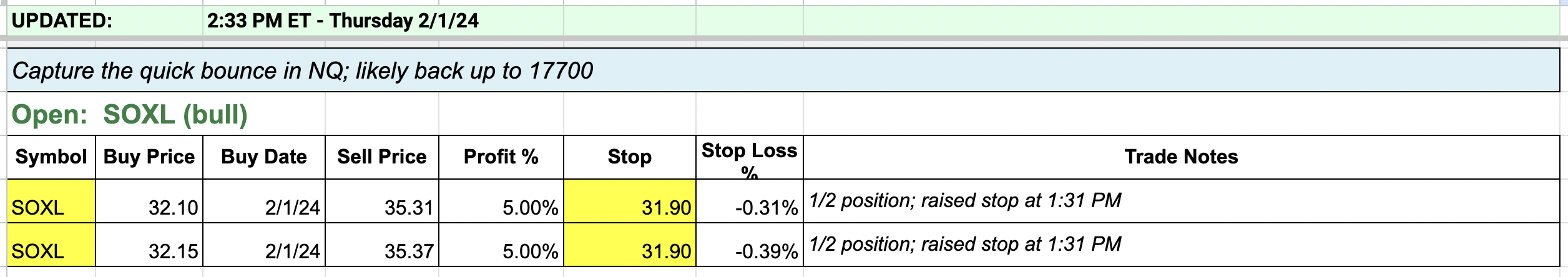

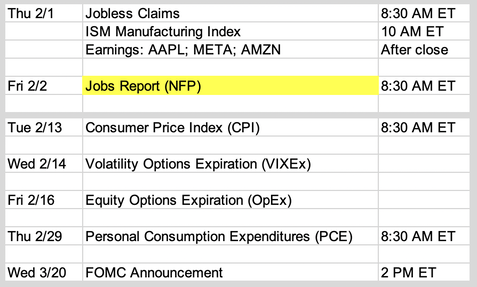

Updates 4 PM ET - Thursday Entered into SOXL NQ failed to drop to test support at 17000 today. We used this fail signal as the new signal to enter long via SOXL. Updates 2:35 AM ET - Thursday Upcoming key events The Fed feels it will be appropriate to begin cutting rates some time later this year. But first they need more evident that inflation will continue to drop and eventually get back to 2%. For now rates remain unchanged and QT remains unchanged. QRA was a non-event. Read more about rates and the economy here. Big picture: bull market; short term: weakening momentum The indicators are still sending out the same message. This is a bull market with weakening momentum, with more selling than buying right now. However the indicators are not showing that this is the start of a bear market. So at some point soon the strong momentum should resume, just not this week. S&P and Nasdaq Advance-Decline Percents (Stockcharts $SPX ADP $NDXADP) are both showing lower high topping patterns on their daily chart. This declining market breadth is now reflected in declining price for ES NQ RTY. VIX daily chart below shows its 20-day EMA blue line about to rise above its 50-day EMA red line. This will likely push VIX up to 16, possibly 17. This supports the current sell mode for ES NQ RTY. Key S/R levels NQ: NQ did not tag any key resistance levels on Wednesday. Instead it dropped sharply after FOMC. While NQ may quickly tag 17450 on Thursday, it is likely to keep dropping, down to 17000 by Friday. Then we may see some basing at that level, followed by a bounce from there back up to 17800 next week. ES: Similar to NQ, ES did not tag its Jan 29 high on Wednesday. Instead it dropped sharply after FOMC. While ES may quickly tag 4905 on Thursday, it is likely to keep dropping, down to 4820 by Friday. Then we may see some basing at that level, followed by a bounce from there back up to 4954 next week. RTY: RTY did manage to get close to its Jan 29 high on Wednesday after FOMC. Then it dropped sharply. While RTY may quickly tag 1990 on Thursday, it is likely to keep dropping, down to 1925 by Friday. Then we may see some basing at that level, followed by a bounce from there back up to 2025 next week. Our personal trade plan We scaled into half SQQQ position, with plans to add the remainng half at open on Thursday. See updated positions and buy target here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed