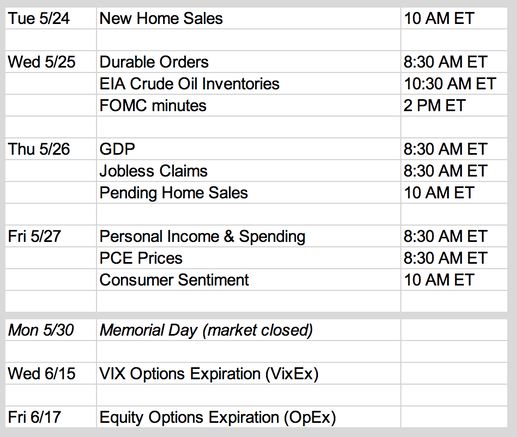

Updates 12 AM ET - Monday 5/23/22 Upcoming key events FOMC minutes on Wednesday and GDP report on Thursday will no doubt move the market in some ways. But given the disastrous earning reports of Walmart and Target last week, Friday's reports are going to be monitored closely to gauge whether or not consumers will continue to support this economy. And speaking of earnings, the following earning reports will also be closely monitored on Thursday after hours: COST (Costco), NVDA (Nvidia). Bear market is not done In the big picture context, the bear market is not done yet. The horrible combination of super hot inflation, supply chain disruption, unending pandemic, China shutdown, Ukraine war is not improving. Not anytime soon. A recent WSJ article discussed how this could be the lost decade for stocks. We are inclined to agree. But a bear market rally is imminent Having said all that, we will now say that a bear market rally is imminent. It is likely to start as early as Monday based on volatility signal (see more on that further below.) Besides volatility signal, there are other important signs of market stabilizing for the short term.

Short-term volatility signal: "Fully Bullish" $VIX: "Fully Bullish"

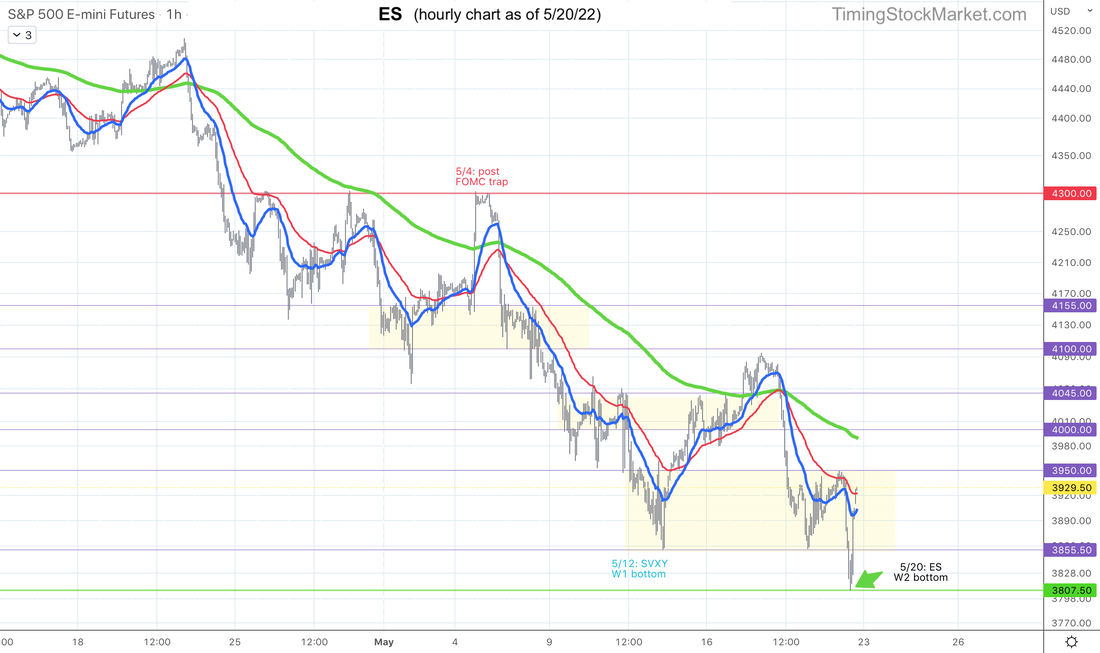

SVXY: "Fully Bullish" SVXY 15-minute chart below shows 2 sets of W bottoms formed since 5/2. ES: "Fully Bullish" Don't let ES $SPX dip towards 3800 on Friday fool you. That was a bear trap. Price dropped just enough towards this key level to trigger the criteria for the algos to go short. Then price reversed hard. And reversed across the board for S&P, Nasdaq and small caps. All this happened in on a Friday afternoon. That's a bullish turnaround. However, we don't think ES, along with all the other indices, will just take off right away on Monday. Below is ES hourly chart with key consolidation zones highlighted in yellow. While we don't think ES will retest 3800 again this week, we think bulls and bears are going to fight it out in ES support zone between 3855 and 3950 for a bit. If ES can get down close to 3855 one more time and find enough buyers there to help it reverse sharply upward, then the bargain hunters are likely to step in to help with momentum. Once ES reverses upward, it can rise up to the top of the next consolidation zone at 4045. Ultimately, ES may rise back up to 4300 before signal turns "Fully Bearish" again. Trade plan Click here for live trades. Subscribe to get our latest analysis, daily trade plans and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades.

1 Comment

douglas rath

5/31/2022 07:52:31 am

have no email for Tuesday

Reply

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed