|

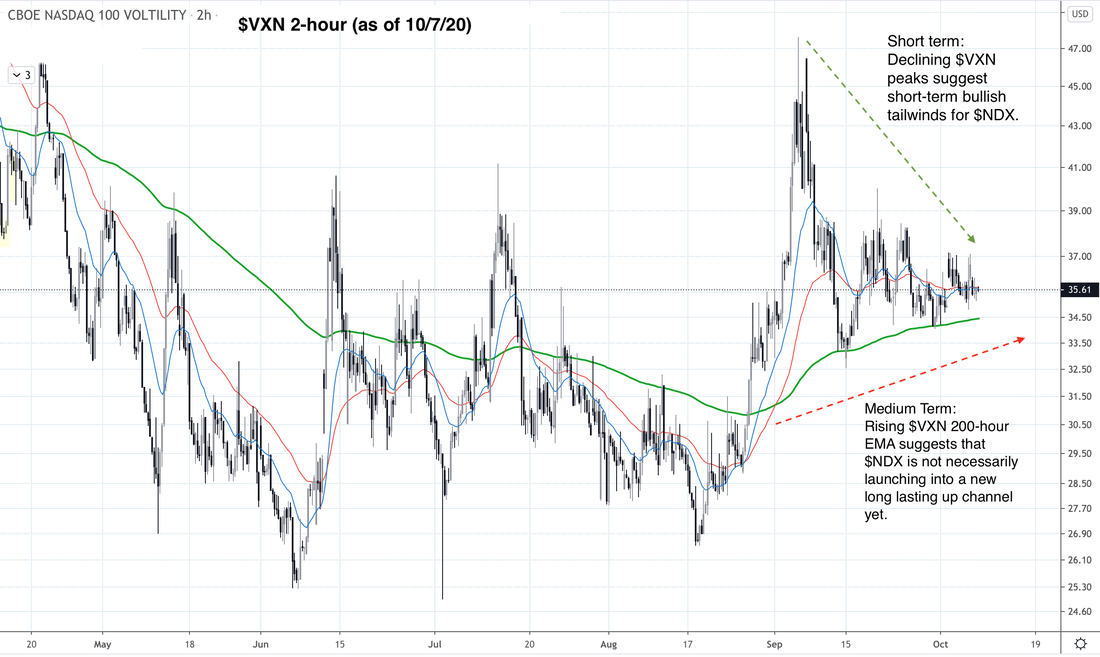

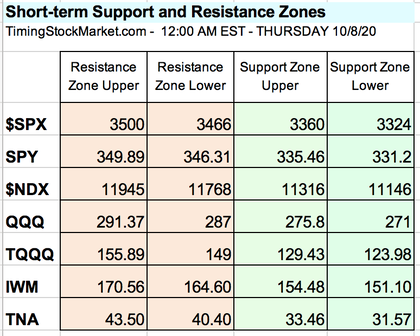

Click here for our Signal Trades. Updates 3:11 PM EST - Thursday 10/8/20 $VIX $VXN Conditions are bullish in the short term for $SPX $NDX IWM. $VIX $VXN are steadily dropping lower. UVXY dropped sharply today. $VIX $VXN 200-hour EMA green lines are starting to flatten. They may descend in the next few days. This potentially sets up $SPX $NDX IWM for new bullish up channels. We will explore this possibility in the full analysis tonight. Updates 9:15 AM EST - Thursday 10/8/20 Pre-market Conditions are bullish in the short term for $SPX $NDX IWM. Futures rose overnight, and pre-market prices are up. We have started to scale into our Big Swing positions and have posted updates in Signal Trades. We expect $SPX $NDX IWM to reach the top of their orange resistance zones in the next couple trading days. Updates 2:09 AM EST - Thursday 10/8/20 $VIX $VXN Both $VIX $VXN 2-hour charts below show the same two themes. Short term: Declining $VIX $VXN peaks suggest short-term bullish tailwinds for $SPX $NDX IWM. Medium Term: As long as $VIX $VXN 200-hour EMA green lines continue to rise up, it means that conditions are still not yet conducive for a medium-term bullish trend to be launched. A bullish trend will show up as an up channel. And medium term here means multiple months. This actually makes sense. There are potentially enough buy-the-dip buyers out there to lift $SPX $NDX up toward their 9/2 highs. But market participants, especially big money, are nervous about 11/3 election. There is a good chance that chaos and violence and lack of clear leadership may ensue. That kind of unstable and uncertain situation is what Wall Street dreads. Table of Support & Resistance Zones The S/R table has been updated to reflect the potentials for $SPX $NDX IWM to rise short term. $SPX $NDX Conditions are bullish in the short term for both $SPX and $NDX. On Thursday, they may tag their 200-hour EMA green lines one more time to anchor and bring in more buyers. This will enable them to rise higher, possibly to the top of their orange resistance zones by Friday. IWM Conditions are also bullish in the short term for IWM. It may retest the high of January by the end of this week. Signal Trades We are going to scale into multiple positions to capture the bullish up swings for $NDX IWM. We'll do this via TQQQ and TNA. We will post updated buy limit orders pre-market. Click here for current Signal Trades. Disclaimer The information presented here is our own personal opinion. It is intended to supplement your own research and trading systems. Consider it as food for thought. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. While we offer scenarios for you to consider in your trade planning, know that you are proceeding at your own risk if you follow our suggestions. Note that we trade highly risky 3x leveraged ETFs. You may end up losing a lot of money with them. They suit our portfolio, but they may not be appropriate for you. Please read more about them before trading them. Proshares UltraPro and UltraPro Short ETFs Direxion Leveraged and Inverse ETFs Why 3x ETFs like TQQQ lose money over the long term The risks of investing in inverse ETFs Simple explanations of contango and backwardation

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed