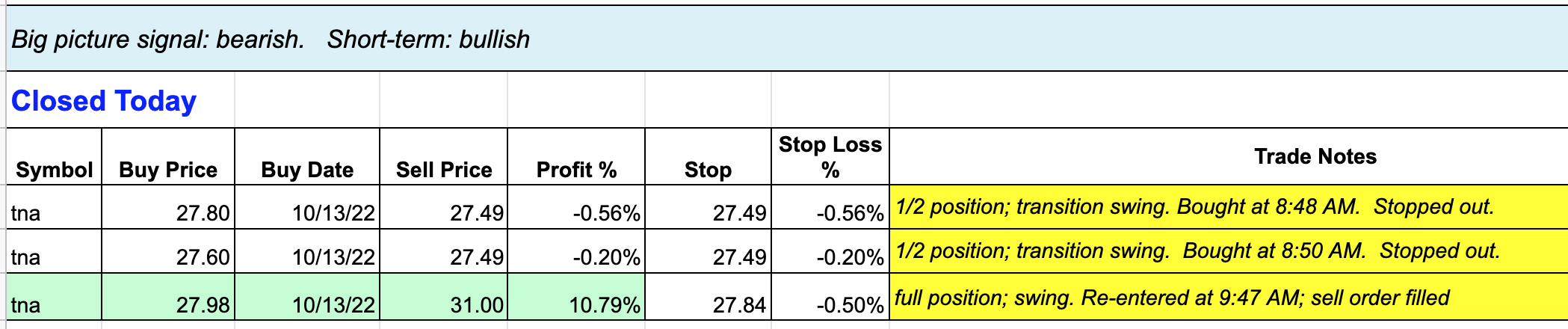

Updates 4 PM ET - Thursday 10/13/22 Trade results Updates 9:46 AM ET - Thursday 10/13/22 Re-entered TNA We have re-entered TNA. (Sorry but Stocktwits messaging is not working right now). Updates 8:53 AM ET - Thursday 10/13/22 $VIX is struggling $VIX is struggling to rise above 33.5. This is NOT supportive of a massive market crash. Updates 8:46 AM ET - Thursday 10/13/22 CPI hot From CNBC: "Consumer price index rose 0.4% in September, above the 0.3% expected by economists according to Dow Jones. Core CPI, which strips out food and energy, was up 0.6% month over month, also higher than expected." ES NQ RTY dropped sharply with ES getting close to 3500. However, UVXY is not rising above October 11 high just yet. We're monitoring for now, but if UVXY forms a top above its 200 EMA (5-min chart), we may scale into TNA. Remaining flexible because market is very news driven right now. Updates 8:15 AM ET - Thursday 10/13/22 Squeeze alert CNBC headlines said futures are jumping because of the British pound. ES NQ RTY as well as SVXY have spiked up. We may have a setup for a squeeze. So we're looking at either SQQQ or TNA depending on the post CPI reaction. Don't feel compelled to jump in immediately. Updates 12:15 AM ET - Thursday 10/13/22 Market breadth is supportive

$VIX is stalling or transitioning $VIX hourly chart below shows that it has been stuck in the 33-34 range for multiple days. After a hot PPI report that exceeded projection, $VIX barely moved. So we have to ask ourselves if the market is about to undergo a short squeeze. That is certainly possible given the large amount of puts purchased for CPI hedging. They function as potential fuel for short squeeze. But the truth is no one really knows. So rather than speculating, we are going to focus on two patterns that have been reliable, and they both share one common characteristic. Bullish: If $VIX forms a true 2nd top (relative to 9/30), then conditions are supportive of a rally. But to do so $VIX 20-hr EMA blue line has to weave around its 50-day EMA red line for a few days before dropping. This means $VIX has to have a sharp dip to start, perhaps down to 31-32 (see pink arrows below). From this sharp dip, $VIX then can rise up to test 34 again before forming a top. Bearish: In order for $VIX current trend to resume with vigor and longevity, $VIX also needs to dip a bit. Again, we want to see $VIX dips to 31-21 zone to gain fuel for the next surge up. Trade plan So we want to catch $VIX dip as described above, whether it's a setup for a $VIX top, or a setup for $VIX trend resumption. We plan to do so by looking for comparable dip in SQQQ. By the way, small caps RTY IWM TNA look promising in terms of a possible W bottom. But we need SVXY to confirm first, and SVXY is quite lethargic right now. So we will continue to monitor SVXY RTY, but not jump in just yet. Incidentally, if $VIX does form the complex top, SVXY will form a W bottom and that will be a very bullish setup for RTY. Subscribe to get our latest analysis, daily trade plans and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed