|

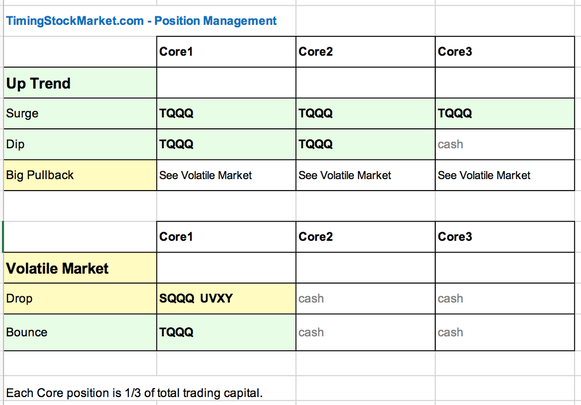

Our gratitude First of all, we apologize for not being able to post all of last week. Our dad’s health has stabilized for now. He is out of the hospital and is recovering at home. We want to take a brief moment to say thank you from the bottom of our hearts to all of you who reached out with your kind words and best wishes. It has been a very difficult week, but your thoughtful gestures really helped. We are very thankful to you. Our apologies for not responding to you individually sooner. Stocks are in Volatile Market The last leg of the Up Trend (that started on 12/26/18) was Surge7. Surge7 was cut short on 9/24/19 when it failed to rise up from a strong support level. This was a big psychological change for the stock market. It greatly reduces the probability of a new all-time high for $SPX. Before we dive deeper, we want to take a moment to discuss terminology. This is important because trading strategy changes depending on what type of market stocks are in. While stocks may not be showing a clear downward direction right now, they are not exactly in a healthy Up Trend either. From a macro standpoint, there are a whole lot of factors working against future economic growth right now. And it’s not just the US that is on the brink of a recession. When we zoom into the weekly charts, $SPX has formed a double-top pattern. $NDX has formed a lower-high triple top pattern. Most importantly, $RUT is starting to trend downward, very slowly but steadily. Small-cap stocks usually lead the way up in a healthy bull market. The fact that $RUT has been forming lower highs on its weekly chart since September 2018 is a big warning sign for the bulls. Finally, market breadth and the percentage of bullish Nasdaq stocks have been lagging behind NYSE, since September 2018. This confirms that under the hood, growth is not happening, certainly not as reflected in small caps and tech stocks. Big-picture trading strategy for Volatile Market Market internals and $SPX $NDX $RUT charts are telling us that we ought to proceed with caution. Stocks are no longer in calm Up Trend. They are in what we label Volatile Market. And this requires a different trading strategy as shown below. In calm Up Trend during periods we label “Surge”, you can build up larger positions, hold them longer, add to them during buy-the-dip opportunities, and cash out big at the end of a Surge. In Volatile Market like right now, whether it’s going sideway or down, we have to trade differently. Think small positions and fast profit taking. Unlike calm Up Trend, you cannot enter randomly in Volatile Market and hope that a dollar-cost-averaging, buy-and-hold strategy will generate profits over time. You do have to know whether stocks are ready to pivot into a short-term Bounce or a Drop, and trade accordingly. If you don’t want to trade, then patiently stay out of stocks altogether until we approach the bottom of a Volatile Market. Volatile Market will give you lots of trading opportunities, but as the name implies, the swings can come fast and furious. This is why we recommend trading smaller positions, and take your profits quickly during these up swings (Bounce) or down swings (Drop). And don’t trade every signal. Be very choosy and wait for a low-risk, high-reward, high-probability setups only. The rest of this article covers: Table of support and resistance levels Updates from market internals Planning your trades Register your email here for full access to all our nightly analysis, trading plans and intraday updates. No credit card. All free.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed