|

Entry/exit signals for SPY QQQ TQQQ IWM SPX NDX based on VIX. Click here for all our Signal Trades. Updates 1:11 PM EST- Tuesday 1/19/21 $SPX $NDX IWM continuing to rise Yesterday we wrote: "there is a higher probability that $SPX $NDX IWM may continue rising up this coming week." And this scenario is unfolding right now.

We are continuing to hold our Quick Bull TNA, but not planning to add a new position right now. The inauguration tomorrow Wednesday 1/20 is still a potentially volatile event. So we are just personally going to wait it out one more day. We prefer to give up a bit of potential gain instead of being overly exposed. If you choose to re-enter long today, exercise more precaution with your stops. Updates 10:30 PM EST- Monday (for Tuesday 1/19/21) Perspective Since mid November until early January, the stock market has been very bullish. But now there is a more cautious approach on the part of traders and investors.

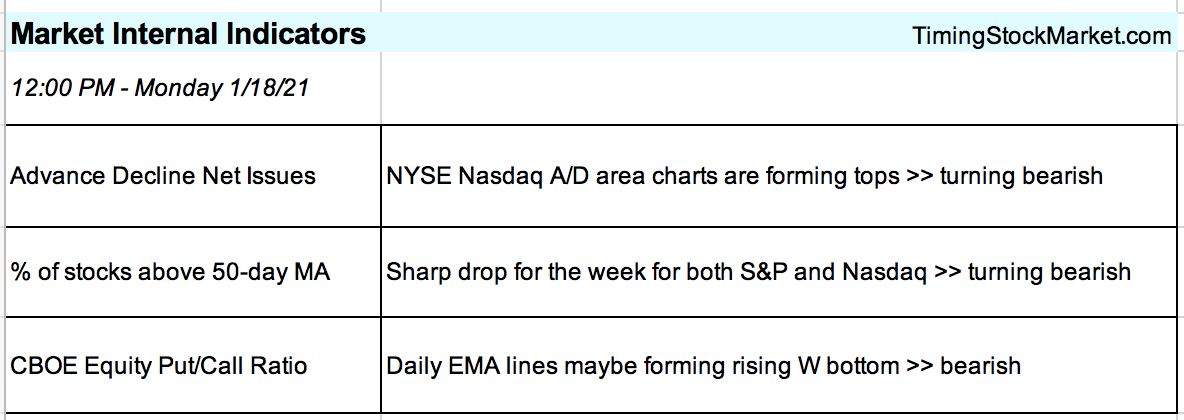

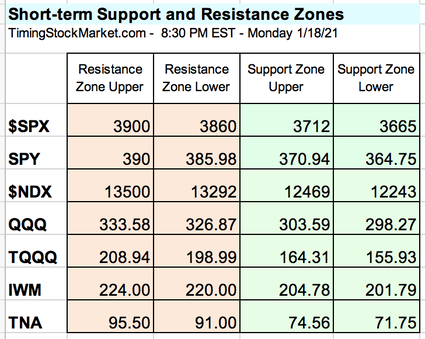

Market Internals Market internal messages are turning bearish, which confirms the more cautious vibes that we are picking up. $VIX $VXN At this point, bulls can take comfort in the fact that there is no crash signal on $VIX $VXN charts yet. Additionally, on their daily charts, $VIX $VXN show formations of short-term tops. So there is a good chance that the bullishness will continue for a while longer yet. However, it is concerning that $VIX $VXN have been going sideway for multiple weeks now. They are still not showing signs of really dropping yet. So bulls should proceed with caution here, and watch out for one potentially very bearish scenario described on $VIX $VXN charts below. Table of Support & Resistance Zones The S/R table has been updated to show a lower level of green support zones. $NDX $SPX IWM Note how the new green support zones are near the bottom of the yellow channels for $SPX $NDX IWM. Given that the yellow up channels are still intact and continuing to rise, these green zones should provide strong short-term support. What this means is that if $VIX $VXN do spike up big, $SPX $NDX IWM may drop down into their new green support zones. However, $SPX $NDX IWM should find sufficient buyers in these zones to resume the rise up in their yellow channels. Signal Trades On Friday 1/15, we had re-entered just Quick Bull TNA in Signal Trades. While there is a chance that $SPX $NDX IWM may encounter more bearish headwinds from rising $VIX $VXN, there is a higher probability that $SPX $NDX IWM may continue rising up this coming week. Of the 3 indices, $RUT IWM TNA have the most bullish momentum. So we are aiming to capture a portion of the ride up, while minimizing risks by not having too many positions. See Signal Trades for actual trades. Disclaimer The information presented here is our own personal opinion. It is intended to supplement your own research and trading systems. Consider it as food for thought. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. While we offer scenarios for you to consider in your trade planning, know that you are proceeding at your own risk if you follow our suggestions. Why 3x ETFs like TQQQ lose money over the long term The risks of investing in inverse ETFs Simple explanations of contango and backwardation

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed