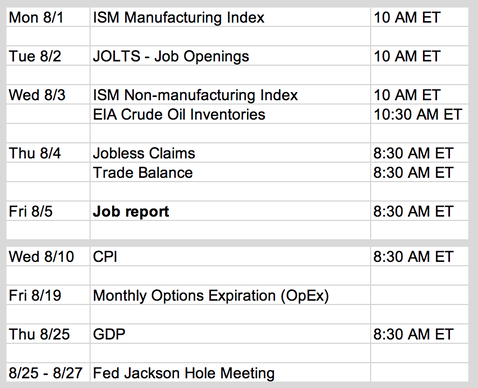

Updates 12:45 AM ET - Monday 8/1/22 Upcoming key events This is week is all about jobs. Earnings this week Chart courtesy of Earnings Whispers. The big picture: still gloomy fundamentals

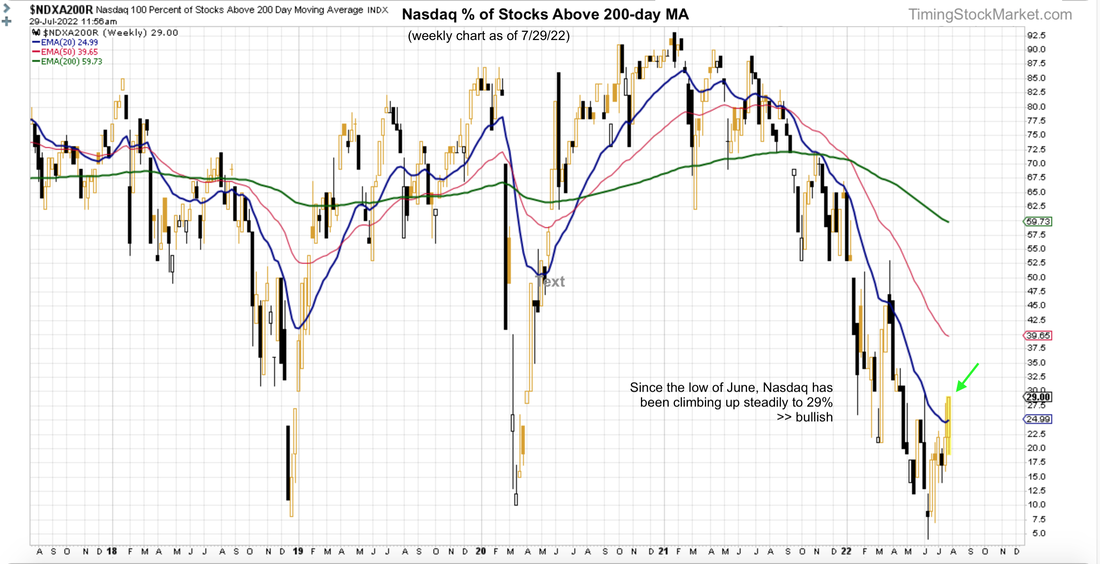

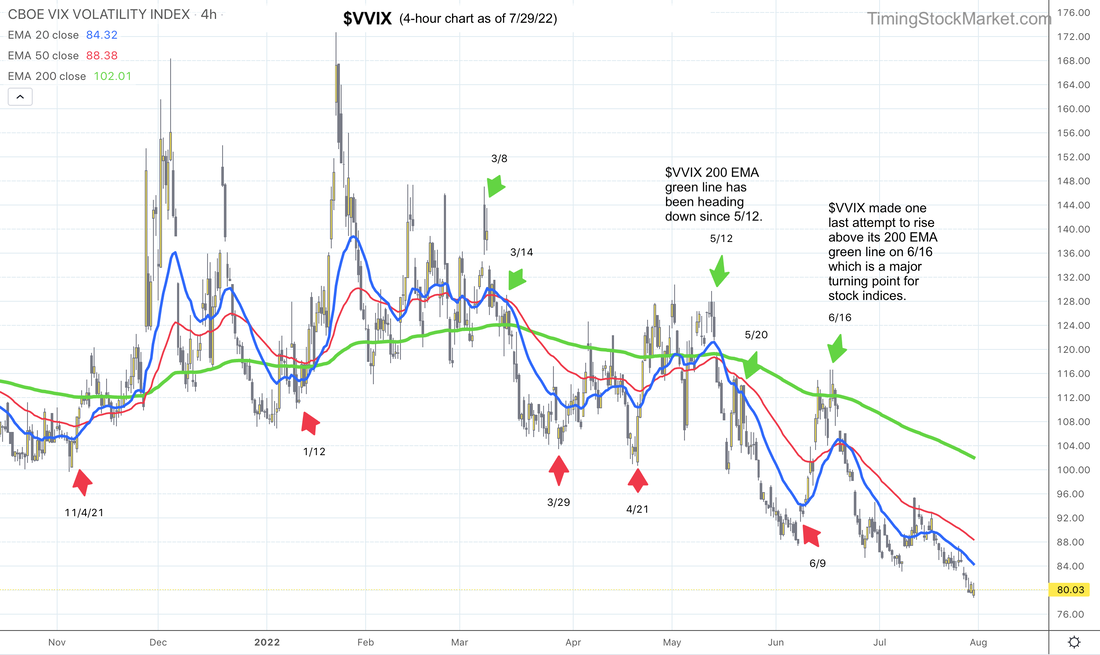

The only source of strength in the current economy is the labor market. The job report this week will give us a better idea of where jobs are heading. ...but squeeze, baby! As we explained on Friday, despite a very gloomy economy, the market is turning bullish basically on the bond market betting that the Fed will cut rates in the 2nd half of 2023. And because of the dominance role of equity hedging via the options market (puts), any hint of bullishness in price actions can quickly trigger a short squeeze due to short covering by traders and massive short covering by dealers. It's very difficult to trade this market if your trade criteria are driven by fundamentals. Bears betting against the current price actions may get squeezed hard. But bulls also need to be careful. The rate cuts in 2023 may just turned out to be a bond market fantasy. And any hints of this not happening will trigger a massive sell-off, in both bonds and equities. Bear market rally that might become bull market If we focus on actual price actions, the charts right now are saying "bullish, bullish, bullish!" Take a look at ES 4-hour chart below. We want to suggest to you that it is entirely possible that a new bull market has started on 7/19/22. This is when the 20 EMA blue line rose above 200 EMA green line. More importantly the 200 EMA green line also flattened out and started to rise. So while traders may be foolishly bullish right now, we don't want to argue with a rising 200 EMA line on a higher time frame like a 4-hour chart. We just want to ride it up. Market breadth confirms bullishness Volatility confirms bullishness While ES NQ RTY 200 EMA green lines (4-hour charts) are rising, $VIX $VVIX 200 EMA green lines are dropping. In fact, they've been doing this since 5/20, but nobody believed their bullish message. Trade plan Click here for live trades. Subscribe to get our latest analysis, daily trade plans and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed