Updates 3:20 PM ET - Wednesday 10/26/22 Bear market rally is still intact

Price actions this morning set up a bull trap, and we are likely to see sharp selling. We are still projecting ES NQ RTY to drop and tag S1 as $VIX rises and tags 30. This type of swing is to be expected in this market. But again, volatility and breadth support the bear market rally continuing. We continue to hold TNA runner position as is, and wait for RTY to retest S1 to scale back into TNA swing position. Updates 11:40 PM ET - Tuesday Summary

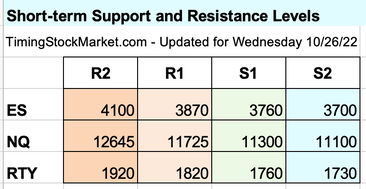

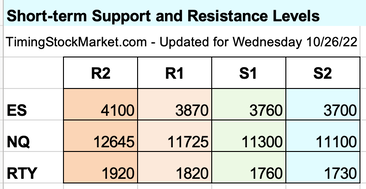

Against this bullish backdrop, Microsoft and Alphabet earnings resulted in sharp drops after hours. S/R levels So expect some pullback on Wednesday, or at least choppy market conditions. Below are updated S/R levels. We may see ES NQ RTY1 tag S1 before resuming the bullish rise. Is the rally over? Not according to volatility and market breadth.

Trade plan The TNA runner position is still intact and we will continue to leave the stops at breakeven for now. We will be monitoring for pullback overnight and at open to re-enter TNA swing position. Subscribe to get our latest analysis, daily trade plans and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed