|

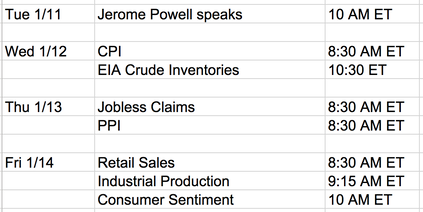

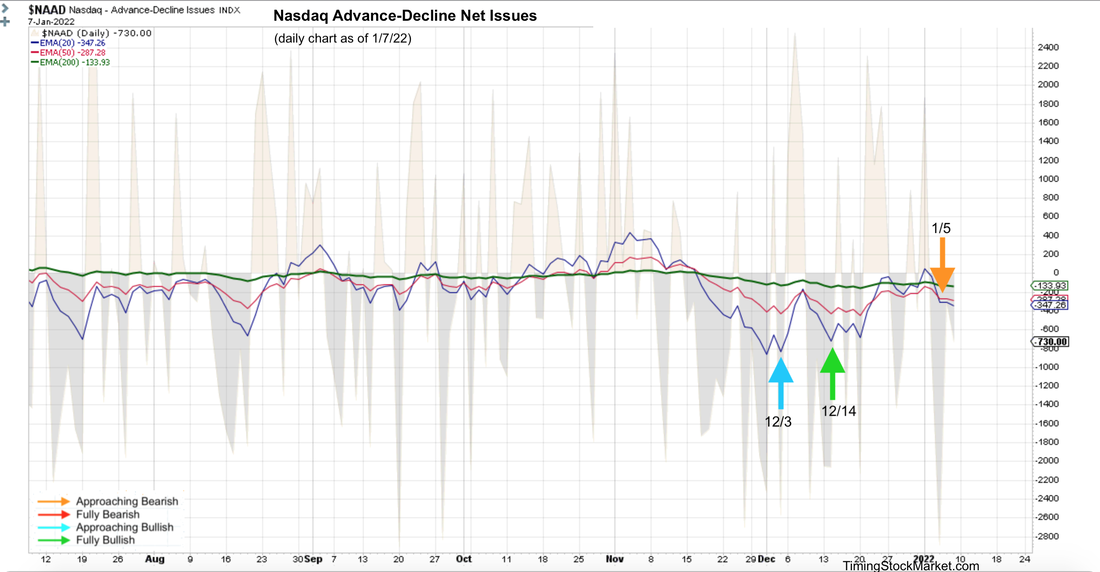

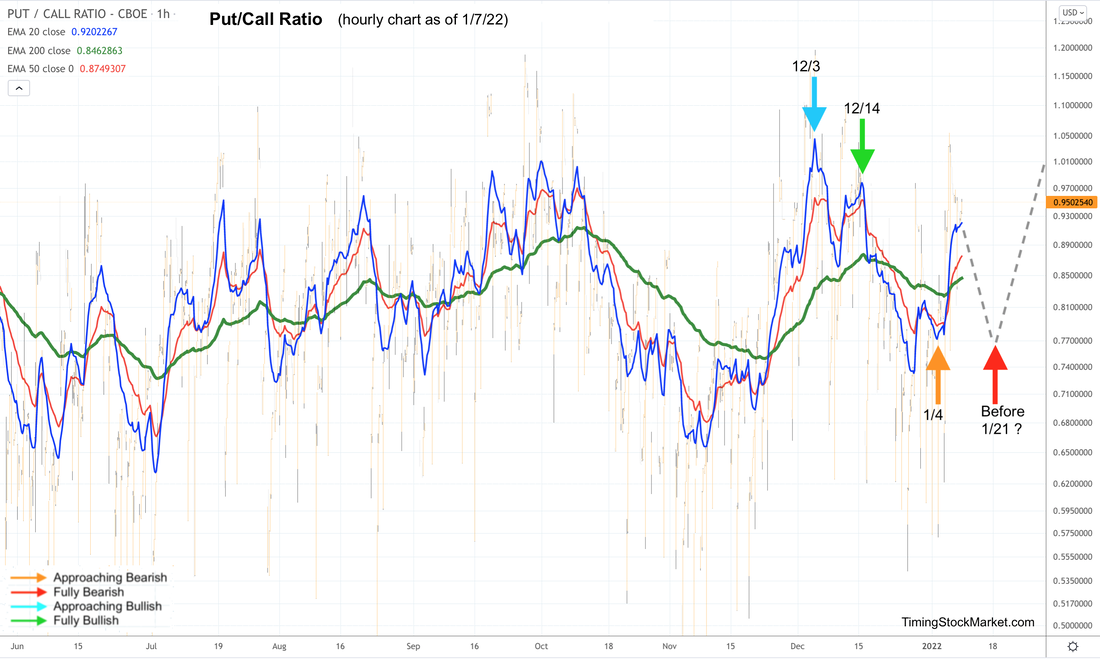

We trade 3x ETFs such as TQQQ TNA SOXL LABU UVXY using proprietary analysis of volatility. Subscribe to get our latest analysis, trade plans and live intraday trades. Current trade record here. Updates 12:45 AM ET - Monday 1/10/22 Key Dates Here is the economic calendar for this week. Jerome Powell's speech will undoubtedly be monitored closely for level of hawkishness. And the inflation data (CPI and PPI) can potentially move the market a lot too. Looking further into January, we have two key dates. Fri 1/21: OPEX Wed 1/26: FOMC announcement Finally, all markets will be closed on Monday 1/17 for Martin Luther King holiday. Market Breadth: Advance-Decline Net Issues We start today with the indicator that has the clearest pattern. The signal from A/D line "Approaching Bearish". This is true for NYSE, Nasdaq and small cap charts. Hedging by Traders: Put/Call Ratio The current signal from P/C ratio chart is "Approaching Bearish". From here, there are two possible scenarios for P/C ratio.

Hedging by Dealers Below are volatility trigger levels. If price is above the trigger level, dealer hedging will change from "fueling volatility" (big price swings) to "dampening volatility" (calm price movements).

As of this writing, $SPX $NDX IWM are all below their trigger levels. Expect big price swings to continue. Volatility: $VVIX $VIX $VXN $RVX Read more about $VIX $VXN $RVX $VVIX and the effects of options and hedging on the market here. By the end of last week, $VIX $VXN $RVX daily charts all show the possibility of a lower high topping formation. If this pattern persists, it certainly is a bullish divergence and eventually becomes bullish tailwind for $SPX $NDX IWM. However, when it comes to volatility, we can't ignore the monthly option expiration (OPEX) cycle. As January progresses, the chart that is the most reliable keeper of this cycle is $VVIX (volatility of $VIX). $VVIX 2-hour chart below shows that it may have formed the "Approaching Bearish" signal on 1/5. Assuming that this is true, we are now looking for a same-low or higher-low pattern to form which would make the signal "Fully Bearish". Then we would expect to see $VVIX rises above its 200 EMA green line, and keeps rising until it forms its monthly spike around OPEX. Of course, none of this is guaranteed. But there is a high probability that some pattern comparable to this will unfold. Other Signals The Dark Pool Index brings some good news for the bulls. It is showing a moderate upturn in $SPX buying. There are a few possible implications:

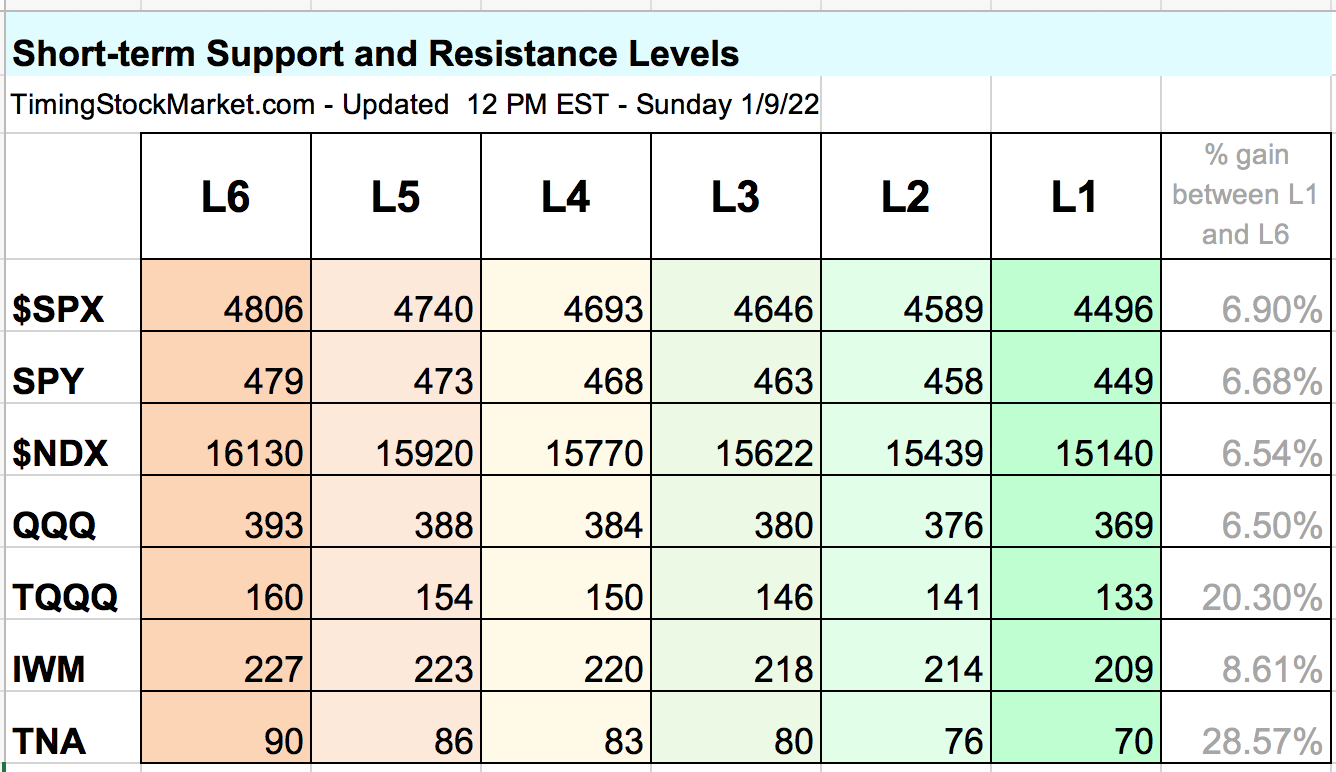

Bond volatility (MOVE index) eased up again on Friday. Zooming out on this chart, we observe that over the next few weeks, bond volatility is likely to drop some amount. But over the next few months, there is a strong possibility that bond volatility will really spike up big. If this happens, it will have a big impact on the stock market. Junk bonds (JNK HYG) dropped steeply last week, and may be approaching a short-term bottom. Junk bonds tend to behave more like $SPX, so this may be welcoming for $SPX bulls. But in the big picture context, junk bonds chart continues to look vulnerable. Short-term Key Levels This table is all updated except for $SPX SPY. Trade Plan At this point, the combined signal is "Approaching Bearish". So here is our personal short-term strategy for trading. We plan to wait for this signal to turn into "Fully Bearish", then:

See updated plan in spreadsheet. To Read We urge you to read this article about risk management and position sizing. 1% Risk Rule If you are new to trading 3x leveraged ETFs like TQQQ TNA SOXL FNGU, read: Why 3x ETFs like TQQQ lose money over the long term If you are new to trading inverse ETFs like SQQQ TZA SOXS FNGD, read: The risks of investing in inverse ETFs Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our suggestions.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed