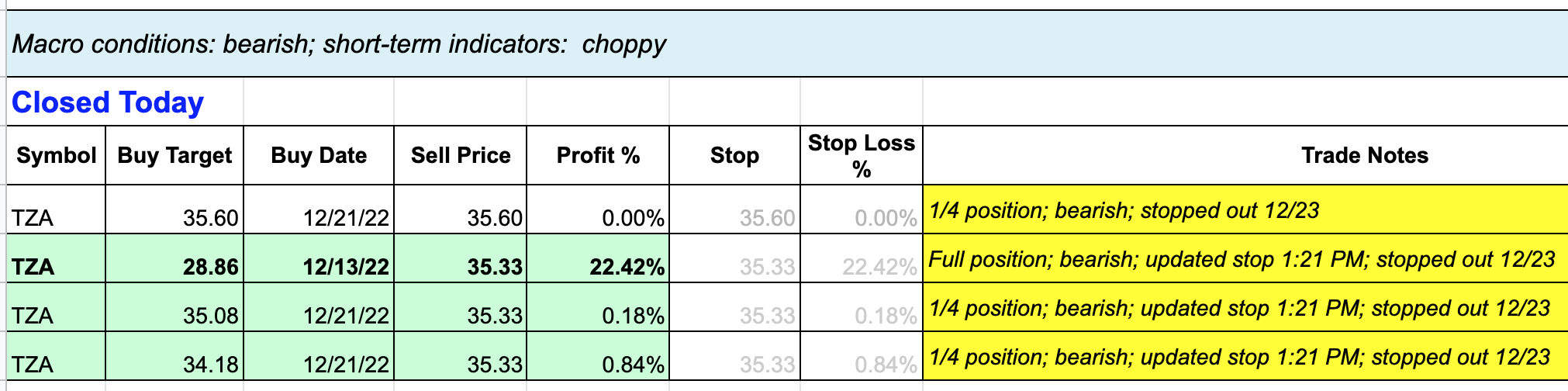

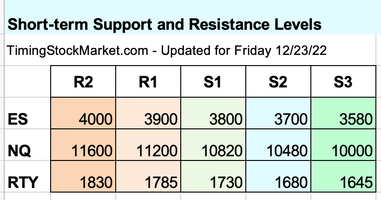

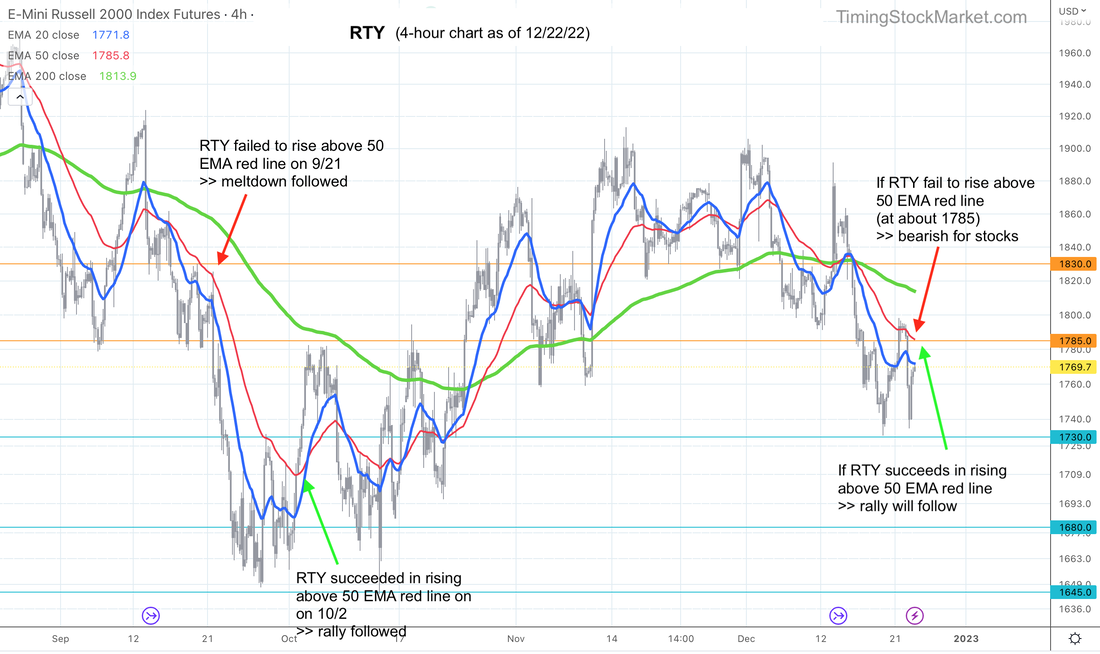

Updates 4 PM ET - Friday 12/23/22 Today's exit from bear position (TZA) Updates 1:33 PM ET - Friday 12/23/22 $VIX and market breadth suggest a rally may be in the making $VIX tried to rise this morning but did not succeed. It may be still building a base for rising, but so far it has very little momentum. We have to allow for the possibility that $VIX is building a base for possibly dropping a lot more. This would mean another bear market rally is in the making. Market breadth charts support this possibility. ES NQ RTY price actions also support this possibility. So we have tightened the stop on our TZA positions. We are not entering TNA or any bullish position yet. The next key reversal point will likely come after the job report on January 6. Have a wonderful holiday. Updates 1:00 AM ET - Friday 12/23/22 Key S/R levels The relief bounce was sharp but short. Below are the new key S/R levels. Right now price actions, volatility and market breadth tell us that conditions are bearish. We need to continue monitoring the key charts for clues. Are the bearish conditions continuing, or are ES NQ RTY setting up for another bear market rally? In RTY 4-hour chart below, we discussed the bearish versus bullish EMA patterns that we are looking for. We are leaning bearish at the moment. Note that Personal Income & Spending report at 8:30 AM may move market direction given the thin holiday trading. Market breadth: bearish; Volatility: bearish Market breadth charts have gone back to being quite bearish. $VIX chart is finally forming the W bottom pattern that we've been waiting for. To ensure that this W pattern continues to develop, we want to see $VIX 20-hour EMA blue line surges above its 200-hour EMA green line. This green line currently is close to 22.8 which is a crucial $VIX level. If the W pattern stays intact and $VIX 20-hour EMA blue line surges up, that's a very bearish setup for stocks. On the other hand, we may see $VIX 20-hour EMA blue line rises just a bit above its 200-hour EMA green line, then drops back below it. That's actually a highly bullish setup for stocks to reverse into a bear market rally. Our Personal Trade Plan

Subscribe to get our latest analysis, daily trade plans and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed