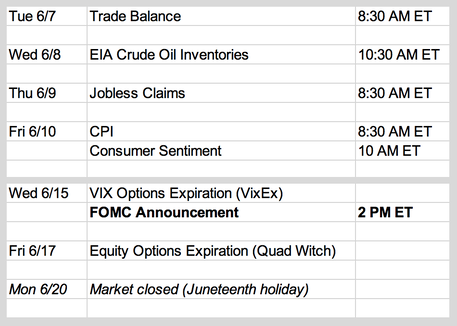

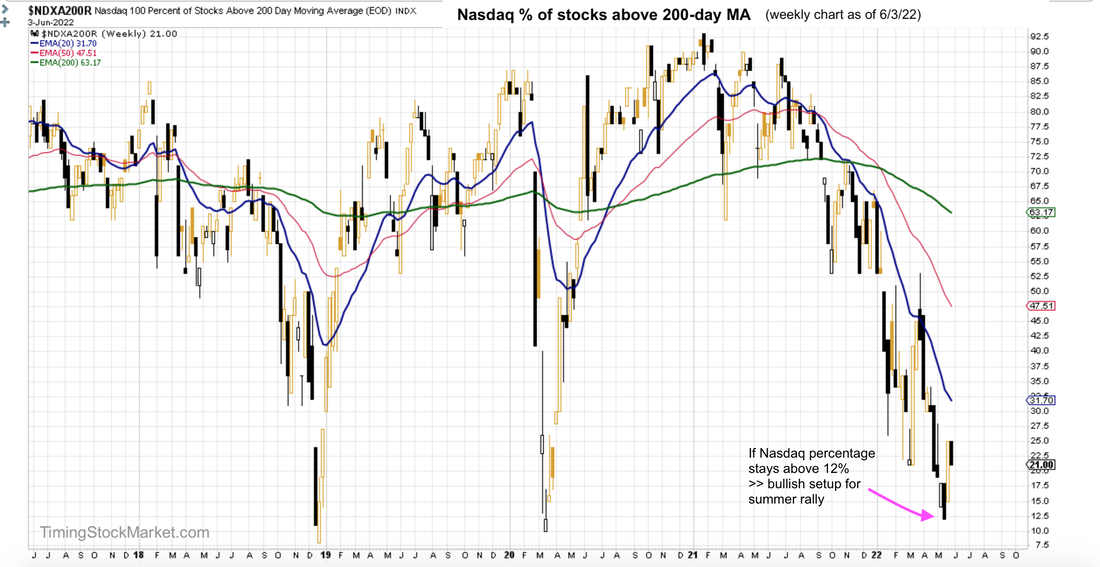

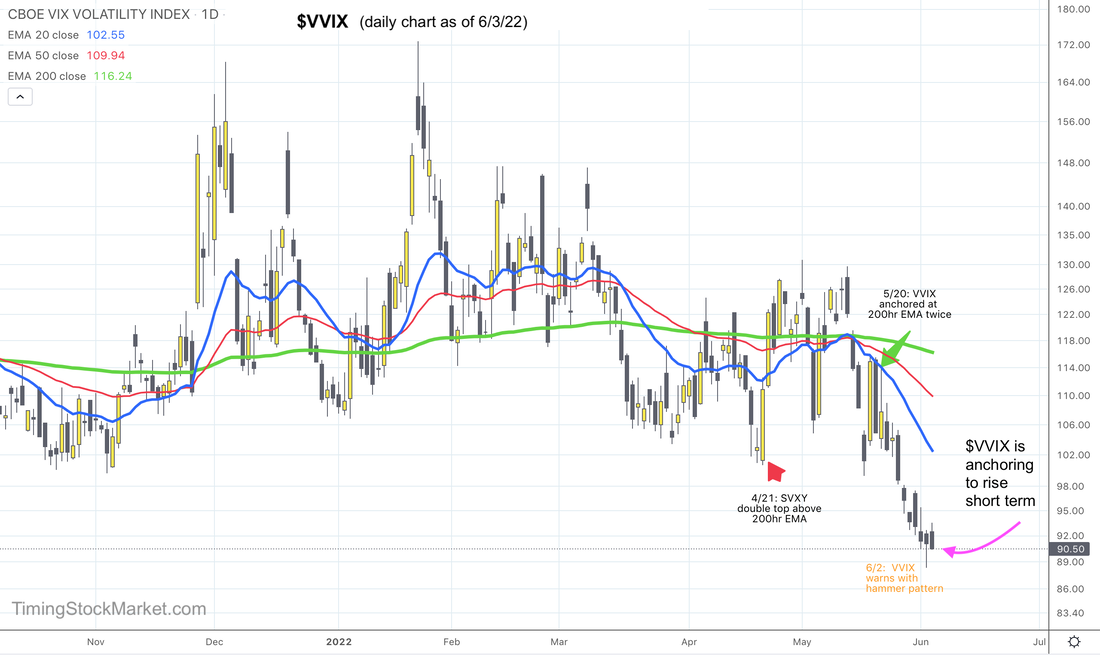

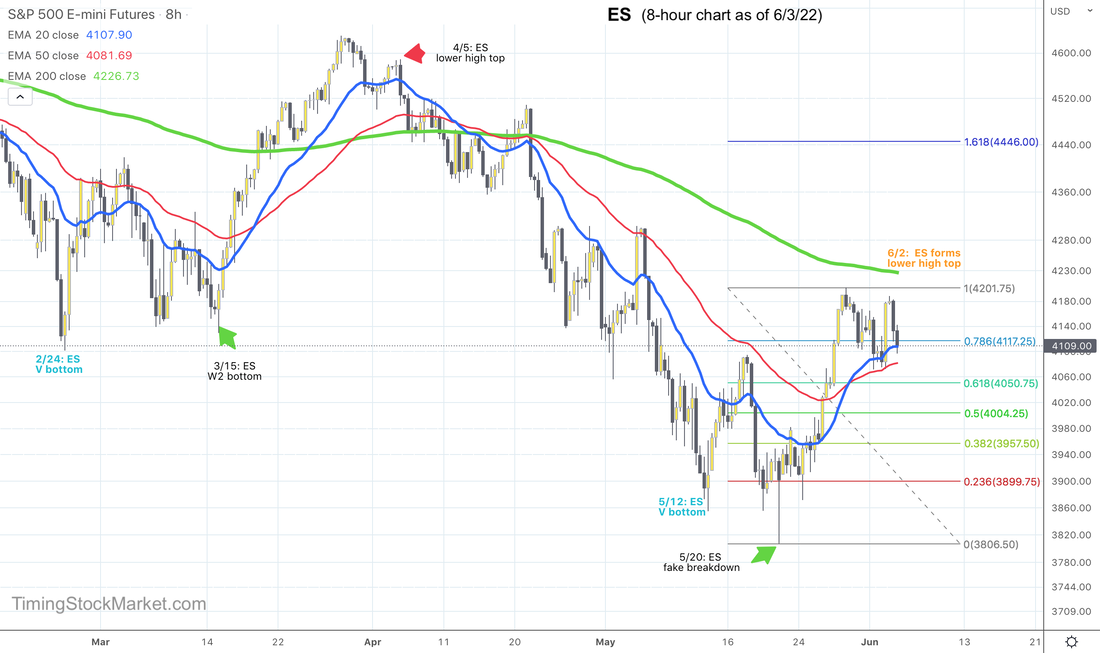

Updates 12 AM ET - Monday 6/6/22 Upcoming key events The CPI report on Friday will be closely monitored as it comes right before FOMC announcement on 6/15. The week of 6/13 will be a fairly explosive week, followed by a 3-day weekend. So mark your calendar not to go on vacation during that week. Bear market is closer to the end than to the beginning Take a look at the weekly chart of Nasdaq percentage of stocks above 200-day MA. This percentage is the worst among all the stock indices. But it is in the process of forming a bottom. As long as this percentage can stay above its recent low of 12%, the bottom becomes stronger. And if this percentage dives below 10%, that is historically capitulation area. OpEx week can lead into big summer rally The upcoming OpEx on 6/17 is very very big. Over $3.2 trillion in options are set to expire, and the majority of them are put options. Traders and portfolio managers have been purchasing massive amount of puts to hedge against the drop in stock prices. When a trader buys puts, a dealer is selling it from his book. To keep his book neutral from the direction of the market, the dealer has to hedge. He typically hedges against his sold puts (bullish) buy shorting stock futures (bearish). When these puts expire or are monetized by traders, dealers have to cover their shorts to stay market neutral. The result is a short covering rally because dealers are now buying into strength. Their buying raises stock prices, prompting traders to sell more puts, which then forces dealers to cover more shorts. And a virtuous cycle starts for the bulls. Imagine over $3.2 trillion options, most of which are puts, expiring on 6/17. The resulting short squeeze can trigger a massive rally that may last multiple weeks into the summer. Read more about how options are impacting the underlying stock market here. Short-term volatility signal: "Transition" However, before we get there we may have to endure another week of choppy or slightly bearish trade actions. $VVIX is hinting that it is getting ready to rise, at least back up to the zone between 106 and 110 (20-day and 50-day EMA lines). As $VVIX rises, stock prices are likely to drop some amount. So we should be prepared for choppy to bearish price actions. Read more about volatility and volatility ETFs here. Key support and resistance levels Given the likely choppy market conditions, we are looking at tight trading ranges to start the week

Between now and 6/17, we should be prepared for price actions similar to the period between 2/24 and 3/15. Recall that March FOMC was on 3/16, and March OpEx was on 3/18. And similar to June, March OpEx was the end of the first quarter, and was quadruple witching as well. And the stock market turned bullish on 3/15, right before all these key dates.

Trade plan Click here for live trades. Subscribe to get our latest analysis, daily trade plans and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed