|

Winter is coming Before we dive into the weekly analysis, let’s review some pivot points.

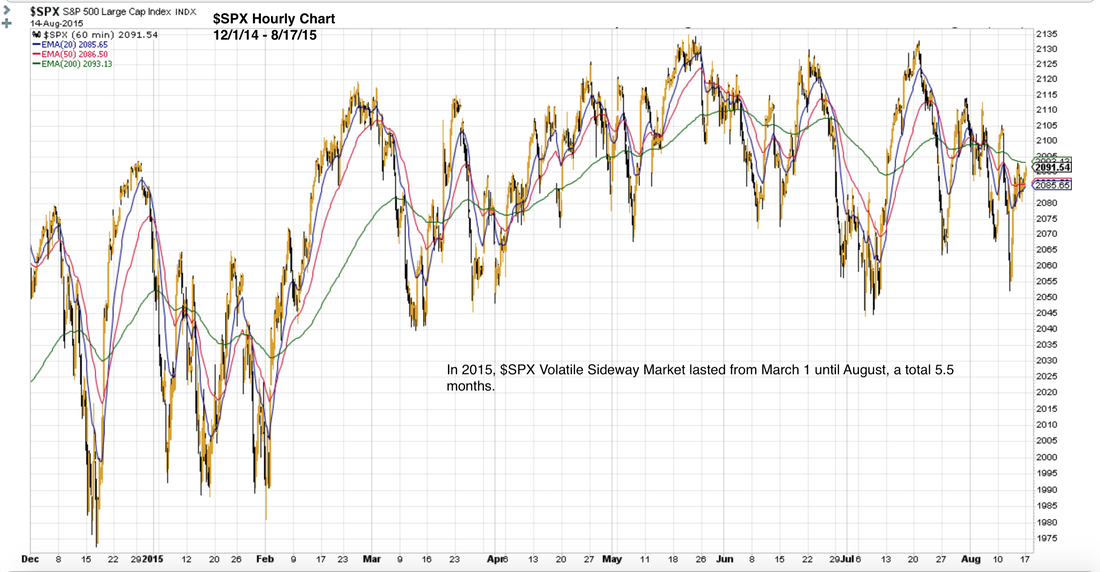

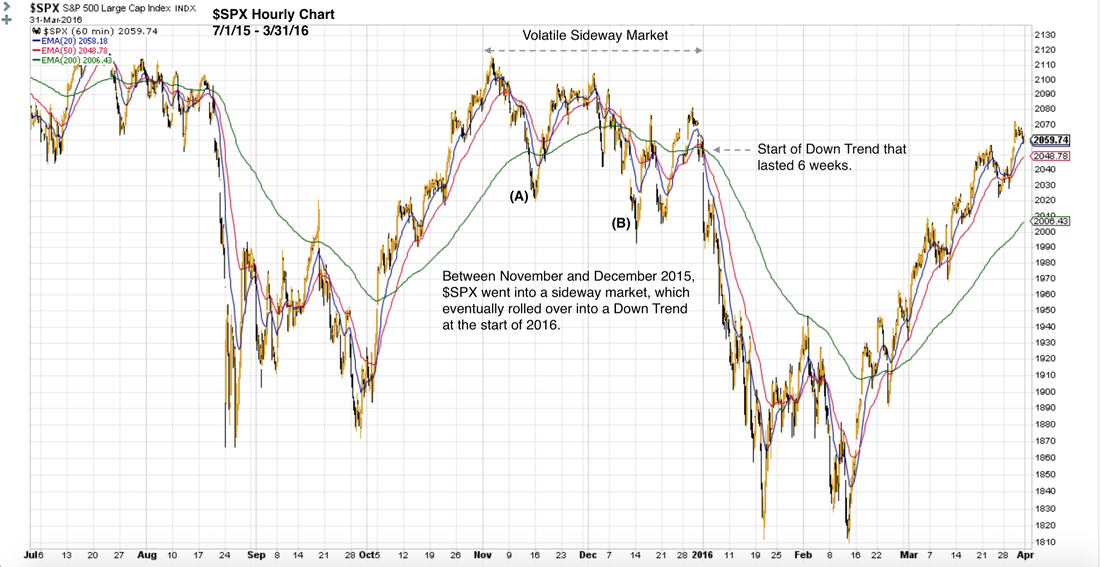

When Surge7 was cut short on 9/24, it was a big psychological change in the market. Market participants (us included) were holding out for at least one last bullish surge to a new all-time high for $SPX. But a noxious combination of negative news lead to additional sell-offs. And the fate of the Up Trend is highly questionable at this point. So what is a Volatile Sideway Market? Below is a visual example of a Volatile Sideway Market that occurred in 2015, lasting 5.5 months before a major crash. This is $SPX hourly chart from March until mid-August 2015. This is a rather extreme example. More typical is this type of pattern seen below. This is $SPX hourly chart from mid 2015 through the first quarter of 2016. Observe that between November and December 2015, $SPX went into a sideway market, which eventually rolled over into a steep drop that is the Down Trend at the start of 2016. This Down Trend lasted 6 weeks. If the left side of the above chart looks familiar, it is because it greatly resembles the Major Pullback2 period of this past August. We are now at an inflection point similar to either (A) or (B). Stock market sometimes transition from an Up Trend to a Down Trend via a Volatile Sideway Market. This type of market simply reflects the fact that bulls and bears are fighting it out. The winner of this psychological battle will lead the market in the next period. As mentioned above, stocks are now at an inflection point similar to either (A) or (B). From here, there is a high probability that $SPX $NDX SPY QQQ TQQQ will swing upward one more time to test a couple resistance levels, just like how it played out in the above chart. There is also a high probability that $SPX $NDX SPY QQQ TQQQ won’t be able to break above the strong resistance formed on 9/24. How many more times will they traverse the range up and down? No one can say for sure. But there is a high probability that they will roll over into a Down Trend from the current Volatile Sideway Market some time in October. Winter is coming. The rest of this article covers: Table of support and resistance levels Updates from market internals Planning your trades Register your email here for full access to all our nightly analysis, trading plans and intraday updates. No credit card. All free.

0 Comments

Updates from market internals

Market internals confirm today that we are transitioning into Volatile Market. In fact, the most likely scenario is that we will see choppy price actions into early October. In the very short term, $VIX $VXN volatility charts tell us that the re-test of Support1 is approaching the end. There is a good chance based on price actions of futures tonight that $SPX $NDX SPY QQQ TQQQ may start rising tomorrow. However, there is still a chance we will see a quick dip down to get near Support1 one more time early tomorrow Friday. The important point is that there is likely enough strong support at Support1 to enable prices to rise up from here. The rest of this article covers: Updates from market internals (more) Table of support and resistance levels Planning your trades Register your email here for full access to all our nightly analysis, trading plans and intraday updates. No credit card. All free. Coping with volatile market

Yesterday when we sent out the intraday update of the S/R table, we noted that you should wait to exit your long positions at either Resistance1 and/or Resistance2. We did not suggest that you should sell immediately while prices were dropping rapidly intraday. We hope that this message was clear and did not cause any confusion for you. While it is frustrating to see our unrealized gains turn into unrealized losses, it is the nature of trading. We can cope with it by:

There is no trading system that is going to provide us with 100% reliability 100% of the time. It is therefore very important to develop a good risk management strategy for all market conditions. Protective stops are essentially your automated risk management strategy. The rest of this article covers: Table of support and resistance levels Updates from market internals Planning your trades Register your email here for full access to all our nightly analysis, trading plans and intraday updates. No credit card. All free. Updates from market internals

In the last couple of days, we have been warning you that the Up Trend that started on 12/26/18 is still intact, but it is getting weaker based on the weekly charts of market internals. In other words, Surge7 may end soon, along with the current Up Trend. Normally, we get a few weeks with this kind of early warning from the weekly charts of market internals. However, today’s price actions indicate that market internal weekly charts may be in a hurry to get their messages out, regardless of what their corresponding daily and hourly charts are saying. The rest of this article covers: Updates from market internals (more) Table of support and resistance levels Planning your trades Register your email here for full access to all our nightly analysis, trading plans and intraday updates. No credit card. All free. Updates from market internals

As we mentioned the messages from market internals are getting complex. The following messages from market internals are important, so we want to repeat them here today. The Up Trend that started on 12/26/18 is still intact, but it is getting weaker. In other words, this Up Trend may end after Surge7. This is just an early warning from market internals though. Do not bet against the Up Trend yet. Early bears can suffer some really bad losses. The rest of this article covers: Updates from market internals (more) Table of support and resistance levels Planning your trades Setting protective stops Register your email here for full access to all our nightly analysis, trading plans and intraday updates. No credit card. All free. Market context

At the end of this article, we added a discussion on setting stops and where to get access to market internal data. On Thursday evening 9/19/19, we wrote in our analysis: Market internals are all sending out the same message. And the message consists of 2 parts:

And that is pretty much what happened during the day on Friday 9/20. TQQQ dropped down to 62.74 as the intraday low. And if you consult the S/R table from that same post, it says Support1 for TQQQ is at 62.75. So once again, the messages from market internals came true. But why did this happen? In order for stocks to continue marching up, there has to be fresh waves of buyers. These waves of buyers typically will jump in when one of these 2 things happen:

Since Surge7 has started on 9/4, prices have not dropped enough yet to entice more buyers to jump it. Without the V reversal, stocks have to prove that they have found support at some strong level before more buyers will actively buy again. Successfully testing Support1/Support2 is what buyers want to see. And that is the condition we need to monitor for. The rest of this article covers: Table of support and resistance levels Updates from market internals Planning your trades Setting protective stops Accessing market internal data Register your email here for full access to all our nightly analysis, trading plans and intraday updates. No credit card. All free. Market context

The repo story may have been downgraded a bit, but it is not going away. According to Bloomberg: This week’s actions have helped calm the funding market, with repo rates declining to more normal levels after soaring to 10% Tuesday, four times last week’s levels. However, swap spreads tumbled to record lows Thursday amid concern that Fed policy makers… didn’t announce more aggressive steps to keep rates from spiking. Swaps are signaling less appetite for Treasuries, driven by concern traders won’t be able to fund purchases of U.S. debt through the repo market. Keep an eye on this story as it may have the potential to alter the Fed’s current course of actions. It may also have the potential to derail the current Up Trend. However, it’s too soon to guess at the outcome. We must trade the signals in front of us, right now, as presented by market internals. Unfortunately for us bulls, market internals are saying that Minor Dip2 is still not fully done yet. The rest of this article covers: Table of support and resistance levels Updates from market internals Planning your trades Register your email here for full access to all our nightly analysis, trading plans and intraday updates. No credit card. All free. Market context

The Fed cut rates by 0.25% today, as widely expected. However, Fed officials are struggling to agree on future rate cuts. According to WSJ: “Seven of 10 Fed officials voted in favor of lowering the benchmark federal-funds rate to a range between 1.75% and 2%, with two reserve bank presidents preferring to hold rates steady and one favoring a larger, half-point cut.” Still, the door has been left open for possibly one more rate cut this year. Additionally: “The Fed also on Wednesday injected money into the banking system for the second day in a row to ease a crunch in overnight funding markets, and said it would do so again on Thursday. The operations are aimed at keeping the fed-funds rate in the central bank’s target range.” Stocks responded by rising, after an initial quickie sell-off. However, as we write this, futures are showing that stocks may gap down at open tomorrow still. The rest of this article covers: Table of support and resistance levels Updates from market internals Planning your trades Register your email here for full access to all our nightly analysis, trading plans and intraday updates. No credit card. All free. Market context

The big event this week was going to be FOMC announcement, which is scheduled for 2:00 PM EST tomorrow Wednesday 9/18. However, an important mini crisis happened today that you may want to pay more attention to because it has a direct effect on market liquidity. According to Bloomberg: “The Federal Reserve took action <today> to calm money markets...Money markets saw funding shortages Monday and Tuesday, driving the rate on one-day loans backed by Treasury bonds -- known as repos -- as high as 10%, about four times greater than last week’s levels, according to ICAP data. More importantly, the turmoil in the repo market caused a key benchmark for policy makers -- known as the effective fed funds rate -- to jump to 2.25%, an increase that, if left unchecked, could have started impacting broader borrowing costs in the economy…. ...the central bank...resorted to a money-market operation it hasn’t deployed in a decade. The New York Fed bought $53.2 billion of securities on Tuesday, hoping to quell the liquidity squeeze. It appeared to help... Late Tuesday, the New York Fed said it would conduct another overnight repo operation of up to $75 billion Wednesday morning.” Here is a lengthy and highly informative explanation on repos. This stuff is complex, but is worth paying attention to. This is the type of liquidity problem that can spill over into other markets in a hurry. It was the lack of liquidity that caused the crash of 2008. So while headlines like Saudi oil or Hong Kong turmoil can sound dramatic, pay close attention to anything that pops up on the horizon that can suck the liquidity out of the market. That’s when really bad crashes tend to happen. The rest of this article covers: Table of support and resistance levels Updates from market internals Planning your trades Register your email here for full access to all our nightly analysis, trading plans and intraday updates. No credit card. All free. Updates from market internals

In the context of the big picture, market internals are still sending out very bullish message, as of today. However, traders are getting nervous. FOMC announcement on Wednesday still has the potential to move the market in a big way. The tension in Saudi Arabia and Hong Kong does not help. This is why we wrote on Stocktwits that Minor Dip2 is unlikely to be done. The rest of this article covers: Table of support and resistance levels Planning your trades Register your email here for full access to all our nightly analysis, trading plans and intraday updates. No credit card. All free. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed