|

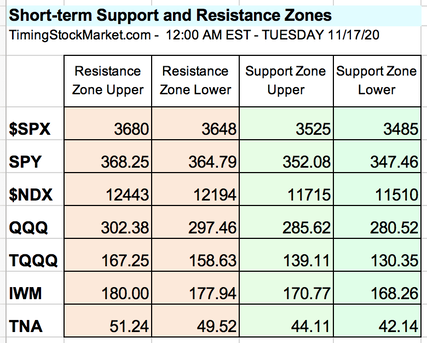

Click here for our recent Signal Trades. Below is a time-delayed excerpt from our live updates for members. Updates 11:45 AM EST - Tuesday 11/17/20 Summary After a quick rise this morning, $VIX $VXN are continuing to form their "anchor to drop" patterns on charts in different time frames. This indicates that there are a lot of bullish tailwinds for stocks right now. We wrote at 2:15 AM "However, we may see some profit taking on Tuesday." This did turn out to be true early morning for $NDX $SPX IWM. And it was great because it relieved some of the selling pressure. Furthermore, the pullback provided opportunities to enter at a lower price. In fact, in Signal Trades our TNA buy limit order was filled and reversed upward quickly. We also decided to add SPXL to the Signal Trades portfolio. Again, SPXL target entry price from yesterday was met. At this point $NDX $SPX IWM are all in up swings based on the direction of their 200 EMA (5-minute charts). Any price pullback to anchor at the 200 EMA line is low-risk setup to enter or add to your long positions. We will be updating stops shortly in Signal Trades. Updates 2:15 AM EST - Tuesday 11/17/20 Summary Big Picture: $VIX $VXN have been dropping and are getting ready to drop even more. Conditions are highly bullish for $SPX $NDX IWM. Short Term: $NDX $SPX IWM are in up swings again. However, we may see some profit taking on Tuesday. Market Internals Market internals are sending out very bullish messages right now. Table of Support & Resistance Zones The S/R table has been updated. $VIX $VXN ... SUBSCRIBE now to read the rest of this post, including current analysis and projections for $SPX $NDX IWM. Get complete access to our intraday live Signal Trades. Take advantage of our introductory low rate of just $39/month. You can cancel anytime. Click here for our Signal Trades.

2 Comments

Ann H.

11/18/2020 07:59:58 pm

Clearly the sky is the limit.

Reply

Ann

11/19/2020 06:30:07 am

Hi Ann. You are right. The stock market is not behaving rationally, but it rarely does. It tends to swing too far between exuberance and panic. If we choose to trade, we have no choice but to follow the signals (from $VIX $VXN). Thanks for sharing your thoughts.

Reply

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed