|

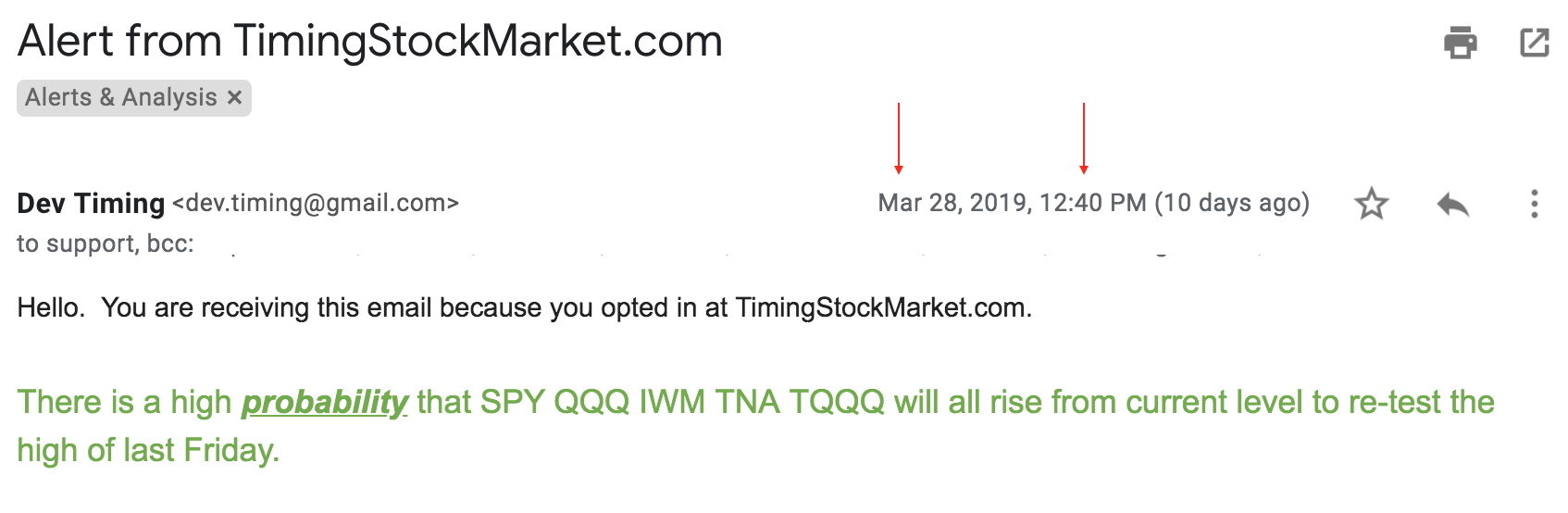

First of all, we would like to extend a warm welcome to all recent subscribers who have been signing up at a rate that we hadn't anticipated when we launched our service in early February. We would also like to thank Doug K and Jamie C for taking the time to write to us to share their appreciation of our service. You sure made our day! "I think your service is remarkably thorough and a wonderful addition to the StockTwits community. I think you will make a significant contribution in the years ahead....My last trade of TQQQ based on your call to enter went from 48.14 to 58.21 (3/8 to 3/22/19). It’s pretty hard to do that every time but that worked out tremendously." - Doug K "Your system seems very powerful and you communication has been honest and timely. I find myself looking forward to your communication, as your system has been uncanny in its ability to truly predict a market that is extremely unpredictable. Thank you for your hard work and your dedication to helping others succeed in this crazy market we all love!" - Jamie C Stocks had a very bullish week this past week. Much of it was attributed to the finalizing of the China trade deal, positive March job report, and positive ISM report. However, our system successfully detected the early bullish signals on March 27, and additional bullish confirmations on March 28. We emailed intraday alerts to our subscribers on March 28. That's a few days before the first of the positive reports showing up. So how does our system know? We don't know. However, we can tell you that if you are trading short-term, you will get more timely data with technical indicators rather than financial headlines. We call this learning to read the "body language of the market". Just like with humans, someone with high emotional quotient, someone who can read other people's body language well, is likely to have a better understanding on other people's moods, way before they verbalize their feelings. Getting back to the market, the question on traders' minds this week are likely: When will this bullish up swing end? When are we going to start the next dip? Our system is giving us some early partial answers to those questions. We just emailed our latest analysis, system signals and our own trading plan with our subscribers. You can get a FREE copy here. And take a look at our recent trades and open positions here. Good luck trading!

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed