|

We trade 3x ETFs such as TQQQ TNA SOXL LABU UVXY using proprietary analysis of volatility. See trade record here. Updates 12 AM EST - Monday 11/22/21 Key dates This is a major holiday week for US stock market.

Here's the economic calendar for the full week. Wednesday is heavy-duty report day. Monday: Existing Home Sales Wednesday:

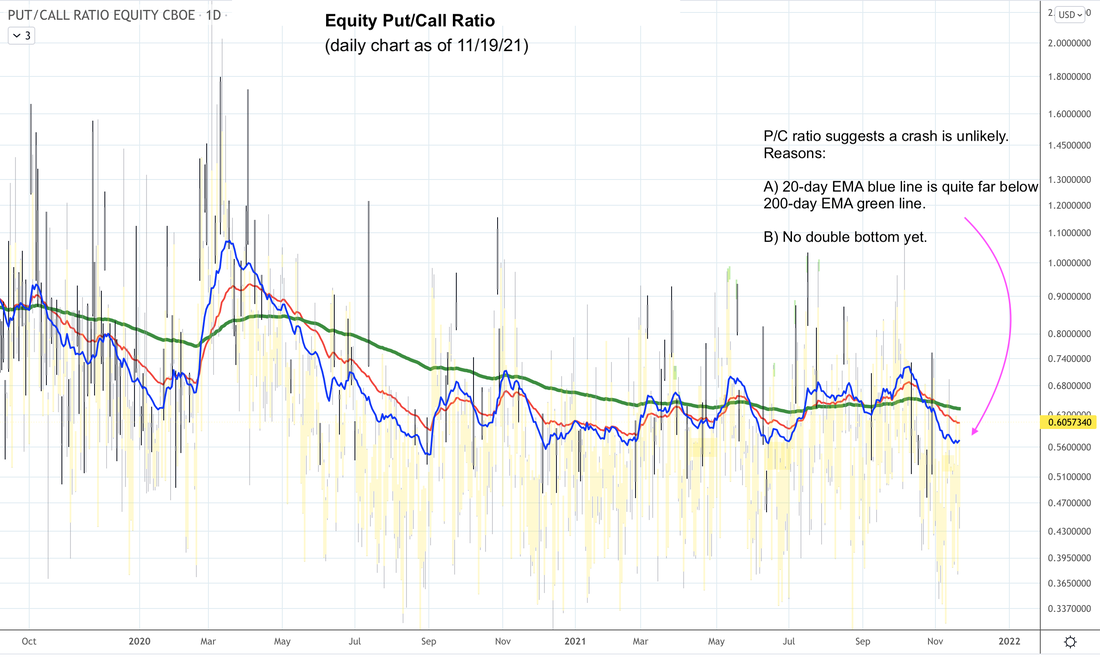

Volatility $VVIX (volatility of $VIX) hourly chart below tells us that a quick dip in price is possible early in the week. $VVIX 20-hour EMA red line and 50-hour EMA blue line are still above the 200-hour EMA green line and rising. This means the possibility of a $VIX spike is still high, just like the pattern shown at (1). There's a good chance we'll see this spike on Monday. We don't, however, expect this spike to be very big or long lasting. Alternatively, if the red and green EMA lines start to turn down like the pattern at (2), then $VVIX is dropping and conditions are back to fully bullish. Equity Put/Call Ratio Today we want to show P/C ratio daily chart just to put things in perspective. This chart tells us that while a quick price dip is possible, a crash is unlikely. Reasons:

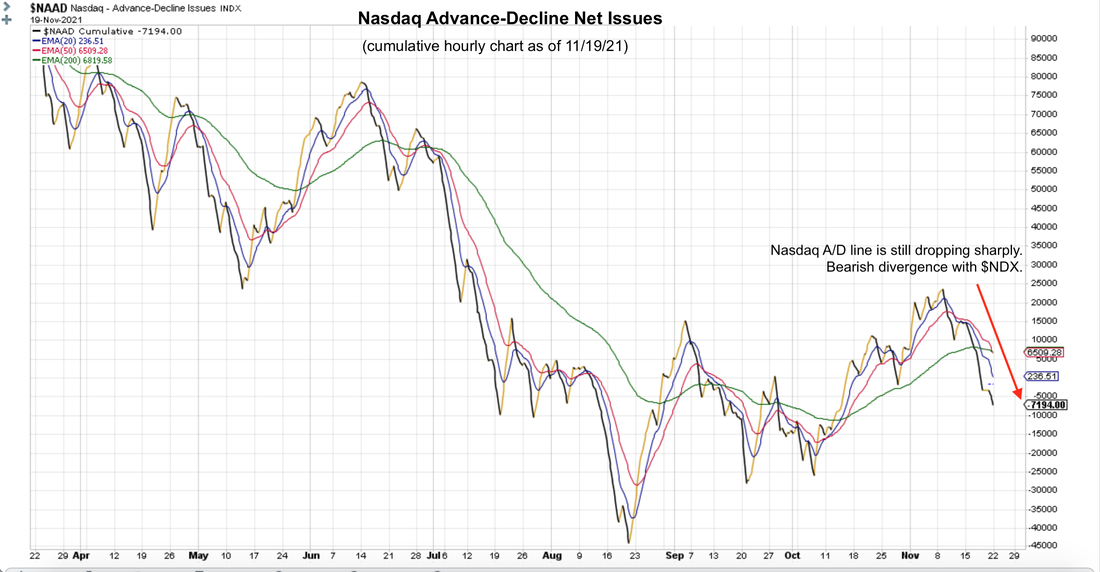

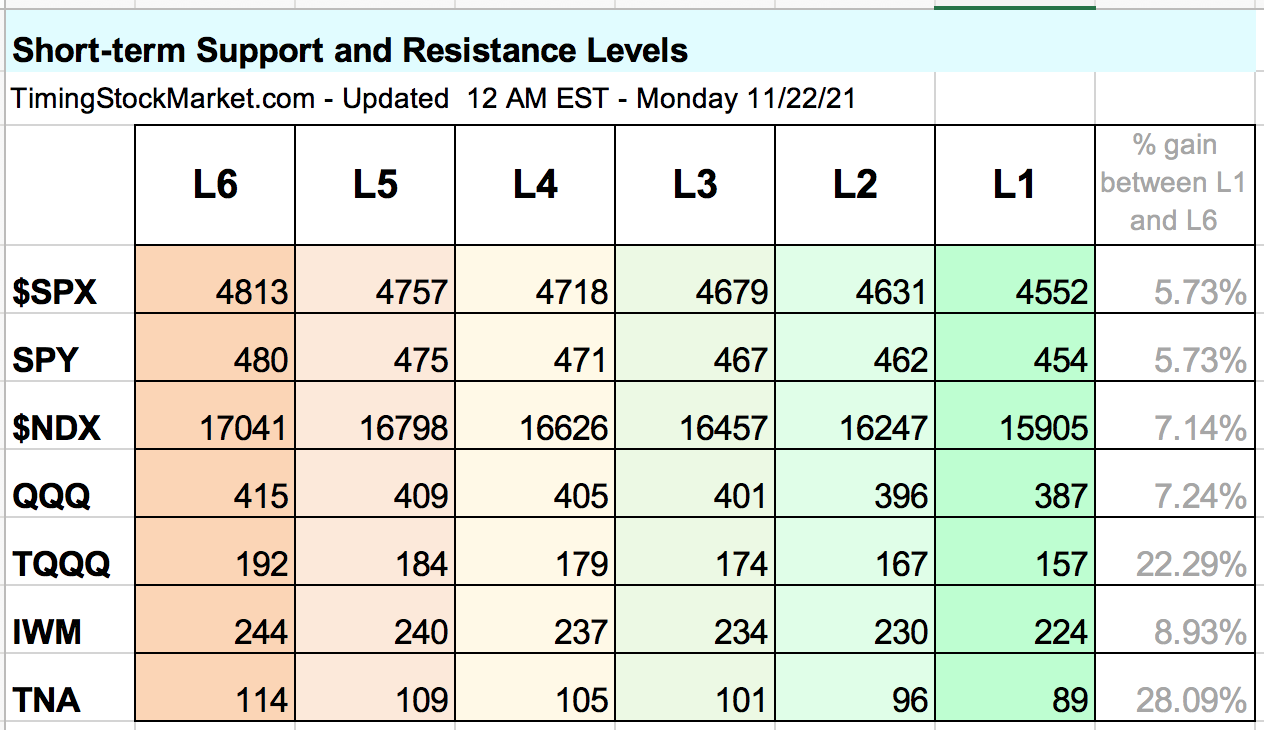

Advance-Decline Net Issues The A/D lines for NYSE and Nasdaq have all dropped sharply for multiple days now. This is particularly true for Nasdaq. This is a bearish divergence from the bullish price actions for $NDX and $SPX. Seasonality Statistically, this is a bullish period of the trading year. Dealer Hedging As long as the $SPX $NDX IWM stay above these price levels shown below, dealer hedging activities will keep price swings smallish, resulting in calmer market. If $SPX $NDX IWM drop below these levels, dealer hedging activities will feed into price swings, resulting in much more volatile market.

Observe that IWM closed on Friday at below the key level of 234 above. So we may see bigger price swings for IWM TNA Monday. Short-term Key Levels The table below has been fully updated. Trade Plan Subscribe to get our latest analysis, trade plan and live intraday trades. See trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our suggestions.

1 Comment

ratna

12/1/2021 05:58:01 pm

Are we holding the TNA and TQQQ long positions

Reply

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed