|

On Tuesday 3/31/20 at 12:28 PM EST, our system had identified a bearish signal for $SPX $NDX $RUT. This signal confirmed the bearish warning issued by our system on Friday 3/27/20. The warning is: Bounce1 is over, and the Down Trend is going to resume. We posted the following updates for our members throughout the day and into the evening on Tuesday 3/31/20. Members who follow this signal had the opportunity to capture the drop that started on 3/31. Members are now alerted to new information in preparation for Friday 4/3. Updates 7:46 PM EST - Tuesday 3/31/20

At 12:28 PM today, we alerted you that the signal was reading -17, which is much more bearish relative to the reading at the start of the trading day. We mentioned that you could start partial entry of your short positions. Our system is projecting the following scenario:

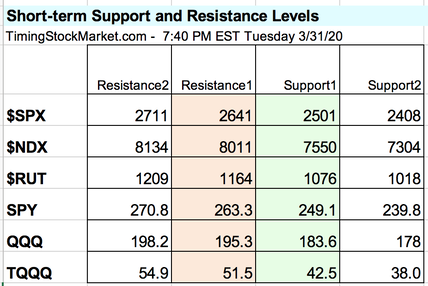

Below is the updated S/R table. (Mostly we updated Resistance1 to be at today's highs.) There is a good chance that $SPX $NDX $RUT will test Support1 tomorrow Wednesday. Updates 6:32 PM EST - Tuesday 3/31/20

The current S/R table is still valid, but we will refine and update it soon after we get some more data from futures. Updates 3:25 PM EST - Tuesday 3/31/20

A reader had asked for some ETF recommendations for betting against $SPX $NDX $RUT. They are: SPXS, SQQQ, TZA. These are short-term ETFs designed to capture a down segment within a Down Trend. They are not buy-and-hold instruments for riding the remainder of this Down Trend. Please read more about them if you are not already familiar with them. Here are some articles to start: Using SQQQ to bet against $NDX Three ETFs that rise as small caps fall Using SPXS to bet against $SPX Remember: they are like fast cars. Capable of fast ride, but also big crash. Do your research and test small if you are new to this. Updates 12:28 PM EST - Tuesday 3/31/20

If you want to start entering short, keep your initial entries small with tight stops. There is now a significant new signal after hours Thursday 4/2/20.

SUBSCRIBE to read our analysis of this signal for $SPX $NDX $RUT SPY QQQ TQQQ. Take advantage of our introductory low rate of just $39/month. You can cancel at any time.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed