|

We trade 3x ETFs such as TQQQ TNA SOXL LABU UVXY using proprietary analysis of volatility. Subscribe to get our latest analysis, trade plans and live intraday trades. Current trade record here. Updates 9:15 AM ET - Tuesday 2/22/22 Short-covering rally happening Futures started Monday evening dropping down hard, with ES down close to 1/24 low. But ES NQ RTY all found short-term support and rose substantially overnight. $VIX gapped up big overnight to 1/24 high, but dropped sharply. So is this the end of the bear market? No. This is not capitulation for the big picture market current. That condition is still bearish. The fundamental causes for all this fear has not changed: Fed raising rate, Fed tightening, political tension. What we have this morning is a short-covering rally. As prices rose some amount overnight and $VIX dropped, dealers cover their hedges which were short futures. As a result, price rose rapidly. The short-term volatility-based bearish signal may be peaking for now. It may be transitioning from "Fully Bearish" (last night) to "Tilt Bullish" this morning. We need P/C ratio and A/D line to confirm this. We are not planning to chase price up. Short-covering rally induced by dealers is notorious for rapid big price swings in both directions. Furthermore, switching to a bullish trade right now is going against the big picture bearish current. So we want a stronger short-term bullish signal to help our position. The best setup is for ES NQ RTY to test their overnight lows. That would change the short-term signal to "Fully Bullish" and be more favorable price point to enter long. We'll post updated trade setups shortly. Updates 8:19 PM ET - Monday 2/21/22 Bulls should hope for more immediate fear, not less In our analysis below, we pointed out that the market is currently in a phase where there are 2 bearish forces in effect:

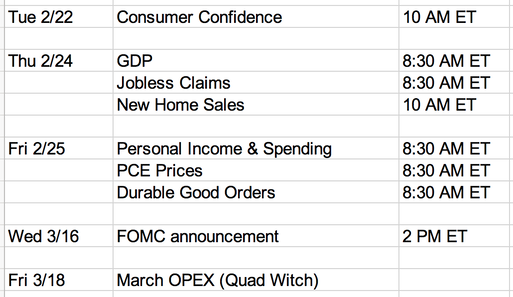

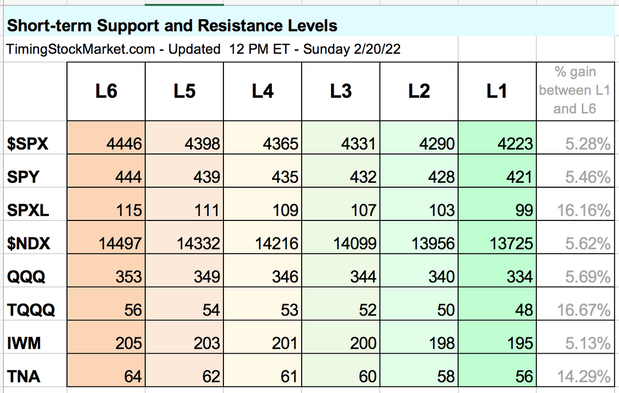

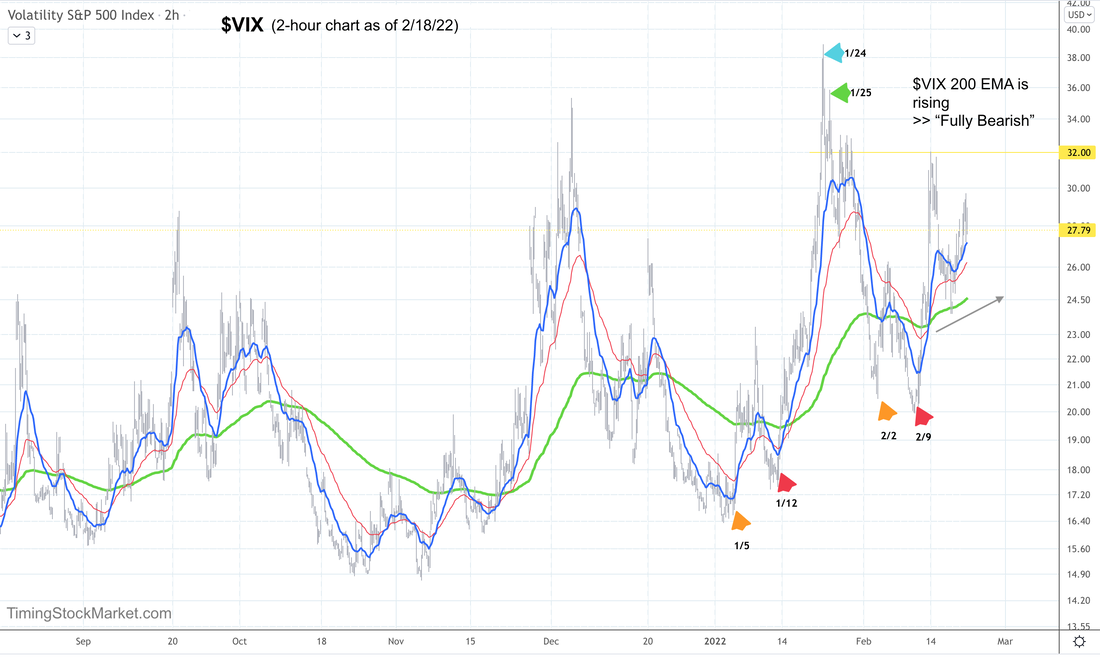

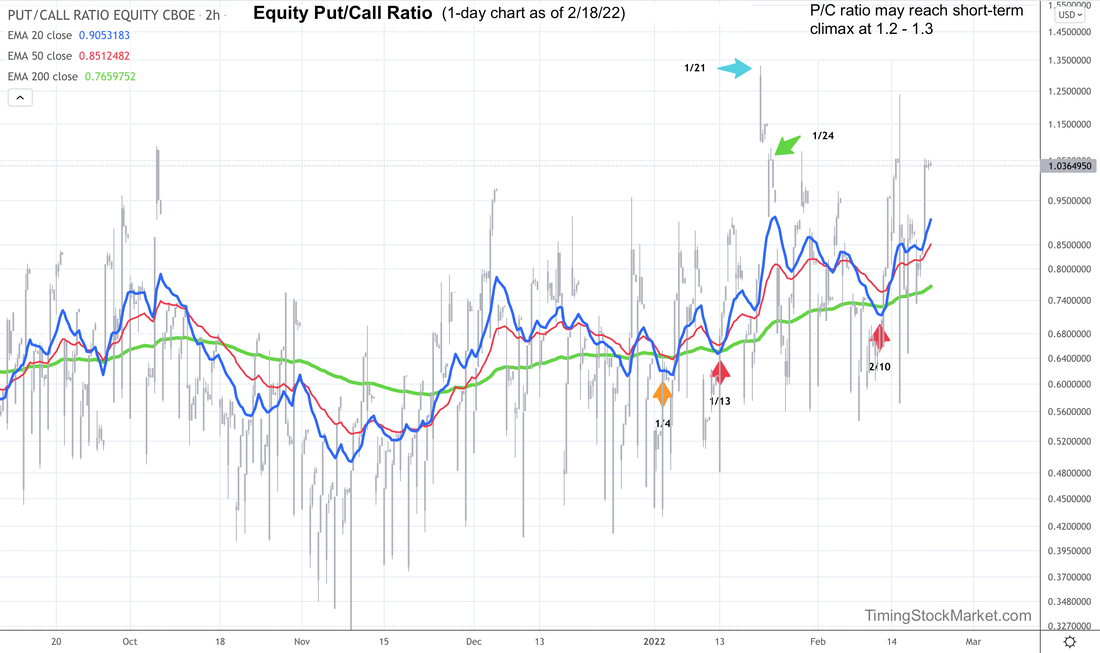

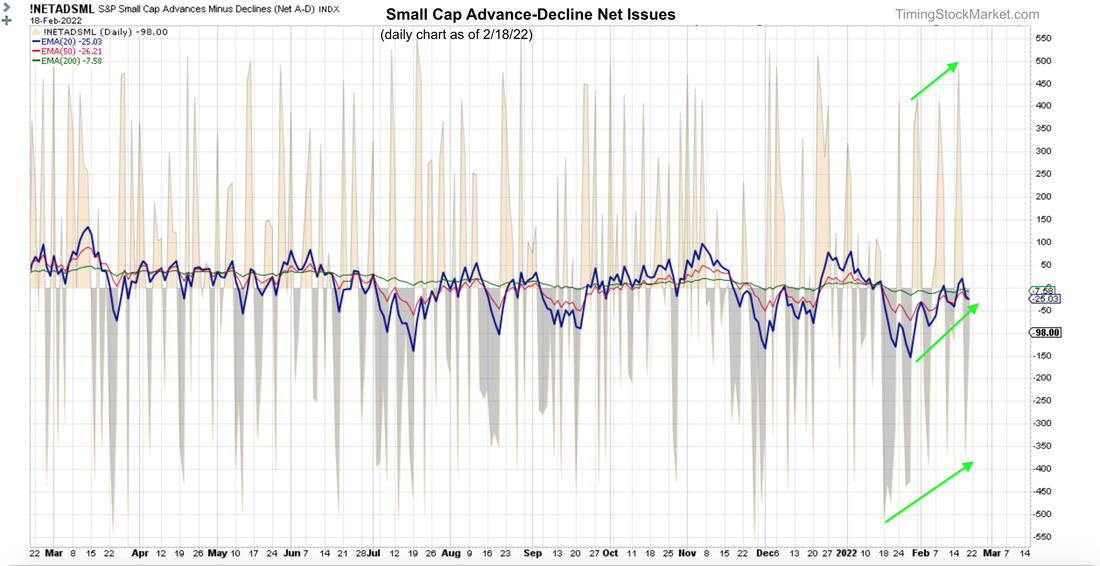

This combination amplifies the overall bearishness. Futures confirmed this bearishness by gapping down hard at open this Monday evening. It's certainly is stomach churning for the bulls. So how do we cope with this? First of all, keep in mind that no bear market lasts forever. If you stick to just trading the major stock indices, you can count on them coming back. We've seen this and traded this in 2008, 2015, 2016, 2018, and 2020. Different styles of bear market: yes. Last forever bear market: no. Recall we also said we're closer to the bottom than to the top. It's a matter of time. And it's a matter of getting most of the participants to panic and throw in the towel. When most of the bulls have sold (and sold at a loss) is when the market typically will turn around. Having said that, we will now say that this bear market is not near capitulation yet. Not enough fear. $VIX daily chart below shows the level of fear that bulls should be rooting for. Unfortunately, fear is not high enough yet. So just be patient. It will get there. Trade plan As we said above, there are 2 bearish forces in effect at the same time right now: big picture and short-term volatility. If futures continue to sell hard tonight, $VIX will shoot up overnight and may peak by 8 AM ET. If we see a big gap up in $VIX and a big gap up in put/call ratio at open on Tuesday, we will monitor for the possibility that the short-term bearish signal has peaked. This short-term bearish signal may then retreat for a couple days. So we may see volatility signal goes from "Fully Bearish" (now) to "Tilt Bullish" by tomorrow. We don't think this is the set up to scale into big bullish positions yet because we would be swimming up stream against the bearish force of the big picture market current. But it may be ok for a small and quick bullish trade via TNA. We'll update more pre-market. Updates 2:30 AM ET - Monday 2/21/22 Upcoming key reports & events Big Picture Market Current: Bearish In the context of the multi-month big picture, market is in a bearish phase and it's not done being bearish yet. Market participants are still feeling highly fearful, as evident in the steadily climbing level of put/call ratio. (See chart discussion further below.) Additionally, the level of "happy stocks" has not dropped low enough yet. By happy stocks we mean stocks currently above their 200-day moving average. For Nasdaq, this level is at 34%. Bear market usually capitulates once this level drops below 10%. Alas we have some distance to go yet. This bear market is not like the 2020 panic that lasted for 1 month. This one is an orderly downward march that goes something like down>up>down>up. This kind of action can be treacherous for traders as it creates traps for both of bulls and bears. But cheer up, bulls. This market is closer to 10% "happy stocks" than it is to being at a vulnerable top. The final drop will be stomach churning, but the worse it feels, the better the bullish reversal will be. Short-term Volatility Cycle Signal: Fully Bearish Volatility charts and P/C ratio charts are all showing a high probability of more bearishness. (See chart discussions further below.) Keep in mind that even though the big picture market condition is bearish, and the short-term signal is "Fully Bearish", the market will still have bounces. The bounces can make everything appear all right temporarily, but until there's multi-day confirmations, the bears still have the upper hand. Key price levels The table below has been fully updated. Trade plan We will post updates to the trade plan pre-market on Tuesday. There's a lot that can happen between now and then. Signal: Volatility ($VVIX $VIX $VXN $RVX) Read more about $VIX $VXN $RVX $VVIX here. Even though on the surface $VIX $VVIX $VXN $RVX all show lower highs right now, the intraday charts continue to show rising 200 EMA lines. This means that the volatility-based short-term signal continues to be "Fully Bearish". Signal: Trader Hedging (Equity Put/Call ratio) The current equity P/C ratio shows a rising 200 EMA line, which implies "Fully Bearish". Signal: Market Breadth (Advance-Decline net issues) And now a tiny bit of good news for the bulls. Small caps A/D chart below shows rising patterns. We'll declare this as not "Fully Bearish". But we won't categorize it as "Tilt Bullish" yet. Hedging by Dealers Read more about how options are impacting the market and the effects of dealer hedging here. Below are the updated volatility trigger levels.

As of this writing, $SPX $NDX IWM are still below their trigger levels. So we can expect continued wild price movements as dealer hedging fuels volatility rather than dampening it. Other signals for big picture consideration The good news for the bulls is the Dark Pool Index (DIX) shows silent money are still steadily buying $SPX. They've been at it since 1/25. This is a very strong bullish divergence for $SPX. Another major bullish divergence is the bottoming patterns shown on TLT IEF LQD JNK charts for multiple days last week. This is also a strong bullish divergence for stocks. We trade 3x ETFs such as TQQQ TNA SOXL LABU UVXY using proprietary analysis of volatility. Subscribe to get our latest analysis, trade plans and live intraday trades. Current trade record here.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed