|

Below is an excerpt from this weekend analysis. The Overall Message The overall message from our analysis is this. We are entering key decision time, as highlighted on $SPX monthly chart at the start of this post. Most new traders obsess about the stock market going up or going down. But statistically, the market spends more time trading in a sideway range than in a directional move. This makes a lot of sense if we view the sideway range as decision time. Market participants rarely arrive at the same decision at the same time. It takes time, but eventually enough buyers step in and prices take off to the next level. Conversely, if enough sellers step in, prices will break down to the next level. Then the cycle starts all over again at the next level as they battle it out. Right now, $SPX is entering into a decision zone, as shown on the monthly chart. Bears shouldn’t count on Dive2 taking off right away. And bulls shouldn’t count on Bounce2 continuing higher and higher. SUBSCRIBE to read our full analysis and get live signal updates for $SPX $NDX $RUT SPY QQQ TQQQ. Take advantage of our introductory low rate of just $39/month. You can cancel at any time.

0 Comments

On Thursday 4/2/20 at 7:15 PM EST, our system dropped the highly bearish signal down to mildly bearish signal of -10. We explained to our readers that it was time to scale out of short positions. This came ahead of the weekend. Updates 7:15 PM EST - Thursday 4/2/20 SIGNAL: -10 (mildly bearish) Maximum bearishness is -55. Maximum bullishness is +55. Zero is neutral. Earlier today, we wrote: We may scale out of the short positions if the signal becomes a lot more positive, and reaches -10 or more positive (ex: -7 or -3 etc.). This is what we did after hours, once we posted at 6:22 PM EST. We scaled out of some of our short positions. Summary:

SUBSCRIBE to read our analysis and get live signal updates for $SPX $NDX $RUT SPY QQQ TQQQ. Take advantage of our introductory low rate of just $39/month. You can cancel at any time.

On Tuesday 3/31/20 at 12:28 PM EST, our system had identified a bearish signal for $SPX $NDX $RUT. This signal confirmed the bearish warning issued by our system on Friday 3/27/20. The warning is: Bounce1 is over, and the Down Trend is going to resume. We posted the following updates for our members throughout the day and into the evening on Tuesday 3/31/20. Members who follow this signal had the opportunity to capture the drop that started on 3/31. Members are now alerted to new information in preparation for Friday 4/3. Updates 7:46 PM EST - Tuesday 3/31/20

At 12:28 PM today, we alerted you that the signal was reading -17, which is much more bearish relative to the reading at the start of the trading day. We mentioned that you could start partial entry of your short positions. Our system is projecting the following scenario:

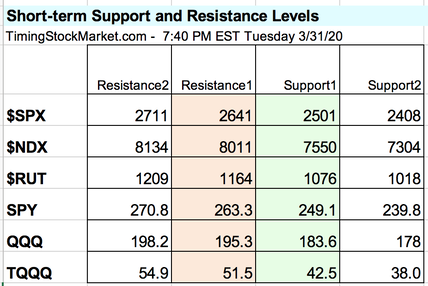

Below is the updated S/R table. (Mostly we updated Resistance1 to be at today's highs.) There is a good chance that $SPX $NDX $RUT will test Support1 tomorrow Wednesday. Updates 6:32 PM EST - Tuesday 3/31/20

The current S/R table is still valid, but we will refine and update it soon after we get some more data from futures. Updates 3:25 PM EST - Tuesday 3/31/20

A reader had asked for some ETF recommendations for betting against $SPX $NDX $RUT. They are: SPXS, SQQQ, TZA. These are short-term ETFs designed to capture a down segment within a Down Trend. They are not buy-and-hold instruments for riding the remainder of this Down Trend. Please read more about them if you are not already familiar with them. Here are some articles to start: Using SQQQ to bet against $NDX Three ETFs that rise as small caps fall Using SPXS to bet against $SPX Remember: they are like fast cars. Capable of fast ride, but also big crash. Do your research and test small if you are new to this. Updates 12:28 PM EST - Tuesday 3/31/20

If you want to start entering short, keep your initial entries small with tight stops. There is now a significant new signal after hours Thursday 4/2/20.

SUBSCRIBE to read our analysis of this signal for $SPX $NDX $RUT SPY QQQ TQQQ. Take advantage of our introductory low rate of just $39/month. You can cancel at any time. On Friday 3/27/20 at 5:00 PM EST, our system had identified a bearish signal for $SPX $NDX $RUT. This was the advanced warning that Bounce1 is over, and the Down Trend is going to resume. So we posted the following updates for our members on Friday 3/27/20 at 5:00 PM EST. Members who follow this signal had the opportunity to lock in profit from their long positions on Monday 3/30, and are capturing profit from the current down swing. Updates 5:00 PM - Friday 3/27/20 Our system has identified these are bearish signals: $SPX $NDX $RUT all formed bearish spires on their daily chart today. They ran into resistance near the highs of yesterday. $VIX $VXN have been finding support for multiple days around the 200 EMA on their 30-min charts. That's a reliable signal that they are going to rise next week. Not a guarantee, but a high probability. Market breadth dropped into very negative zone today. SQQQ (bearish inverse of TQQQ) and TZA (bearish inverse of TNA) have formed W bottom on their hourly charts. The reward:risk ratio for entering short positions against $SPX $NDX $RUT has improved a lot now that the Big Bounce is fading. Conditions are favorable for at partial entry of short positions. However, if you choose to enter short right now, you may need to be prepared for one last possible short squeeze on Monday. There is now a significant new signal as of 3/31/20.

SUBSCRIBE to read our analysis of this signal for $SPX $NDX $RUT SPY QQQ TQQQ. Take advantage of our introductory low rate of just $39/month. You can cancel at any time. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed