|

See FAQ for more explanations on terms, labels and abbreviations that we use. Below is a time-delayed excerpt from our live updates for members. Updates 10:57 AM EST - Tuesday 7/7/20 Short Term

Updates 10:42 AM EST - Tuesday 7/7/20 Short Term $VIX is rising back up.

Updates 10:32 AM EST - Tuesday 7/7/20 Short Term While $VIX is dropping some amount, $VXN (Nasdaq volatility index) is steadily rising. This is an important bearish divergence from $NDX rising, indicating that traders are nervous. Additionally, market breadth shows a moderate net declining day for both NYSE and Nasdaq stocks. Again this is a bearish divergence, as more stocks are being sold then bought. We consider $NDX $SPX rise into the orange resistance zone as Thrust5 formation (of Bounce8). We discussed this in our post at 12:45 AM today. Keep in mind that Thrust5 is really stretching it, so take advantage of it to book your profit. Updates 9:55 AM EST - Tuesday 7/7/20 Market price actions are unfolding pretty much as we projected in our 12:45 AM updates. Short Term: $VIX

Short Term: $NDX $SPX

Short Term: IWM TZA Yesterday we posted a few entry zones for TZA throughout the day. At 9:41AM we wrote:

At 12:45 PM we wrote:

Some members day traded TZA, but some used these entry points to build up the position. Congratulations! If you are building TZA position today, look for.

Updates 9:13 AM EST - Tuesday 7/7/20 Short Term Trades The indices are gapping down this morning pre-market, and $VIX is climbing up. We are not going to get the signal combination we were looking for as the ideal setup to enter short against $RUT IWM. Here are updated signals to look for.

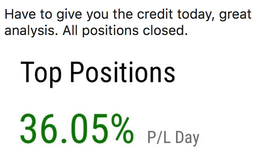

Updates 12:45 AM EST - Tuesday 7/7/20 <Subscribe for full nightly analysis.> Here's a comment from one of our members who successful day traded using our signal at on Tuesday 7/7/20. SUBSCRIBE now and take advantage of our introductory low rate of just $39/month. You get full analysis and signals in advance of your trading day. You also get live intraday signal updates. And you can cancel at any time.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed