|

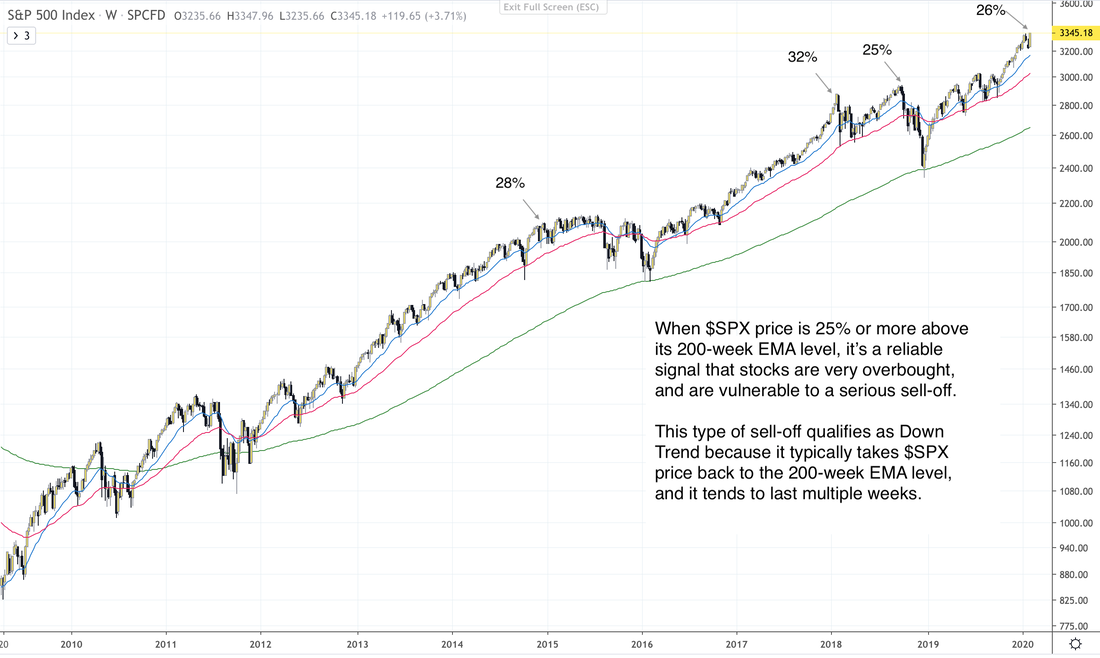

The Big Picture and The Long Term Portfolio Tonight the Fed brought out their big weapons, but they failed to ignite a burst of buying. Instead, market responded by sending futures sharply down, and triggered limit down in the process. QE is a stop-gap measure to keep the financial system from a meltdown. But QE isn't a vaccine against the coronavirus. The Fed cannot stop social distancing, or lockdown, or quarantine. Until human activities can flow freely, economic growth cannot happen. In fact, the opposite is happening. We are seeing sudden and massive economic contractions. It is the equivalent of an economic heart attack. Back in early February, we shared this weekly chart with you, explaining that stocks are very overbought and are vulnerable to a serious sell-off. We pointed out that $SPX could drop as low as the 200-week EMA. At the time the projection was greeted with skepticism, as the stock market was seemingly reaching an all-time high every day. It would mean big drop from 3385 to 2660. Fast forward 5 weeks, and here we are. On Thursday March 12, $SPX spiraled down to a low of 2479. Let’s zoom out on the monthly chart and take a look at how low prices can potentially go from here. Subscribe to read the full article, and get access to our daily trading plans immediately. Subscribe now and take advantage of our introductory low rate of only $39 per month.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed