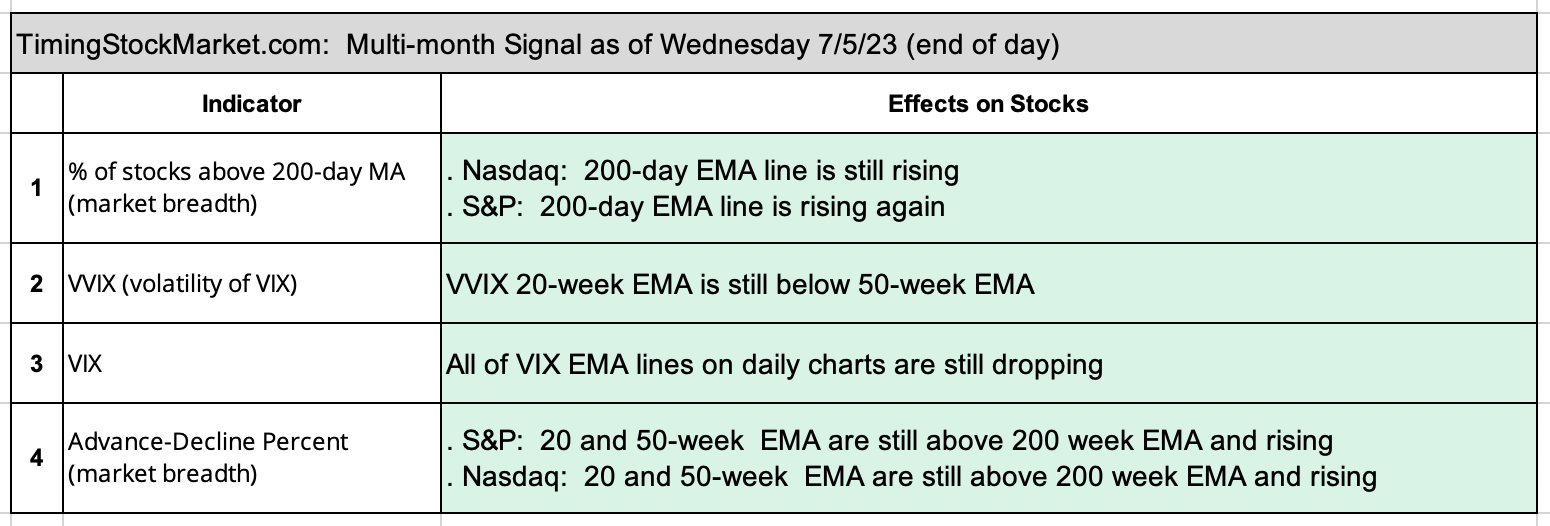

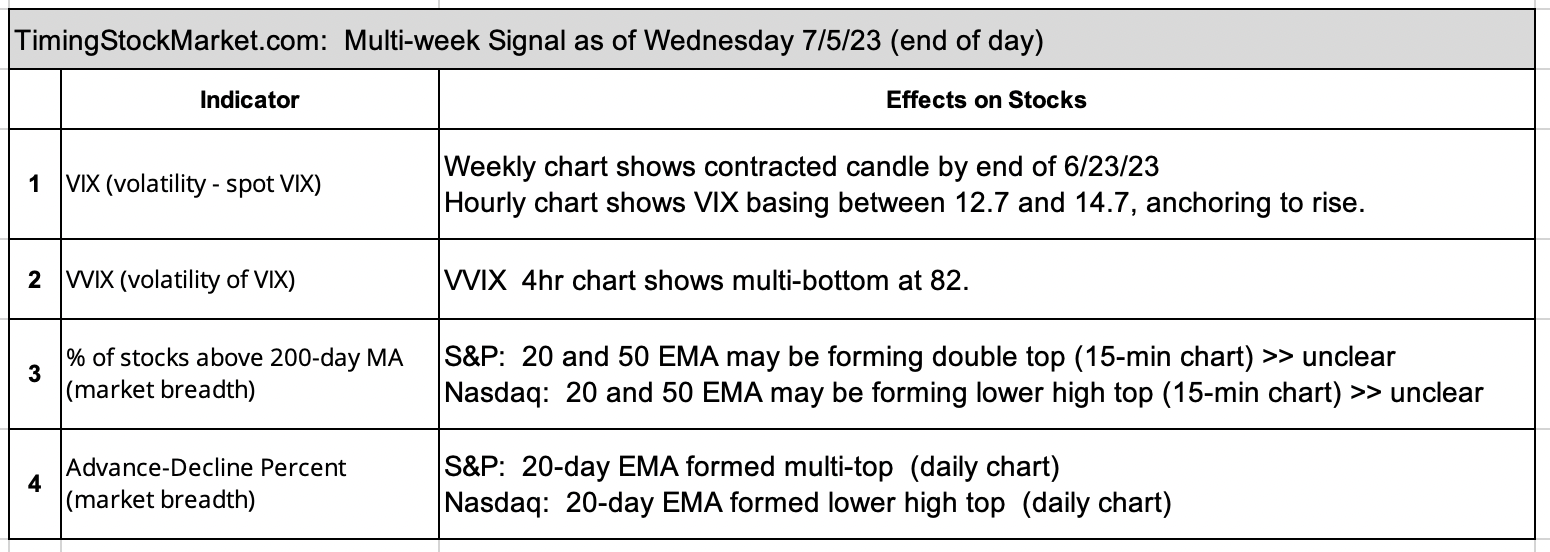

Updates 1:45 AM ET - Thursday 7/6/23 Multi-month bull signal intact The four key indicators below tell us that the bull market that started last October remains intact. There is no setup for a crash or even a massive pullback right now. Multi-week bull signal is fading All 4 indicators below are now saying "no longer supportive of multi-week bull". Therefore:

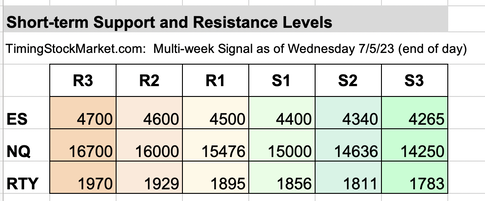

Key S/R levels All RTY levels in the S/R table below have been updated. The others remain the same Yesterday, we wrote: "Since the multi-week bull signal has faded, ES NQ RTY are vulnerable to a pullback." Wednesday brought the start of the pullback, most evident in RTY. We expect ES and NQ to follow in RTY footsteps down. None of them seems capable of pushing through R1 in the short term. ES NQ RTY are likely to dip down to S1 while VIX rises up to the zone 17-18. Then we may see the start of a new multi-week bull that can take ES NQ RTY from support at S1 up to R2. Our personal trade plan No more quick bull trade for now. We've shared the setup for a multi-day bear trade via TZA. Click here for Signal Trades spreadsheet. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed