|

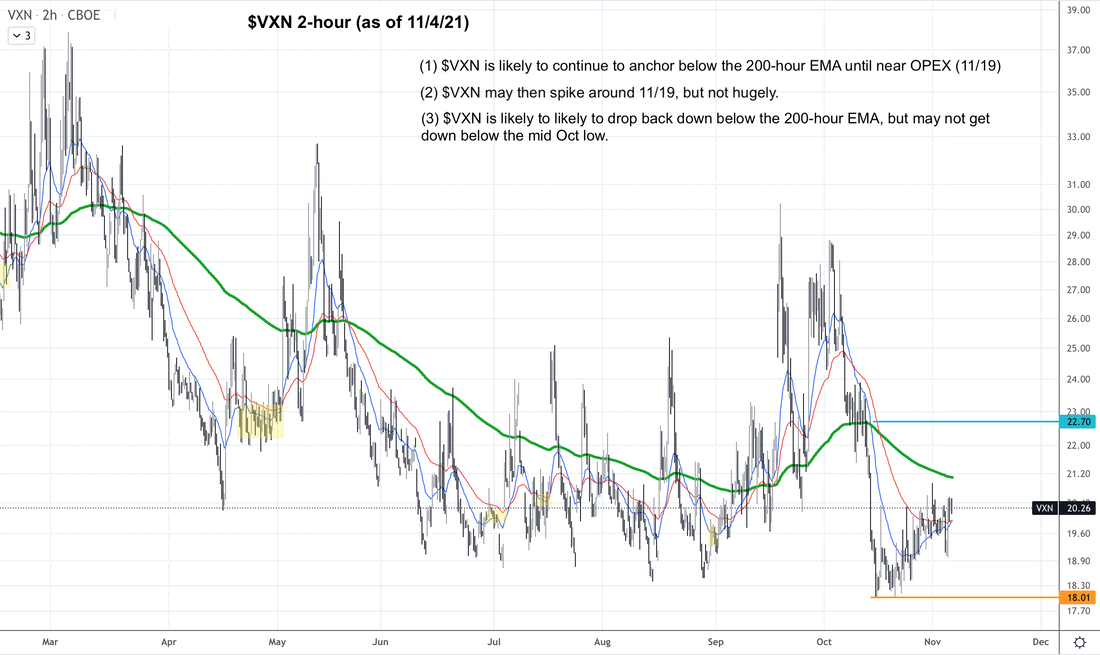

We trade 3x ETFs such as TQQQ TNA SOXL LABU UVXY using proprietary analysis of volatility. Updates 2:45 AM EST - Friday 11/5/21 Volatility >> bullish $VIX $VXN $RVX are showing similar chart patterns:

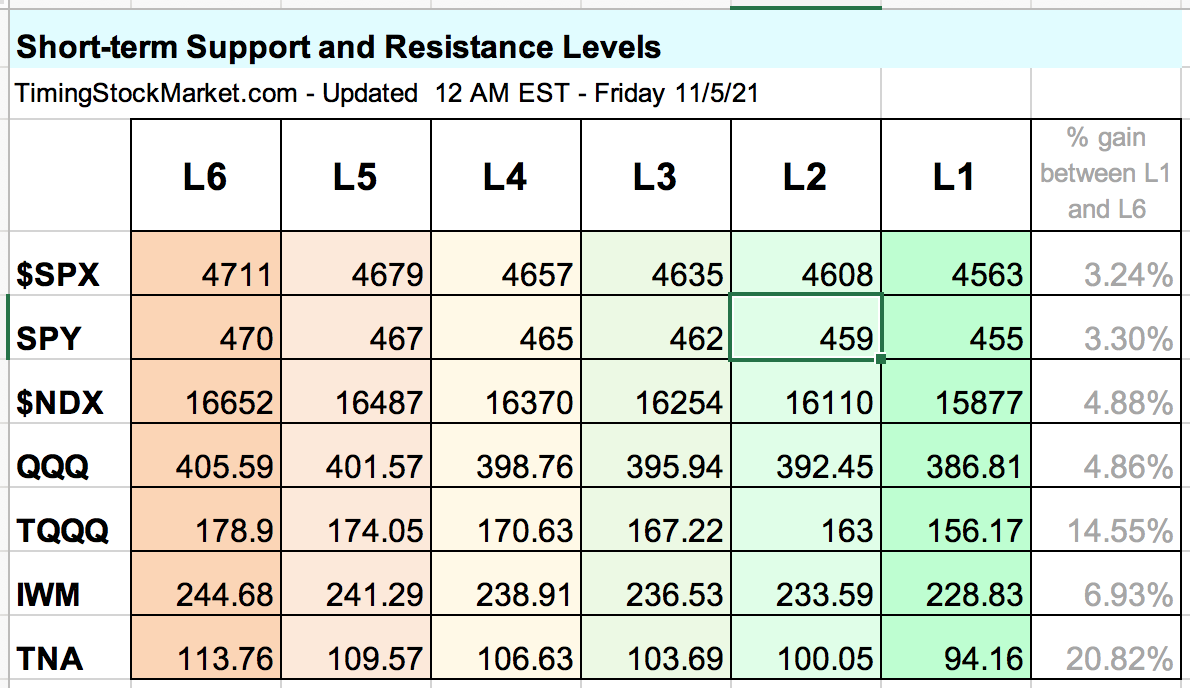

Advance-Decline Net Issues >> bullish NYSE and Nasdaq A/D lines are still above their 200-hour EMA on their cumulative hourly charts. Overall message is still bullish. Seasonality >> bullish Statistically, this is a bullish period of the trading year. Positive gamma >> bullish Gamma is positive right now for $SPX $NDX IWM. This means that dealers are hedging their books by buying into weakness, and selling into strength. The net effect is supportive of a steady march upward, without outsize swings. Short-term Key Levels $NDX QQQ TQQQ have been updated. All other are the same. Trade Plan Subscribe to get our trade plan and live intraday trades. Trade record here (281% gain in 15 months). ... Take advantage of introductory low rate of only $39 per month!

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed