|

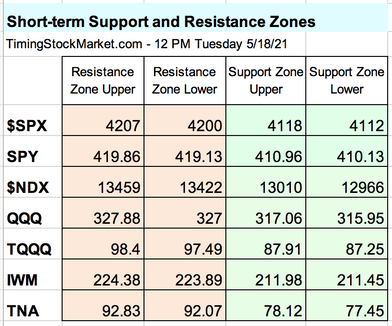

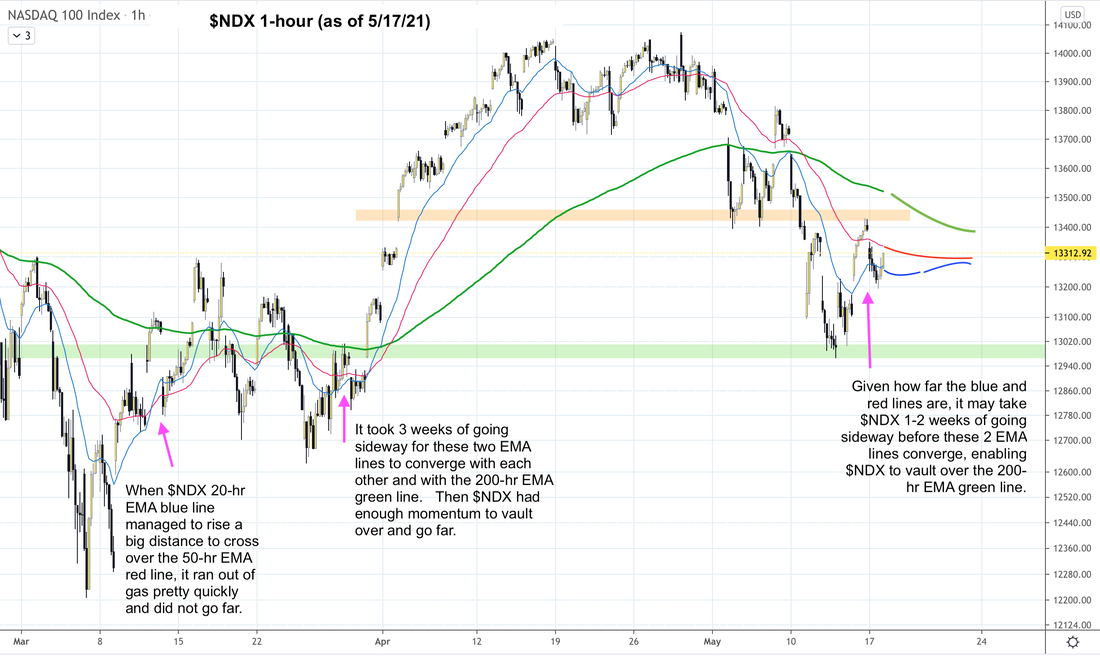

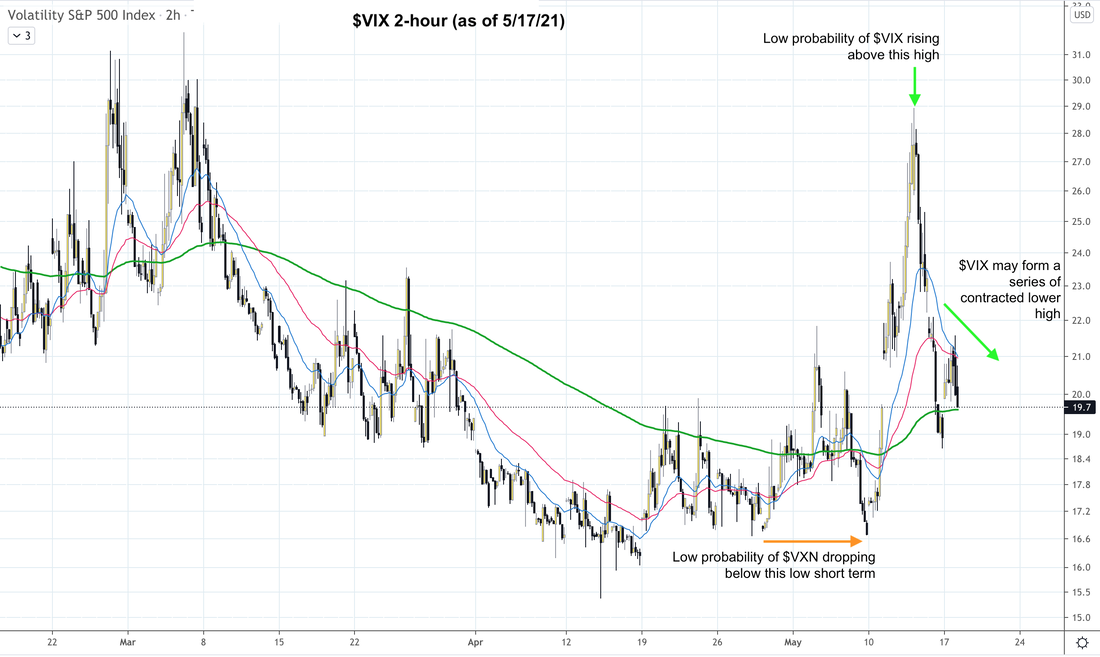

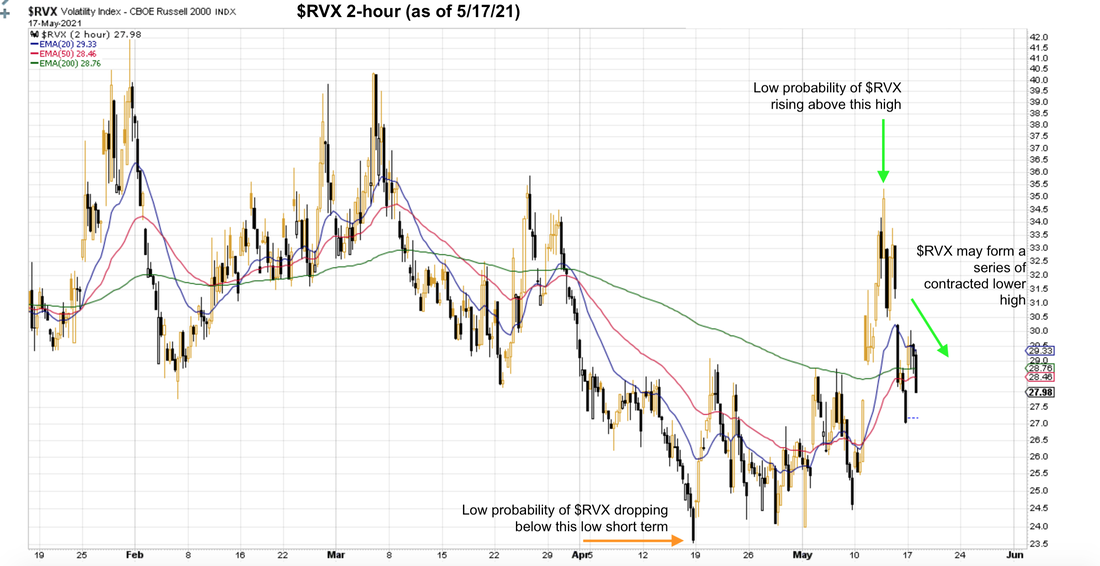

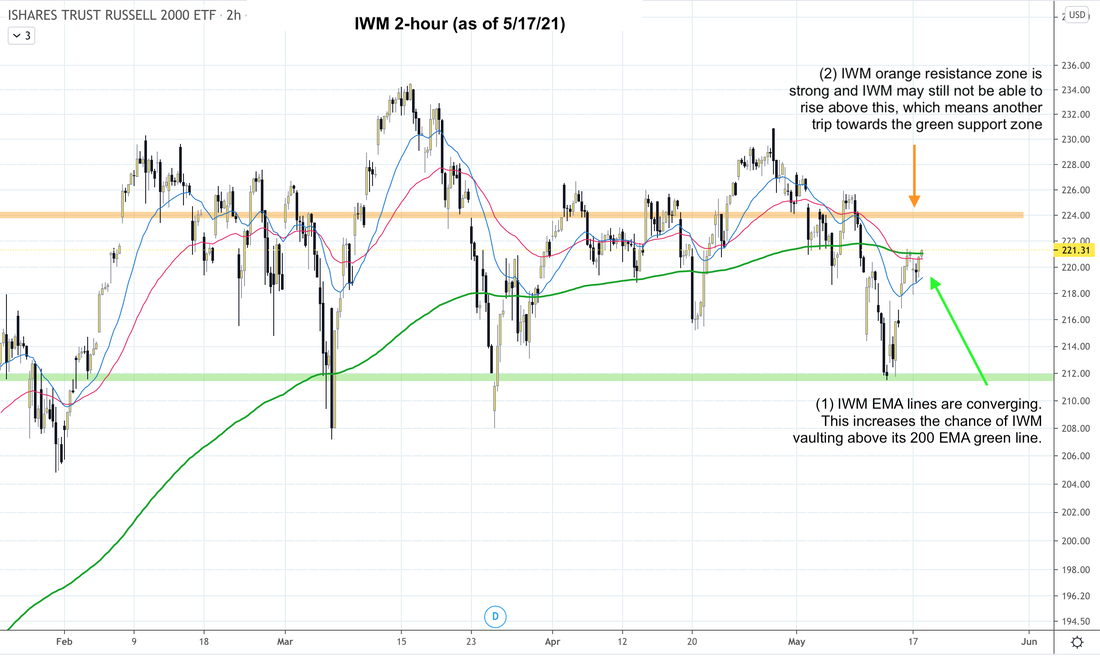

Click here for latest Signal Trades. Updates 2:30 AM EST- Tuesday 5/18/21 Table of Support & Resistance Zones IWM and TNA orange resistance zone have been updated in the S/R table below. Everything else is the same. The green support zone is where this current major pullback may end. The orange resistance zone is short-term strong resistance level. $VXN $NDX In yesterday's post, we discussed the scenario where $NDX may quickly drop down to anchor in its green support zone, in order to bring in new buyers to really rise up. However, we should also consider the sideway range scenario discussed below. If $VXN is going to contract and form a gradual series of lower highs, $NDX is very likely going to contract into a range while forming a gradual series of higher lows. $VIX $SPX If $VIX is going to contract and form a gradual series of lower highs, $SPX is very likely going to contract into the range between its 50 EMA red line and its green support zone. $RVX IWM If $RVX is going to contract and form a gradual series of lower highs, IWM is very likely going continue it sideway moves, crisscrossing above and below its 200 EMA green line. Signal Trades The most important thing to keep in mind is this. $NDX $SPX IWM are all likely going to rise into a biggish up swing at some point in the next couple weeks. Some time in June, $SPX is likely to revisit is May high, $NDX its April high, and IWM its March high. The odds of $NDX $SPX IWM dropping substantially lower than their 5/12 low is quite low. In Signal Trades we are going to leave the buy targets as is, but we plan to adjust them once the sideway pattern emerges. Click here for Signal Trades. To Read We urge you to read this article about risk management and position sizing. 1% Risk Rule If you are new to trading 3x leveraged ETFs like TQQQ TNA SOXL FNGU, read: Why 3x ETFs like TQQQ lose money over the long term If you are new to trading inverse ETFs like SQQQ TZA SOXS FNGD, read: The risks of investing in inverse ETFs Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our suggestions.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed