|

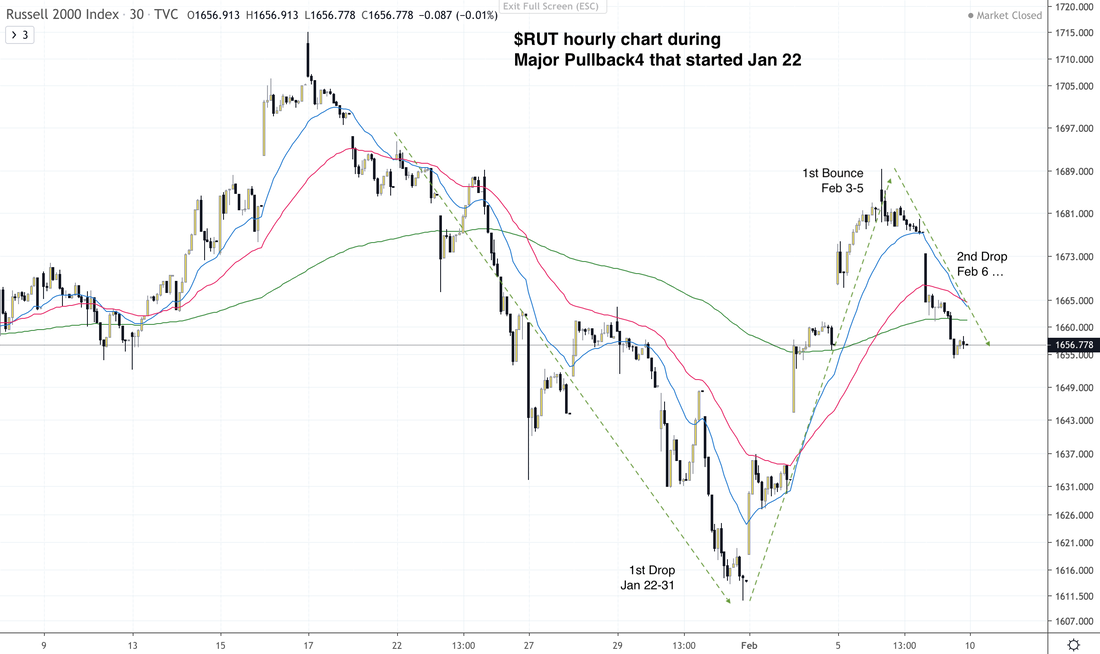

How To Trade In This Market After steadily climbing upward between Oct 2019 and most of Jan 2020 (Surge10), $SPX $NDX $RUT started Major Pullback4 on Jan 22. $SPX $NDX $RUT are technically still in Major Pullback4. Even though the charts don’t show it clearly, $SPX $NDX $RUT are going through their Drop/Bounce sequence in a classic way. Let’s review the movements of Major Pullback4 so far. Please note that we characterize these movements by what shows up in market internal messages, not necessarily by the appearance on the chart. However, if you want to compare to a price chart, take a look at $RUT. It has the most classic appearance.

Trading Major Pullback4 is similar to trading Down Market. Traders need to be aware that prices are not going to steadily march down in a stair-stepping pattern like what they did while they marched up for most of the last 4 months (Surge10). Instead, down markets are characterized by sharp Drops, followed by sharp Bounces. The effect is equivalent to riding a fast elevator. Traders need to decide ahead of time what they can stomach. The choices are:

Market internals will give us some intermediate clues as to when a Drop/Bounce starts and ends. But we caution you in thinking you can nail it end to end. It is better for your profits and inner peace if you simply aim to take a good chunk of profits from the middle of the price swing. Doing that while trading small and protecting your positions will help you to maximize your gains and minimize your loss. Market internals will also send out fairly reliable signals when they are turning bullish at the end of Major Pullback4. They usually will do so before the bullish mood actually shows up in prices. The bullish signals from market internal indicators will be our clue that Major Pullback4 is ending, and Surge11 is starting. In the sections below, we will discuss what the reliable end-game signals are for Major Pullback4. The full article covers: Market Internal Indicators

Short-term Support & Resistance Levels

Market Projections and Trading Plan

Subscribe to read the full article.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed