|

We trade 3x ETFs such as TQQQ TNA SOXL LABU UVXY using proprietary analysis of volatility. Updates 12:00 AM EST - Monday 11/8/21 Key dates Here's the economic calendar for the full week. Tuesday: Producer Price Index (PPI) Wednesday: Consumer Price Index (CPI) Friday: Consumer Sentiments; Job Openings (JOLTS)

Here are the companies reporting this week including PYPL, TME, COIN, DIS, DHI, PLTR, TCEHY. Volatility There is no guarantee in any pattern, but keep an eye out for the following pattern that $VIX $VXN $RVX may follow.

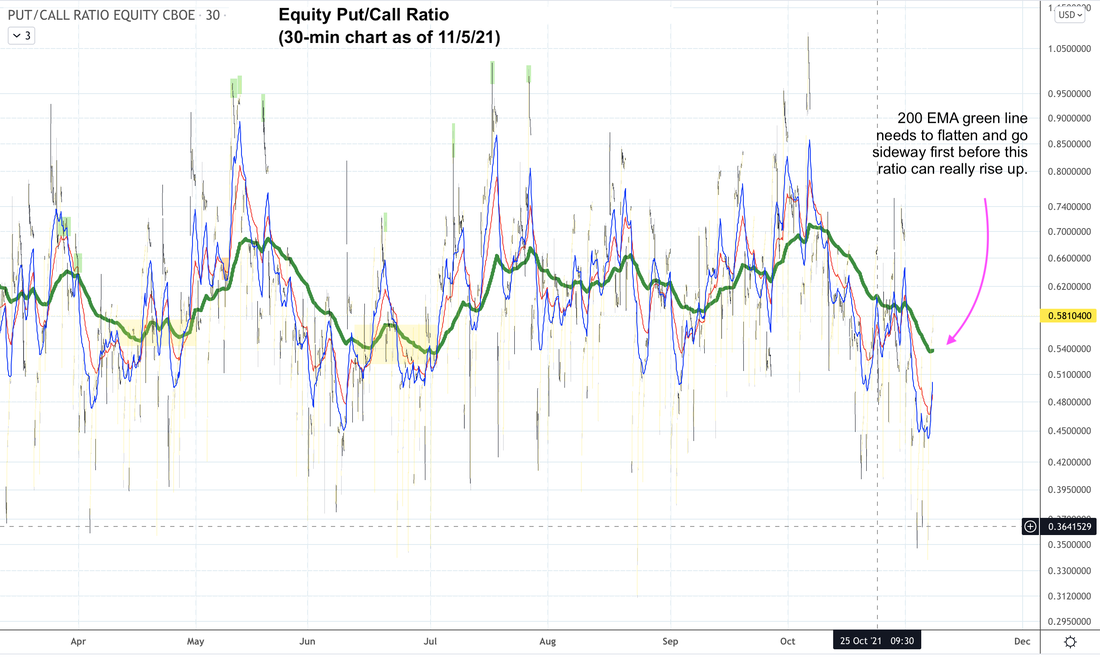

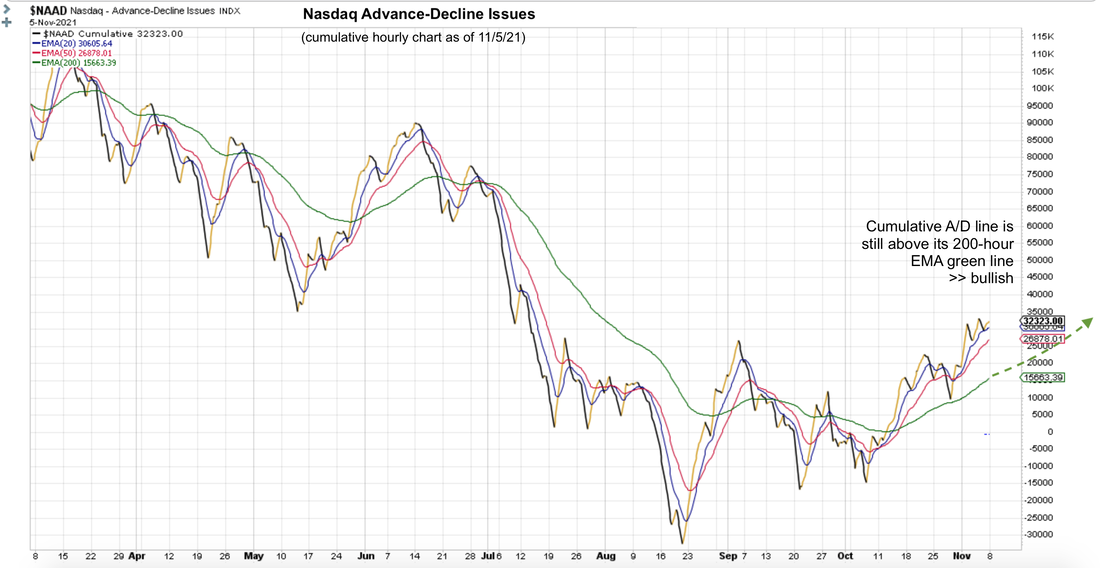

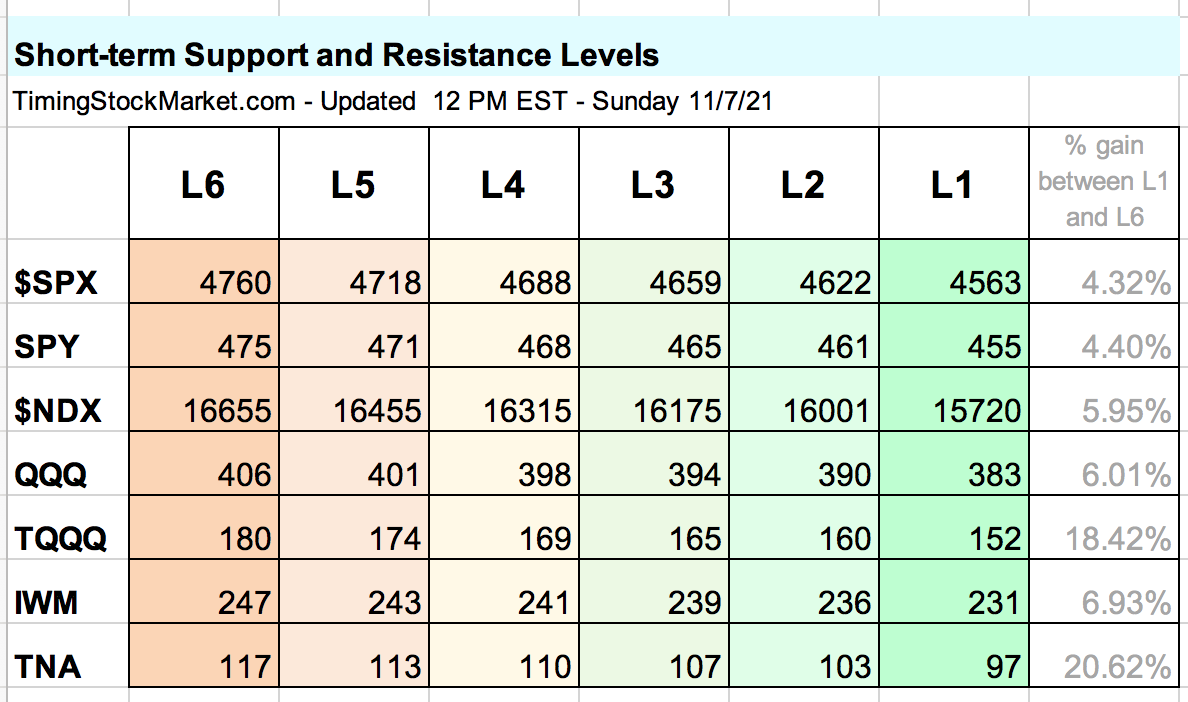

Equity Put/Call Ratio In the P/C ratio 30-minute chart below, keep an eye on the 200 green line. It needs to flatten and go sideway for a few days before it can really spike. So for right now, it is bullish. When this ratio spikes, it means traders are buying more puts than calls in an effort to hedge. That's more bearish. Advance-Decline Net Issues >> bullish NYSE and Nasdaq A/D lines are still above their 200-hour EMA on their cumulative hourly charts. Overall message is still bullish. Seasonality >> bullish Statistically, this is a bullish period of the trading year. Positive gamma >> bullish Gamma is positive right now for $SPX $NDX IWM. This means that dealers are hedging their books by buying into weakness, and selling into strength. The net effect is supportive of a steady march upward, without outsize swings. Short-term Key Levels The table below has been fully updated. Trade Plan Subscribe to get our latest analysis, trade plan and live intraday trades. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our suggestions.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed