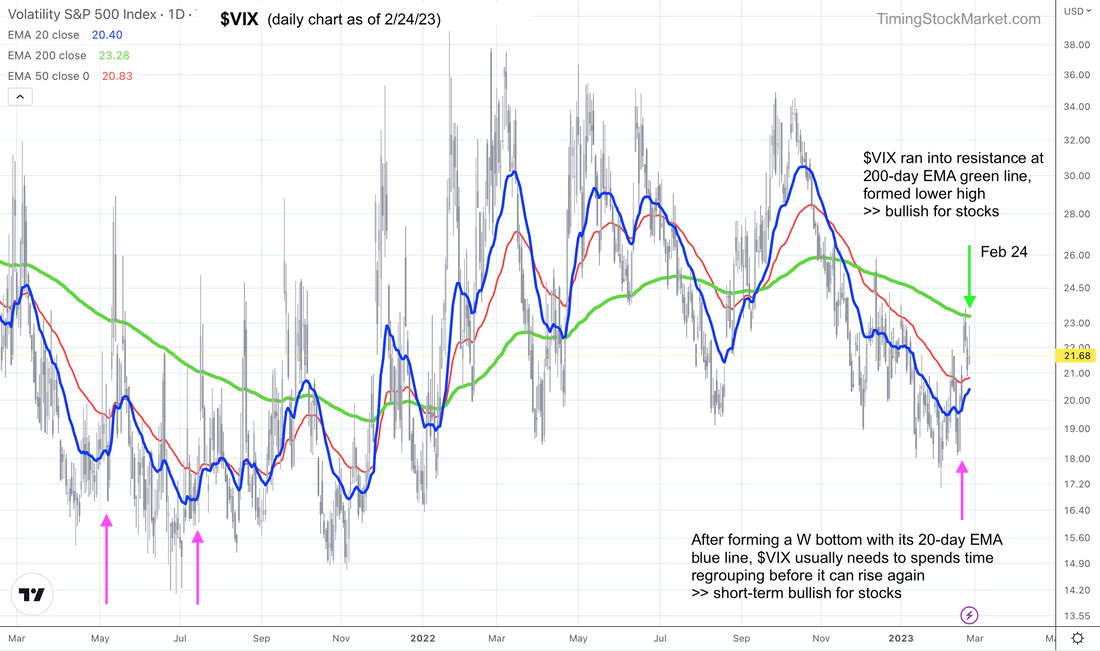

As the charts above show, $VIX and $VVIX will need time to form the bearish W bottoms in order to really surge. Until $VIX $VVIX form such patterns, we are going to lean bullish with ES NQ RTY. Furthermore, if $VIX $VVIX fail to form the bearish W bottoms, ES NQ RTY will take off even more. Our personal trade plan It seems to us that the best strategy is to wait for ES NQ RTY to form a bullish setups on their intraday day charts (30-min) to scale into multiple bull positions. We are monitoring the 20 EMA on these charts and waiting for W bottom patterns to form. We may enter a quick bear position if we observe a highly bearish intraday setup. As of right now, there is no such pattern. We understand the desire to trade frequently and capture every swing in the market. However, given current market conditions, unless we are day trading, we are likely to get stopped out from short-term, choppy conditions. Therefore, we are choosing to wait for intraday setups to form before taking any positions in either direction. Click here for Signal Trades spreadsheet. Questions? For new members who may not be familiar with the information we post in this blog, please check the glossary for more information. You can also email us with questions directly. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades.

0 Comments

|

Archives

July 2024

Categories |

RSS Feed

RSS Feed