|

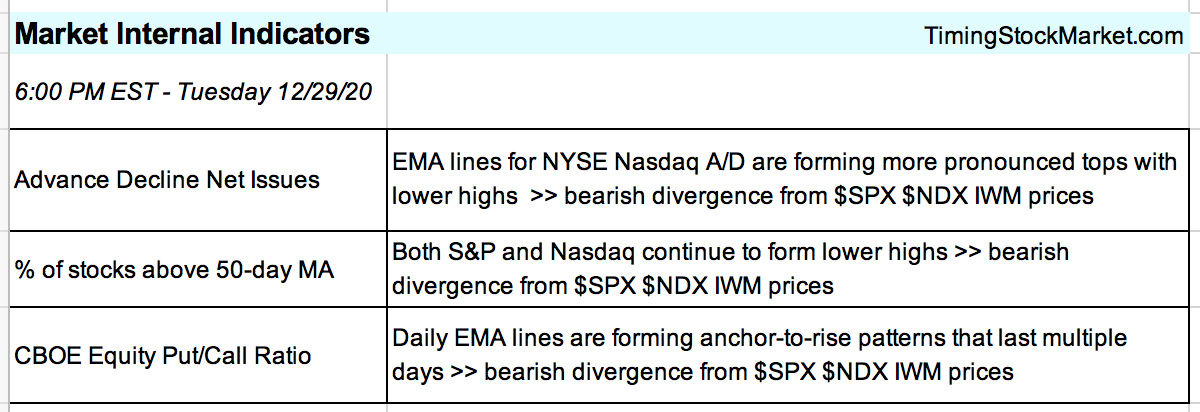

Entry/exit signals for SPY QQQ TQQQ IWM SPX NDX based on VIX. Click here for our Signal Trades. Updates 1:48 AM EST - Wednesday 12/30/20 Summary The dip for $SPX $NDX IWM came on Tuesday, just as we projected on Monday night. $VIX $VXN charts show that this is likely a shallow dip for $SPX $NDX, and the Santa Claus rally is likely to resume. Market Internals Having said that, we want to emphasize that market internals still continue to diverge bearishly from $SPX $NDX IWM prices. These dark clouds on the horizon will turn into a nasty storm at some point in the near future. Just not this week. $VXN $VIX UVXY $VIX $VXN charts warned on Monday that they were going to rise. And just like clockwork, $VIX $VXN rose on Tuesday. So far the volatility rise is minor, and the resulting dips in $NDX $SPX are shallow. The exception is IWM which has a bigger dip. Here are the same charts that we shared yesterday, with Tuesday data added. For now $VXN $VIX UVXY have formed short-term tops and are likely to drop early Wednesday. However, $VXN $VIX UVXY may still rise further as we explained yesterday. Therefore, we have outlined bullish and bearish scenarios to monitor for. There is no guarantee which one will show up, but you will know how to interpret them as $VXN $VIX UVXY patterns unfold on Wednesday. ... Read the rest of this analysis, and get the latest entry/exit signals for SPY QQQ TQQQ IWM SPX NDX based on VIX here.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed