|

OK, that's a little bit of an exaggeration, but just a little bit.

You see, on Sunday 4/28/19, we emailed our subscribers to warn them that the short-term signals were turning bearish. As a matter of fact, these short-term indicators started turning bearish on Thursday 4/25. The fact that they stayed bearish for multiple days indicated that some serious storm clouds are forming on the horizon. When you go sailing while storm clouds are forming on the horizon, you run the risk of getting caught in the storm. You know the storm is very likely, you just don't know when it might start for real. Well that rainstorm started for real today. Google revenue miss was the catalyst for the gap down in $COMPQ $NDX QQQ TQQQ this morning. A number of traders on Stocktwits were upset and surprised by the turn of events. Our readers, however, knew in advance that market was turning negative under the hood. We advised our readers to take partial profits, tighten their stops, and not to enter into new long positions ahead of today's gap down. Tomorrow Wed 5/1/19 is a significant date. The Fed will be making new rate policy announcement at 2:00pm EST. We will be emailing updates tonight with specific discussion on what to expect tomorrow, and how to trade before and after FOMC announcement. You can sign up here to start subscribing to our emails for free. No credit card or personal information is required. Also, take a look at our trading record which has locked in 43.22% profit since start of March. If you like what you see, read more about our trading strategy here.

0 Comments

The major event for this coming week is FOMC announcement on Wednesday 5/1/19 at 2:00PM EST.

If you go back and review the charts, all the FOMC announcements in the last 12 months have created big movements in $SPX $COMPQ $RUT prices. This one on Wed will not be different. And even if the Fed continues their do-nothing strategy for now, their choice of words could have big effects on market moves. Big money is unlikely to deploy fresh capital into this market prior to FOMC announcement. The important questions everyone will be asking come Tuesday are:

Projecting answers for these questions is tough. But our trading system short-term indicators are providing some advanced information ahead of Wednesday's big move. We emailed a detailed discussions about our system signals, how to trade short-term this FOMC week, and what to expect from the long-term signals that may affect your long-term investment portfolio. You can sign up here to start subscribing to our emails for free. No credit card or personal information is required. Also, take a look at our trading record which has locked in 43.22% profit since start of March. If you like what you see, read more about our trading strategy here. In our nightly update sent last night Wed 4/24/19 to our email subscribers, we wrote:

“Since last Thursday 4/18, our short-term indicators have turned bearish. Today, our proprietary volatility indicators show that $VIX and $VXN are likely to rise up in the short-term. They won’t necessarily surge up tomorrow, but in the short-term there’s a strong possibility that $VIX will re-test 18 and $VXN will re-test 21.” $VIX surged from the low of 12.4 yesterday to 14.20 this morning. $VXN surged from the low of 15.6 yesterday to 18.05 this morning. They are likely to drop back down some amount, but they are not dropping lower than the low of 4/18/19. Instead, in the short-term $VIX is very likely to re-test 18 and $VXN to re-test 21. While volatility works its way upward, $SPX $COMPQ $RUT are likely to drop in a good-size dip. We discussed how to trade short-term and invest long term in this scenario in our emails to our subscribers. Sign up here to receive this information. It's free and no credit card is required. Here are the screenshots of our trades since March that yield 43.22% locked-in profit so far. Stay prudent and good luck trading! Despite the slow start on this Earth Day, there are lots of events on the short-term horizon. Facebook and Amazon are reporting this week. Latest GDP number will be out this Friday. And next Wed May 1st is FOMC announcement.

It's not easy to trade in this environment. $SPX and $COMPQ have been marching up since March 27, almost one month ago. That's a long time for a short-term signal to persist. Market internals are not looking as rosy as price actions seem to be. We have discussed with our email readers the prudent things to do in a scenario like this, and what to do if you are long SPY SSO QQQ TQQQ IWM TNA. Don't let the lull of this market lull you into being overly complacent. And don't let the lack of actions lead you to over-trade from boredom. You only need to make a couple of trades per month with 3% to 5% gain in order to achieve 6% to 10% profit target every month. The operative words here are "every month". If you can achieve that kind of consistency, you can make a living as a trader. Sign up here to receive daily signal analysis, our long-term investment strategy and our short-term trading plan. It's free and no credit card is required. Here are the screenshots of our trades since March that yield 43.22% cashed-out profit so far. Stay prudent and good luck trading! Last night in our email to our subscribers, we wrote:

“Based on the signals our system picked up today, tomorrow Wednesday 4/17/19 we potentially will see some downward actions for stocks. Volatility is likely to rise some amount, though not hugely. We are likely to see TQQQ and TNA drop more than they have been dropping.” That’s pretty much what happened today. $RUT IWM TNA in particular dropped hard. This is something we’ve been expecting also, as small caps have been stuck for several weeks, unable to rise above the high of February. All our short-term indicators have turned fully bearish today. For more on these short-term indicators, and long-term signals, and how to navigate in this environment, sign up here. It's FREE and no credit card or personal info is required. Since March 1 2019, our profit is 30.02%. See all our trades so far. As of this writing at 2:30PM EST on Thursday 4/11/19, most of our short-term indicators have turned bearish. This confirms that the end of the current short-term Up Segment in Up Trend is rapidly approaching.

So if you are still holding on to your long positions, you may want to take partial profit and tighten your stops. Our TNA and TQQQ sell limit orders got filled yesterday. See all our profits so far. We are, of course, very happy to get another set of profitable trades. More importantly, we are happy to see further confirmation that our trading system is working very well. The long-term signals remain the same as what we discussed in our last email to you. Our subscribers get info like this and more on a daily basis. Sign up to get your FREE copy. The current Up Segment in the Up Trend that started on 3/27/18 is approaching the end.

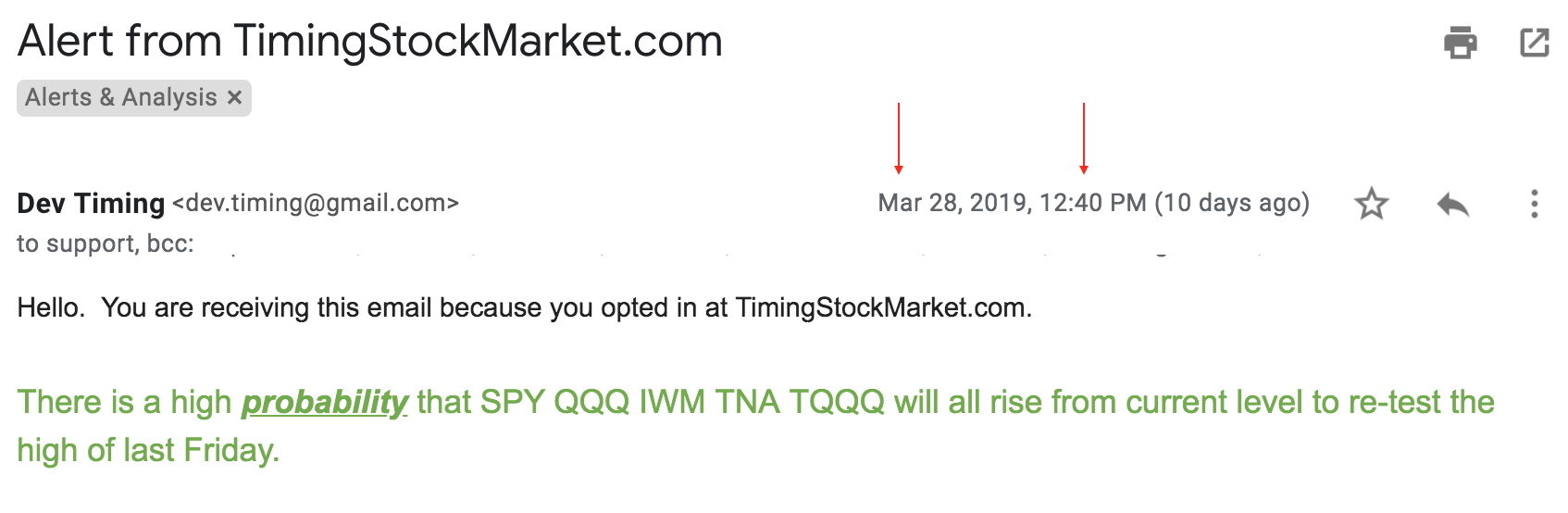

Our key short-term indicators have turned bearish. Therefore we have to exit, even though there is a chance that TNA and TQQQ might continue a bit higher. In any event, we personally like walking away from every trade with money in our pocket, be it large or small. See our trading record here. If you still are still holding TNA, TQQQ, SPY, IWM, or QQQ, consider taking partial profit, and tightening your stops. As the Up Segment in the Up Trend approaches the end, things get unpredictable. And it's never fun to wake up and discover your positions have gapped down hugely. The long-term signals remain the same as what we discussed in our last email to you. Our subscribers get info like this and more on a daily basis. Sign up to get your FREE copy here. First of all, we would like to extend a warm welcome to all recent subscribers who have been signing up at a rate that we hadn't anticipated when we launched our service in early February. We would also like to thank Doug K and Jamie C for taking the time to write to us to share their appreciation of our service. You sure made our day! "I think your service is remarkably thorough and a wonderful addition to the StockTwits community. I think you will make a significant contribution in the years ahead....My last trade of TQQQ based on your call to enter went from 48.14 to 58.21 (3/8 to 3/22/19). It’s pretty hard to do that every time but that worked out tremendously." - Doug K "Your system seems very powerful and you communication has been honest and timely. I find myself looking forward to your communication, as your system has been uncanny in its ability to truly predict a market that is extremely unpredictable. Thank you for your hard work and your dedication to helping others succeed in this crazy market we all love!" - Jamie C Stocks had a very bullish week this past week. Much of it was attributed to the finalizing of the China trade deal, positive March job report, and positive ISM report. However, our system successfully detected the early bullish signals on March 27, and additional bullish confirmations on March 28. We emailed intraday alerts to our subscribers on March 28. That's a few days before the first of the positive reports showing up. So how does our system know? We don't know. However, we can tell you that if you are trading short-term, you will get more timely data with technical indicators rather than financial headlines. We call this learning to read the "body language of the market". Just like with humans, someone with high emotional quotient, someone who can read other people's body language well, is likely to have a better understanding on other people's moods, way before they verbalize their feelings. Getting back to the market, the question on traders' minds this week are likely: When will this bullish up swing end? When are we going to start the next dip? Our system is giving us some early partial answers to those questions. We just emailed our latest analysis, system signals and our own trading plan with our subscribers. You can get a FREE copy here. And take a look at our recent trades and open positions here. Good luck trading! The headlines are now focusing on the possible end game and the signing of a new trade deal with China. However, with 2 slippery principle players named Xi and Trump involved, don't count your chickens yet.

We also don't think that this trade deal will move the market that much because its impact has most likely already been factored into stock prices. In our opinion, the next FOMC announcement on 5/1/19 is far more likely to move the market, just as how it did on 3/21 and 3/22, after the announcement on 3/20. We just emailed today's full analysis, updated signals and trading plan. You can get a FREE copy here. And take a look at our recent trades and open positions here. Good luck trading! $SPX $COMPQ $RUT all have resumed their up trends, as of last Wed March 27 2019.

According to Wall Street Journal, recent positive economics data help turned the mood to bullish: "The better-than-expected US durable goods data are likely to further ease economists’ worries about a slowdown in growth in 2019, as the manufacturing sector is highly cyclical and is seen as a bellwether for trends in the economic cycle. Financial markets rallied Monday after the Institute for Supply Management said its manufacturing index rose more than expected in March, to 55.3 from 54.2 in February, indicating expansion." And traditionally, April is a good month for stocks. We sent out email alerts to our subscribers last Thu 3/28 and Fri 3/29 once our system detected the bullish change of mood. We bought into some TNA and TQQQ. See our open positions here. And we just emailed our subscribers the full signal analysis and trading plan for how to enter into this up trend, and profit from of this bullishness. You can sign up here if you are interested. It is FREE and no credit card or personal info is required. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed