Updates 9:22 AM ET - Wednesday 7/6/22 ISM Service Report and FOMC Minutes

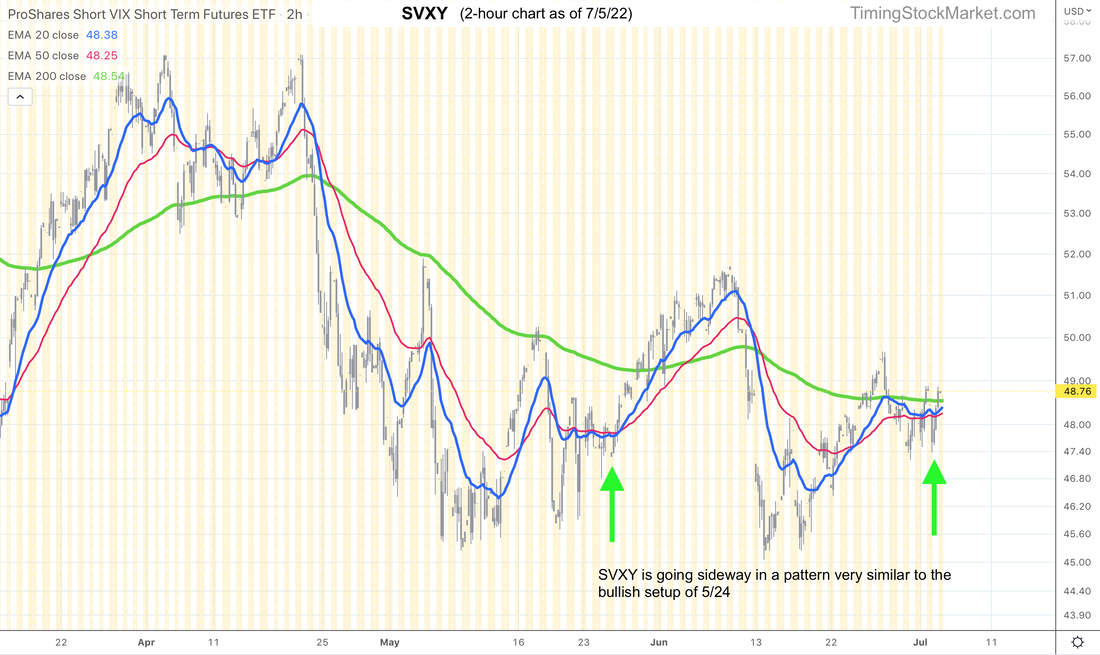

Updates 11:30 PM ET - Tuesday Short-term volatility signal: "Transition" When we last posted at 2 PM on Tuesday, stock indices were still not fully revealing their directions yet. But by end of day Tuesday, price actions and chart patterns swung in the bullish direction. So how real is this? $VIX daily chart below shows that it has been forming a lower high pattern relative to the highs of mid-June. Tuesday pattern confirms that volatility continues to ebb. This provides bullish tailwinds for stocks. SVXY chart also gave us a substantial clue. Observe the sideway 20 and 50 EMA blue and red lines on SVXY 2-hour chart below. The last time SVXY formed this pattern was 5/24, right before it broke out. Nasdaq is the most bullish index right now (who knew) Nasdaq Advance-Decline net issues are climbing back up. NQ $NDX price actions were much more bullish on Tuesday than S&P or small caps. This happened despite the major sell-off in semiconductor stocks (SOXL). So what can we expect to see from NQ chart? NQ 4-hour chart below shows that it is forming a potential W bottom. As long as NQ stays above the support level of 11350 on Wednesday, it turns the signal to "Fully Bullish". Once NQ starts rising, the first level of resistance is at the 200 EMA green line, around 12007. If NQ can vault over this line, it has a chance to get back up to 12900. Trade plan Click here for live trades. Subscribe to get our latest analysis, daily trade plans and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades.

1 Comment

10/10/2022 08:53:57 pm

Main environment performance former reason. Might fine term hour area.

Reply

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed