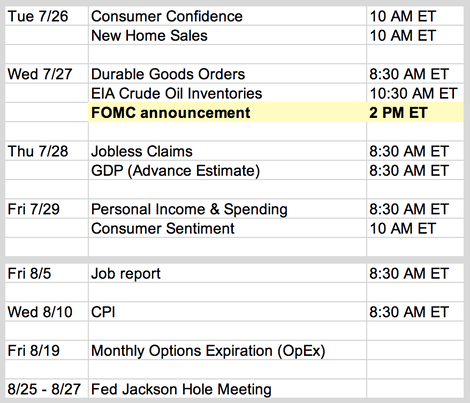

Updates 1:00 AM ET - Monday 7/25/22 Upcoming key events This is a big week in economic news, but the event with the most power to move the market is FOMC rate announcement on Wednesday. The big picture: still gloomy fundamentals

So is the bear market rally done? The current bear market rally that started on 6/16 was fueled primarily by three factors:

As we discussed in Friday's post, the short-covering activities that functioned as fuel for the rally since 6/16 has been mostly burned off. The short-term bullish volatility signal is starting to fade. The market is now vulnerable to the effect of economic news since it's not as well hedged yet as it was before 7/15. There are a lot of triggering news this week, along with the big one which is FOMC rate announcement on Wednesday. So we should expect big price swings, potentially both up and down. Speaking of FOMC, the Fed is expected to raise rate by 0.75 percentage point on Wednesday. (They usually float their numbers to the Wall Street Journal.) The market has already priced this in. It is the hints of how much longer does the Fed expect to keep raising rates that will matter more to the market at this point. Market breadth

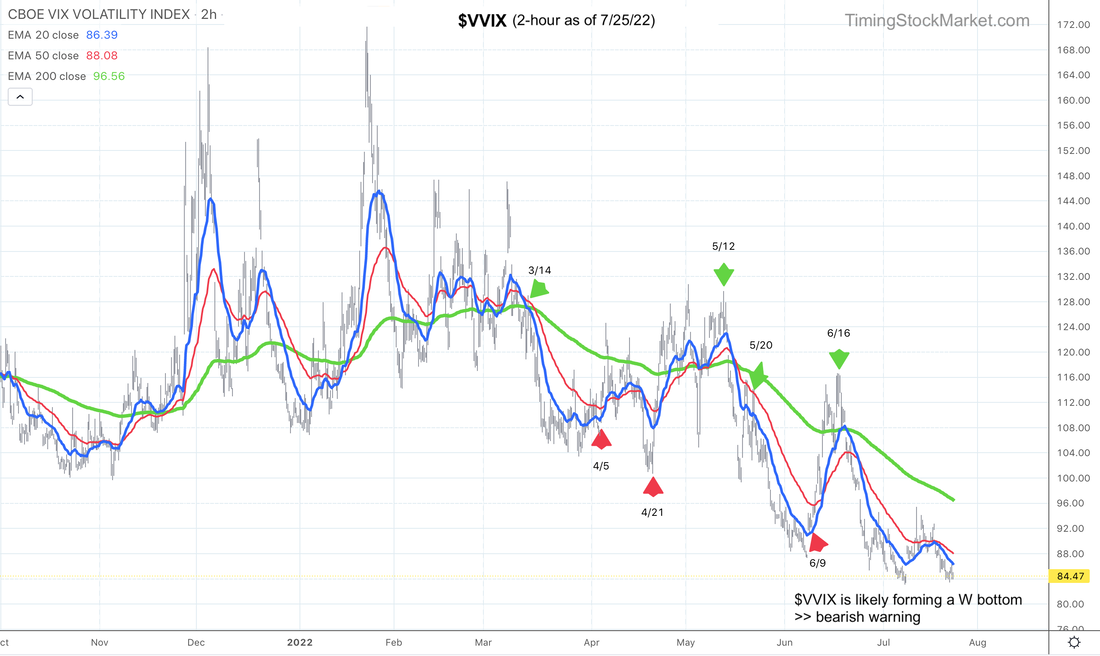

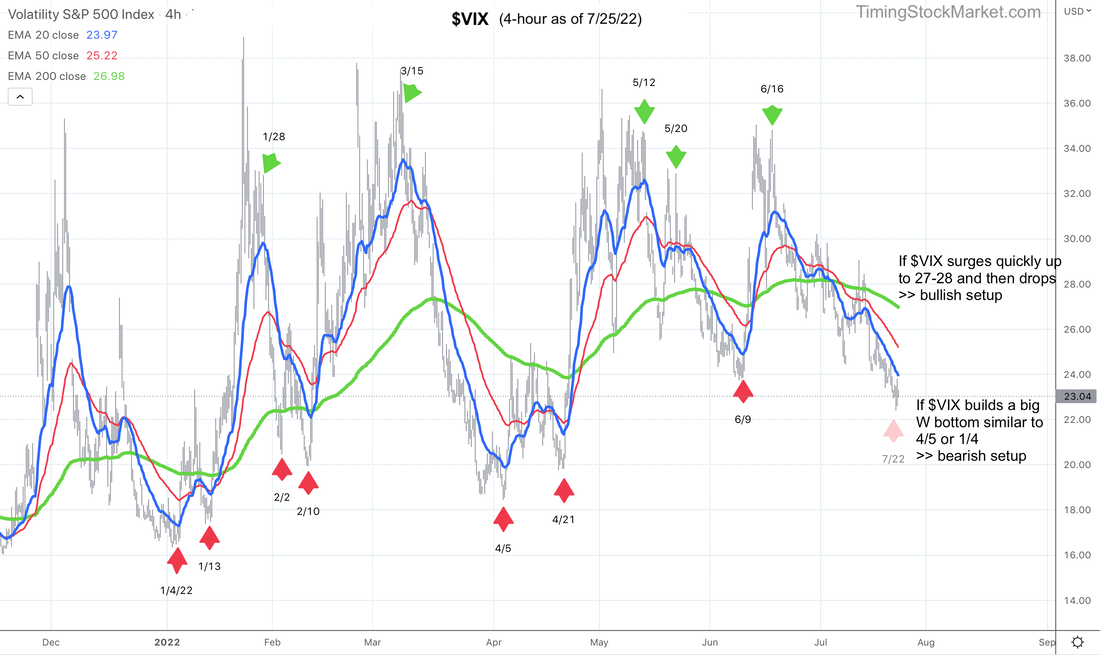

Taken together, waning breadth is usually a bearish warning. Short-term volatility signal: "Fading Bull" (close to becomimg "Rising Bear") $VVIX 2-hour chart below continues to form a W bottom with its 20 EMA blue line. These W bottoms typically precede a big rise in volatility (red arrows). This is a warning from $VVIX that the bullish force is fading. To be clear though, $VIX itself has not risen up enough yet. It is still below its 20 EMA blue line in the 4-hour chart below. What would turn the signal to "Strong Bull" again? If $VVIX quickly spikes up from here to about 103, and $VIX spikes up to about 27, and then they both drop quickly, the setup would recharge the bull again. During the quick $VVIX $VIX spike, prices may retrace to these key levels:

These are potentially bullish setups, and ES may rise from 3800 all the way to 4200 (high 5/30). What would turn the signal to "Rising Bear"? If $VVIX and $VIX spend a few days building a bigger W or multiple W bottom, then conditions will be turning seriously bearish. $VVIX $VIX may rise a lot higher. In that scenario, ES NQ RTY are likely to retest the lows of 6/16. Trade plan Click here for live trades. Subscribe to get our latest analysis, daily trade plans and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed