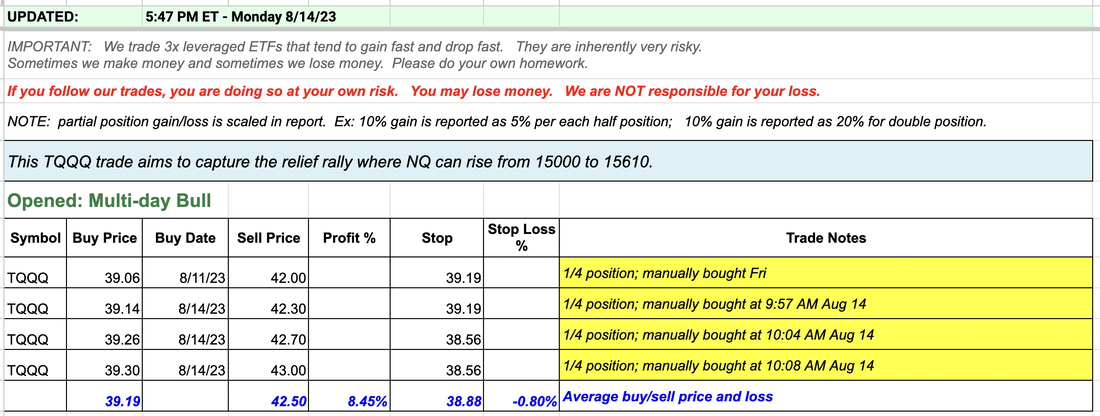

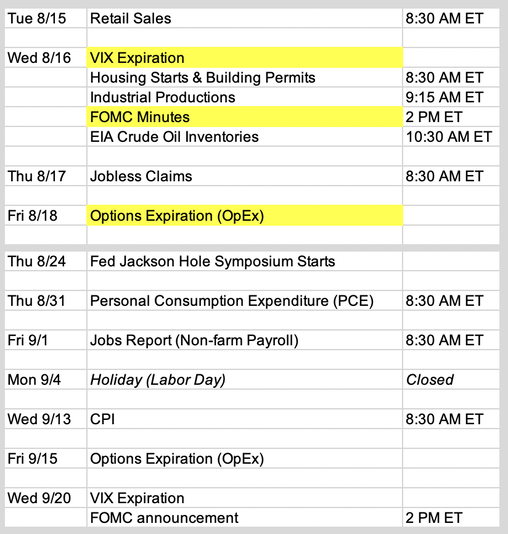

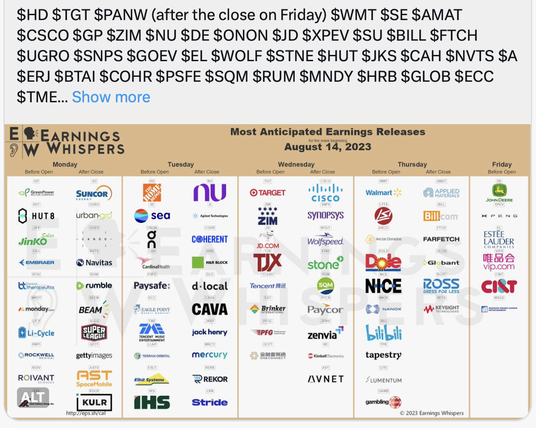

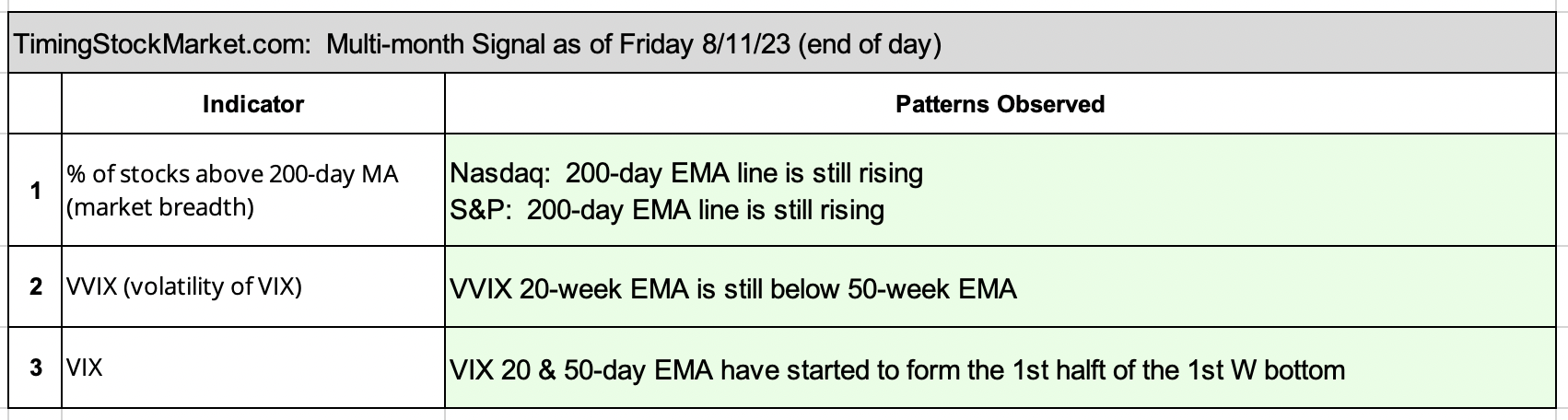

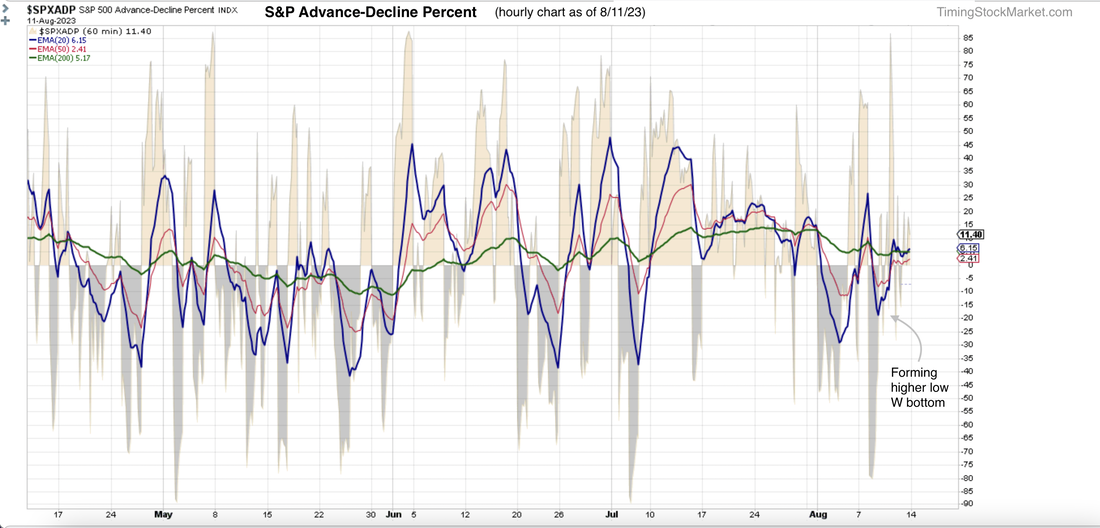

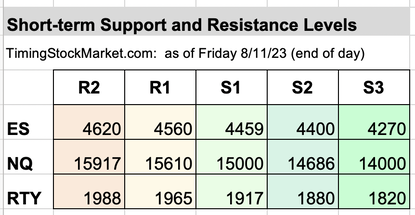

Updates 5:47 PM ET - Monday 8/14/23 Opened new position: multi-day bull We entered into TQQQ as outlined in our trade plan earlier today. Entered just above the low of the day. This TQQQ trade aims to capture the anticipated relief rally where NQ can rise from 15000 to 15610 (S1 to R1). Updates 12:50 AM ET - Monday 8/14/23 Upcoming key events Most of this week will be quiet until Wednesday and Friday. Read more economic analysis here. Earnings this week Chart courtesy of Earnings Whispers. Multi-month outlook: Bull market is still intact but needs recharging Our multi-month indicators show the bull market is still intact, but its strength is waning a bit. It will take multiple weeks of recharging to get this bull back close to full strength. If we have a big VIX fear spike in September, then this bull may be recharged enough to run through the first quarter of 2024. Calming messages from volatility and breadth VIX daily chart below shows that it has been forming a top consisting of lower high candles since Aug 4. This suggests that VIX is more likely to drop in the short term rather than rise. The hourly chart of S&P Advance-Decline Percent below shows a clear W bottom has been formed. These W bottoms suggest that more stocks are able to advance rather than before. The S/R table below has all the support levels lowered. Short-term outlook: Relief rally likely coming this week Right now market flow is very bearish:

If there is a big immediate negative catalyst, this bearish setup will create a vicious cycle of selling. We will see VIX surge hugely, while ES NQ RTY dive sharply. However, all of these bets are time sensitive. VIX expiration is this Wednesday, and equity expiration is this Friday. Most of these bearish bets will expire worthless if we don't get a big immediate negative catalyst. The calming messages from VIX and A/D Percent tell us that nothing super scary is on the horizon right now. As expiration approaches with no big bad bearish catalyst, traders will unwind their bets, and dealers will have to reverse their books, swinging over to the bullish side. This provides fuel for a short squeeze where EQ NQ RTY may rise sharply, creating a virtuous cycle in the process. This relief rally may enable ES NQ RTY to rise from S1 up to R1. They may even try to climb as high as R2, but they are very unlikely to surpass R2 for now. The Fed Jackson Hole Symposium starts on Aug 24. You may recall that last Aug, Jerome Powell's opening speech killed the relief rally in late Aug and sent the market down for another bearish leg. We may see a similar pattern at this year's symposium. We don't think a fear spike will show up until closer to that big window of weakness between Sep 15 and Sep 21 (see schedule of key events above). During this period, VIX may rise as high as 22-23, and ES NQ RTY may dip as low as S3. The good news is this fear spike should recharge the bull for another run through the first quarter of 2024. Our inner bull is hoping for this scenario to come true so that we can enter multi-month and multi-week bull positions. Our personal trade plan We have started to scale into TQQQ to capture the relief rally where NQ can rise from 15000 to 15610. After the relief rally, we are likely to see more selling. We want to wait for VIX to drop into the zone 13.5 - 14 and SQQQ to retest the zone 17 - 17.5 before entering SQQQ. This SQQQ trade aims to capture NQ dropping again from 15610 to 14686. Click here for Signal Trades spreadsheet. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed