|

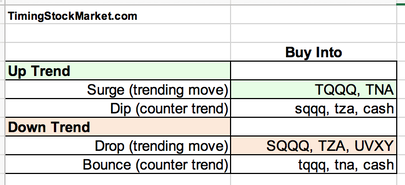

Members click here for full article. (It is currently free to join our membership.) Here is an excerpt from our trading plan. A summary of our trading strategy Since we have a number of new subscribers on board, we’d like to take a moment to summarize our trading strategy and the instruments we use to trade them. We feel that this is important for all readers to understand, because our trading system is not necessarily suitable for everyone. But our trading system has been designed and refined so that we can identify and trade the following scenarios, using the following trading tools. This system can potentially generate substantial and steady profits. The key is to be able to identify the phases correctly. And for that we turn to market internals. Market internals Volatility: $VIX continued to drop down sharply on Wednesday 7/3. It closed the day at 12.57, which is approaching the key zone between 11 and 12 where previous market tops have formed. Similarly $VXN closed at 16.15, approaching the key zone between 15 and 16. The tricky part about $VIX $VXN is this. Even though they are going to start dipping into the key zones soon, they can spend another 7-10 days in these zones before Surge5 will be done. The rest of this article covers: Volatility (more) Market breadth Buy/Sell Cycles $SPX $NDX $RUT support & resistance zones during Surge5 Trading plan Register here to read the rest of the article. All free.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed