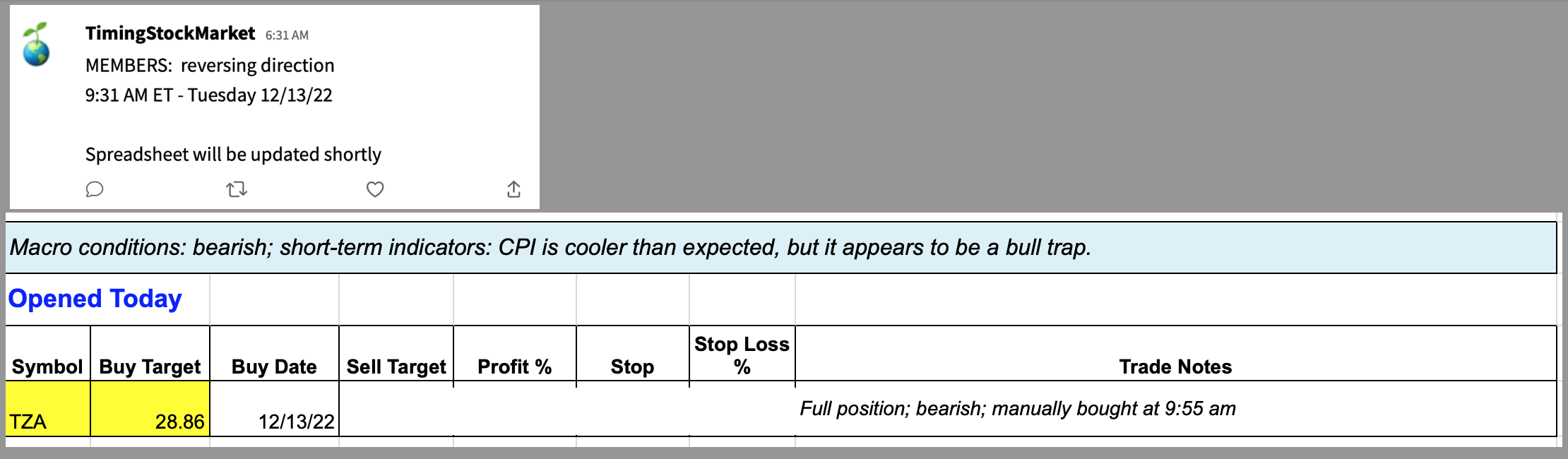

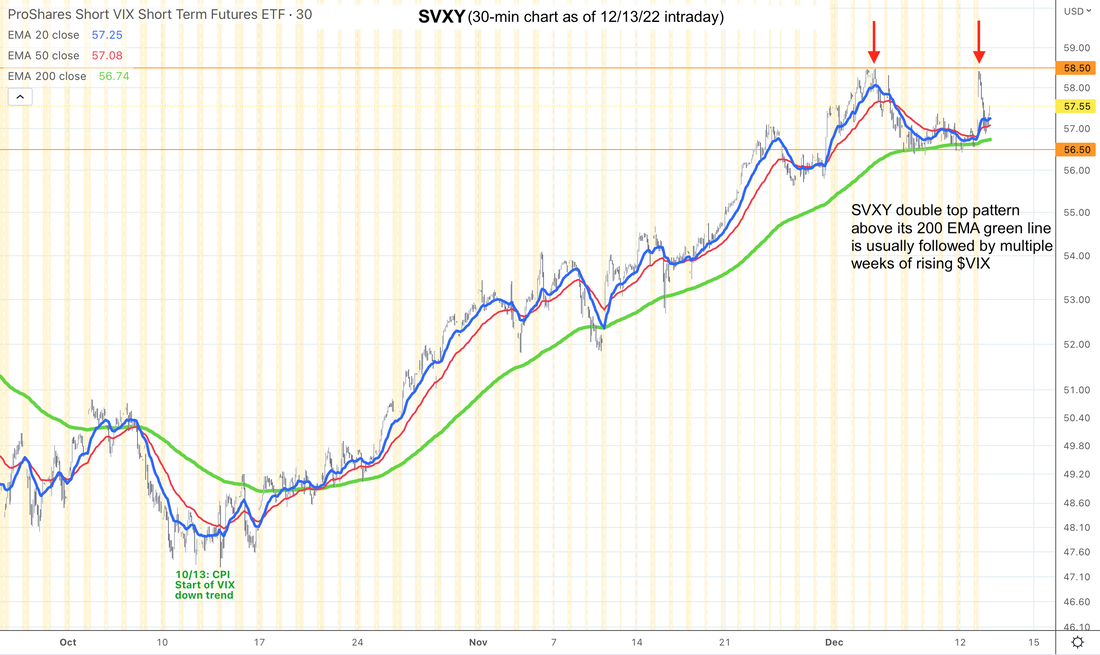

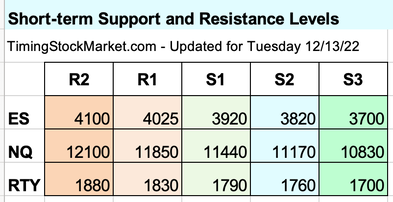

Updates 4 PM ET - Tuesday 12/13/22 Today's bearish entry into TZA Updates 3:06 PM ET - Tuesday 12/13/22 It was a bull trap as anticipated $VIX chart was very difficult to track today as it swung all over the place pre-market. But SVXY chart gave us a pretty good clue where volatility is heading. SVXY 30-min chart below shows SVXY forming double top pattern above its 200 EMA green line. This pattern is usually followed by multiple weeks of rising $VIX. So we entered TZA this morning, after a quick small test of TQQQ. TZA took off nicely as ES NQ RTY all dropped sharply. But don't expect them to keep dropping just yet. The odds are high that there will be some thrashing price actions while ES NQ RTY form a top. We are holding on to our TZA position and have not tightened stop just yet. We plan to add another TZA position after FOMC tomorrow if this bearish pattern plays out. Updates 8:57 AM ET - Tuesday 12/13/22 Maybe bull trap Consumer prices rose less than expected. ES NQ RTY have shot up, but $VIX and UVXY charts are sending out warnings that this may be a bull trap. Our buy target right now is actually SQQQ. Monitoring to scale into when it forms a bit more of a base. Updates 12 AM ET - Tuesday 12/13/22 Key S/R levels The S/R levels have been revised in the table below. Post CPI scenarios to consider 1. Very cool CPI: Highly bullish. ES NQ RTY will surge sharply right away, while $VIX will drop. ES NQ RTY may end up above R2, with ES possibly up near 4300 eventually. In this scenario, we'd enter TQQQ immediately. 2. Very hot CPI: Highly bearish. ES NQ RTY will drop sharply right away, while $VIX will surge. ES NQ RTY may end up as low as S3 eventually. In this scenario, we'd enter TZA immediately. 3. Barely budging CPI: Very tough scenario to discern in advance. We think that the following $VIX path may take place in this scenario. (See chart below.)

Subscribe to get our latest analysis, daily trade plans and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed