|

Members click here for full article. (It is currently free to join our membership.) Here is an excerpt from our trading plan. Our trading strategy This past week was a big one for us. Our membership jumped by 20%. We would like to welcome all our new subscribers who came on board recently. We would also like to share with you a snapshot of our trading strategy. We hope this helps to put in perspective the way we frame up our market analysis. Our trading system is based primarily on analysis of $SPX $NDX $RUT price actions, with heavy reliance on market internals for context and confirmations. When we say market internals, we mean specifically:

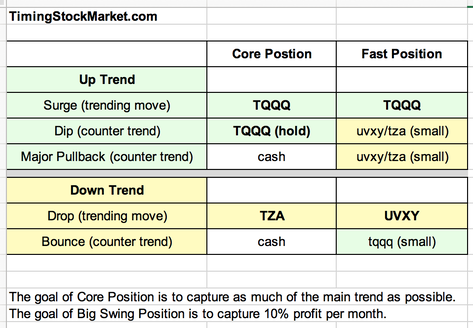

Many of our readers have remarked that our trading system is amazingly accurate. (Thank you!) As you may have noticed, we don’t rely on popular technical indicators. That is because they are overused, and because they are derivatives of price actions. Prices can be easily distorted in the short-term. Instead, we have found over the years that market internals, when analyzed properly and viewed collectively, can deliver a much more reliable message consistently. Up Trend is still intact Before we plunge into the discussion of Dip6, we should explain that the current Up Trend that started on 12/26/18 is still intact. And it may last into early October, though that is merely an early projection at this point. Dip6 is launched During most of last week, we relied on market internals to guide us through the transition from Surge6 into Dip6. It was a very useful guide as market internal messages were spot on. And now market internals are collectively shouting "Dip6 is happening for real". During Dip6, we should expect to see $SPX $NDX $RUT drop substantially more. $VIX $VXN will surge a good amount. However, at the start of tomorrow Monday ... The rest of this article covers: Dip6 is launched (more) Dip6 may morph into Major Pullback2 Support zones for $SPX $NDX $RUT at the end of Dip6 Our trading plan Register here to read the rest of the article. All free.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed